any maha /k can advise mau up or maintain.

I read say can maintain but will effect sustainability wo...wtf do that mean. is this scam?

inb4 /k all kaya, no need insurance

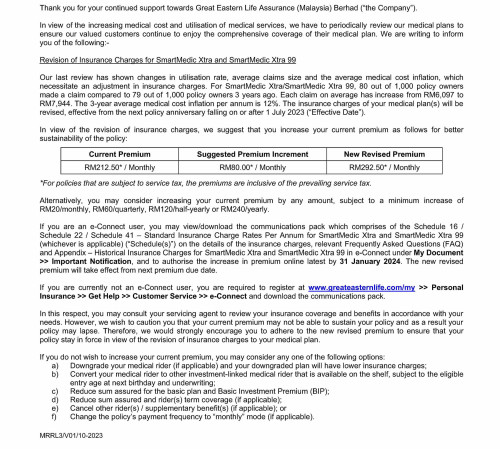

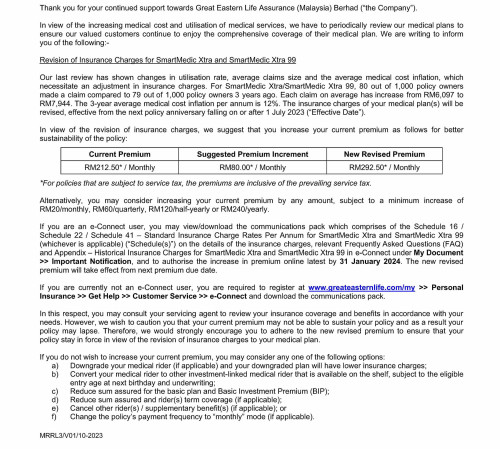

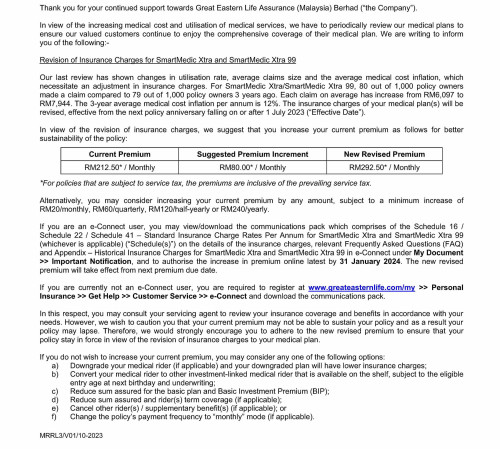

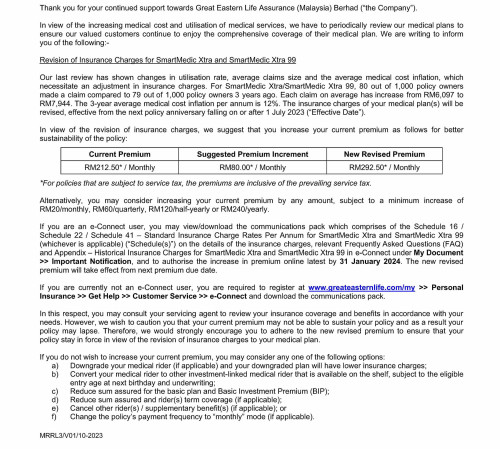

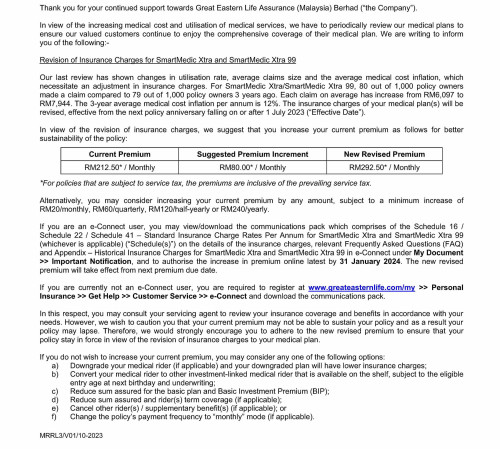

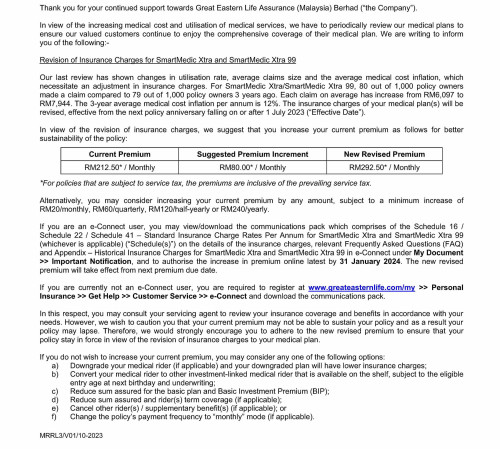

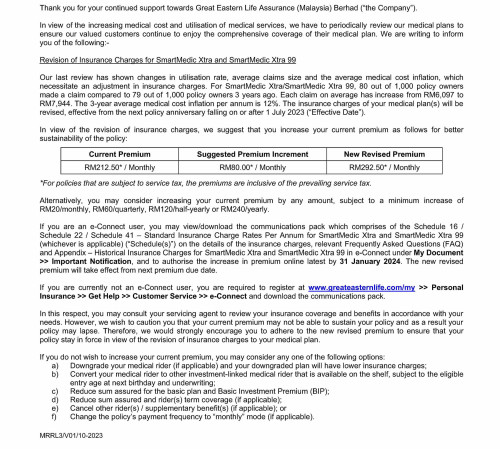

Insurance Premium Naik!

|

|

Jul 28 2023, 10:07 AM, updated 3y ago Jul 28 2023, 10:07 AM, updated 3y ago

Show posts by this member only | Post

#1

|

Junior Member

70 posts Joined: Aug 2014 |

|

|

|

|

|

|

Jul 28 2023, 10:13 AM Jul 28 2023, 10:13 AM

Show posts by this member only | Post

#2

|

Senior Member

1,590 posts Joined: Sep 2011 |

Why post in serious kopitam but you speak like in kopitiam, so just expecting us to be serious but not you?

This post has been edited by kelvinfixx: Jul 28 2023, 10:13 AM |

|

|

Jul 28 2023, 10:14 AM Jul 28 2023, 10:14 AM

Show posts by this member only | Post

#3

|

Junior Member

70 posts Joined: Aug 2014 |

QUOTE(kelvinfixx @ Jul 28 2023, 10:13 AM) Why post in serious kopitam but you speak like in kopitiam, so just expecting us to be serious but not you? lol, ini kopitiam style talking. serious or not, the same. sudah makan ubat belum? djlake liked this post

|

|

|

Jul 28 2023, 10:21 AM Jul 28 2023, 10:21 AM

Show posts by this member only | IPv6 | Post

#4

|

Junior Member

286 posts Joined: Sep 2008 |

Insurance is like a gamble. U may use it, U may not use it. I have asked a few of my colleagues, about 50/50 have it. I have a life insurance in case I die prematurely, my family got money. Medical insurance, KKM rm1 or company GL can cover. If U think it's worth the sub, U don't have a choice do U? Cost of living is going up. And it will go up. SYAMiLLiON and JimbeamofNRT liked this post

|

|

|

Jul 28 2023, 10:22 AM Jul 28 2023, 10:22 AM

Show posts by this member only | Post

#5

|

Senior Member

4,954 posts Joined: Jul 2010 |

|

|

|

Jul 28 2023, 10:27 AM Jul 28 2023, 10:27 AM

Show posts by this member only | Post

#6

|

Senior Member

1,601 posts Joined: Sep 2021 |

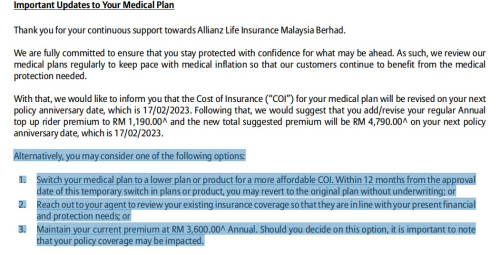

QUOTE(karazure @ Jul 28 2023, 10:07 AM) Unker just go this, 1 of my policy wanna charge me extra 80 per month le. Call your servicing agent. Ask him how come last time explained the premium once locked / bought earlier, it will not change but now how come got revision & got extra , else will effect sustainability ? See how your service agent explain when he used that point to sell the plan years ago. any maha /k can advise mau up or maintain. I read say can maintain but will effect sustainability wo...wtf do that mean. is this scam?  inb4 /k all kaya, no need insurance SYAMiLLiON and karazure liked this post

|

|

|

|

|

|

Jul 28 2023, 10:34 AM Jul 28 2023, 10:34 AM

Show posts by this member only | Post

#7

|

Junior Member

70 posts Joined: Aug 2014 |

QUOTE(nihility @ Jul 28 2023, 10:27 AM) Call your servicing agent. Ask him how come last time explained the premium once locked / bought earlier, it will not change but now how come got revision & got extra , else will effect sustainability ? See how your service agent explain when he used that point to sell the plan years ago. problem is the agent no longer available anymore, Unker buy this like 20+ years ago. Last time got increase like 10 yrs ago. |

