Outline ·

[ Standard ] ·

Linear+

IPO: [0338 KOPI] Oriental Kopi Holdings, Listing on ACE Market

|

nexona88

|

Jan 7 2025, 08:45 AM Jan 7 2025, 08:45 AM

|

|

Oriental Kopi Holdings Bhd, a cafe chain operator en route to the ACE Market, said it is not spared from rising cost pressure and plans to raise prices to mitigate the impact.

[/b]

The company regularly reviews its menu prices every six months, executive director Callie Chan Yen Min said at a press conference after launching its listing prospectus on Monday. Rising costs, including that of coffee beans and vegetables, have affected the company, she noted.

Oriental Kopi has locked in the supply of coffee beans, which have seen record-high prices, thanks to its high volume. “Our suppliers are also supportive enough as our volume for the coffee powder is big for them,” she said. “They are giving us really good pricing.”

Coffee futures have hit record highs, driven by supply shortage and adverse weather conditions in key coffee-producing regions like Brazil and Vietnam. Prices breached the previous all-time high set in 1977 when the market was rattled by Brazil’s devastating frost that shrivelled crops.

Oriental Kopi, which launched its initial public offering (IPO) on Monday, has more than doubled its net profit to RM43.13 million in the financial year ended Sept 30, 2024 (FY2024) thanks to its rapid expansion of its cafe network.

Competitive strength

Chan highlighted that Oriental Kopi’s strong growth was due to its competitive strength, including strong brand, signature products such as egg tarts, polo buns, and coffee as well as halal-certified outlets that set it apart from competitors.

Established in December 2020, the company now has 20 cafes across Malaysia and one in Singapore. Gross margins have been stable around 30% over the past three years.

Oriental Kopi also managed to open at good locations in several shopping malls, she said. “You can see that our locations are quite good,” she continued, “so that also differentiates [us] from the other competitors.”

All of its cafes are owned by Oriental Kopi, which allows the company to have full control over the outlets, she added.

