QUOTE(eggplants @ Mar 22 2023, 05:00 PM)

No issue just stay away from their bonds onlyAHAM Capital, (Formally Affin Hwang Asset Management)

AHAM Capital, (Formally Affin Hwang Asset Management)

|

|

Mar 22 2023, 08:14 PM Mar 22 2023, 08:14 PM

Return to original view | IPv6 | Post

#1

|

Senior Member

4,676 posts Joined: Jan 2003 |

|

|

|

|

|

|

Mar 23 2023, 03:32 AM Mar 23 2023, 03:32 AM

Return to original view | IPv6 | Post

#2

|

Senior Member

4,676 posts Joined: Jan 2003 |

QUOTE(Cookie101 @ Mar 22 2023, 09:45 PM) Are u referring to some bond series specifically? Otherwise not much of issue. When the bond series suspended by AHAM it still has a nominal value of at least 30% value coupled with 15% of portfolio in cash hence it still have value of close to 50% The bond currently suspended from trading but still accruing interest. Waiting to see what is their next step. All bonds have this kind of risk. The next step is to claim back the nominal value from FINMA and CS only will only process the bond value either through swap or payoff from CS which only happens once the merger is completed by September |

|

|

Mar 23 2023, 12:55 PM Mar 23 2023, 12:55 PM

Return to original view | IPv6 | Post

#3

|

Senior Member

4,676 posts Joined: Jan 2003 |

QUOTE(aurora97 @ Mar 23 2023, 12:37 PM) Referring to the item in bold, how do you derive this values? 30% is based on the last traded value from AHAM and they have stated in the press statement that the fund has 15% in cash FINMA has indicated that the bond value for AT1 is write down to ZERO. Did FINMA say that the AT1 holders will get something?? https://www.ft.com/content/3f405e6d-d4a3-46...ba-3ec9cf4f7054 FINMA only indicated the value is Zero meaning the losses is being write down but the bonds are still having a nominal value because it is not completely zero because the write down is only the losses but not the value of the paper 🤦♀️ At the end of the day it is up to CS to decide what course of action being taken on whether bond swaps, new bonds issuance or equity swap with the blessing of SNB |

|

|

Mar 23 2023, 04:27 PM Mar 23 2023, 04:27 PM

Return to original view | IPv6 | Post

#4

|

Senior Member

4,676 posts Joined: Jan 2003 |

QUOTE(aurora97 @ Mar 23 2023, 02:10 PM) Press statement, do you have a link? Their communique didn't mention anything about that. https://www.theedgemarkets.com/node/659947I am skeptical about what you mention, paper loss, as it seems its a total loss based on most major financial media reportings. In any case, its academic now, will see how it plays out. You need to check Bloomberg because the value is still there before suspension It is still not total loss because it is not a realised loss until they totally liquidate completely 🤦♀️ FINMA is actually forcing some party to carry losses and that party will have to decide what to do with it whether to write down or not hence why UBS is asking for liquidity guarantee or backstop in order to hold losses UBS already requested 9billion earlier from SNB to cover at least 60% but it is still pending Sometimes you need to take media reporting me with pinch of a salt as they tend overblown it 🤦♀️ Just wait for UBS statement on what they do next within this 6 months upon merger |

|

|

Mar 23 2023, 05:17 PM Mar 23 2023, 05:17 PM

Return to original view | IPv6 | Post

#5

|

Senior Member

4,676 posts Joined: Jan 2003 |

QUOTE(aurora97 @ Mar 23 2023, 04:58 PM) Not everyone has visibility but its not wrong to ask and take it the wrong way. The fund fact sheet was taken by end of Feb hence there is lagged of 15 days on what did AHAM hence they might have liquidate some of the bonds which they are able to cut the losses and shore up the cash pile to 15%The factsheet at at 28 Feb 23 for both series 2 and 4 states 95.6%(AT1)/4.4%(Cash) and 95.7%(AT1)/4.3%(cash) respectively. Still highly doubtful that AT1 investors will get anything (even though paper value suggest otherwise), if it is open and shut, folks like Lazard, Pimco, Artemis won't be launching a suit over the shotgun marriage made by FINMA and UBS. Definitely, exciting times. PimCo is launching suit because they are holding most of the AT1s by CS and the suit is alleged because there is clause between them and it was breach of certain clause that triggers the suit Just wait for next month meeting from FINMA and SNB to see the actual scale because I got a gut feeling now they are liquidating some of the gold reserves to shore the liquidity in this crisis This wouldn’t have happen if the other SNB would have extend another line of credit to CS and now they are bearing a billion in losses just on the equities holding 🤦♀️ This post has been edited by xander2k8: Mar 23 2023, 05:18 PM aurora97 liked this post

