QUOTE(JimbeamofNRT @ Dec 6 2024, 08:08 PM)

fnb players, how do you guys cope with the high turnover of staff? Around Subang Jaya, I notice that every month there’s always a new F&B outlet opening or closing

Kinda at the point of acceptance lol, times really have changed. A conversation I had during interview:

Me: How long you plan on working (nowadays I just ask from the get go cos they're never staying).

Her: Quite long.

Me: Can you clarify?

Her: Atleast 2 weeks.

Our concept of time is just different I guess. Still an issue when they're quitting though, even after explaining about notice period during interview,

most of them insists on not serving notice (one parent even paid for her kid).

Another gripe with the employees situation are actually other employers IMO, while min. wage is being raised, some of the store around me I know is not even paying the 1.5k monthly for their employees / no OT / whatnot.

One of my employee punya sister worked in this China-brand chain beverage, she's only paid around RM200 extra what I'm paying him yet she's working 12 hours, 6 days a week.

Anyway onboarding & standardization of tasks and routine need to be tiptop to bring the employees up to speed. Managing what we can actually manage is my approach. QUOTE(faridr @ Dec 6 2024, 10:46 PM)

Are able to get anything out of it after minus the operating cost?

My wife in f&b business, even with more than 10k revenue, after minus the operating cost (rent, commercial rate utilities, salary of 2 workers, raw materials) barely making anything out of it, sometimes even not enough to cover. Cant increase the price to much as target market is low to mid income group.

Realising its not sustainable, with months of losses since end of last year, back to home based without any worker, lower volume but at least she’s making good profit now as only have to think about the raw material cost.

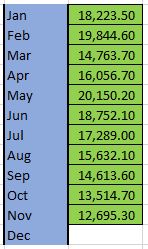

Below breakeven no, had to topup a lil bit. My case employees are needed cos need to follow mall rules (open 365 days a year), I'm not healthy and/or available ALL the time.

Sometimes you profit sometimes no, hopefully less of the latter. I'm being optimistic since everywhere I read nowadays even big businesses mau belly up, so it's not a unique situation.

This post has been edited by keybearer: Dec 6 2024, 11:20 PM

Feb 23 2023, 09:09 PM

Feb 23 2023, 09:09 PM

Quote

Quote

0.0340sec

0.0340sec

0.55

0.55

6 queries

6 queries

GZIP Disabled

GZIP Disabled