QUOTE(Lee Wei Sheng @ Mar 1 2022, 11:03 AM)

no current installment/cash in hand, im still a first year uni student lol

just curious and wanted to know about how much commitment it usually takes to finance a house, so that next time when come out working life wont be so clueless and susah payah.

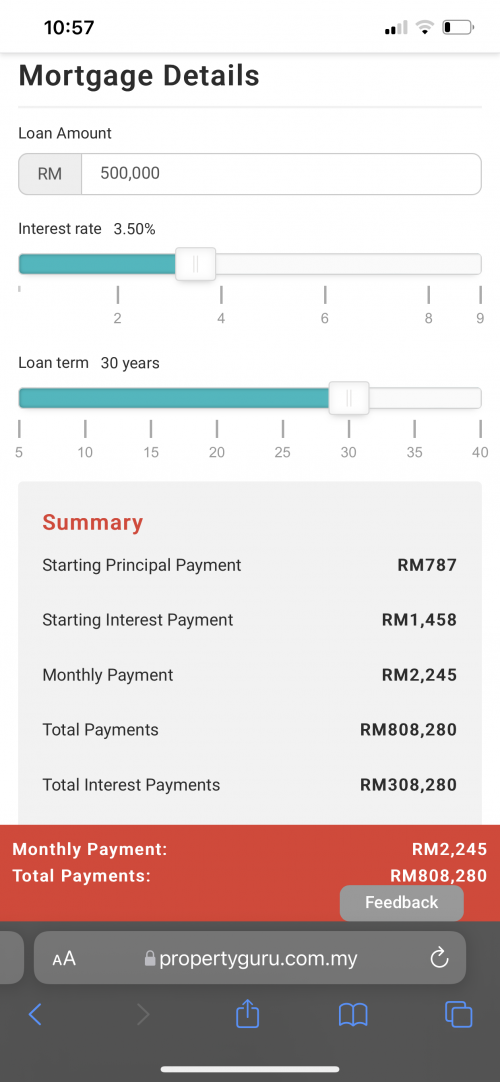

Very broadly speaking, to calculate conservatively:

Keep home loan instalment amount less than 1/3 of your gross salary, and keep total debts (including PTPTN, credit card, car etc) less than 50% of gross salary.

Minimise loan tenure and loan margin to reduce total interest paid to bank, while maintaining the debt ratio above.

A minimum 10% cash on hand is required (some new launches "waive" this by giving discount/rebate, but mind you that the high loan margin means long term interest payment can easily cost you more than that 10% in cash), especially for subsale homes.

However, bear in mind lifestyle costs also, and maintenance of home (electricity, repairs, maintenance fees, quit rent + assessment fees etc.).

There's a reason why people always push RUMAWIP/RSKU as first house purchase, because of the low upfront costs and maintenance, given Malaysia's low median salary. First homes are also rarely going to be your lifetime/final home (as job and lifestyle may cause you to move or require smaller/bigger space), so don't be too ambitious.

Feb 28 2022, 10:05 PM, updated 4y ago

Feb 28 2022, 10:05 PM, updated 4y ago

Quote

Quote

0.0321sec

0.0321sec

0.89

0.89

5 queries

5 queries

GZIP Disabled

GZIP Disabled