QUOTE(xander2k8 @ Apr 3 2023, 07:54 AM)

AHAM Capital, (Formally Affin Hwang Asset Management)

AHAM Capital, (Formally Affin Hwang Asset Management)

|

|

Apr 3 2023, 11:12 AM Apr 3 2023, 11:12 AM

|

Junior Member

263 posts Joined: Aug 2017 |

|

|

|

|

|

|

Apr 3 2023, 11:28 AM Apr 3 2023, 11:28 AM

Show posts by this member only | IPv6 | Post

#22

|

Senior Member

4,499 posts Joined: Mar 2014 |

|

|

|

Apr 3 2023, 11:53 AM Apr 3 2023, 11:53 AM

|

Junior Member

263 posts Joined: Aug 2017 |

|

|

|

Apr 3 2023, 12:12 PM Apr 3 2023, 12:12 PM

|

Junior Member

263 posts Joined: Aug 2017 |

QUOTE(xander2k8 @ Mar 23 2023, 03:32 AM) When the bond series suspended by AHAM it still has a nominal value of at least 30% value coupled with 15% of portfolio in cash hence it still have value of close to 50% what about AHAM Single bond series 2 and 4 ?The next step is to claim back the nominal value from FINMA and CS only will only process the bond value either through swap or payoff from CS which only happens once the merger is completed by September |

|

|

Apr 3 2023, 02:53 PM Apr 3 2023, 02:53 PM

Show posts by this member only | IPv6 | Post

#25

|

Senior Member

4,676 posts Joined: Jan 2003 |

|

|

|

Apr 10 2023, 03:56 AM Apr 10 2023, 03:56 AM

|

Junior Member

263 posts Joined: Aug 2017 |

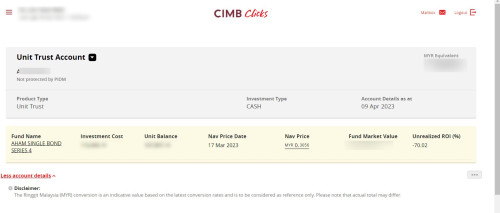

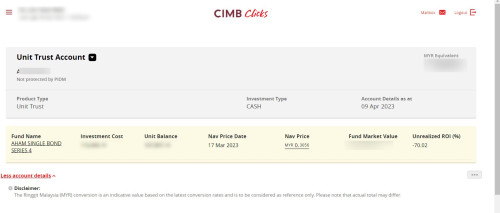

QUOTE(xander2k8 @ Apr 3 2023, 02:53 PM) Despite of Credit Suisse Bond writing down to "ZERO" (NO VALUE AT ALL), below info of AHAM SINGLE BOND SERIES 4(Product Highlights Sheet) and Screenshot of CIMB Clicks web (UT Account section)Following info extract from one of AHAMs document: Document source link: https://aham.com.my/invest-with-us/list-of-...tails?q=SBS4HCF KEY PRODUCT FEATURES: Investment Strategy: The Fund will be investing directly into a single-credit bond. The remaining NAV of the Fund will be in money market instruments, deposits, derivatives, and/or any other form of investments as may be determined by the Manager from time to time that is in line with the Fund’s objective. The Fund may invest in foreign market. Asset Allocation • A minimum of 60% of the Fund’s NAV to be invested in bond; and • A maximum of 40% of the Fund’s NAV to be invested in money market instrument and/or deposits.. Following screenshot from CIMB Clicks: As per app last NAV Price was 0.3056 @ 17 MAC 2023, with Unrealized ROI (%) -70.02  I still see numbers under FUND MARKET VALUE |

