QUOTE(marquis @ Apr 15 2025, 01:36 PM)

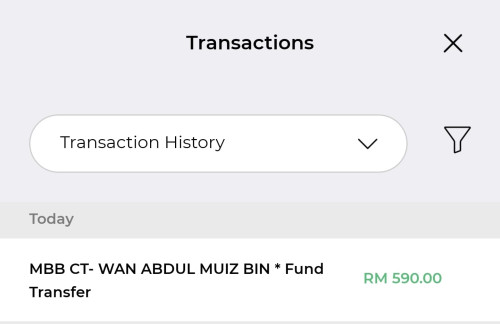

If it's around that time then it's Pre-NSRC...which means Maybank really did a good job, coz most banks won't bother to initiate. Especially back then . Usually they will only take action after recipient bank contacts them to verify. Not sure how much have things changed since NSRC though.

But yes, that is the correct SOP. Receive report, account will be frozen pending result of their investigation. If they refuse to launch the investigation it's either their incompetent (best case) or protecting the account owner (Pretty sure this is considered criminal).

I personally see that as an obstruction of justice. Pretty sure BNM would be interested to know why they didn't carry out what should be routine SOP.

Yes and TS can initial the report to BNM.But yes, that is the correct SOP. Receive report, account will be frozen pending result of their investigation. If they refuse to launch the investigation it's either their incompetent (best case) or protecting the account owner (Pretty sure this is considered criminal).

I personally see that as an obstruction of justice. Pretty sure BNM would be interested to know why they didn't carry out what should be routine SOP.

Else, we can use the example from Bank Islam to commit scam from legitmate account that they can't do anything or don't do anything to the account?

I don't think so. U know the reason why they don't initial the investigation to freeze acc. U know I know.. haha

and TS also can initial another police report against BI to investigate why they didn't investigate on this matter. Same gang? Protect the account holder?

Banks should not use this reason that "money can't be recovered" and not to investigate or do nothing to the account holder for the reason that it is legitimate account, not a mule account?

This post has been edited by GalaxyV: Apr 15 2025, 02:08 PM

Apr 15 2025, 01:56 PM

Apr 15 2025, 01:56 PM

Quote

Quote

0.0228sec

0.0228sec

0.42

0.42

6 queries

6 queries

GZIP Disabled

GZIP Disabled