T bill auction 24 Nov 2022 is now open for application.

https://www.mas.gov.sg/bonds-and-bills/auct...date=2022-11-29

SG Savings Bond (SSB) & Treasury Bills (T-bills), Guaranteed by Singapore Government

SG Savings Bond (SSB) & Treasury Bills (T-bills), Guaranteed by Singapore Government

|

|

Nov 17 2022, 05:35 PM Nov 17 2022, 05:35 PM

Return to original view | IPv6 | Post

#21

|

Senior Member

2,543 posts Joined: Jan 2003 |

T bill auction 24 Nov 2022 is now open for application.

https://www.mas.gov.sg/bonds-and-bills/auct...date=2022-11-29 |

|

|

|

|

|

Nov 17 2022, 06:04 PM Nov 17 2022, 06:04 PM

Return to original view | IPv6 | Post

#22

|

Senior Member

2,543 posts Joined: Jan 2003 |

|

|

|

Nov 23 2022, 09:45 AM Nov 23 2022, 09:45 AM

Return to original view | IPv6 | Post

#23

|

||||||||||||

Senior Member

2,543 posts Joined: Jan 2003 |

QUOTE(TOS @ Nov 22 2022, 01:07 PM) Today's MAS Bill auction results: I bid 4% this time round. If still cannot get then i will go for DBS eFD again but i read the DBS promotion has ended. Have to wait for new promo then.

Source: 4-week: https://www.mas.gov.sg/bonds-and-bills/auct...date=2022-11-25 12-week: https://www.mas.gov.sg/bonds-and-bills/auct...date=2022-11-25 So, tomorrow gonna bid 4.5% p.a. for the 6-month T-bill. TOS liked this post

|

||||||||||||

|

|

Nov 23 2022, 10:58 AM Nov 23 2022, 10:58 AM

Return to original view | IPv6 | Post

#24

|

Senior Member

2,543 posts Joined: Jan 2003 |

QUOTE(TOS @ Nov 23 2022, 10:14 AM) Have another account SCB but i just closed the account last week when i went to SG. Too troublesome to maintain 2 accounts and their bonus saver account requires maintain sgd3k else sgd5 being charged every month. So i closed it. TOS liked this post

|

|

|

Nov 24 2022, 03:47 PM Nov 24 2022, 03:47 PM

Return to original view | IPv6 | Post

#25

|

Senior Member

2,543 posts Joined: Jan 2003 |

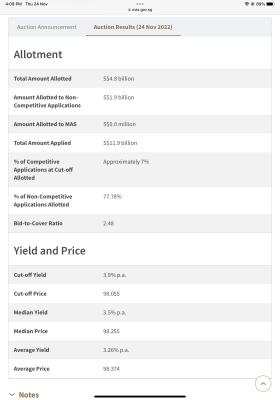

Cut off yield for T bill BS22123S 3.9%

This post has been edited by ikanbilis: Nov 24 2022, 04:10 PM TOS liked this post

|

|

|

Nov 24 2022, 04:38 PM Nov 24 2022, 04:38 PM

Return to original view | IPv6 | Post

#26

|

Senior Member

2,543 posts Joined: Jan 2003 |

|

|

|

|

|

|

Nov 30 2022, 11:21 AM Nov 30 2022, 11:21 AM

Return to original view | IPv6 | Post

#27

|

||||||||||||

Senior Member

2,543 posts Joined: Jan 2003 |

QUOTE(TOS @ Nov 30 2022, 09:02 AM) Yesterday's 4-week and 12-week MAS Bill auction results: Yet the sg pipu so dumb bid low2 for the t bills

4-week 5.49% is crazy yield figure... The SG institutions all pakat and bully cheng hu Source: 4-week: https://www.mas.gov.sg/bonds-and-bills/auct...date=2022-12-02 12-week: https://www.mas.gov.sg/bonds-and-bills/auct...date=2022-12-02 |

||||||||||||

|

|

Dec 1 2022, 05:04 PM Dec 1 2022, 05:04 PM

Return to original view | IPv6 | Post

#28

|

Senior Member

2,543 posts Joined: Jan 2003 |

T bill 22124H announced today. Auction date 8 dec 2022 https://www.mas.gov.sg/bonds-and-bills/auct...date=2022-12-13 Amount offered 4.6 billion TaiGoh liked this post

|

|

|

Dec 1 2022, 11:03 PM Dec 1 2022, 11:03 PM

Return to original view | IPv6 | Post

#29

|

Senior Member

2,543 posts Joined: Jan 2003 |

QUOTE(zebras @ Dec 1 2022, 10:39 PM) Malaysia bond can refer to thread belowhttps://forum.lowyat.net/topic/5328012 TOS liked this post

|

|

|

Dec 7 2022, 12:23 PM Dec 7 2022, 12:23 PM

Return to original view | IPv6 | Post

#30

|

Senior Member

2,543 posts Joined: Jan 2003 |

|

|

|

Dec 8 2022, 02:09 PM Dec 8 2022, 02:09 PM

Return to original view | IPv6 | Post

#31

|

||||||||||||

Senior Member

2,543 posts Joined: Jan 2003 |

QUOTE(TOS @ Dec 8 2022, 01:26 PM)