|

|

Jul 28 2023, 10:36 AM Jul 28 2023, 10:36 AM

Show posts by this member only | IPv6 | Post

#8

|

All Stars

12,573 posts Joined: Nov 2008 |

QUOTE(karazure @ Jul 28 2023, 10:07 AM) Unker just go this, 1 of my policy wanna charge me extra 80 per month le. Is yours an investment linked policy?any maha /k can advise mau up or maintain. I read say can maintain but will effect sustainability wo...wtf do that mean. is this scam?  inb4 /k all kaya, no need insurance If so, I'm sure you should be aware that the investment portion is actually used to "cover" for increasing cost of insurance. When the investment does not give back good returns, you need to top up, if not, the policy will sustain to let's say 60 years and not 70 years old as earlier estimated when u signed the policy. Even for standalone medical plans, you need to top up with increasing cost of insurance.... No such thing as "locked" premium.. Anyway, if you are serious about looking for answers, should post here: https://forum.lowyat.net/topic/5096196/+3700 |

|

|

Jul 28 2023, 10:39 AM Jul 28 2023, 10:39 AM

Show posts by this member only | Post

#9

|

Junior Member

70 posts Joined: Aug 2014 |

QUOTE(-kytz- @ Jul 28 2023, 10:36 AM) Is yours an investment linked policy? Tq bro, yes my Insurance is investment link.If so, I'm sure you should be aware that the investment portion is actually used to "cover" for increasing cost of insurance. When the investment does not give back good returns, you need to top up, if not, the policy will sustain to let's say 60 years and not 70 years old as earlier estimated when u signed the policy. Even for standalone medical plans, you need to top up with increasing cost of insurance.... No such thing as "locked" premium.. Anyway, if you are serious about looking for answers, should post here: https://forum.lowyat.net/topic/5096196/+3700 |

|

|

Jul 28 2023, 10:40 AM Jul 28 2023, 10:40 AM

|

Senior Member

3,843 posts Joined: Oct 2011 |

QUOTE(karazure @ Jul 28 2023, 10:07 AM) Means originally the insurance can cover you until 99y/o*, but if you maintain the premium it may only cover until 75y/o*. *EXAMPLE ONLY. Akaashi liked this post

|

|

|

Jul 28 2023, 10:43 AM Jul 28 2023, 10:43 AM

Show posts by this member only | IPv6 | Post

#11

|

Junior Member

229 posts Joined: Feb 2022 |

QUOTE(karazure @ Jul 28 2023, 10:07 AM) Unker just go this, 1 of my policy wanna charge me extra 80 per month le. You become the owner of the insurance company then you will be insured by all the clients if you can getany maha /k can advise mau up or maintain. I read say can maintain but will effect sustainability wo...wtf do that mean. is this scam?  inb4 /k all kaya, no need insurance |

|

|

Jul 28 2023, 10:50 AM Jul 28 2023, 10:50 AM

|

Junior Member

222 posts Joined: Nov 2021 |

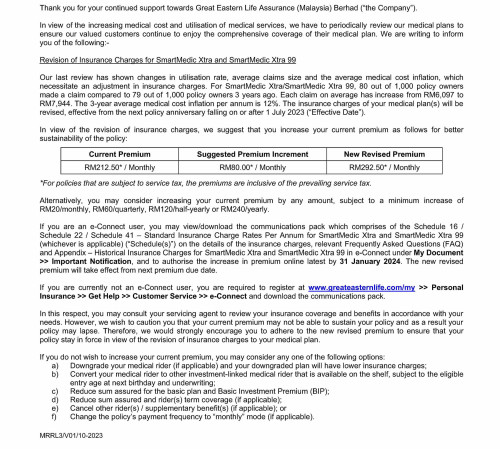

Same with mine la and thy put 3 option :  I juz dont care , i think it will cut the portion from investment and pay the extra premium la swch liked this post

|

|

|

Jul 28 2023, 10:56 AM Jul 28 2023, 10:56 AM

|

Junior Member

70 posts Joined: Aug 2014 |

|

|

|

|

|

|

Jul 28 2023, 11:00 AM Jul 28 2023, 11:00 AM

|

Senior Member

1,267 posts Joined: Oct 2009 |

Some insurance lagi tua lagi mahal, your only RM 80 naik dah complain .

You can choose not to buy, just keep saving money and visit public hospitals to me public hospitals is better than private sometimes unless cannot wait only i go private, , if you have optional saving 1 million just for medical yes you don't have to buy Buy or not the insurance you decide, your life, your health , your choice, no one force you . |

|

|

Jul 28 2023, 11:05 AM Jul 28 2023, 11:05 AM

|

Junior Member

222 posts Joined: Nov 2021 |

QUOTE(karazure @ Jul 28 2023, 10:56 AM) The premium remain at RM3600 annually , wat i mean the medical card fees is increasing thn thy will auto readjust from RM3600.Example from RM3600 , 1.6k go to pay medical card fees and 2k investment thn now auto adjust 2k on medical card then 1.6k for investment like that lur . The reason thy wana increase the premium because thy forecast in future investment not enuf to cover medical card fees because the medical fees is increasing . This post has been edited by prdkancil: Jul 28 2023, 11:06 AM |

|

|

Jul 28 2023, 11:08 AM Jul 28 2023, 11:08 AM

|

Junior Member

70 posts Joined: Aug 2014 |

QUOTE(prdkancil @ Jul 28 2023, 11:05 AM) The premium remain at RM3600 annually , wat i mean the medical card fees is increasing thn thy will auto readjust from RM3600. I see, tq for clarifying.Example from RM3600 , 1.6k go to pay medical card fees and 2k investment thn now auto adjust 2k on medical card then 1.6k for investment like that lur . The reason thy wana increase the premium because thy forecast in future investment not enuf to cover medical card fees because the medical fees is increasing . |

|

|

Jul 28 2023, 11:18 AM Jul 28 2023, 11:18 AM

Show posts by this member only | IPv6 | Post

#17

|

Junior Member

763 posts Joined: Jan 2003 |

i think no need add lah....

|

|

|

Jul 28 2023, 11:23 AM Jul 28 2023, 11:23 AM

|

Junior Member

303 posts Joined: Aug 2005 |

Anyone bother to check the fund performance for investment link ?

seems like all the funds performance suck balls, better they just create one fund that buy malaysian local banks, that at least have dividend to rebuy back the fund. |

|

|

Jul 28 2023, 11:50 AM Jul 28 2023, 11:50 AM

|

Senior Member

597 posts Joined: May 2006 |

Same goes for my Allianz investment linked, wanted to increase 50% 😮😮

|

|

|

Jul 28 2023, 11:53 AM Jul 28 2023, 11:53 AM

|

Junior Member

70 posts Joined: Aug 2014 |

|

|

|

Jul 28 2023, 12:01 PM Jul 28 2023, 12:01 PM

|

Junior Member

222 posts Joined: Nov 2021 |

QUOTE(anangryorc @ Jul 28 2023, 11:50 AM) Mine is Allianz investment link too , annually 3.6k and suggest increase another 1k+ = near to 5k but i dont care . Let them readjust the investment portion themself and fix at RM3.6k annually . |

|

|

Jul 28 2023, 12:05 PM Jul 28 2023, 12:05 PM

|

Junior Member

70 posts Joined: Aug 2014 |

|

|

|

Jul 28 2023, 12:12 PM Jul 28 2023, 12:12 PM

|

Senior Member

9,617 posts Joined: Aug 2015 |

QUOTE(nihility @ Jul 28 2023, 10:27 AM) Call your servicing agent. Ask him how come last time explained the premium once locked / bought earlier, it will not change but now how come got revision & got extra , else will effect sustainability ? See how your service agent explain when he used that point to sell the plan years ago. No such thing lock. Sure got clause you din notice similar to " we can revise the price from time to time reasonably"If the economy gets worse and higher inflation, then the premium will keep increasing. Recently a person had a stroke, 36 age only, medical cost hospital and Physiotherapy already more than 200k. And that person previously only pay 200++ per month like TS. |

|

|

Jul 28 2023, 12:14 PM Jul 28 2023, 12:14 PM

|

Junior Member

222 posts Joined: Nov 2021 |

|

|

|

Jul 28 2023, 12:16 PM Jul 28 2023, 12:16 PM

|

Junior Member

70 posts Joined: Aug 2014 |

QUOTE(Accord2018 @ Jul 28 2023, 12:12 PM) No such thing lock. Sure got clause you din notice similar to " we can revise the price from time to time reasonably" this is only 1 of my many policy. My medical is cap at 1Mil from GE.If the economy gets worse and higher inflation, then the premium will keep increasing. Recently a person had a stroke, 36 age only, medical cost hospital and Physiotherapy already more than 200k. And that person previously only pay 200++ per month like TS. I guess other policy will have the same issue comin. |

|

|

Jul 28 2023, 12:17 PM Jul 28 2023, 12:17 PM

|

Junior Member

70 posts Joined: Aug 2014 |

|

|

|

Jul 28 2023, 12:18 PM Jul 28 2023, 12:18 PM

|

Junior Member

222 posts Joined: Nov 2021 |

|

|

|

Jul 28 2023, 12:18 PM Jul 28 2023, 12:18 PM

|

Junior Member

70 posts Joined: Aug 2014 |

|

|

|

Jul 28 2023, 12:19 PM Jul 28 2023, 12:19 PM

Show posts by this member only | IPv6 | Post

#29

|

Senior Member

2,506 posts Joined: Apr 2020 |

QUOTE(karazure @ Jul 28 2023, 12:16 PM) this is only 1 of my many policy. My medical is cap at 1Mil from GE. Good luck with GE , they famous for making yr life hard when want claim .I guess other policy will have the same issue comin. Ramjade liked this post

|

|

|

Jul 28 2023, 12:24 PM Jul 28 2023, 12:24 PM

|

Junior Member

222 posts Joined: Nov 2021 |

|

|

|

Jul 28 2023, 12:31 PM Jul 28 2023, 12:31 PM

|

Junior Member

70 posts Joined: Aug 2014 |

|

|

|

Jul 28 2023, 12:32 PM Jul 28 2023, 12:32 PM

|

Senior Member

1,411 posts Joined: Dec 2009 From: Everywhere |

I'm on AIA medical insurance. I take pure medical insurance only. No investment link.