|

|

|

Mar 23 2023, 08:00 PM Mar 23 2023, 08:00 PM

Return to original view | IPv6 | Post

#6

|

Senior Member

4,676 posts Joined: Jan 2003 |

QUOTE(eggplants @ Mar 23 2023, 04:47 PM) Would like to know anyone have used them and their experience dealing with them. Is there minimum amount of capital for using them? So far so good as their CS is quite efficient in getting back to you if you have any enquires in the morning and by afternoon will sort it out easily Minimum is at RM10 for MMF to certain UTs at 100 to 250k minimum for wholesale bond Downside if no promo or vouchers be prepared to pay high SC 🤦♀️ |

|

|

|

|

|

Apr 3 2023, 07:54 AM Apr 3 2023, 07:54 AM

Return to original view | IPv6 | Post

#7

|

Senior Member

4,676 posts Joined: Jan 2003 |

|

|

|

Apr 3 2023, 02:53 PM Apr 3 2023, 02:53 PM

Return to original view | IPv6 | Post

#8

|

Senior Member

4,676 posts Joined: Jan 2003 |

|

|

|

Apr 10 2023, 10:43 AM Apr 10 2023, 10:43 AM

Return to original view | IPv6 | Post

#9

|

Senior Member

4,676 posts Joined: Jan 2003 |

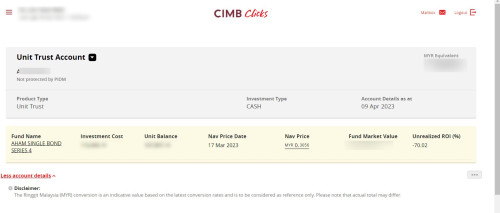

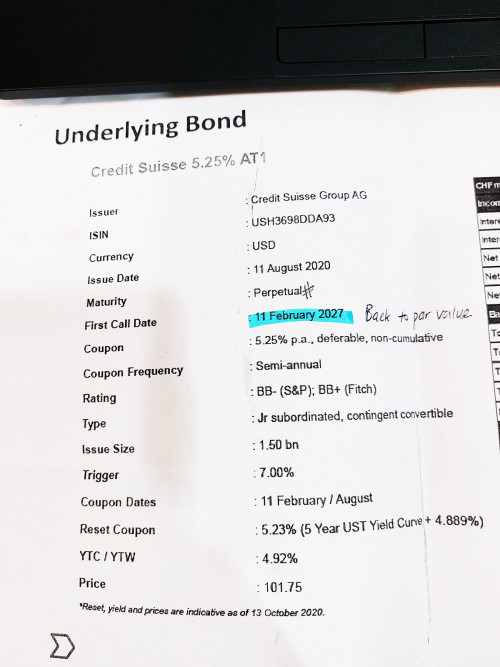

QUOTE(csbong87 @ Apr 10 2023, 03:56 AM) Despite of Credit Suisse Bond writing down to "ZERO" (NO VALUE AT ALL), below info of AHAM SINGLE BOND SERIES 4(Product Highlights Sheet) and Screenshot of CIMB Clicks web (UT Account section) Which means you just lose 70% which they allocate to AT1 bonds while 30% is still in MMF or liquid depositsFollowing info extract from one of AHAMs document: Document source link: https://aham.com.my/invest-with-us/list-of-...tails?q=SBS4HCF KEY PRODUCT FEATURES: Investment Strategy: The Fund will be investing directly into a single-credit bond. The remaining NAV of the Fund will be in money market instruments, deposits, derivatives, and/or any other form of investments as may be determined by the Manager from time to time that is in line with the Fund’s objective. The Fund may invest in foreign market. Asset Allocation • A minimum of 60% of the Fund’s NAV to be invested in bond; and • A maximum of 40% of the Fund’s NAV to be invested in money market instrument and/or deposits.. Following screenshot from CIMB Clicks: As per app last NAV Price was 0.3056 @ 17 MAC 2023, with Unrealized ROI (%) -70.02  I still see numbers under FUND MARKET VALUE |

