Investment Kenanga Digital Investing (KDI), KDI Invest, KDI Save

|

|

Jul 31 2022, 11:21 AM Jul 31 2022, 11:21 AM

Return to original view | Post

#1

|

Junior Member

887 posts Joined: Mar 2012 |

Thank you everybody for sharing information and thank you TS for starting this thread. Finally finish reading from page 1. Took me 3 days to finish reading every post. I just downloaded and register for an account. I only plan to use the save function (therefore no referral needed). Hopefully by year end they have good rate moving forward. Sorry i am late to this and that's very regretful

|

|

|

|

|

|

Jul 31 2022, 12:34 PM Jul 31 2022, 12:34 PM

Return to original view | Post

#2

|

Junior Member

887 posts Joined: Mar 2012 |

QUOTE(babysotong @ Jul 31 2022, 11:30 AM) You should use a referral code as each party gets free RM10 within 30 days if you put rm250 in KDI Invest I am aware of that but I thought about it and I am very sure i will not use the invest function so there is no point in using the referral. First of all, as someone pointed out, to use the free management 3k limit, there is not much growth before you hit past 3k (if all of green). If you put tiny amount then it doesn't make much difference in 5 or 10 years down the line. Moving profit regularly to KDI save is not worth the effort as pointed out. If you wish to buy etf in larger amount, it is better to DIY (another learning curve but right now i am very phobia about risky instruments so probably won't touch). Not to mention DIY as ppl here pointed out will have inheritance issue since money oversea. Might as well just use the KDI save (money market) and search further until better opportunity arises. Hence no point for the referral for me.https://app.digitalinvesting.com.my/registr...ral_code=104898 lovelyuser liked this post

|

|

|

Jul 31 2022, 05:42 PM Jul 31 2022, 05:42 PM

Return to original view | IPv6 | Post

#3

|

Junior Member

887 posts Joined: Mar 2012 |

QUOTE(lovelyuser @ Jul 31 2022, 04:22 PM) Yes. I tend to read as much as possible before asking. 73 something pages are ok. I read up to few hundreds before but don't comment coz usually lost interested after a few hundred threads but this one is really what i needed. QUOTE(Ramjade @ Jul 31 2022, 05:00 PM) If you don't want to run into inheritance issue, just but Singapore reits and stock. Sg don't have any inheritance issue. Only issue is they only have reits and banks there. Nothing much of quality there. Singapore reits is something i want to look into. Thank you very very very much. I been thinking to diversify to other country coz lately i see the issue in Malaysia i am very very very worried. So been on my mind to look "outside" of Malaysia and into Singapore but so far i only found one which gives 5% plus return a year (last year and consider good coz of the economy situations) and had gone up to 10% before. The only problem is i have to personally fly there to open account |

|

|

Aug 1 2022, 10:56 AM Aug 1 2022, 10:56 AM

Return to original view | IPv6 | Post

#4

|

Junior Member

887 posts Joined: Mar 2012 |

Hmm.. my application still pending approval and it's 10.57am. looks like i still out of action for save function.

|

|

|

Aug 1 2022, 03:43 PM Aug 1 2022, 03:43 PM

Return to original view | Post

#5

|

Junior Member

887 posts Joined: Mar 2012 |

I just got my approval for my account!!! 3.41pm!! I was just complaining to ramjade on another thread i no hope today to get it. 😂 Time to fund the account

FYI. 7 hours and 41 minutes for the approval (I registered on the weekend and hence Monday aka today 8am start counting) |

|

|

Aug 4 2022, 11:14 AM Aug 4 2022, 11:14 AM

Return to original view | Post

#6

|

Junior Member

887 posts Joined: Mar 2012 |

QUOTE(tadashi987 @ Aug 1 2022, 05:03 PM) Their AI seems to be switching/buy-sell the ETF allocation a lot, not sure if it is a good thing to be made transparent to customers, we can just entrust on their AI, and review monthly Thread looks quiet so i bump by asking a qs. Does the switch/buy-sell incur any charges or its free? Do they sell/switch back to RM then buy/switch back to USD when buy when they do that (as in we incur exchange rate difference)? If none, then is there any other charges for putting in invest besides the annual fee (3k free, then 0.3 to 0.7% per annum depending on the sum invested) ETF shouldn't have any fees right? So is the management fee (0.3% to 0.7% per annum) worth it since we using AI to help us 24/7? What's your view on that as compare to DIY. DIY might be cheaper but you cannot monitor 24/7 and technically won't be able to react fast enough. Has the AI proven it is very good at switching fast enough to protect capital?if every switch/buy-sell is made visible to us, bet it will be StashAway, investor just keep questioning on every transaction made by the robo Edit: oh, what about the issue with US tax system and witholding tax? Is this qs too early to ask? 😂 Stashaway help us claim the tax after one year. Will kdi do the same? This post has been edited by Wolves: Aug 4 2022, 11:17 AM |