Already 3 years I'm on this insurance and no increase. I hope can stay the same amount for a while since I have other commitments. |

|

|

Jul 28 2023, 12:33 PM Jul 28 2023, 12:33 PM

|

Junior Member

70 posts Joined: Aug 2014 |

QUOTE(xpole @ Jul 28 2023, 12:32 PM) I'm on AIA medical insurance. I take pure medical insurance only. No investment link. Unker policy 20+ years jor, if not wrong got increase 1 time b4.Already 3 years I'm on this insurance and no increase. I hope can stay the same amount for a while since I have other commitments. |

|

|

Jul 28 2023, 02:09 PM Jul 28 2023, 02:09 PM

Show posts by this member only | IPv6 | Post

#34

|

Senior Member

5,587 posts Joined: Aug 2011 |

QUOTE(karazure @ Jul 28 2023, 10:07 AM) Unker just go this, 1 of my policy wanna charge me extra 80 per month le. Huh I thought SMX was reprice in 2021? I recall my monthly insurance charges jumped by 20% back then.any maha /k can advise mau up or maintain. I read say can maintain but will effect sustainability wo...wtf do that mean. is this scam?  inb4 /k all kaya, no need insurance |

|

|

Jul 28 2023, 02:27 PM Jul 28 2023, 02:27 PM

Show posts by this member only | IPv6 | Post

#35

|

All Stars

24,431 posts Joined: Feb 2011 |

karazure, anangryorc,

that's why you go with standalone. Whatever increase they already write out and inform you upfront before you sign the form. Of course can increase more than what they stated but all this increase usually affect ILP. That's the reason I avoided ILP at all cost. If you are still healthy, can surrender the ILP and buy standalone one. QUOTE(contestchris @ Jul 28 2023, 02:09 PM) Huh I thought SMX was reprice in 2021? I recall my monthly insurance charges jumped by 20% back then. Maybe increase some more?This post has been edited by Ramjade: Jul 28 2023, 02:27 PM |

|

|

Jul 28 2023, 02:36 PM Jul 28 2023, 02:36 PM

|

Senior Member

1,751 posts Joined: Jun 2005 From: Malaysia |

QUOTE(karazure @ Jul 28 2023, 10:07 AM) Unker just go this, 1 of my policy wanna charge me extra 80 per month le. u damn lucky, only increase 80.any maha /k can advise mau up or maintain. I read say can maintain but will effect sustainability wo...wtf do that mean. is this scam?  inb4 /k all kaya, no need insurance mine increased 450 per month. |

|

|

Jul 28 2023, 02:48 PM Jul 28 2023, 02:48 PM

Show posts by this member only | IPv6 | Post

#37

|

Junior Member

156 posts Joined: Mar 2022 |

QUOTE(bill11 @ Jul 28 2023, 11:23 AM) Anyone bother to check the fund performance for investment link ? mmg suck ballsseems like all the funds performance suck balls, better they just create one fund that buy malaysian local banks, that at least have dividend to rebuy back the fund. is there a US Equity focused fund? |

|

|

Jul 28 2023, 02:48 PM Jul 28 2023, 02:48 PM

Show posts by this member only | IPv6 | Post

#38

|

Junior Member

156 posts Joined: Mar 2022 |

|

|

|

Jul 28 2023, 02:50 PM Jul 28 2023, 02:50 PM

Show posts by this member only | IPv6 | Post

#39

|

Senior Member

1,154 posts Joined: Oct 2021 |

QUOTE(karazure @ Jul 28 2023, 10:07 AM) Unker just go this, 1 of my policy wanna charge me extra 80 per month le. Your age also increase by day, just keep it.any maha /k can advise mau up or maintain. I read say can maintain but will effect sustainability wo...wtf do that mean. is this scam?  inb4 /k all kaya, no need insurance |

|

|

Jul 28 2023, 03:00 PM Jul 28 2023, 03:00 PM

|

Junior Member

660 posts Joined: Jul 2008 From: PJ |

As you age, the premium gets adjusted up, I'm guessing that's what happened

|

|

|

Jul 28 2023, 03:05 PM Jul 28 2023, 03:05 PM

Show posts by this member only | IPv6 | Post

#41

|

Senior Member

2,506 posts Joined: Apr 2020 |

|

|

|

Jul 28 2023, 03:21 PM Jul 28 2023, 03:21 PM

Show posts by this member only | IPv6 | Post

#42

|

Senior Member

5,587 posts Joined: Aug 2011 |

|

|

|

Jul 28 2023, 03:53 PM Jul 28 2023, 03:53 PM

Show posts by this member only | IPv6 | Post

#43

|

Junior Member

387 posts Joined: Mar 2009 |

QUOTE(prdkancil @ Jul 28 2023, 12:24 PM) Now is 1mil annual limit for cheapest plan jo lor , no life time limit . Insurance company purposely set the annual limit to 1mil so to increase premium. Scam to the max!Ur agent no help u upgrade a when those plan upgraded from time to time How many need 1mil medical per year? 1 in million? |

|

|

Jul 28 2023, 04:16 PM Jul 28 2023, 04:16 PM

|

Senior Member

9,617 posts Joined: Aug 2015 |

QUOTE(karazure @ Jul 28 2023, 12:16 PM) this is only 1 of my many policy. My medical is cap at 1Mil from GE. Just check GE(Sinkie), AIA(HK) and Prudential(British) all not local boss 1 eh rupanya. Their premiums collected really a lot, very good business. I guess other policy will have the same issue comin. They wun scare you claim 1M because no way can claim that much. Claim 150K above also very serious adi and you likely can't work adi. |

|

|

Jul 28 2023, 04:26 PM Jul 28 2023, 04:26 PM

Show posts by this member only | IPv6 | Post

#45

|

All Stars

24,431 posts Joined: Feb 2011 |

QUOTE(bigduck @ Jul 28 2023, 02:48 PM) No. I guess it's BNM rules that they have to invest locally. There are some global funds but never pure US fund.QUOTE(contestchris @ Jul 28 2023, 03:21 PM) No, this is due to repricing. The increasing cost of insurance cue to age increase is already priced in at policy inception. To add on, if a fund is not performing, then increase in premium is likely going to be more frequent. Increase in premium is cause by1. Not much money left in the pool as lots of people claim 2. Underperforming or not performing funds 3. Medical inflation Wedchar2912 liked this post

|

|

|

Jul 28 2023, 04:46 PM Jul 28 2023, 04:46 PM

Show posts by this member only | IPv6 | Post

#46

|

Junior Member

133 posts Joined: Oct 2021 |

Is Fi.life good and anyone use this before?

|

|

|

Jul 28 2023, 05:07 PM Jul 28 2023, 05:07 PM

Show posts by this member only | IPv6 | Post

#47

|

All Stars

24,431 posts Joined: Feb 2011 |

|

|

|

Jul 28 2023, 07:17 PM Jul 28 2023, 07:17 PM

|

Junior Member

303 posts Joined: Aug 2005 |

QUOTE(bigduck @ Jul 28 2023, 02:48 PM) i have checked, agent/insurance company said oh your this policy cannot purchase US fund because of we need to be risk-averse .Niamah really, putting in malaysia market even more riskier as we are losing/depreciating 2% riggint yearly against SGD. even if they allow SP500 index purchase also proven in 20 years simply 10X better than put in Malaysia market (unfriendly to make business, how stock will rise ?) bigduck liked this post

|

|

|

Jul 28 2023, 08:02 PM Jul 28 2023, 08:02 PM

|

Senior Member

1,601 posts Joined: Sep 2021 |

QUOTE(Accord2018 @ Jul 28 2023, 12:12 PM) No such thing lock. Sure got clause you din notice similar to " we can revise the price from time to time reasonably" Already experienced this revision of premium 2 years ago. My SA got grilled by me, I was so furious , I asked him “ did you or did you not said the premium will be locked / frozen, the earlier you buy, the cheaper it is?”. He just remained silent. Had they are more ethical & made known this, I”ll not be that angry. Now they will said it was due to the BNM instruction/ regulation. All my kids premium , I decided to purchase from another agents after the incident. If the economy gets worse and higher inflation, then the premium will keep increasing. Recently a person had a stroke, 36 age only, medical cost hospital and Physiotherapy already more than 200k. And that person previously only pay 200++ per month like TS. My intention is to get TS to grilled his SA if he was promised the similar, mana tau he said his SA no more. 13th liked this post

