QUOTE(poweredbydiscuz @ Nov 5 2024, 04:50 PM)

Not to mention getting 150k MYR within minutes is a sure way to bankrupt someone who doesn't know the meaning of indebtedness...I hope they have highlighted the word "up to"...

Banking GXBank - First Malaysian Digital Bank (by Grab), UNLIMITED 1% cashback+3% p.a. interest!

|

|

Nov 5 2024, 04:57 PM Nov 5 2024, 04:57 PM

Return to original view | IPv6 | Post

#101

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(poweredbydiscuz @ Nov 5 2024, 04:50 PM) Not to mention getting 150k MYR within minutes is a sure way to bankrupt someone who doesn't know the meaning of indebtedness...I hope they have highlighted the word "up to"... |

|

|

|

|

|

Nov 5 2024, 05:00 PM Nov 5 2024, 05:00 PM

Return to original view | IPv6 | Post

#102

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

Nov 5 2024, 06:41 PM Nov 5 2024, 06:41 PM

Return to original view | IPv6 | Post

#103

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(poooky @ Nov 5 2024, 05:59 PM) 0 fee for early settlement. Depending on rates, there may be room to borrow short term to park into Boost or KDI Save. They lend you below 4% p.a. effective rate? That would be ridiculous... poooky liked this post

|

|

|

Nov 5 2024, 08:46 PM Nov 5 2024, 08:46 PM

Return to original view | IPv6 | Post

#104

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(poooky @ Nov 5 2024, 05:55 PM) This is nice, planning for overseas trip soon. Ready to enjoice 1% cashback and 0 markup. Means no need to maintain so much in Wise. Just curious. When they say 0 markups on FX rates, do they compare that against mid-market rates quoted by XE.com and those used in wholesale corporate banking rates? That means you are getting rates exactly the same as those reported in international FX markets?Some more 0 fees on overseas cash withdrawal in case need cash. ~~~ 1% cashback on all in-store overseas spending Zero markups on exchange rates Zero fees for overseas ATM cash withdrawals Zero fees on overseas transactions ~~~ If they compare against say, Mastercard's rate, you still lose some 30-50 basis points right (benchmarked against the international FX market)? This post has been edited by TOS: Nov 5 2024, 08:46 PM poooky liked this post

|

|

|

Nov 5 2024, 08:48 PM Nov 5 2024, 08:48 PM

Return to original view | IPv6 | Post

#105

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

Nov 6 2024, 09:35 AM Nov 6 2024, 09:35 AM

Return to original view | Post

#106

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

|

|

|

Nov 6 2024, 10:07 AM Nov 6 2024, 10:07 AM

Return to original view | Post

#107

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(togekiss @ Nov 6 2024, 10:03 AM) Haha joking. I don't think the lowest effective rate will be below FD rates. Banks make money by pay less interests on deposits and earn more interests on loans.The problem with digital banks however, is that they don't have a huge customer base like conventional banks, e.g. RHB, Maybank, CIMB, Public, Hong Leong etc. Also, they don't offer diversified loans like car loans, housing loans etc. None of the digital banks' loans are collateralized too, so unsecured loan rates should be high.... |

|

|

Nov 6 2024, 11:30 PM Nov 6 2024, 11:30 PM

Return to original view | Post

#108

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

I am still waiting for them to increase the number of saving pockets and raise interest rates...