|

|

|

|

|

Apr 10 2023, 10:43 AM Apr 10 2023, 10:43 AM

Show posts by this member only | IPv6 | Post

#27

|

Senior Member

4,676 posts Joined: Jan 2003 |

QUOTE(csbong87 @ Apr 10 2023, 03:56 AM) Despite of Credit Suisse Bond writing down to "ZERO" (NO VALUE AT ALL), below info of AHAM SINGLE BOND SERIES 4(Product Highlights Sheet) and Screenshot of CIMB Clicks web (UT Account section) Which means you just lose 70% which they allocate to AT1 bonds while 30% is still in MMF or liquid depositsFollowing info extract from one of AHAMs document: Document source link: https://aham.com.my/invest-with-us/list-of-...tails?q=SBS4HCF KEY PRODUCT FEATURES: Investment Strategy: The Fund will be investing directly into a single-credit bond. The remaining NAV of the Fund will be in money market instruments, deposits, derivatives, and/or any other form of investments as may be determined by the Manager from time to time that is in line with the Fund’s objective. The Fund may invest in foreign market. Asset Allocation • A minimum of 60% of the Fund’s NAV to be invested in bond; and • A maximum of 40% of the Fund’s NAV to be invested in money market instrument and/or deposits.. Following screenshot from CIMB Clicks: As per app last NAV Price was 0.3056 @ 17 MAC 2023, with Unrealized ROI (%) -70.02  I still see numbers under FUND MARKET VALUE |

|

|

Apr 11 2023, 05:31 AM Apr 11 2023, 05:31 AM

|

Junior Member

263 posts Joined: Aug 2017 |

QUOTE(xander2k8 @ Apr 10 2023, 10:43 AM) Which means you just lose 70% which they allocate to AT1 bonds while 30% is still in MMF or liquid deposits Thanks for the reply, btw how can I file a complain against my CIMB banker for not following clients instructions for liquidating the fund (Called and met numerous occasions, when NAV was around 80 cents). He blames AHAM instead. any advice ? |

|

|

Apr 11 2023, 05:41 AM Apr 11 2023, 05:41 AM

Show posts by this member only | IPv6 | Post

#29

|

All Stars

14,931 posts Joined: Mar 2015 |

QUOTE(csbong87 @ Apr 11 2023, 05:31 AM) Thanks for the reply, btw how can I file a complain against my CIMB banker for not following clients instructions for liquidating the fund (Called and met numerous occasions, when NAV was around 80 cents). He blames AHAM instead. any advice ? Just asking, ....do you still hv documented evidence of communication or instruction to liquidate that fund when nav was still at 0.80? |

|

|

Apr 11 2023, 11:53 AM Apr 11 2023, 11:53 AM

Show posts by this member only | IPv6 | Post

#30

|

Senior Member

4,676 posts Joined: Jan 2003 |

QUOTE(csbong87 @ Apr 11 2023, 05:31 AM) Thanks for the reply, btw how can I file a complain against my CIMB banker for not following clients instructions for liquidating the fund (Called and met numerous occasions, when NAV was around 80 cents). He blames AHAM instead. any advice ? Did you have any written standing instruction as proof of execution?Verbal would be very hard to proof He has the right to blame AHAM because he can instruct but execution by the fund house itself This is why never ever buy from 3rd party particularly banks because it is out their hands unlike buying direct from the fund house where you locked in the projected price |

|

|

Apr 11 2023, 12:03 PM Apr 11 2023, 12:03 PM

Show posts by this member only | IPv6 | Post

#31

|

Senior Member

4,499 posts Joined: Mar 2014 |

QUOTE(csbong87 @ Apr 11 2023, 05:31 AM) Thanks for the reply, btw how can I file a complain against my CIMB banker for not following clients instructions for liquidating the fund (Called and met numerous occasions, when NAV was around 80 cents). He blames AHAM instead. any advice ? You make the complaint to the bank official channel first. Go check cimb website for how to complaint. The bank will be obligated to respond.Draft your complaint properly. Maybe get a lawyer friend to help draft it. Get ready supporting documents. Other than not following instructions, was there also misseling? A lot of bankers get away with misselling financial products without properly informing client of the risk. If not happy with the Bank response then can go to BNM, SC and or Financial Ombudsman for further action. |

|

|

Apr 11 2023, 02:26 PM Apr 11 2023, 02:26 PM

|

Junior Member

263 posts Joined: Aug 2017 |

Replying to respondents of the forum members. I have file a complaint via CIMB's CRU unit regarding this and certain Rules and ACT that the banker did not follow.