|

|

|

Jul 28 2023, 08:04 PM Jul 28 2023, 08:04 PM

Show posts by this member only | IPv6 | Post

#50

|

Senior Member

1,009 posts Joined: Mar 2019 |

QUOTE(anangryorc @ Jul 28 2023, 11:50 AM) Yea.. allianz saya also want me to top up and send a letter giving a lot of reason.. say average claim increase, and medical fee increase..But never say why their investment like shet return and cannot cover This post has been edited by Boomwick: Jul 28 2023, 08:05 PM karazure liked this post

|

|

|

Jul 28 2023, 08:09 PM Jul 28 2023, 08:09 PM

|

Junior Member

133 posts Joined: Oct 2021 |

|

|

|

Jul 28 2023, 08:53 PM Jul 28 2023, 08:53 PM

|

Senior Member

4,728 posts Joined: Jul 2013 |

QUOTE(nihility @ Jul 28 2023, 10:27 AM) Call your servicing agent. Ask him how come last time explained the premium once locked / bought earlier, it will not change but now how come got revision & got extra , else will effect sustainability ? See how your service agent explain when he used that point to sell the plan years ago. It is abit technical to explain over text and no drawing but long story short is, if more people claim, insurance compamy need to increase the charges, then customer need to pay more premium.QUOTE(karazure @ Jul 28 2023, 10:34 AM) problem is the agent no longer available anymore, Unker buy this like 20+ years ago. Last time got increase like 10 yrs ago. You can always reach out to GE for advice. But i will be honest, if you want the insurance coverage, the simpler solution is to pay the increase in premium.QUOTE(prdkancil @ Jul 28 2023, 12:01 PM) Mine is Allianz investment link too , annually 3.6k and suggest increase another 1k+ = near to 5k but i dont care . If you are young, maybe still ok. By young i mean, below 30 years old. At some point, the premium you pay is not enough to sustain your future charges then your policy will lapse. Lapse means no coverage.Let them readjust the investment portion themself and fix at RM3.6k annually . But anyway, there is too many moving parts that it is really hard to explain and generalise. Your rm3600 may be enough, may not be enough. QUOTE(xpole @ Jul 28 2023, 12:32 PM) I'm on AIA medical insurance. I take pure medical insurance only. No investment link. 3 to 5 years is usually time already. Already 3 years I'm on this insurance and no increase. I hope can stay the same amount for a while since I have other commitments. QUOTE(synical @ Jul 28 2023, 03:00 PM) There are 2 kinds of increment. 1 is if your age increase. 2 is if everybody who bought the same thing going to pay the higher prive for the same thing.1 is following the line on the graph. 2 is moving the entire line up on the graph. Not the same. This post has been edited by adele123: Jul 28 2023, 08:54 PM |

|

|

Jul 28 2023, 08:59 PM Jul 28 2023, 08:59 PM

Show posts by this member only | IPv6 | Post

#53

|

Junior Member

202 posts Joined: Sep 2013 |

My take on why most investment linked don't have pure US equity funds.

Simply reason, what's the world's most performing stock market in the long run? It's US. If they put your funds in US equity funds, it means that your policy investment portion will do well. Thus, no excuse for them to increase your premium due to policy can't sustained. But those conservative people who go and select local income fund in their policy, Conlanfirm in the long run return is negative. So of course the policy can't sustain. Then will ask you to top up premium to sustain longer. |

|

|

Jul 28 2023, 09:00 PM Jul 28 2023, 09:00 PM

Show posts by this member only | IPv6 | Post

#54

|

Junior Member

202 posts Joined: Sep 2013 |

Double posted

This post has been edited by cedriclee: Jul 28 2023, 09:01 PM |

|

|

Jul 29 2023, 03:49 AM Jul 29 2023, 03:49 AM

Show posts by this member only | IPv6 | Post

#55

|

Junior Member

763 posts Joined: Jan 2003 |

QUOTE(nihility @ Jul 28 2023, 08:02 PM) Already experienced this revision of premium 2 years ago. My SA got grilled by me, I was so furious , I asked him “ did you or did you not said the premium will be locked / frozen, the earlier you buy, the cheaper it is?”. He just remained silent. Had they are more ethical & made known this, I”ll not be that angry. Now they will said it was due to the BNM instruction/ regulation. All my kids premium , I decided to purchase from another agents after the incident. Please dont trsut your agent. Read the official materials to be safe.My intention is to get TS to grilled his SA if he was promised the similar, mana tau he said his SA no more. |

|

|

Jul 29 2023, 04:42 AM Jul 29 2023, 04:42 AM

Show posts by this member only | IPv6 | Post

#56

|

Junior Member

30 posts Joined: Jul 2021 |

My great eastern oso increase from 300 to 340

|

|

|

Jul 29 2023, 09:56 AM Jul 29 2023, 09:56 AM

Show posts by this member only | IPv6 | Post

#57

|

All Stars

24,431 posts Joined: Feb 2011 |

QUOTE(nihility @ Jul 28 2023, 08:02 PM) Already experienced this revision of premium 2 years ago. My SA got grilled by me, I was so furious , I asked him “ did you or did you not said the premium will be locked / frozen, the earlier you buy, the cheaper it is?”. He just remained silent. Had they are more ethical & made known this, I”ll not be that angry. Now they will said it was due to the BNM instruction/ regulation. All my kids premium , I decided to purchase from another agents after the incident. You buy from what company is the same. All ILP will have this problem. Only way to avoid this problem is buy standlaone. But standalone can also have this issue if say not enough money in the insurance pool already.My intention is to get TS to grilled his SA if he was promised the similar, mana tau he said his SA no more. QUOTE(Xith @ Jul 28 2023, 08:09 PM) Their PA don't think it's under Generali. |

|

|

Jul 29 2023, 04:03 PM Jul 29 2023, 04:03 PM

Show posts by this member only | IPv6 | Post

#58

|

Senior Member

1,084 posts Joined: Jul 2022 |

QUOTE(karazure @ Jul 28 2023, 10:34 AM) problem is the agent no longer available anymore, Unker buy this like 20+ years ago. Last time got increase like 10 yrs ago. 10 years ago only had increase? Mine 5 years only.. got letter increasing, just like the one you had. But mine was Allianz.QUOTE(bill11 @ Jul 28 2023, 11:23 AM) Anyone bother to check the fund performance for investment link ? Right. I tried to change to the most good.. but they didn't approve at first. I don't have that letter, they were asking some stuff.. I just decided to ignore it.seems like all the funds performance suck balls, better they just create one fund that buy malaysian local banks, that at least have dividend to rebuy back the fund. QUOTE(xpole @ Jul 28 2023, 12:32 PM) I'm on AIA medical insurance. I take pure medical insurance only. No investment link. For awhile should be.. you have another 2 years. But I hope it will still stay the same for you.Already 3 years I'm on this insurance and no increase. I hope can stay the same amount for a while since I have other commitments. |

|

|

Jul 29 2023, 04:08 PM Jul 29 2023, 04:08 PM

Show posts by this member only | IPv6 | Post

#59

|

Senior Member

1,084 posts Joined: Jul 2022 |

QUOTE(anangryorc @ Jul 28 2023, 11:50 AM) QUOTE(contestchris @ Jul 28 2023, 03:21 PM) No, this is due to repricing. The increasing cost of insurance cue to age increase is already priced in at policy inception. Maybe I'm not smart, but it is still not making sense to me. I got premium increase letter, and I spoke with my agent. My agent told me a lot of stuff, some examples.. "a lot of people claiming, and also medical cost gone up, with ringgit performing very bad." I was there like .. "a lot of people claiming, and I never claimed but they want to increase mine also? why not just increase only those who have made claims?" Medical cost gone up? I was like, "well, medical cost up or down, if I claim, I still will only get within my limit/plan which they've already allocated. In case ringgit starts doing well, will my coverage increase? no right?" "if my plan is 500k, then doesn't matter cost up or down, I should entitle for max 500k." So this: QUOTE(yeapsc73 @ Jul 28 2023, 03:53 PM) Insurance company purposely set the annual limit to 1mil so to increase premium. Scam to the max! As long I pay the agreed price today, even 20 years from now.. they should be able to provide coverage for RM1m per year.How many need 1mil medical per year? 1 in million? But after years paying, they say to continue providing the agreed coverage, they have to increase premium! I'm not asking for RM1.5m coverage because of medical inflation right? So they shouldn't increase! |