|

|

|

Nov 7 2024, 01:47 PM Nov 7 2024, 01:47 PM

Return to original view | Post

#109

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

Nov 15 2024, 06:17 PM Nov 15 2024, 06:17 PM

Return to original view | IPv6 | Post

#110

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

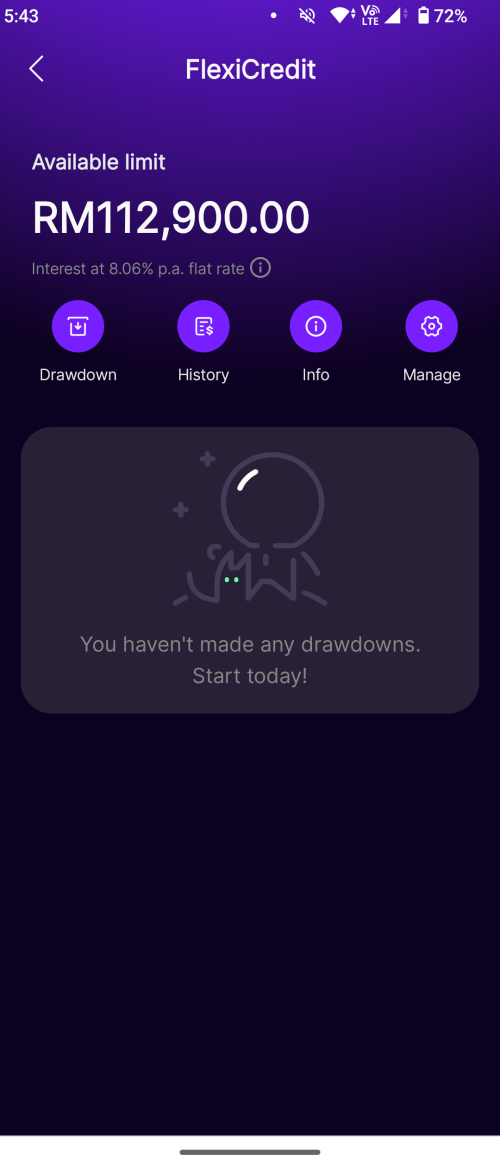

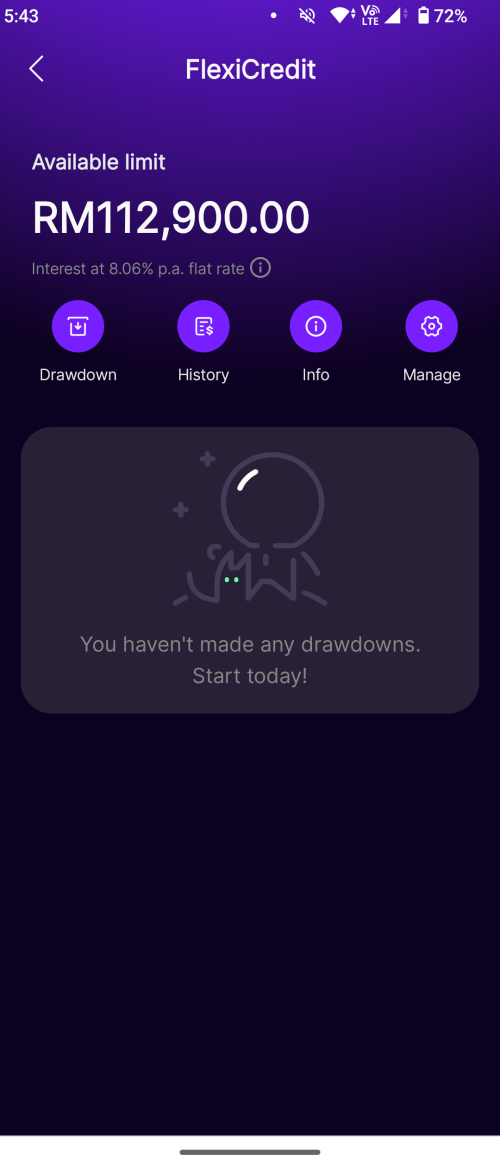

QUOTE(Mr Gray @ Nov 15 2024, 05:45 PM)  Lol 8.06% interest rate for Flexi Credit. Like Ah Long already. I better cash out from hong leong credit card for any short term need cash need. HLB always save 0% BT promo. |

|

|

Nov 19 2024, 10:19 PM Nov 19 2024, 10:19 PM

Return to original view | IPv6 | Post

#111

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(Mr Gray @ Nov 15 2024, 05:45 PM)  Lol 8.06% interest rate for Flexi Credit. Like Ah Long already. I better cash out from hong leong credit card for any short ter cash need. HLB always have 0% BT promo. |

|

|

Nov 20 2024, 03:27 PM Nov 20 2024, 03:27 PM

Return to original view | IPv6 | Post

#112

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(dannychen @ Nov 20 2024, 02:35 PM) They offered me 7.5% interest. I activated without drawdown just to get RM20 cashback. CS called and ask why no draw down, told them that interest is too high and I have rejected even lower offer for credit card fast cash. CS ask to share proof by email to get grab voucher as token of appreciation. Oh got RM 20 cashback...Can I activate flexicredit, get RM 20 cashback, then deactivate flexicredit again? |

|

|

Nov 20 2024, 04:30 PM Nov 20 2024, 04:30 PM

Return to original view | IPv6 | Post

#113

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Now I know why I didn't receive Flexicredit offers... Cuz I open GX Bank account as student... which in theory I am, though paid stipend in SGD worth some 9000 MYR a month...

The use of EPF to decide the credit limit is not sensible. Some people may withdraw from EPF account 3 for investment purpose, while some may have low EPF balance but huge asset outside Malaysia... Anyway, based on this: https://gxbank.my/flexicredit The lowest effective rate is 6.62% p.a. |

|

|

Nov 30 2024, 08:06 AM Nov 30 2024, 08:06 AM

Return to original view | IPv6 | Post

#114

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

T&C out liao

https://gxbank.my/campaign-tnc --------------------- QR warrior wants you to spend 30 MYR x 5 QR transaction per month = 150 MYR to get 5 MYR "cashback"... https://gxbank.my/campaign-qrwarrior 5/150 = 3.33% ------------------------ Tauke cashback wants you to spend 10 times using GX bank debit card, then from the 11th time onwards, you get 0.4% extra... (reset every month...) https://gxbank.my/campaign-taukecashback This post has been edited by TOS: Nov 30 2024, 08:13 AM |

| Change to: |  0.0183sec 0.0183sec

0.54 0.54

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 5th December 2025 - 02:30 AM |