A meeting was made on 27/03/2023 with representative from AHAM, Regional Director, Investment Specialist and Branch Manager of CIMB, but non unable to reply when questioned the rights of liquidating and baring the cost of loses. |

|

|

Apr 11 2023, 02:37 PM Apr 11 2023, 02:37 PM

Show posts by this member only | IPv6 | Post

#33

|

All Stars

14,931 posts Joined: Mar 2015 |

QUOTE(csbong87 @ Apr 11 2023, 02:26 PM) Replying to respondents of the forum members. I have file a complaint via CIMB's CRU unit regarding this and certain Rules and ACT that the banker did not follow. They just kept quite when asked? Or they gives answers which you think is not answering it?A meeting was made on 27/03/2023 with representative from AHAM, Regional Director, Investment Specialist and Branch Manager of CIMB, but non unable to reply when questioned the rights of liquidating and baring the cost of loses. Dud you question them again? |

|

|

|

|

|

Apr 11 2023, 02:50 PM Apr 11 2023, 02:50 PM

|

Junior Member

263 posts Joined: Aug 2017 |

QUOTE(MUM @ Apr 11 2023, 02:37 PM) They just kept quite when asked? Or they gives answers which you think is not answering it? Pending CIMB's CRU unit to reply my E-Mail. Kept quite when asked during the meeting regarding rights of liquidating and who's going to bare the loses.Dud you question them again? |

|

|

Apr 11 2023, 02:59 PM Apr 11 2023, 02:59 PM

Show posts by this member only | IPv6 | Post

#35

|

Senior Member

4,676 posts Joined: Jan 2003 |

QUOTE(csbong87 @ Apr 11 2023, 02:26 PM) Replying to respondents of the forum members. I have file a complaint via CIMB's CRU unit regarding this and certain Rules and ACT that the banker did not follow. Ask for follow up come Sept A meeting was made on 27/03/2023 with representative from AHAM, Regional Director, Investment Specialist and Branch Manager of CIMB, but non unable to reply when questioned the rights of liquidating and baring the cost of loses. QUOTE(csbong87 @ Apr 11 2023, 02:50 PM) Pending CIMB's CRU unit to reply my E-Mail. Kept quite when asked during the meeting regarding rights of liquidating and who's going to bare the loses. You should check the prospectus and see whether you got any loopholes or your rights as the deed holders to question them bankSuggest find some one in the legal field who does legal banking for advise on the prospectus itself Seems the meeting itself was show to shift the blame to AHAM but the banker himself know that he is the wrong for not executing your standing instructions AHAM can’t answer you that much unless the Investment Board or fund manager who can give you a better answer on the liquidation Only Stashaway can answer with the similar situation with KWEB debacle last year 🤦♀️ |