|

|

Jul 29 2023, 04:16 PM Jul 29 2023, 04:16 PM

|

Senior Member

4,706 posts Joined: Mar 2012 |

i hv just terminated and take back the money

|

|

|

Jul 29 2023, 04:36 PM Jul 29 2023, 04:36 PM

Show posts by this member only | IPv6 | Post

#61

|

All Stars

24,431 posts Joined: Feb 2011 |

QUOTE(Natsukashii @ Jul 29 2023, 04:08 PM) Maybe I'm not smart, but it is still not making sense to me. I got premium increase letter, and I spoke with my agent. My agent told me a lot of stuff, some examples.. "a lot of people claiming, and also medical cost gone up, with ringgit performing very bad." That's not how insurance work. Insurance works by collecting everyone money into a pool which is use to pay someone whenever claims are make.I was there like .. "a lot of people claiming, and I never claimed but they want to increase mine also? why not just increase only those who have made claims?" Medical cost gone up? I was like, "well, medical cost up or down, if I claim, I still will only get within my limit/plan which they've already allocated. In case ringgit starts doing well, will my coverage increase? no right?" "if my plan is 500k, then doesn't matter cost up or down, I should entitle for max 500k." So this: As long I pay the agreed price today, even 20 years from now.. they should be able to provide coverage for RM1m per year. But after years paying, they say to continue providing the agreed coverage, they have to increase premium! I'm not asking for RM1.5m coverage because of medical inflation right? So they shouldn't increase! Now if everyone don't claim then the pool remain constant. If people start claiming, it will come a time when there is not enough money for everyone. So because you are in the pool, you are also forced to pay up even though you never claim. Cause not everyone so good hearted don't want to claim. Think of it as a reservoir. When reservoir no water, water rationing affects everyone. Imagine you already pay so much for insurance, to get back some of the money back, you need to get yourself admitted or else money wasted right? So if one person think like that, you bet there will be others who also think like that. Also the coverage amount is the same but the sustainability (means the insurance can last until xyz years) will decrease if you don't agree to increase the premium. This is what my agent said not I said, standalone tends to follow the projected rate increase and yes there are some years which are exception while ILP won't follow the timetable. So some people get increase in price as early as 2 years. That's why I didn't go with ILP. I was like I already pay so much and you want me to pay extra money every now and then when the insurance company request? Nope. Not going to happen. This post has been edited by Ramjade: Jul 29 2023, 04:37 PM |

|

|

Jul 29 2023, 05:35 PM Jul 29 2023, 05:35 PM

Show posts by this member only | IPv6 | Post

#62

|

Senior Member

1,084 posts Joined: Jul 2022 |

QUOTE(Ramjade @ Jul 29 2023, 04:36 PM) That's not how insurance work. Insurance works by collecting everyone money into a pool which is use to pay someone whenever claims are make. You made the right choice. ILP was told will never have premium increase.. now different story from them.Now if everyone don't claim then the pool remain constant. If people start claiming, it will come a time when there is not enough money for everyone. So because you are in the pool, you are also forced to pay up even though you never claim. Cause not everyone so good hearted don't want to claim. Think of it as a reservoir. When reservoir no water, water rationing affects everyone. Imagine you already pay so much for insurance, to get back some of the money back, you need to get yourself admitted or else money wasted right? So if one person think like that, you bet there will be others who also think like that. Also the coverage amount is the same but the sustainability (means the insurance can last until xyz years) will decrease if you don't agree to increase the premium. This is what my agent said not I said, standalone tends to follow the projected rate increase and yes there are some years which are exception while ILP won't follow the timetable. So some people get increase in price as early as 2 years. That's why I didn't go with ILP. I was like I already pay so much and you want me to pay extra money every now and then when the insurance company request? Nope. Not going to happen. |

|

|

Jul 29 2023, 05:54 PM Jul 29 2023, 05:54 PM

Show posts by this member only | IPv6 | Post

#63

|

All Stars

24,431 posts Joined: Feb 2011 |

|

|

|

Jul 30 2023, 12:25 AM Jul 30 2023, 12:25 AM

Show posts by this member only | IPv6 | Post

#64

|

Junior Member

436 posts Joined: Dec 2021 |

QUOTE(Ramjade @ Jul 29 2023, 04:36 PM) That's not how insurance work. Insurance works by collecting everyone money into a pool which is use to pay someone whenever claims are make. Just sharing here. My parents non ILP, when they reached a certain age and issues started to come like diabetes and all, the insurance company refused to insure them anymore.Now if everyone don't claim then the pool remain constant. If people start claiming, it will come a time when there is not enough money for everyone. So because you are in the pool, you are also forced to pay up even though you never claim. Cause not everyone so good hearted don't want to claim. Think of it as a reservoir. When reservoir no water, water rationing affects everyone. Imagine you already pay so much for insurance, to get back some of the money back, you need to get yourself admitted or else money wasted right? So if one person think like that, you bet there will be others who also think like that. Also the coverage amount is the same but the sustainability (means the insurance can last until xyz years) will decrease if you don't agree to increase the premium. This is what my agent said not I said, standalone tends to follow the projected rate increase and yes there are some years which are exception while ILP won't follow the timetable. So some people get increase in price as early as 2 years. That's why I didn't go with ILP. I was like I already pay so much and you want me to pay extra money every now and then when the insurance company request? Nope. Not going to happen. Now i asked my agent what if my ILP when I reach a certain age they don't want to insure me anymore. My agent said in ILPs there are clauses stating to what age I must be insured whether or not I have made claims before that age. So in a way, that is the advantage of ILP according to my agent. |

|

|

Jul 30 2023, 01:09 AM Jul 30 2023, 01:09 AM

Show posts by this member only | IPv6 | Post

#65

|

All Stars

24,431 posts Joined: Feb 2011 |

QUOTE(Sihambodoh @ Jul 30 2023, 12:25 AM) Just sharing here. My parents non ILP, when they reached a certain age and issues started to come like diabetes and all, the insurance company refused to insure them anymore. Yes what you said is true but that's for the old plan. Nowadays all new plan does not have that clause anymore. That's the not guaranteed clause. Nowdays insurance only won't cover if you Now i asked my agent what if my ILP when I reach a certain age they don't want to insure me anymore. My agent said in ILPs there are clauses stating to what age I must be insured whether or not I have made claims before that age. So in a way, that is the advantage of ILP according to my agent. 1. Don't pay on time/fully pay 2. Commit fraud 3. Surrender policy That was one of my main criteria make sure there is guaranteed renewal. I said I don't want your word, I want black and white from company. She pull up the contract and it's stated there policy will be renew unless the above happen (can't remember the whole terms an condition) This post has been edited by Ramjade: Jul 30 2023, 01:14 AM Sihambodoh liked this post

|

|

|

Jul 30 2023, 02:31 AM Jul 30 2023, 02:31 AM

|

Senior Member

1,861 posts Joined: Dec 2008 From: In The HELL FIRE |

QUOTE(karazure @ Jul 28 2023, 10:07 AM) Unker just go this, 1 of my policy wanna charge me extra 80 per month le. Same these 3 years keep Naik, I don't agree so they reducing my insured years from 85 to 72, next year not going to reduce I guess since investment link fund start doing well any maha /k can advise mau up or maintain. I read say can maintain but will effect sustainability wo...wtf do that mean. is this scam?  inb4 /k all kaya, no need insurance You don't pay they will reduce years of insured This post has been edited by Pain4UrsinZ: Jul 30 2023, 02:33 AM |

|

|

Jul 31 2023, 01:26 PM Jul 31 2023, 01:26 PM

|

Senior Member

1,601 posts Joined: Sep 2021 |

QUOTE(Ramjade @ Jul 29 2023, 09:56 AM) You buy from what company is the same. All ILP will have this problem. Only way to avoid this problem is buy standlaone. But standalone can also have this issue if say not enough money in the insurance pool already. Personally, I'm ok if the conditions are made / declared upfront. What I'm pissed off is more on the way the SA carried out their sales talk.Their PA don't think it's under Generali. |

|

|

Jul 31 2023, 01:28 PM Jul 31 2023, 01:28 PM

|

All Stars

24,431 posts Joined: Feb 2011 |

|

|

|

Jul 31 2023, 01:30 PM Jul 31 2023, 01:30 PM

|

Junior Member

156 posts Joined: Mar 2022 |

QUOTE(Ramjade @ Jul 30 2023, 01:09 AM) Yes what you said is true but that's for the old plan. Nowadays all new plan does not have that clause anymore. That's the not guaranteed clause. Nowdays insurance only won't cover if you You bought ILP or term?1. Don't pay on time/fully pay 2. Commit fraud 3. Surrender policy That was one of my main criteria make sure there is guaranteed renewal. I said I don't want your word, I want black and white from company. She pull up the contract and it's stated there policy will be renew unless the above happen (can't remember the whole terms an condition) |

|

|

Jul 31 2023, 01:55 PM Jul 31 2023, 01:55 PM

Show posts by this member only | IPv6 | Post

#70

|

Senior Member

1,354 posts Joined: Sep 2021 |

QUOTE(prdkancil @ Jul 28 2023, 11:05 AM) The premium remain at RM3600 annually , wat i mean the medical card fees is increasing thn thy will auto readjust from RM3600. Wow. You spend around 10% of your income on insurance.Example from RM3600 , 1.6k go to pay medical card fees and 2k investment thn now auto adjust 2k on medical card then 1.6k for investment like that lur . The reason thy wana increase the premium because thy forecast in future investment not enuf to cover medical card fees because the medical fees is increasing . No wonder. |

|

|

Jul 31 2023, 01:57 PM Jul 31 2023, 01:57 PM

Show posts by this member only | IPv6 | Post

#71

|

Senior Member

1,354 posts Joined: Sep 2021 |

QUOTE(bill11 @ Jul 28 2023, 11:23 AM) Anyone bother to check the fund performance for investment link ? Why can't you just buy yourself?seems like all the funds performance suck balls, better they just create one fund that buy malaysian local banks, that at least have dividend to rebuy back the fund. You do realize you have to pay fees so you? Unless, you can claim income tax. Then investment linked might be worth it if they focus on low risk investment. |

