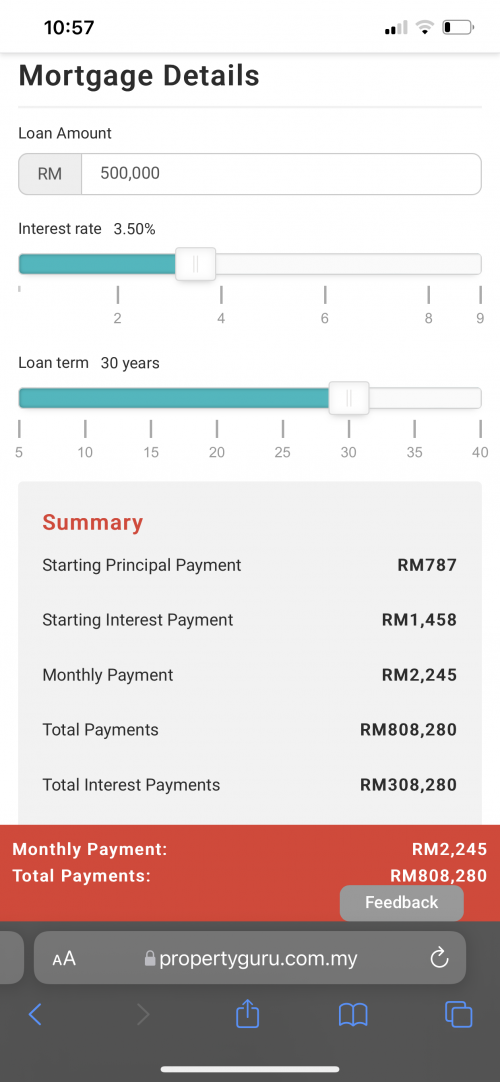

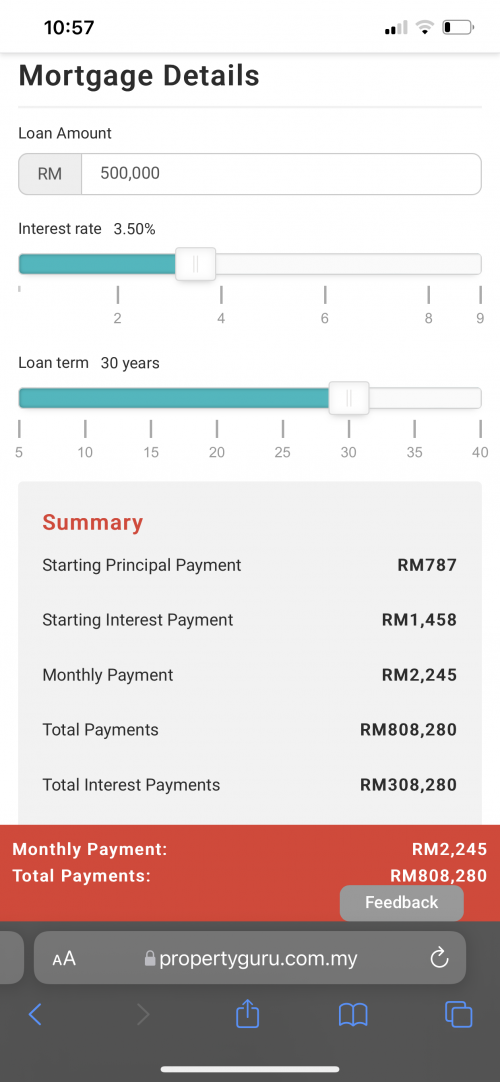

Rule of thumb, the home loan instalment should be cap at 1/3 of your monthly salary .

Hence 1/3 = RM 2245, your monthly salary should be RM 6735.

optimum salary to start house installment

|

|

Feb 28 2022, 11:01 PM Feb 28 2022, 11:01 PM

Return to original view | IPv6 | Post

#1

|

Senior Member

1,596 posts Joined: Sep 2021 |

Too generic , however a quick check from the loan calculator shall be as following for 30 years tenure 👇  Rule of thumb, the home loan instalment should be cap at 1/3 of your monthly salary . Hence 1/3 = RM 2245, your monthly salary should be RM 6735. Stirmling liked this post

|

|

|

|

|

|

Mar 1 2022, 05:57 AM Mar 1 2022, 05:57 AM

Return to original view | IPv6 | Post

#2

|

Senior Member

1,596 posts Joined: Sep 2021 |

QUOTE(cy91 @ Feb 28 2022, 11:50 PM) There always other options :-1) Go for unit below 300k according to affordability first, slowly upgrade to your dream house as the salary increases over time. 2) Use joint name & joint loan for the property purchase with your life partner/spouse/family 3) Go for longer loan tenure, drag as maximum as possible to lessen the monthly commitment The main hindrance will be the upfront 10% down payment. Many will have missed out the 5% additional for the SPA, MOT & Loan Agreement. Total 15% upfront cash to be ready. This post has been edited by nihility: Mar 1 2022, 06:17 AM |

|

|

Mar 1 2022, 05:57 AM Mar 1 2022, 05:57 AM

Return to original view | IPv6 | Post

#3

|

Senior Member

1,596 posts Joined: Sep 2021 |

deleted. double posted

This post has been edited by nihility: Mar 1 2022, 05:58 AM |

|

|

Mar 1 2022, 02:08 PM Mar 1 2022, 02:08 PM

Return to original view | Post

#4

|

Senior Member

1,596 posts Joined: Sep 2021 |

QUOTE(Lee Wei Sheng @ Mar 1 2022, 11:03 AM) no current installment/cash in hand, im still a first year uni student lol Go the Economy Faculty within your university, check if the Economy Faculty of your university is offering any Personal Finance Elective Course, enroll into that class. They will give you the real process of how to do purchase your house from location selection & financing + things to take into considerations.just curious and wanted to know about how much commitment it usually takes to finance a house, so that next time when come out working life wont be so clueless and susah payah. |

|

|

Mar 2 2022, 09:49 AM Mar 2 2022, 09:49 AM

Return to original view | Post

#5

|

Senior Member

1,596 posts Joined: Sep 2021 |

QUOTE(taitianhin @ Mar 1 2022, 10:03 PM) If to buy for investment and rent out immediately. For the 1st house, normally ppl will buy sub-sale ready to move in. If buy new unit, the monthly rental + loan servicing concurrently will suffocate the young buyer.For exact 2K loan, i would say 5K probably is good also. Do take income tax deduction into account. Buying New house (House/condo to be build) is more tricky, where we pay installment incrementally and getting nothing in return for 2-3 years. Then you need to reserve a bit la |

| Change to: |  0.0191sec 0.0191sec

0.26 0.26

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 16th December 2025 - 07:50 AM |