IPO to raise RM184 million

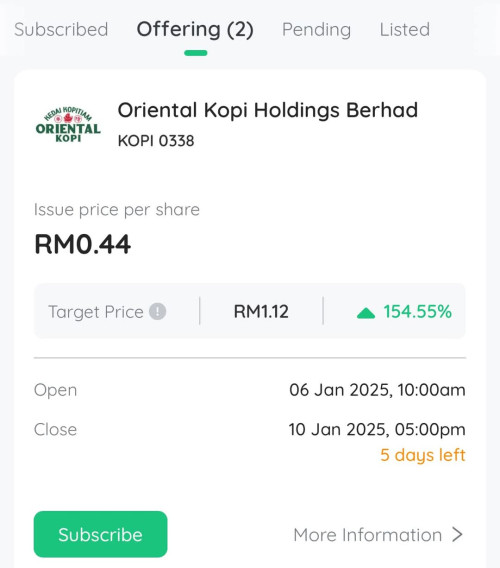

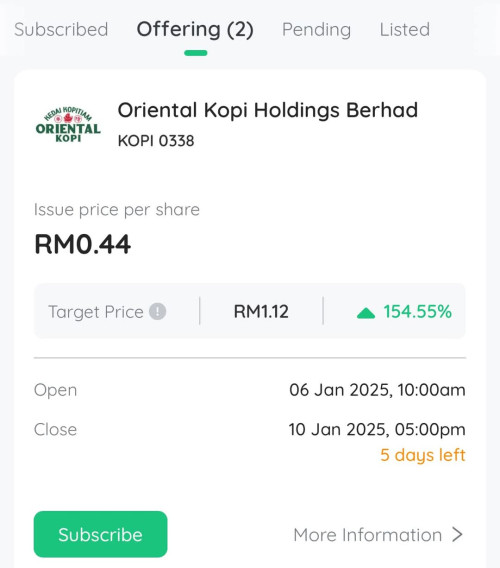

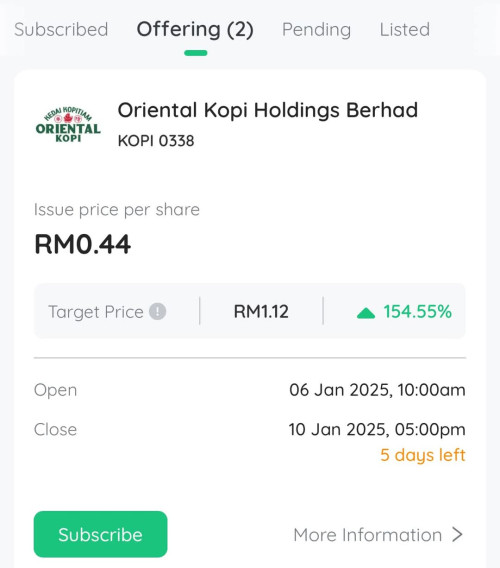

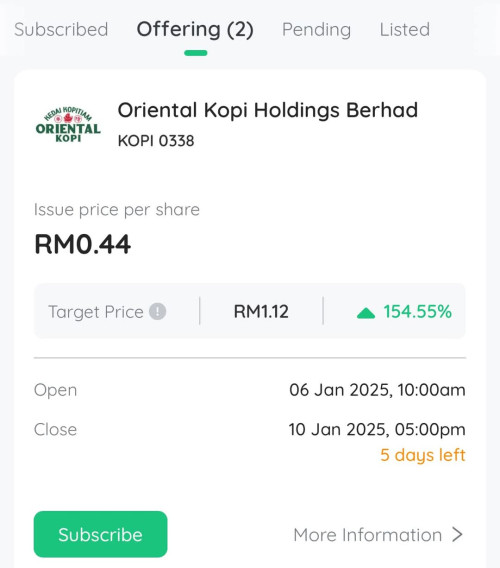

Oriental Kopi set its IPO price at 44 sen apiece in a share sale that would raise RM183.96 million ahead of its listing on the ACE Market.

At the IPO price, Oriental Kopi is expected to have a market capitalisation of RM880 million upon listing and value the company at about 20 times its earnings for FY2024.

Applications will close on Jan 10, and listing has been scheduled for Jan 23.

Oriental Kopi has earmarked RM75.78 million of the IPO proceeds for working capital and RM53.68 million to set up a new head office, central kitchen and warehouse. The company will also use RM36.4 million for the expansion of cafes within Malaysia.

The rest has been allocated to marketing activities in foreign countries, expansion of its brands of packaged food segment, and to defray listing expenses.

|

|

|

|

|

|

tnang

|

Jan 7 2025, 08:58 AM Jan 7 2025, 08:58 AM

|

|

Market cap: RM880 mil

Total Shares: 2bil shares

Forecast P/E: 20.37

Net asset: 0.1149

mahal nya kopi ini. but very high growth.

imagine one shop worth how much ?

|

|

|

|

|

|

coyouth

|

Jan 7 2025, 09:49 AM Jan 7 2025, 09:49 AM

|

|

so far no TP?

|

|

|

|

|

|

tehoice

|

Jan 7 2025, 09:55 AM Jan 7 2025, 09:55 AM

|

|

This one sure very hot and would be highly subscribed.

anyone read the prospectus in detail yet? any major thing to share?

later i will go download and read.

and the open for application period is so short lol. closing this Friday ady. so better apply fast.

|

|

|

|

|

|

JAIDK23

|

Jan 7 2025, 10:03 AM Jan 7 2025, 10:03 AM

|

|

still no TP?? haha

|

|

|

|

|

|

coyouth

|

Jan 7 2025, 10:07 AM Jan 7 2025, 10:07 AM

|

|

QUOTE(JAIDK23 @ Jan 7 2025, 10:03 AM) maybe they're still calculating.  |

|

|

|

|

|

JAIDK23

|

Jan 7 2025, 10:38 AM Jan 7 2025, 10:38 AM

|

|

QUOTE(coyouth @ Jan 7 2025, 10:07 AM) maybe they're still calculating.  dont know if the short opening is some kind of gimmick  tempted if not franchise model |

|

|

|

|

|

lim47

|

Jan 7 2025, 11:10 AM Jan 7 2025, 11:10 AM

|

|

QUOTE(JAIDK23 @ Jan 7 2025, 10:03 AM) Got leh , you simply tembak also can . I put 50sen Bbb  |