|

|

|

|

|

Aug 5 2022, 03:39 PM Aug 5 2022, 03:39 PM

Return to original view | Post

#7

|

Junior Member

887 posts Joined: Mar 2012 |

QUOTE(Davidtcf @ Aug 5 2022, 10:57 AM) all robo advisors will use US etf, hence by default all dividends are charged 30% tax. The amount you receive is after tax. Thank you boss for the detailed answer. This is very helpful. Thank youno estate tax if we use robo advisors since the companies like Stashaway are the custodian.. they using their account to buy ETFs on behalf of us. Also if you read the page on Stashaway your investments is safe even if they go bankrupt: https://www.stashaway.my/help-center/360009...s-my-money-kept KDI also same, under Saxo: https://digitalinvesting.com.my/faq/ (read under Security and Protection section> "What happens to my investments if Kenanga Digital Investing (KDI) closes down, gets acquired/goes public?") If you self invest in US stocks or ETFs, estate tax only applies if you have USD60k and above in brokers like IBKR. Some people workaround this by sharing their login and passwords with their loved ones (as long you don't get caught). If wanna self invest and avoid estate tax, then invest into Irish Domiciled ETFs e.g. VWRA, VUAA, CSPX, etc (these are similar to US etfs but are for European or non US people to invest in - they will have the word "UCITS" in their ETF name). They also charge lower dividend tax at 15%. Why robo advisors don't invest in them? Their excuse is liquidity. I am guessing it's due to higher fees involve when buying them too. whether KDI will help us claim back withholding tax you can send a chat inquiry to KDI via their site.. I think got people here ask before. But so far from most people who use Invest the performance is better than Stashaway. Yes 0.3 to 0.7% is their management fees depending on the amount you invest in KDI Invest. All robo advisors got this fee. You can try below RM3k if wanna avoid this fee. If hate this fee, I suggest self invest using IBKR.. but using that you'll need to pay Wise transfer fee also.. And also currency conversion fees. However they are 1 off. Also need to learn more on how to do them. You can check Ziet Invest youtube video on how to open SG CIMB account, using Wise transfer to IBKR.. all in his videos. Davidtcf liked this post

|

|

|

Aug 14 2022, 06:05 PM Aug 14 2022, 06:05 PM

Return to original view | IPv6 | Post

#8

|

Junior Member

887 posts Joined: Mar 2012 |

QUOTE(yourinfohere @ Aug 14 2022, 05:16 PM) Look like all profit? This is better than stashaway? 1 account 5 different screen shot over 5 different months i think.How can you choose? You study a lot or just blind tick then rely lucky? you own 5 accounts? Each account below RM3k no need pay fees? so you frequency sale and buy? I remember not matter below RM3K no need pay fees, but when you deposit RM250 system will deducted some money? If you sale will deducted again? Thank you. You choose your profile (5 types) depending on how much risk you willing to take (can change in setting later if you wish to change later) Not need frequent buy sell. Just keep deposit in and let the robo advisor do the rest according to your risk profile. Yes, below 3k no management fee but other fees related to the etf you still pay as per usual. And no, no money is deducted. It is just the exchange rate which some claim around 0.1% each time you deposit and the robo advisor convert myr to usd. And the sell is the same. You will lose some money from the conversion rate but no sales charges. And no, technically you cannot own more than 1 account unless you have ppl who let you use thier details. Edit: better than stashaway? Hard to say coz this one started in feb this year but so far they seems to be doing better and more frequent swapping and so on. So.... Only time will tell.. This post has been edited by Wolves: Aug 14 2022, 06:07 PM |

