QUOTE(mushigen @ Oct 3 2023, 01:39 PM)

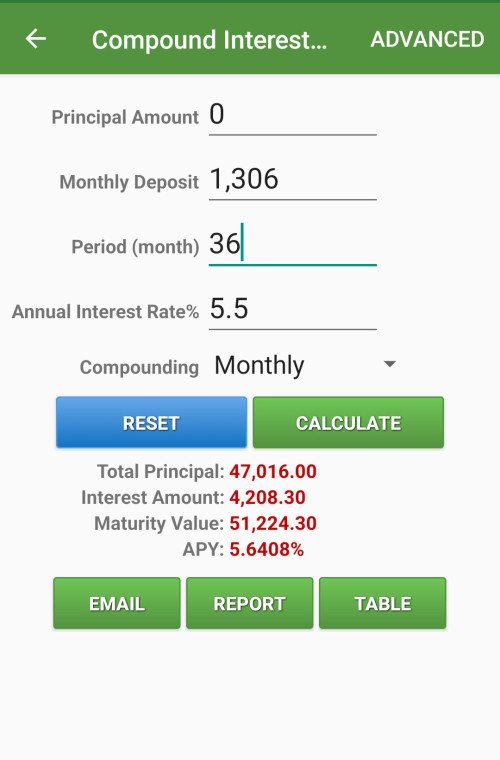

47k/36=RM1306 pm.

Put in epf at 5.5%, you'll earn rm4208 interest and will have RM5,1224 after 36 months.

» Click to show Spoiler - click again to hide... «

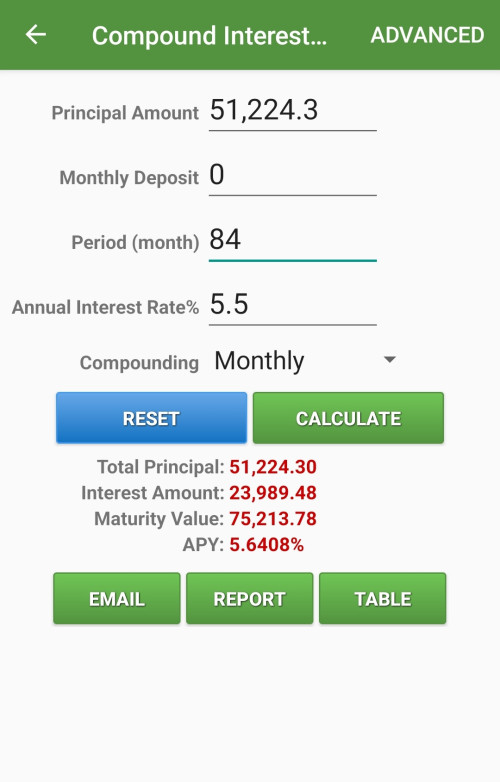

After this 36 months, for the next 7 years, you will earn rm23,989 in interest giving you the total rm75213.

» Click to show Spoiler - click again to hide... «

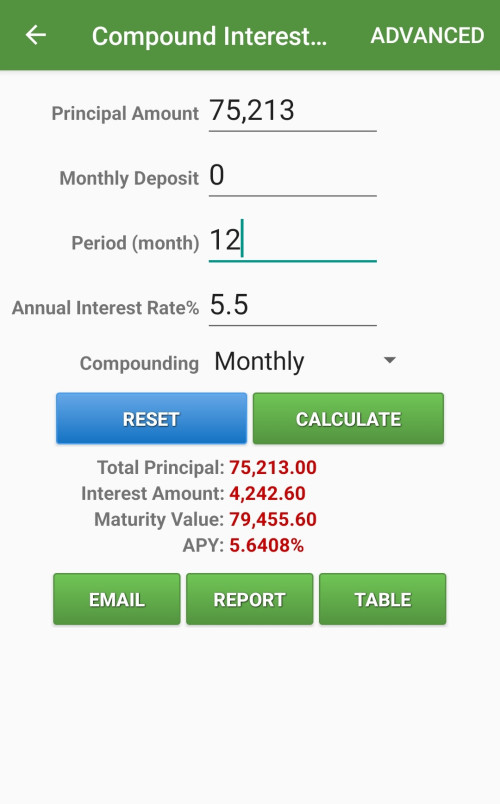

For year 11, you will earn RM4242 interest, translating to RM353 per month.

» Click to show Spoiler - click again to hide... «

If you're not able to extend NEM, your PV must offset RM350 pm to break even. Don't forget that your EPF money is still there for you to withdraw, whereas your PV and its peripheral hardware are considered sunk costs and are basically worthless if you decide to give up on it (no/low resale value). Will it add to your house market value? Not sure.

This write-off is not taken into account in the untung-rugi calculation. It essentially means at the wnd of Year 10, your TNB savings is just RM15k (at current tariffs and consumption) more than your EPF balance, but your epf continues to grow while your solar panel system continues to deteriorate in terms of performance and resale value while requiring maintenance.

First, we don’t have the money to put in kwsp one lump sum like that.

So your calculation lari by a lot dy.

Second. , we are using money we set aside monthly. to pay Tnb. So that money is not for investment for kwsp also.

So your calculation become irrrelevant dy.

The analogy is

I need to pay 300 bus lrt pass every month to go to work

I use thr 300 to py for a cheap car, kancil and the total maintenance for then car monthly and petrol is only rm300

So I my transportation method just changed. But my commitment still same. The money is never for epf coz it is a necessary spending to work.

End of the payment , I got a car, and I can save a bit, and maybe hook up an awek in the kancil. Hahahah.

Oct 3 2023, 11:25 AM

Oct 3 2023, 11:25 AM

Quote

Quote

0.1030sec

0.1030sec

0.48

0.48

7 queries

7 queries

GZIP Disabled

GZIP Disabled