|

|

Jul 31 2023, 01:58 PM Jul 31 2023, 01:58 PM

Show posts by this member only | IPv6 | Post

#72

|

Senior Member

1,354 posts Joined: Sep 2021 |

QUOTE(Accord2018 @ Jul 28 2023, 12:12 PM) No such thing lock. Sure got clause you din notice similar to " we can revise the price from time to time reasonably" I am pretty sure the insurance did not cover everything.If the economy gets worse and higher inflation, then the premium will keep increasing. Recently a person had a stroke, 36 age only, medical cost hospital and Physiotherapy already more than 200k. And that person previously only pay 200++ per month like TS. |

|

|

Jul 31 2023, 02:00 PM Jul 31 2023, 02:00 PM

Show posts by this member only | IPv6 | Post

#73

|

Senior Member

1,354 posts Joined: Sep 2021 |

QUOTE(MrBaba @ Jul 28 2023, 12:19 PM) Only thing good about ge is, you can claim for income tax as well. And they even give you voucher and your surrender value increases each year. Taking into tax account, it's not too bad actually |

|

|

Jul 31 2023, 02:01 PM Jul 31 2023, 02:01 PM

Show posts by this member only | IPv6 | Post

#74

|

Senior Member

1,354 posts Joined: Sep 2021 |

QUOTE(xpole @ Jul 28 2023, 12:32 PM) I'm on AIA medical insurance. I take pure medical insurance only. No investment link. Well. If your medical bills more then the max coverage good luck.Already 3 years I'm on this insurance and no increase. I hope can stay the same amount for a while since I have other commitments. |

|

|

Jul 31 2023, 02:09 PM Jul 31 2023, 02:09 PM

Show posts by this member only | IPv6 | Post

#75

|

Junior Member

156 posts Joined: Mar 2022 |

|

|

|

Jul 31 2023, 02:10 PM Jul 31 2023, 02:10 PM

Show posts by this member only | IPv6 | Post

#76

|

Junior Member

156 posts Joined: Mar 2022 |

QUOTE(BrookLes @ Jul 31 2023, 01:57 PM) Why can't you just buy yourself? I don't think he purposely wanna invest in those funds, those are only the available funds when you purchase an ILPYou do realize you have to pay fees so you? Unless, you can claim income tax. Then investment linked might be worth it if they focus on low risk investment. |

|

|

Jul 31 2023, 02:11 PM Jul 31 2023, 02:11 PM

Show posts by this member only | IPv6 | Post

#77

|

Senior Member

1,354 posts Joined: Sep 2021 |

QUOTE(bigduck @ Jul 31 2023, 02:09 PM) Can claim. But surrender value increasing?You see. I am more interested that I put in and then get more out after income tax considerations. My surrender value always increasing at the same amount as the premium that I pay. I end up saving after claiming tax relief. This post has been edited by BrookLes: Jul 31 2023, 02:13 PM bigduck liked this post

|

|

|

Jul 31 2023, 02:15 PM Jul 31 2023, 02:15 PM

|

Junior Member

222 posts Joined: Nov 2021 |

|

|

|

Jul 31 2023, 02:24 PM Jul 31 2023, 02:24 PM

|

Junior Member

70 posts Joined: Aug 2014 |

|

|

|

Jul 31 2023, 02:31 PM Jul 31 2023, 02:31 PM

Show posts by this member only | IPv6 | Post

#80

|

Senior Member

1,354 posts Joined: Sep 2021 |

QUOTE(bigduck @ Jul 31 2023, 02:10 PM) I don't think he purposely wanna invest in those funds, those are only the available funds when you purchase an ILP Yes and why would you want to invest in those funds when you can diy and buy those bank stocks yourself.Only advantage for investment linked is if you can save on taxes and they invest on only fixed income investment. I dun mind paying them fees if my tax saved is more then the fees. |

|

|

Jul 31 2023, 03:26 PM Jul 31 2023, 03:26 PM

Show posts by this member only | IPv6 | Post

#81

|

All Stars

24,431 posts Joined: Feb 2011 |

QUOTE(bigduck @ Jul 31 2023, 01:30 PM) Term la. I won't waste good money by paying for things I don't want and are useless.QUOTE(BrookLes @ Jul 31 2023, 01:57 PM) Why can't you just buy yourself? Er no. That's why it's call investment linked. You choose the fund and they buy the fund and you get charged 1.5-1.8%p.aYou do realize you have to pay fees so you? Unless, you can claim income tax. Then investment linked might be worth it if they focus on low risk investment. QUOTE(BrookLes @ Jul 31 2023, 01:58 PM) Physiotherapy, medications cover la.QUOTE(BrookLes @ Jul 31 2023, 02:11 PM) Can claim. But surrender value increasing? If you buy medical rider with the ILP, then overtime no more surrender value cause ILP with medical rider will become zero or negative.You see. I am more interested that I put in and then get more out after income tax considerations. My surrender value always increasing at the same amount as the premium that I pay. I end up saving after claiming tax relief. |

|

|

Jul 31 2023, 03:38 PM Jul 31 2023, 03:38 PM

|

Junior Member

90 posts Joined: Jul 2013 |

most likely this is investment linked policy and whenever they fail in their investment, they charged higher premium. Or whenever they fail to achieve their investment ROI, they charged higher premium. Every year, they declare very high profit and annual dinner. james.6831 liked this post

|

|

|

Jul 31 2023, 03:48 PM Jul 31 2023, 03:48 PM

|

Junior Member

70 posts Joined: Aug 2014 |

QUOTE(taurean @ Jul 31 2023, 03:38 PM) most likely this is investment linked policy and whenever they fail in their investment, they charged higher premium. mcm unker ade jasa sponsor their annual dinner?Or whenever they fail to achieve their investment ROI, they charged higher premium. Every year, they declare very high profit and annual dinner. |

|

|

Jul 31 2023, 04:19 PM Jul 31 2023, 04:19 PM

Show posts by this member only | IPv6 | Post

#84

|

All Stars

24,431 posts Joined: Feb 2011 |

|

|

|

Jul 31 2023, 06:52 PM Jul 31 2023, 06:52 PM

|

Junior Member

652 posts Joined: Dec 2016 |

1m is meaningless , just an excuse to increase the premium

if you claim a certain amount or above, the insurance company already ask long ask short to the doctor and hospital and need explanation.... better buy life insurance instead, medical insurance be practical better, reasonable amount then ok, the amount paid yearly ngam ngam can utilize the max amount to claim the tax relief then ok if u go see those insurance company boss, all those drive luxury car already This post has been edited by mlamlam: Jul 31 2023, 06:53 PM |

|

|

Jul 31 2023, 07:03 PM Jul 31 2023, 07:03 PM

Show posts by this member only | IPv6 | Post

#86

|

Junior Member

692 posts Joined: Oct 2006 |

QUOTE(Ramjade @ Jul 29 2023, 04:36 PM) That's not how insurance work. Insurance works by collecting everyone money into a pool which is use to pay someone whenever claims are make. there is an event called called adverse selection where "high-risk people are more willing to take out and pay greater premiums for policies. If the company charges an average price but only high-risk consumers buy, the company takes a financial loss by paying out more benefits or claims."Now if everyone don't claim then the pool remain constant. If people start claiming, it will come a time when there is not enough money for everyone. So because you are in the pool, you are also forced to pay up even though you never claim. Cause not everyone so good hearted don't want to claim. Think of it as a reservoir. When reservoir no water, water rationing affects everyone. Imagine you already pay so much for insurance, to get back some of the money back, you need to get yourself admitted or else money wasted right? So if one person think like that, you bet there will be others who also think like that. Also the coverage amount is the same but the sustainability (means the insurance can last until xyz years) will decrease if you don't agree to increase the premium. This is what my agent said not I said, standalone tends to follow the projected rate increase and yes there are some years which are exception while ILP won't follow the timetable. So some people get increase in price as early as 2 years. That's why I didn't go with ILP. I was like I already pay so much and you want me to pay extra money every now and then when the insurance company request? Nope. Not going to happen. |

|

|

Jul 31 2023, 08:14 PM Jul 31 2023, 08:14 PM

Show posts by this member only | IPv6 | Post

#87

|

Senior Member

1,354 posts Joined: Sep 2021 |

QUOTE(Ramjade @ Jul 31 2023, 03:26 PM) Term la. I won't waste good money by paying for things I don't want and are useless. I know you are the insecure type. Few years ago, when ppl say that cimb for Sgd to myr gives the best rate you still ask ppl to use TransferWise where the rate is not so good and there are extra fees. But I digress.Er no. That's why it's call investment linked. You choose the fund and they buy the fund and you get charged 1.5-1.8%p.a Physiotherapy, medications cover la. If you buy medical rider with the ILP, then overtime no more surrender value cause ILP with medical rider will become zero or negative. Of course if any plan that is ilp and no tax benefits obviously dun buy. I highlighted that right? And I already highlighted that my insurance plan work in such a way that my premium that I pay is the same as the surrender value. I even highlighted this in the insurance thread. What further issue you have? |

