QUOTE(kinnasai @ Aug 29 2024, 12:42 PM)

Actually, in personal opinion, I do understand and accept the repricing due to increase of insurance cost. But, while the premium increase, the additional premium paid are AGAIN subjected to the new allocation fee, and ~30% (average) paid the agency, and only ~70% effectively goes to your policy fund, for the 1st 6th~8th years. Means the insurer and agent doing nothing but also to enjoy the repricing for the allocation rate for the 1st few years for the increment.... but sad to say, u got not much choice on this if you wish to be continuously insured. BNM should do something to exempt this allocation rate (fee) if this is forced premium increase. Haih....

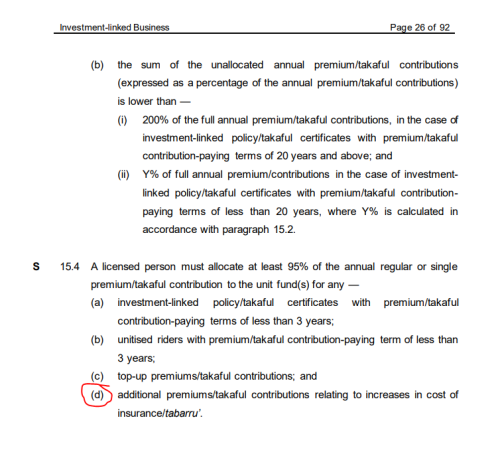

Yes, there is a way.You need to select "regular premium TOP-UP". You will still only get a 95% allocation rate, but it's a lot better than 43%/43%/76%/76%/85%/85% and then 100% from 7th year onwards.

So for example, recently due to repricing, my monthly premium was suggested to increase by RM100. Now, I have a monthly basic premium of RM220 (which is at 100% allocation since I am past the 7th year), and a monthly regular top-up premium of RM100 (which is at 95% allocation rate). This is for a Great Eastern ILP purchased around a decade ago.

Agents will con you to increase your basic regular premium. Be firm and say you want to do a top-up of regular premium instead.

I agree though, the allocation due to medical repricing should instead be at 100%. Sadly, the BNM guidelines allow insurers to take a 5% cut, which is shared between the insurer and agents.

This post has been edited by contestchris: Aug 29 2024, 02:40 PM

Aug 29 2024, 02:35 PM

Aug 29 2024, 02:35 PM

Quote

Quote 0.2765sec

0.2765sec

0.82

0.82

7 queries

7 queries

GZIP Disabled

GZIP Disabled