» Click to show Spoiler - click again to hide... «

SG Savings Bond (SSB) & Treasury Bills (T-bills), Guaranteed by Singapore Government

SG Savings Bond (SSB) & Treasury Bills (T-bills), Guaranteed by Singapore Government

|

|

Feb 18 2023, 12:37 PM Feb 18 2023, 12:37 PM

Return to original view | Post

#121

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

BT 170223 reports on the latest 3.93% COY 6M T-bill:

» Click to show Spoiler - click again to hide... « |

|

|

|

|

|

Feb 21 2023, 03:04 PM Feb 21 2023, 03:04 PM

Return to original view | Post

#122

|

|||||||||||||||

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

This week's MAS Bill auction results:

Source: 4-week: https://www.mas.gov.sg/bonds-and-bills/auct...date=2023-02-24 12-week: https://www.mas.gov.sg/bonds-and-bills/auct...date=2023-02-24 Both 1-month and 3-month MAS bill still below 4%. ikanbilis liked this post

|

|||||||||||||||

|

|

Feb 23 2023, 07:11 PM Feb 23 2023, 07:11 PM

Return to original view | Post

#123

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

For those interested in medium term safe vehicle parking, 2-year SGS bond is reopened for auction tomorrow.

Apply before 9pm today. https://www.mas.gov.sg/bonds-and-bills/auct...date=2023-03-01 Yield is around 3.4% p.a. This post has been edited by TOS: Feb 23 2023, 07:12 PM |

|

|

Feb 24 2023, 01:35 PM Feb 24 2023, 01:35 PM

Return to original view | Post

#124

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(TOS @ Feb 23 2023, 07:11 PM) For those interested in medium term safe vehicle parking, 2-year SGS bond is reopened for auction tomorrow. The cut-off yield is 3.66% p.a. https://www.mas.gov.sg/bonds-and-bills/auct...date=2023-03-01Apply before 9pm today. https://www.mas.gov.sg/bonds-and-bills/auct...date=2023-03-01 Yield is around 3.4% p.a. |

|

|

Feb 25 2023, 02:52 PM Feb 25 2023, 02:52 PM

Return to original view | Post

#125

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Allotment Result for SBMAR23:

Total amount applied: S$261.1 million Total amount within individual allotment limits: S$258.3 million Total amount alloted: S$258.3 million Quantity ceiling: - There is no quantity ceiling. You get everything you applied for subject to individual limit ($200k). Courtesy of hwckhs at HWZ. https://forums.hardwarezone.com.sg/threads/...006693/page-562 Result on SSB website: https://www.mas.gov.sg/bonds-and-bills/auct...date=2023-03-01 This post has been edited by TOS: Feb 25 2023, 02:52 PM |

|

|

Feb 27 2023, 10:51 AM Feb 27 2023, 10:51 AM

Return to original view | Post

#126

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

|

|

|

Feb 28 2023, 03:17 PM Feb 28 2023, 03:17 PM

Return to original view | Post

#127

|

|||||||||||||||

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

This week's MAS Bill auction results:

Source: 4-week: https://www.mas.gov.sg/bonds-and-bills/auct...date=2023-03-03 12-week: https://www.mas.gov.sg/bonds-and-bills/auct...date=2023-03-03 Both 1-month and 3-month MAS bill above 4%. The response is cooler however, judging by BTC compared to last week's issuances. |

|||||||||||||||

|

|

Mar 1 2023, 09:06 AM Mar 1 2023, 09:06 AM

Return to original view | Post

#128

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(billyboy @ Mar 1 2023, 06:33 AM) noob here trying to learn and perhaps invest in this space. Hi there. The 4-week and 12-week MAS bills are available for institutions only. Retail investors can only buy 6 month or 1-year T-bills (SGS bonds and SSBs too).can you help me with my questions ? a) these auctions are held every 4 weeks ? noted that its 4 and 12 week tenure. b) i can apply (from Msia) if i have on-line DBS / UOB / OCBC Spore account ? c) is there a noob guide to the process of applying ? tk you In the primary market, the 6 month T-bill is auctioned once every 2 weeks while the 1-year T-bill is auctioned once every quarter (4 issuances per year). Yes, you can apply from anywhere in the world if you purchase the bills using cash (since it's online application, the banks aka the primary dealers deduct money from your account directly.) If you are using CPF monies to purchase, only DBS allows for online application at the moment (CPF investment account holders at OCBC and UOB will need to queue at SG bank branches to purchase the bills over the counter). You will also need a CDP account for primary market purchase of the bills. Having DBS/UOB/OCBC alone is not sufficient for purchasing the bills in the primary market. Not sure what constitutes a noob guide. I wrote up some stuffs in the 2 links below. You can try to read them and see if you can understand them. https://forum.lowyat.net/index.php?showtopi...ost&p=106297872 https://forum.lowyat.net/index.php?showtopi...ost&p=106023168 *All bills/T-bills above refer to SG T-bills, not the US ones. billyboy liked this post

|

|

|

Mar 1 2023, 09:35 AM Mar 1 2023, 09:35 AM

Return to original view | Post

#129

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

By the way, today is the deadline for the 6 month T-bill to be auctioned tomorrow. I will post the Bloomberg FXFA screenshot later today after the onshore market closes around 5pm.