|

|

Jul 31 2023, 08:44 PM Jul 31 2023, 08:44 PM

Show posts by this member only | IPv6 | Post

#88

|

Senior Member

2,506 posts Joined: Apr 2020 |

QUOTE(BrookLes @ Jul 31 2023, 02:00 PM) Only thing good about ge is, you can claim for income tax as well. And they even give you voucher and your surrender value increases each year. Taking into tax account, it's not too bad actually So far only GE I saw when want claim they will ask u do those pelik pelik test before let u claim . QUOTE(BrookLes @ Jul 31 2023, 02:01 PM) Trust me when u kena those critical illness even with high limit pun u they do set a time limit for u to claim one like 1 yr from operation after that u sendiri tanggun . Even during the one year not every thing can claim . Mil kena breast cancer that why I know |

|

|

Jul 31 2023, 08:45 PM Jul 31 2023, 08:45 PM

Show posts by this member only | IPv6 | Post

#89

|

Junior Member

763 posts Joined: Jan 2003 |

QUOTE(Ramjade @ Jul 31 2023, 03:26 PM) Term la. I won't waste good money by paying for things I don't want and are useless. U compared the price of your term plan with the one in EPF ?Er no. That's why it's call investment linked. You choose the fund and they buy the fund and you get charged 1.5-1.8%p.a Physiotherapy, medications cover la. If you buy medical rider with the ILP, then overtime no more surrender value cause ILP with medical rider will become zero or negative. |

|

|

Jul 31 2023, 09:15 PM Jul 31 2023, 09:15 PM

Show posts by this member only | IPv6 | Post

#90

|

All Stars

24,431 posts Joined: Feb 2011 |

QUOTE(e-lite @ Jul 31 2023, 07:03 PM) there is an event called called adverse selection where "high-risk people are more willing to take out and pay greater premiums for policies. If the company charges an average price but only high-risk consumers buy, the company takes a financial loss by paying out more benefits or claims." I am ordinary people. So not applicable to me. I only buy what's available on the market. Nothing specially tailored.QUOTE(BrookLes @ Jul 31 2023, 08:14 PM) I know you are the insecure type. Few years ago, when ppl say that cimb for Sgd to myr gives the best rate you still ask ppl to use TransferWise where the rate is not so good and there are extra fees. But I digress. What insecured? I know what I want and I shop around for best price. I have no brand loyalty. I think you are got mixed up. I have always said Cimb sg have the best SGD to MYR rate. I have always said CIMB Malaysia have lousy rates even though TransferWise got fees and CIMB Malaysia market themselves as no fees. The net SGD you received after using Cimb MY and TransferWise for huge transfer is significant (you received less SGD by using CIMB MY). Like I said, I shop around. I have compared maybank, Hong leong, uob, standard charted, public bank, cimb, OCBC, all give rubbish MYR to SGD rates. That's why I never recommend anyone to use banks.Of course if any plan that is ilp and no tax benefits obviously dun buy. I highlighted that right? And I already highlighted that my insurance plan work in such a way that my premium that I pay is the same as the surrender value. I even highlighted this in the insurance thread. What further issue you have? Kindly checked again/ask your agent to give you the sustainability table. In the beginning yes, yes you will have cash value. But towards the end of the insurance say when you are 60-70 years old, there is usually no more cash value left unless yours is not medical insurance. QUOTE(cms @ Jul 31 2023, 08:45 PM) Nah. EPF one doesn't have coverage of min RM1m. Anything that does not have RM1m coverage automatically I disqualified them. Also EPF does not have medical insurance. Correct me if I am wrong.This post has been edited by Ramjade: Jul 31 2023, 09:17 PM |

|

|

Jul 31 2023, 09:22 PM Jul 31 2023, 09:22 PM

Show posts by this member only | IPv6 | Post

#91

|

Senior Member

1,354 posts Joined: Sep 2021 |

QUOTE(Ramjade @ Jul 31 2023, 09:15 PM) I am ordinary people. So not applicable to me. I only buy what's available on the market. Nothing specially tailored. Nah it was clearly a discussion of sgd to myr.What insecured? I know what I want and I shop around for best price. I have no brand loyalty. I think you are got mixed up. I have always said Cimb sg have the best SGD to MYR rate. I have always said CIMB Malaysia have lousy rates even though TransferWise got fees and CIMB Malaysia market themselves as no fees. The net SGD you received after using Cimb MY and TransferWise for huge transfer is significant (you received less SGD by using CIMB MY). Like I said, I shop around. I have compared maybank, Hong leong, uob, standard charted, public bank, cimb, OCBC, all give rubbish MYR to SGD rates. That's why I never recommend anyone to use banks. Kindly checked again/ask your agent to give you the sustainability table. In the beginning yes, yes you will have cash value. But towards the end of the insurance say when you are 60-70 years old, there is usually no more cash value left unless yours is not medical insurance. Nah. EPF one doesn't have coverage of min RM1m. Anything that does not have RM1m coverage automatically I disqualified them. Also EPF does not have medical insurance. Correct me if I am wrong. But it's ok. I know you always twist one so no point discussing And why would you say dun use banks when cimb had the best sgd to myr rates. See always contradicting. Suggestion. Dun have to write long essay to me next time when your points contradict. This post has been edited by BrookLes: Jul 31 2023, 09:27 PM |

|

|

Jul 31 2023, 09:26 PM Jul 31 2023, 09:26 PM

Show posts by this member only | IPv6 | Post

#92

|

All Stars

24,431 posts Joined: Feb 2011 |

QUOTE(BrookLes @ Jul 31 2023, 09:22 PM) Nah it was clearly a discussion of sgd to myr. Read carefully. CIMB Malaysia have lousy rates. CIMB sg have good rates.But it's ok. I know you always twist one so no point discussing And why would you say dun use banks when cimb had the best sgd to myr rates. See always contradicting. If you are moving RM to SGD don't use banks. If you are moving SGD to RM use cimb SG. Yes there is a fintech which I know offer better rates than comb sg but it's only available for people working there or staying there not for regular poor human like me. |

|

|

Jul 31 2023, 09:29 PM Jul 31 2023, 09:29 PM

Show posts by this member only | IPv6 | Post

#93

|

Senior Member

1,354 posts Joined: Sep 2021 |

QUOTE(Ramjade @ Jul 31 2023, 09:26 PM) Read carefully. CIMB Malaysia have lousy rates. CIMB sg have good rates. And like I said. You already contradict yourself by saying dun use banks when cimb sgd to myr is the best rate.If you are moving RM to SGD don't use banks. If you are moving SGD to RM use cimb SG. Yes there is a fintech which I know offer better rates than comb sg but it's only available for people working there or staying there not for regular poor human like me. Sorry I doubt your last paragraph. |

|

|

Jul 31 2023, 09:31 PM Jul 31 2023, 09:31 PM

Show posts by this member only | IPv6 | Post

#94

|

All Stars

24,431 posts Joined: Feb 2011 |

|

|

|

Jul 31 2023, 09:34 PM Jul 31 2023, 09:34 PM

Show posts by this member only | IPv6 | Post

#95

|

Senior Member

1,354 posts Joined: Sep 2021 |

QUOTE(Ramjade @ Jul 31 2023, 09:31 PM) You go check yourself. I already check DBS, CIMB, Maybank and transferwise. See. Just now say cimb sgd to myr gives the best rate still talk crap with me.There is. You need to do research. No one is talking about MYR to sgd Research what. Crap? You need to see a doctor seriously. This post has been edited by BrookLes: Jul 31 2023, 09:35 PM |

|

|

Jul 31 2023, 09:40 PM Jul 31 2023, 09:40 PM

Show posts by this member only | IPv6 | Post

#96

|

All Stars

24,431 posts Joined: Feb 2011 |

QUOTE(BrookLes @ Jul 31 2023, 09:34 PM) See. Just now say cimb sgd to myr gives the best rate still talk crap with me. There is a fintech in Singapore that give better rates than what cimb sg is offering. I have seen their rates. Like I said kindly do research.No one is talking about MYR to sgd Research what. Crap? You need to see a doctor seriously. Anyway stay on topic please. This is about insurance premium. This post has been edited by Ramjade: Jul 31 2023, 09:40 PM |

|

|

Jul 31 2023, 09:42 PM Jul 31 2023, 09:42 PM

Show posts by this member only | IPv6 | Post

#97

|

Senior Member

1,354 posts Joined: Sep 2021 |

QUOTE(Ramjade @ Jul 31 2023, 09:40 PM) There is a fintech in Singapore that give better rates than what cimb sg is offering. I have seen their rates. Like I said kindly do research. My point still stand. Anyway stay on topic please. This is about insurance premium. You need to go and get your head examined. |

|

|

Jul 31 2023, 09:43 PM Jul 31 2023, 09:43 PM

Show posts by this member only | IPv6 | Post

#98

|

All Stars

24,431 posts Joined: Feb 2011 |

|

|

|

Jul 31 2023, 09:53 PM Jul 31 2023, 09:53 PM

|

Junior Member

303 posts Joined: Aug 2005 |

QUOTE(BrookLes @ Jul 31 2023, 01:57 PM) Why can't you just buy yourself? ermmm my point is that the ILP that last time preselected by insurance agent didnt generate good return. So if they just use the money to buy bank stock, it will have yield better so i have more fund for future.. You do realize you have to pay fees so you? Unless, you can claim income tax. Then investment linked might be worth it if they focus on low risk investment. Also if you notice, all these insurance companies are "turtle head", they dont dare to publish the fund price since launch.. only one to 3 month data. |