|

|

Apr 11 2023, 03:52 PM Apr 11 2023, 03:52 PM

|

Senior Member

577 posts Joined: Aug 2005 |

their ETF products are also suspended & no longer traded

|

|

|

Apr 11 2023, 04:06 PM Apr 11 2023, 04:06 PM

Show posts by this member only | IPv6 | Post

#37

|

Senior Member

4,676 posts Joined: Jan 2003 |

|

|

|

Apr 11 2023, 04:55 PM Apr 11 2023, 04:55 PM

|

Junior Member

263 posts Joined: Aug 2017 |

QUOTE(xander2k8 @ Apr 11 2023, 02:59 PM) Ask for follow up come Sept Below paragraph extracted from AHAMs PRODUCT HIGHLIGHT SHEET for AHAM Single Bond Series 4 (Formerly known as Affin Hwang Single Bond Series 4):You should check the prospectus and see whether you got any loopholes or your rights as the deed holders to question them bank Suggest find some one in the legal field who does legal banking for advise on the prospectus itself Seems the meeting itself was show to shift the blame to AHAM but the banker himself know that he is the wrong for not executing your standing instructions AHAM can’t answer you that much unless the Investment Board or fund manager who can give you a better answer on the liquidation Only Stashaway can answer with the similar situation with KWEB debacle last year 🤦♀️ "5. What are the possible outcomes of my investment? This Fund is a wholesale bond fund that invests primarily in a single-credit bond. The performance of the Fund would be dependent on the bond that the Fund invests in. The Fund’s performance is reliant on the Manager’s expertise in managing the Fund to meet its objective. Unlike fixed deposits which generally provide a guarantee on capital invested and carry specific rate of return, the Fund’s investment into the bond does not provide a guarantee on capital contributed nor does it guarantee a fixed rate of return." The Fund endeavours to distribute income, if any, on an annual basis. However, the amount of income available for distribution may fluctuate from year to year. Document source link: https://aham.com.my/invest-with-us/list-of-...tails?q=SBS4HCF Different from what our CIMB's bank manager says regarding on capital guarantee. |

|

|

Apr 11 2023, 05:10 PM Apr 11 2023, 05:10 PM

Show posts by this member only | IPv6 | Post

#39

|

Senior Member

4,676 posts Joined: Jan 2003 |

QUOTE(csbong87 @ Apr 11 2023, 04:55 PM) Below paragraph extracted from AHAMs PRODUCT HIGHLIGHT SHEET for AHAM Single Bond Series 4 (Formerly known as Affin Hwang Single Bond Series 4): Standard fund disclaimer hence it is already proven that the fault is not in AHAM hands"5. What are the possible outcomes of my investment? This Fund is a wholesale bond fund that invests primarily in a single-credit bond. The performance of the Fund would be dependent on the bond that the Fund invests in. The Fund’s performance is reliant on the Manager’s expertise in managing the Fund to meet its objective. Unlike fixed deposits which generally provide a guarantee on capital invested and carry specific rate of return, the Fund’s investment into the bond does not provide a guarantee on capital contributed nor does it guarantee a fixed rate of return." The Fund endeavours to distribute income, if any, on an annual basis. However, the amount of income available for distribution may fluctuate from year to year. Document source link: https://aham.com.my/invest-with-us/list-of-...tails?q=SBS4HCF Different from what our CIMB's bank manager says regarding on capital guarantee. Do you have any written or actual recorded verbal communication on capital guarantee as you can file a civil claim against the bank manager and CIMB for product disclosure return misleading and confusing to customers? Most likely you have file via tribunal 1st and if the tribunal is not able to make a decision satisfactory to both parties then you drag to civil court claim Make them feel the pain for product and putting customer negligence on handling of your funds and only worth it if you are talking of losses more than tm100k which I am sure it is even higher |

|

|

Apr 11 2023, 05:16 PM Apr 11 2023, 05:16 PM

Show posts by this member only | IPv6 | Post

#40

|

Senior Member

4,499 posts Joined: Mar 2014 |

QUOTE(csbong87 @ Apr 11 2023, 04:55 PM) Below paragraph extracted from AHAMs PRODUCT HIGHLIGHT SHEET for AHAM Single Bond Series 4 (Formerly known as Affin Hwang Single Bond Series 4): Did cimb represent to you a capital guarantee?"5. What are the possible outcomes of my investment? This Fund is a wholesale bond fund that invests primarily in a single-credit bond. The performance of the Fund would be dependent on the bond that the Fund invests in. The Fund’s performance is reliant on the Manager’s expertise in managing the Fund to meet its objective. Unlike fixed deposits which generally provide a guarantee on capital invested and carry specific rate of return, the Fund’s investment into the bond does not provide a guarantee on capital contributed nor does it guarantee a fixed rate of return." The Fund endeavours to distribute income, if any, on an annual basis. However, the amount of income available for distribution may fluctuate from year to year. Document source link: https://aham.com.my/invest-with-us/list-of-...tails?q=SBS4HCF Different from what our CIMB's bank manager says regarding on capital guarantee. This post has been edited by Cubalagi: Apr 11 2023, 05:17 PM |

| Change to: |  0.0255sec 0.0255sec

0.28 0.28

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 15th December 2025 - 02:24 AM |