QUOTE(TOS2 @ Mar 10 2025, 01:50 AM)

A lot of people make the mistake of choosing IRR vs NPV. The key reason to choose 888 vs 188 is this:

reinvestment opportunity(ies).

Yea, true, 188 indeed offers higher % return vs 888, and we usually quote returns in

annualized percentage, hence this issue arises.

Let's breakdown the maths. RM3 return over 188 for 1 month -> annualized simple interest (x12 months): 19.15% p.a.

RM 8 return over 888 for 1 month -> annualized simple interest (x 12 months): 10.81% p.a.

But one should bear in mind this promo is "seasonal", i.e., it's not year-long, it only happened during CNY promo (and maybe another round during Hari Raya? Christmas?)

We never know. But what we know now, is that in one month's time, you get RM 3 out of 188 and Rm 8 out of 888.

It's important to bear in mind that by quoting the returns in annualized term you are implicitly assuming you will get RM 3 for 188 every month till end of February/early March next year, which is clearly not the case.

Think carefully, 19.15 % p.a. and 10.81% p.a. are both ridiculously high interest rates, why would GX Bank give you such rates when they only charge 8.06% p.a. for their personal loan Flexicredit (annualized, effective rate, which is always higher than simple interest rate anyway).

Thus, from a user's point of view, RM 8 in one month vs RM 3 in one month with a promo not certain to continue in the coming months, or at least with some degree of uncertainty, you should maximize net present value (NPV) by choosing the 888 package instead of the 188 package, even though the later offers higher annualized return, which is right from the start, a misleading figure to use for such a short-term, infrequent promo.

Google "NPV vs IRR fallacy". A lot of people make that mistake. Standard business school lectures will cover that:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3090678 Consider we both kiamsiap and calculative. Just sharing with sifu.

Yeah agree with you IRR is very misleading if the period is so short.

because the rate got amplified 10.81% and 19.15% pa, ' multiplied ' by 12 mah....

Naturally such rate must not be equated to a 1 year FD so no one should go boast oh we get 19.15%pa, so ridiculously high!

But it is still useful for people to decide, you want 10.81% or 19.15%.

Sure 19.15% is better if you are tight or have better use of that additional money elsewhere..

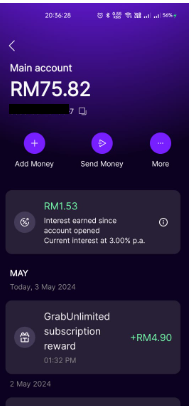

I chose 10.81% as I do not have better use of the extra rm700 on top of RM188, might as well I go for RM8 instead of RM3

Ramjade might have better use of that additional RM700 elsewhere.

So for him 19.15% sure is better than 10.81%

Talking about % rate without time period is meaningless

Like it or not all rates must be based on 1 year, even if it means you can only earn it for 1 month or 3 months

as in eg 1 month FD stated as 3.5%, not 3.5%/12

or 3 month FD stated as 3.6% and not 3.6%/4

For ease of comparison

May 3 2024, 07:57 PM

May 3 2024, 07:57 PM

Quote

Quote

0.0222sec

0.0222sec

0.24

0.24

7 queries

7 queries

GZIP Disabled

GZIP Disabled