|

|

Apr 11 2023, 11:53 AM Apr 11 2023, 11:53 AM

Return to original view | IPv6 | Post

#10

|

Senior Member

4,676 posts Joined: Jan 2003 |

QUOTE(csbong87 @ Apr 11 2023, 05:31 AM) Thanks for the reply, btw how can I file a complain against my CIMB banker for not following clients instructions for liquidating the fund (Called and met numerous occasions, when NAV was around 80 cents). He blames AHAM instead. any advice ? Did you have any written standing instruction as proof of execution?Verbal would be very hard to proof He has the right to blame AHAM because he can instruct but execution by the fund house itself This is why never ever buy from 3rd party particularly banks because it is out their hands unlike buying direct from the fund house where you locked in the projected price |

|

|

Apr 11 2023, 02:59 PM Apr 11 2023, 02:59 PM

Return to original view | IPv6 | Post

#11

|

Senior Member

4,676 posts Joined: Jan 2003 |

QUOTE(csbong87 @ Apr 11 2023, 02:26 PM) Replying to respondents of the forum members. I have file a complaint via CIMB's CRU unit regarding this and certain Rules and ACT that the banker did not follow. Ask for follow up come Sept A meeting was made on 27/03/2023 with representative from AHAM, Regional Director, Investment Specialist and Branch Manager of CIMB, but non unable to reply when questioned the rights of liquidating and baring the cost of loses. QUOTE(csbong87 @ Apr 11 2023, 02:50 PM) Pending CIMB's CRU unit to reply my E-Mail. Kept quite when asked during the meeting regarding rights of liquidating and who's going to bare the loses. You should check the prospectus and see whether you got any loopholes or your rights as the deed holders to question them bankSuggest find some one in the legal field who does legal banking for advise on the prospectus itself Seems the meeting itself was show to shift the blame to AHAM but the banker himself know that he is the wrong for not executing your standing instructions AHAM can’t answer you that much unless the Investment Board or fund manager who can give you a better answer on the liquidation Only Stashaway can answer with the similar situation with KWEB debacle last year 🤦♀️ |

|

|

Apr 11 2023, 04:06 PM Apr 11 2023, 04:06 PM

Return to original view | IPv6 | Post

#12

|

Senior Member

4,676 posts Joined: Jan 2003 |

|

|

|

Apr 11 2023, 05:10 PM Apr 11 2023, 05:10 PM

Return to original view | IPv6 | Post

#13

|

Senior Member

4,676 posts Joined: Jan 2003 |

QUOTE(csbong87 @ Apr 11 2023, 04:55 PM) Below paragraph extracted from AHAMs PRODUCT HIGHLIGHT SHEET for AHAM Single Bond Series 4 (Formerly known as Affin Hwang Single Bond Series 4): Standard fund disclaimer hence it is already proven that the fault is not in AHAM hands"5. What are the possible outcomes of my investment? This Fund is a wholesale bond fund that invests primarily in a single-credit bond. The performance of the Fund would be dependent on the bond that the Fund invests in. The Fund’s performance is reliant on the Manager’s expertise in managing the Fund to meet its objective. Unlike fixed deposits which generally provide a guarantee on capital invested and carry specific rate of return, the Fund’s investment into the bond does not provide a guarantee on capital contributed nor does it guarantee a fixed rate of return." The Fund endeavours to distribute income, if any, on an annual basis. However, the amount of income available for distribution may fluctuate from year to year. Document source link: https://aham.com.my/invest-with-us/list-of-...tails?q=SBS4HCF Different from what our CIMB's bank manager says regarding on capital guarantee. Do you have any written or actual recorded verbal communication on capital guarantee as you can file a civil claim against the bank manager and CIMB for product disclosure return misleading and confusing to customers? Most likely you have file via tribunal 1st and if the tribunal is not able to make a decision satisfactory to both parties then you drag to civil court claim Make them feel the pain for product and putting customer negligence on handling of your funds and only worth it if you are talking of losses more than tm100k which I am sure it is even higher |