Looking at previous day's yield reported by MAS, it's likely to be around 3.9x%. |

|

|

Mar 1 2023, 04:55 PM Mar 1 2023, 04:55 PM

Return to original view | Post

#130

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

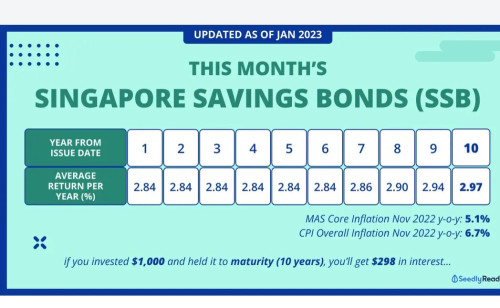

New SSB rates announced. Rates for all tenor above 3% p.a. again. https://www.mas.gov.sg/bonds-and-bills/auct...date=2023-04-03 ikanbilis liked this post

|

|

|

Mar 1 2023, 05:45 PM Mar 1 2023, 05:45 PM

Return to original view | Post

#131

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Today's 6M T-bill yield (issued 2 weeks ago) quoted by MAS is 3.92%. https://eservices.mas.gov.sg/statistics/fda...ssuePrices.aspx As promised these are the FXFA screenshots. EuroSing quoting 3.92-3.97% p.a. Onshore yields 4.08% p.a. » Click to show Spoiler - click again to hide... « I will bid at the lowest possible EuroSing yield 3.92% p.a. Will have class at 1pm tomorrow. ikanbilis can help me update the auction result here. This post has been edited by TOS: Mar 1 2023, 05:57 PM TaiGoh liked this post

|

|

|

Mar 2 2023, 10:11 AM Mar 2 2023, 10:11 AM

Return to original view | Post

#132

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Quotation of taxable book-entry Singapore Government Bonds, as of 28/2/2023. Sourced from BT 010323

» Click to show Spoiler - click again to hide... « |

|

|

Mar 2 2023, 03:05 PM Mar 2 2023, 03:05 PM

Return to original view | Post

#133

|

||

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(ikanbilis @ Mar 2 2023, 01:15 PM) The funny thing is that those who bid 3.98% exactly gets close to nothing according to MAS auction stats lol

BTC is elevated at 2.77. Anyway, the effective annual rate (based on COY of 3.98%, 182 days to maturity) is 4.103% p.a., bond equivalent yield is 4.062% p.a. Auction result link: https://www.mas.gov.sg/bonds-and-bills/auct...date=2023-03-07 This post has been edited by TOS: Mar 2 2023, 03:05 PM ikanbilis liked this post

|

||

|

|

|

|

|

Mar 3 2023, 09:12 AM Mar 3 2023, 09:12 AM

Return to original view | Post

#134

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Straits Times reports:

Interest rates on T-bills and Singapore Savings Bonds back on an uptrend: Should you consider them? https://www.straitstimes.com/business/inter...u-consider-them (no paywall) Source: https://forums.hardwarezone.com.sg/threads/...r-them.6878463/ |

|

|

Mar 3 2023, 10:48 AM Mar 3 2023, 10:48 AM

Return to original view | Post

#135

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

SSB application details from BT 020323.

» Click to show Spoiler - click again to hide... « |

|

|

Mar 4 2023, 04:53 PM Mar 4 2023, 04:53 PM

Return to original view | Post

#136

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(Unkerpanjang @ Jan 15 2023, 07:34 PM) Bro TOS, pls shout out if you find rates increasing, add 1 buy...I no syiok, Jan 2023 yield low, man. But just hold lah, better than 0%. Kamsiah. Happy New Year. Rates increasing as you wished.  https://www.ilovessb.com/ |

|

|

Mar 7 2023, 03:19 PM Mar 7 2023, 03:19 PM

Return to original view | Post

#137

|

|||||||||||||||

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

This week's MAS Bill auction results:

Source: 4-week: https://www.mas.gov.sg/bonds-and-bills/auct...date=2023-03-10 12-week: https://www.mas.gov.sg/bonds-and-bills/auct...date=2023-03-10 Both 1-month and 3-month MAS bill COY below 4%. Response is cooler compared to last week yet COYs are lower. -------------------------- My first 6M T-bill bought last year matures today. Principal will be credited after 5pm supposedly. This post has been edited by TOS: Mar 7 2023, 03:20 PM nexona88 liked this post

|

|||||||||||||||

|

|

Mar 9 2023, 07:51 PM Mar 9 2023, 07:51 PM

Return to original view | Post

#138

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

ilovessb.com may soon include T-bills and SGS securities stuffs, which will be helpful for newcomers to SG's risk-free space. https://forums.hardwarezone.com.sg/threads/...#post-146612514 TaiGoh liked this post

|

|

|

Mar 10 2023, 05:36 PM Mar 10 2023, 05:36 PM

Return to original view | Post

#139

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

OCBC, UOB customers can tap CPF funds to buy T-bills online from Mar 31 and Apr 22 respectively

https://www.businesstimes.com.sg/companies-...s-online-mar-31 There's a paywall, but no worries, I will post the whole article in 2 days time when the physical newspaper is available at my uni's library. This post has been edited by TOS: Mar 10 2023, 05:37 PM |

|

|

Mar 10 2023, 07:36 PM Mar 10 2023, 07:36 PM

Return to original view | Post

#140

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(zebras @ Mar 10 2023, 07:31 PM) https://www.fsmone.com.my/funds/research/ar...bonds-on-fsmone Be mindful it's twice (min. commissions/fees) as expensive as IBKR. (10 USD vs 5 USD)fsmone can trade US and SG government bond online now |

| Change to: |  0.0544sec 0.0544sec

0.68 0.68

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 14th December 2025 - 02:29 PM |