|

|

|

|

|

coyouth

|

Jan 7 2025, 12:00 PM Jan 7 2025, 12:00 PM

|

|

QUOTE(lim47 @ Jan 7 2025, 11:10 AM) Got leh , you simply tembak also can . I put 50sen Bbb  even with valuing the company at about 20 times its earnings for the financial year ended Sept 30, 2024, TP also so high. wow This post has been edited by coyouth: Jan 7 2025, 12:01 PM |

|

|

|

|

|

nexona88

|

Jan 7 2025, 03:44 PM Jan 7 2025, 03:44 PM

|

|

This one is not franchise models

Got strong backing.... Funding is non issues.... Quite surprised with the growth in 3 years period

|

|

|

|

|

|

Bigproblem

|

Jan 7 2025, 05:24 PM Jan 7 2025, 05:24 PM

|

|

anyone know, when is the ballot date?

|

|

|

|

|

|

nexona88

|

Jan 7 2025, 07:51 PM Jan 7 2025, 07:51 PM

|

|

QUOTE(Bigproblem @ Jan 7 2025, 05:24 PM) anyone know, when is the ballot date? 14 Jan, next week |

|

|

|

|

|

jackchp

|

Jan 7 2025, 09:30 PM Jan 7 2025, 09:30 PM

|

New Member

|

QUOTE(lim47 @ Jan 7 2025, 11:10 AM) Got leh , you simply tembak also can . I put 50sen Bbb  i think this is a bug.... M+ already removed the TP.. wait for the latest info |

|

|

|

|

|

TSronnie

|

Jan 7 2025, 11:38 PM Jan 7 2025, 11:38 PM

|

|

QUOTE(nexona88 @ Jan 7 2025, 03:44 PM) This one is not franchise models Got strong backing.... Funding is non issues.... Quite surprised with the growth in 3 years period whose the strong backer ? |

|

|

|

|

|

TSronnie

|

Jan 7 2025, 11:55 PM Jan 7 2025, 11:55 PM

|

|

KOPI MD Pay in 2023 = RM171k

KOPI MD Pay in 2024 = RM422k

KOPI MD Pay in 2024 = RM848k

|

|

|

|

|

|

nexona88

|

Jan 8 2025, 09:13 AM Jan 8 2025, 09:13 AM

|

|

QUOTE(ronnie @ Jan 7 2025, 11:38 PM) whose the strong backer ? This information, not sure who.. But few years back got some group of private investors want to invest... But they said No thanks.... We got financial backer... |

|

|

|

|

|

tohff7

|

Jan 8 2025, 09:40 AM Jan 8 2025, 09:40 AM

|

|

QUOTE(nexona88 @ Jan 8 2025, 09:13 AM) This information, not sure who.. But few years back got some group of private investors want to invest... But they said No thanks.... We got financial backer... not need backer also can la 1 outlet needs RM2-3m to renovate and set-up. because of the crowd, each outlet rake in high sales between RM1.0-1.5m per month. with its 15% net margin, 10 months already payback and recouped capital liao |

|

|

|

|

|

MGTheChosen

|

Jan 8 2025, 09:46 AM Jan 8 2025, 09:46 AM

|

Getting Started

|

Am wondering what is the TP range would be from the brokers 2x?3x?

i also wonder if this would, in the long run, be the next old town

|

|

|

|

|

|

coyouth

|

Jan 8 2025, 09:58 AM Jan 8 2025, 09:58 AM

|

|

QUOTE(jackchp @ Jan 7 2025, 09:30 PM) i think this is a bug.... M+ already removed the TP.. wait for the latest info Aiyo M+. How can be so sloppy when it comes to these things?  |

|

|

|

|

|

nexona88

|

Jan 8 2025, 10:52 AM Jan 8 2025, 10:52 AM

|

|

QUOTE(tohff7 @ Jan 8 2025, 09:40 AM) not need backer also can la 1 outlet needs RM2-3m to renovate and set-up. because of the crowd, each outlet rake in high sales between RM1.0-1.5m per month. with its 15% net margin, 10 months already payback and recouped capital liao Correct also... But need to plan properly... Very Tight financial position... |

|

|

|

|

Jan 7 2025, 08:45 AM

Jan 7 2025, 08:45 AM

Quote

Quote

0.0177sec

0.0177sec

0.52

0.52

6 queries

6 queries

GZIP Disabled

GZIP Disabled