|

|

|

|

|

Apr 12 2023, 11:44 AM Apr 12 2023, 11:44 AM

Return to original view | IPv6 | Post

#14

|

Senior Member

4,676 posts Joined: Jan 2003 |

QUOTE(csbong87 @ Apr 11 2023, 05:57 PM) No written or recorded verbal communication on our CIMB's bank manager says that bond principal is guaranteed. Then you can file an internal dispute with CIMB via CRU If not next steps report BNM if CIMB cannot give satisfactory answer There is so much you can do and a learn lesson to be learn never buy any financial products from a 3rd party and buy it as directly as possible to avoid such thing whenever bad things happened |

|

|

Apr 12 2023, 11:49 AM Apr 12 2023, 11:49 AM

Return to original view | IPv6 | Post

#15

|

Senior Member

4,676 posts Joined: Jan 2003 |

QUOTE(csbong87 @ Apr 12 2023, 07:31 AM) Given only the below document, but did not disclose AHAM's side on capital not guaranteed as stated in it's PRODUCT HIGHLIGHTS SHEET for AHAM Single Bond Series 4 (Formerly known as Affin Hwang Single Bond Series 4) Wah before you bought it you never check the rating itself it is already red flagged as it shown on your sheet 🤦♀️ QUOTE(Cubalagi @ Apr 12 2023, 09:18 AM) So the bank did not share with you the Aham prodict disclsoure sheet? Not possible now because the proof of product mislead 🤦♀️I think you should still complaint on the basis of misleading sales practice as you were not made fully aware of the risk of the product, in addition to the not following instructions to liquidate. Right now follow up on the banks response. After that, if unsatisfactory, get ready to escalate to the relevant authorities. The CIMB officer itself confuse him to submit the bond based on what he is shown and practice from this discussions The red flagged itself was the bond rating which in hindsight it should be check and verified before buying it especially those in B range rating which can be very confusing itself |

|

|

Apr 12 2023, 12:24 PM Apr 12 2023, 12:24 PM

Return to original view | IPv6 | Post

#16

|

Senior Member

4,676 posts Joined: Jan 2003 |

|

|

|

Apr 14 2023, 12:44 PM Apr 14 2023, 12:44 PM

Return to original view | IPv6 | Post

#17

|

Senior Member

4,676 posts Joined: Jan 2003 |

QUOTE(csbong87 @ Apr 14 2023, 10:10 AM) Pressure AHAM to join the lawsuit Even if Swiss Parliament votes against the merger no point because the regulator have the final say 🤦♀️ csbong87 liked this post

|

|

|

Apr 21 2023, 05:11 PM Apr 21 2023, 05:11 PM

Return to original view | IPv6 | Post

#18

|

Senior Member

4,676 posts Joined: Jan 2003 |

QUOTE(csbong87 @ Apr 17 2023, 03:08 PM) Alerting forum members whose friends or relative that has purchased AHAM SINGLE BOND SERIES 2 AND 4 through CIMB to kindly leave a contact info, we are forming a WhatsApp group to keep each other updates relating to this recent bond write off to zero. Thanks. Finally lawsuit is in already suing the regulators https://www.reuters.com/business/finance/cr...-ft-2023-04-21/ |

|

|

Apr 23 2023, 04:56 PM Apr 23 2023, 04:56 PM

Return to original view | IPv6 | Post

#19

|

Senior Member

4,676 posts Joined: Jan 2003 |

|

|

|

Apr 23 2023, 05:13 PM Apr 23 2023, 05:13 PM

Return to original view | IPv6 | Post

#20

|

Senior Member

4,676 posts Joined: Jan 2003 |

QUOTE(csbong87 @ Apr 23 2023, 05:02 PM) You should pose the question to them 🤦♀️Firstly are they direct holders of the AT1 bonds or through are other means and if they are is the bonds still in their holdings or has been sold and written off as losses as you and I won’t know unless they have disclosed it publicly Filing this lawsuit is not just about the money 🤦♀️ It is whether you have the legal expertise to fight this in Swiss courts which is why those big foreign institutions like in US and Japan are banding to fight it in those courts |

| Change to: |  0.0314sec 0.0314sec

0.71 0.71

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 14th December 2025 - 02:47 PM |