|

|

Aug 1 2023, 12:39 AM Aug 1 2023, 12:39 AM

Show posts by this member only | IPv6 | Post

#100

|

Junior Member

763 posts Joined: Jan 2003 |

QUOTE(Ramjade @ Jul 31 2023, 09:26 PM) Read carefully. CIMB Malaysia have lousy rates. CIMB sg have good rates. Chill lah..don't need to stuff your ideas too hard to win internet discussions and.axt like Mr know it all. Better make use of your knowledge in real world. If you are moving RM to SGD don't use banks. If you are moving SGD to RM use cimb SG. Yes there is a fintech which I know offer better rates than comb sg but it's only available for people working there or staying there not for regular poor human like me. No winners or losers on the net. Most will even forget about anyone one this forum the minute we post. Just like.this. |

|

|

Aug 1 2023, 07:34 AM Aug 1 2023, 07:34 AM

|

Senior Member

9,617 posts Joined: Aug 2015 |

QUOTE(mlamlam @ Jul 31 2023, 06:52 PM) 1m is meaningless , just an excuse to increase the premium They must keep a lot of reserves. If suddenly got terrorist attack to hit many2 tower , they may need to bankruptif you claim a certain amount or above, the insurance company already ask long ask short to the doctor and hospital and need explanation.... better buy life insurance instead, medical insurance be practical better, reasonable amount then ok, the amount paid yearly ngam ngam can utilize the max amount to claim the tax relief then ok if u go see those insurance company boss, all those drive luxury car already This post has been edited by Accord2018: Aug 1 2023, 07:47 AM |

|

|

Aug 1 2023, 10:55 AM Aug 1 2023, 10:55 AM

|

Junior Member

50 posts Joined: Sep 2021 |

Agent will definitely said that due to increase in medical fee, you have to pay more premium in order to secure higher limit of medical insurance coverage.

|

|

|

Aug 1 2023, 11:12 AM Aug 1 2023, 11:12 AM

Show posts by this member only | IPv6 | Post

#103

|

Junior Member

387 posts Joined: Mar 2009 |

|

|

|

Aug 1 2023, 11:16 AM Aug 1 2023, 11:16 AM

|

Senior Member

1,782 posts Joined: Jul 2022 |

QUOTE(karazure @ Jul 28 2023, 10:07 AM) Unker just go this, 1 of my policy wanna charge me extra 80 per month le. Did you recently had some health declaration that your insurance co found out? any maha /k can advise mau up or maintain. I read say can maintain but will effect sustainability wo...wtf do that mean. is this scam?  inb4 /k all kaya, no need insurance maybe you went for a health screening and it reported to your insurance co? Perhaps you can adjust, say don't want increase premium but reduce your coverage or investment. |

|

|

Aug 1 2023, 11:38 AM Aug 1 2023, 11:38 AM

Show posts by this member only | IPv6 | Post

#105

|

All Stars

24,431 posts Joined: Feb 2011 |

QUOTE(hoonanoo @ Aug 1 2023, 11:16 AM) Did you recently had some health declaration that your insurance co found out? Got nothing to do with health condition. Cause by only 2 stuff.maybe you went for a health screening and it reported to your insurance co? Perhaps you can adjust, say don't want increase premium but reduce your coverage or investment. 1. Investment not performing 2. Not much money left in the pool already Usually increase premium and coverage stays the same. Can't reduce the investment part as it's already fixed in the plan. This post has been edited by Ramjade: Aug 1 2023, 01:04 PM karazure liked this post

|

|

|

Aug 1 2023, 12:02 PM Aug 1 2023, 12:02 PM

|

Junior Member

70 posts Joined: Aug 2014 |

QUOTE(hoonanoo @ Aug 1 2023, 11:16 AM) Did you recently had some health declaration that your insurance co found out? No unker had no health issue, from what Unker found out this is normal practice for all insurance company. maybe you went for a health screening and it reported to your insurance co? Perhaps you can adjust, say don't want increase premium but reduce your coverage or investment. |

|

|

Aug 1 2023, 12:07 PM Aug 1 2023, 12:07 PM

|

Senior Member

1,782 posts Joined: Jul 2022 |

QUOTE(Ramjade @ Aug 1 2023, 11:38 AM) Got nothing to do with health condition. Cause by only 2 stuff. oh ok makes sense. 1. Investment not performing 2. Not much money left I. The pool already Usually increase premium and coverage stays the same. Can't reduce the investment part as it's already fixed in the plan. investment was supposed to support the premium. |

|

|

Aug 1 2023, 12:22 PM Aug 1 2023, 12:22 PM

|

Senior Member

3,694 posts Joined: Apr 2019 |

|

|

|

Aug 1 2023, 12:36 PM Aug 1 2023, 12:36 PM

Show posts by this member only | IPv6 | Post

#109

|

Junior Member

47 posts Joined: Apr 2020 |

So now everything is affected by inflation?

|

|

|

Aug 1 2023, 01:19 PM Aug 1 2023, 01:19 PM

Show posts by this member only | IPv6 | Post

#110

|

Junior Member

763 posts Joined: Jan 2003 |

|

|

|

Aug 1 2023, 01:54 PM Aug 1 2023, 01:54 PM

|

Junior Member

652 posts Joined: Dec 2016 |

|

|

|

Aug 1 2023, 02:02 PM Aug 1 2023, 02:02 PM

Show posts by this member only | IPv6 | Post

#112

|

Senior Member

1,767 posts Joined: Jan 2019 |

Always remember,

Insurance premiums =/= insurance charges Take the premiums as your account’s credit and the charges as your monthly/yearly subscription fees. Their relationship is roughly like below  You’re paying a roughly fixed sum everymonth to that your interests (hopefully) earned are enough to pay off your exorbitant insurance charges when you’re old. If insurance companies forecasting that your interests are unlikely to last till the projected age, they’ll push you to increase your monthly premiums. That been said, insurance charges after you’re over 70 are high and ridiculously high when you’re closing towards/over 80. It became a luxury to pay the yearly charges and keep your policy active. This post has been edited by msacras: Aug 1 2023, 02:19 PM |

|

|

Aug 1 2023, 02:20 PM Aug 1 2023, 02:20 PM

|

Senior Member

3,843 posts Joined: Oct 2011 |

QUOTE(msacras @ Aug 1 2023, 02:02 PM) Always remember, None of the insurance company can maintain the ILP premium with their investment. All of this ILP are deliberately designed to trap the customers to buy the ILP early and increase the premium later on.Insurance premiums =/= insurance charges Take the premiums as your account’s credit and the charges as your monthly/yearly subscription fees. Their relationship is roughly like below  You’re paying a roughly fixed sum everymonth to that your interests (hopefully) earned are enough to pay off your exorbitant insurance charges when you’re old. If insurance companies forecasting that your interests are unlikely to last till the projected age, they’ll push you to increase your monthly premiums. This post has been edited by poweredbydiscuz: Aug 1 2023, 02:22 PM |

|

|

Aug 3 2023, 10:36 PM Aug 3 2023, 10:36 PM

Show posts by this member only | IPv6 | Post

#114

|

All Stars

12,573 posts Joined: Nov 2008 |

QUOTE(karazure @ Jul 28 2023, 10:07 AM) Unker just go this, 1 of my policy wanna charge me extra 80 per month le. Could i ask u for further details as I myself at the juncture of selecting either standalone or ILP..any maha /k can advise mau up or maintain. I read say can maintain but will effect sustainability wo...wtf do that mean. is this scam?  inb4 /k all kaya, no need insurance So your premium is RM213/month for an ILP, may I know when did you sign the contract, what the original premium was and until what year was the ILP projected to last, eg: 70 years old? I have a feeling that a lot of agents often do not disclose that ILPs are quite prone to frequent increase in premiums due to mediocre returns from the funds. In fact, most agents I have dealt with actually emphasize that the premium you pay for an ILP is "fixed" until the end of the contract... |

|

|

Aug 7 2023, 06:13 PM Aug 7 2023, 06:13 PM

Show posts by this member only | IPv6 | Post

#115

|

All Stars

24,431 posts Joined: Feb 2011 |

QUOTE(vvip @ Aug 7 2023, 05:47 PM) Recently got a letter from my insurance mentioning "If you do not take any futher action, your current policy coverage is projected to last for the next 8 years and 5 months only based on your current premium." You can see example here. Kindly take your time and read through.The revised premium is a whooping 80% increment. Is this kind of thing only happens to Investment Link? |

|

|

Aug 8 2023, 02:38 PM Aug 8 2023, 02:38 PM

|

Senior Member

1,354 posts Joined: Sep 2021 |

QUOTE(-kytz- @ Aug 3 2023, 10:36 PM) Could i ask u for further details as I myself at the juncture of selecting either standalone or ILP.. But yet ppl trust them and still continue to support their Lamborghini.So your premium is RM213/month for an ILP, may I know when did you sign the contract, what the original premium was and until what year was the ILP projected to last, eg: 70 years old? I have a feeling that a lot of agents often do not disclose that ILPs are quite prone to frequent increase in premiums due to mediocre returns from the funds. In fact, most agents I have dealt with actually emphasize that the premium you pay for an ILP is "fixed" until the end of the contract... |

| Change to: |  0.0502sec 0.0502sec

0.49 0.49

5 queries 5 queries

GZIP Disabled GZIP Disabled

Time is now: 23rd December 2025 - 05:03 AM |