Source: https://www.mas.gov.sg/bonds-and-bills/auct...date=2022-12-13 |

||||||||||||

|

|

Dec 8 2022, 02:43 PM Dec 8 2022, 02:43 PM

Return to original view | IPv6 | Post

#32

|

Senior Member

2,543 posts Joined: Jan 2003 |

QUOTE(TOS @ Dec 8 2022, 02:24 PM) I am building bond ladder so i bid 3.90% this time round. Did not expect 4.4% though. TOS liked this post

|

|

|

Dec 8 2022, 05:57 PM Dec 8 2022, 05:57 PM

Return to original view | IPv6 | Post

#33

|

Senior Member

2,543 posts Joined: Jan 2003 |

QUOTE(TaiGoh @ Dec 8 2022, 05:31 PM) Yes, thats the downside of it and early withdrawal needs to be done through phone or walk in to the branch. CIMB at least able to do phone banking for early withdrawal. SCB only allow walk in for early withdrawal. TaiGoh liked this post

|

|

|

|

|

|

Dec 20 2022, 01:31 PM Dec 20 2022, 01:31 PM

Return to original view | IPv6 | Post

#34

|

||||||||||||

Senior Member

2,543 posts Joined: Jan 2003 |

QUOTE(TOS @ Dec 20 2022, 01:13 PM) This week's MAS Bill auction results: I bid 4.2% undercut you

Source: 4-week: https://www.mas.gov.sg/bonds-and-bills/auct...date=2022-12-23 12-week: https://www.mas.gov.sg/bonds-and-bills/auct...date=2022-12-23 So today will bid 4.3% |

||||||||||||

|

|

Dec 20 2022, 04:20 PM Dec 20 2022, 04:20 PM

Return to original view | IPv6 | Post

#35

|

Senior Member

2,543 posts Joined: Jan 2003 |

QUOTE(TOS @ Dec 20 2022, 03:19 PM) From when did you become more kiasu kiasi than Sporeans... If you cant beat them join them » Click to show Spoiler - click again to hide... « Source: https://forums.hardwarezone.com.sg/threads/...#post-145385516 TOS liked this post

|

|

|

Dec 21 2022, 01:45 PM Dec 21 2022, 01:45 PM

Return to original view | IPv6 | Post

#36

|

Senior Member

2,543 posts Joined: Jan 2003 |

|

|

|

Dec 28 2022, 03:12 PM Dec 28 2022, 03:12 PM

Return to original view | IPv6 | Post

#37

|

Senior Member

2,543 posts Joined: Jan 2003 |

QUOTE(TOS @ Dec 28 2022, 03:04 PM) Everyone gives up SSB in favor of t-bill including myself This post has been edited by ikanbilis: Dec 28 2022, 03:13 PM TOS liked this post

|

|

|

Dec 31 2022, 11:22 AM Dec 31 2022, 11:22 AM

Return to original view | IPv6 | Post

#38

|

Senior Member

2,543 posts Joined: Jan 2003 |

Done bidding 4.25% for T-bill BS23100Z

|

|

|

Dec 31 2022, 04:46 PM Dec 31 2022, 04:46 PM

Return to original view | IPv6 | Post

#39

|

Senior Member

2,543 posts Joined: Jan 2003 |

QUOTE(TOS @ Dec 31 2022, 02:11 PM) No need plan so much. Just bid the min interest i am willing to accept.If COY is lower than 4.25% then i will bid again the next round. TOS liked this post

|

|

|

Jan 18 2023, 01:37 PM Jan 18 2023, 01:37 PM

Return to original view | IPv6 | Post

#40

|

||||||||||||

Senior Member

2,543 posts Joined: Jan 2003 |

QUOTE(TOS @ Jan 18 2023, 01:19 PM) 4%... Yield getting lower and and lower.

Source: https://www.mas.gov.sg/bonds-and-bills/auct...date=2023-01-25 BTC ratio is very high at 2.61. Now i dont know what to bid for the 1 year t bill. Maybe around 4% also? |

||||||||||||

| Change to: |  0.0570sec 0.0570sec

0.47 0.47

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 13th December 2025 - 07:35 AM |