|

|

Aug 14 2022, 10:24 PM Aug 14 2022, 10:24 PM

Return to original view | IPv6 | Post

#9

|

Junior Member

887 posts Joined: Mar 2012 |

QUOTE(guy3288 @ Aug 14 2022, 09:31 PM) StashAway? See lah already 1 year now..paper loss RM3500, Thank you for clarifying that. Had i put that SA money in KDI invest , now gain RM7000+ goyang kaki 6 months only how to choose ? u can add money when market down, so far i dont sell any KDI Invest yet. yeah 5 accounts means RM15k no fee , but 5 accs were opened more for that promo kdisave 3% if you read can see is not 1 account. 5 separate accounts, market value for each of them on same day -13.8.2022 1 year SA kalah teruk to 6 months KDI Invest...Regret didnt WD all out from SA. QUOTE(yourinfohere @ Aug 14 2022, 10:12 PM) Thanks others reply, but I no mood and so on, today just choose to ask. If you read what ramjade says.. it's not about guessing the market. It's about putting in at consistent rate. Nobody knows how the market will perform and nobody have a crystal ball to tell you. What kdi invest is a robo advisor. It's an AI (computer that learns) that trades for you depending on your risk appetite. So nobody knows how much you gain in each profile (or losses) but a computer "predicts" the best outcome base on your risk profile. If you don't want losses then kdi save has pro-rated daily interest that gives you 3% per year (until 31st December 2022). Confirmed 0 losses All is "growth" groups, but different returns. The higher is RM 115.32 and RM 151.42. Why this "2" growth can more profit, normally how to choose can get more profit? No matter you want "aggressive growth", but the profit not mean aggressive growth". When deposit in invest account, you estimate RM1000 - 0.1%? and withdraw also estimate - 0.1%? Now, you consider move all stashaway go to kdi invest? How you know market go down or go high? This also dairy different price? You want buy low sale high concept? Thank you. As for the money losses to exchange rate, base on previous user comments, it's around 0.1% for each buy And 0.1% for each sell amount. You can actually read like 5 pages back and it was mentioned here. |

|

|

Aug 14 2022, 10:30 PM Aug 14 2022, 10:30 PM

Return to original view | IPv6 | Post

#10

|

Junior Member

887 posts Joined: Mar 2012 |

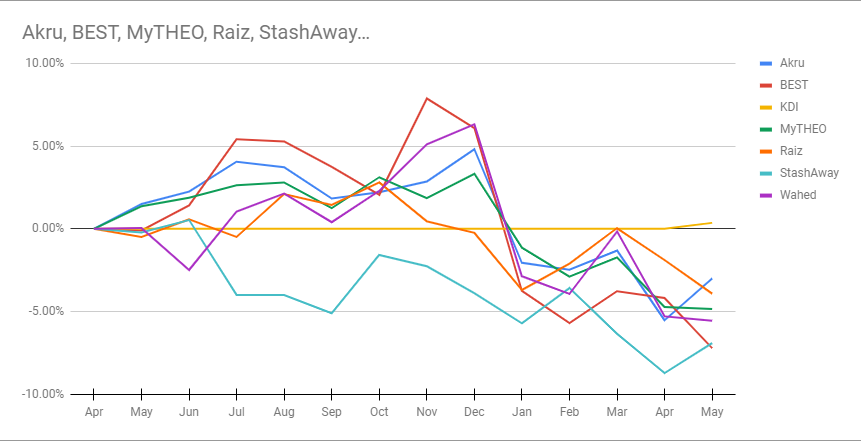

QUOTE(Medufsaid @ Aug 14 2022, 10:10 PM) KDI started this year only, if u want to compare, you need to start with RM100 in SA and RM100 in KDI on the same start date. There's a bear market after Jan so KDI will have a better starting point Base on the charts.. Akru seems to be doing better than the rest in market downtrend but they are also mediocre when market is uptrend. Looks like they are more conservative. Interesting chart. Kdi seems to have a good starting point and a very slow climb compare to the rest but it's a steady climb since the start. Need more data. But interesting chart none the less chart compiled from fiholicMD's experiment -> https://twitter.com/fiholicMD/status/1531111914096340993 This post has been edited by Wolves: Aug 14 2022, 10:30 PM |

|

|

Aug 14 2022, 10:36 PM Aug 14 2022, 10:36 PM

Return to original view | IPv6 | Post

#11

|

Junior Member

887 posts Joined: Mar 2012 |

QUOTE(Medufsaid @ Aug 14 2022, 10:27 PM) got data, but no one is showing the performance in a chart format (or maybe KDI invest doesn't have that), so i'm just like you, only have KDI save Oh. Definitely can relate. I will consider later when the 3% promotional rate finished. If kdi can give consistent uptrend even if slow, and can give more than 5% per annum (annualized data) by then, then it is worth considering. As for now just sit on my hands until end of year and park at kdi save and watch the performance |

|

|

Aug 15 2022, 01:02 PM Aug 15 2022, 01:02 PM

Return to original view | Post

#12

|

Junior Member

887 posts Joined: Mar 2012 |

nice... this is why i say akru seems to be doing better...

|

|

|

Aug 19 2022, 12:27 PM Aug 19 2022, 12:27 PM

Return to original view | Post

#13

|

Junior Member

887 posts Joined: Mar 2012 |

So.. any update on the kdi invest? All making money now? Lol. Is it performing good so far? Any kdi invest ppl can show us current update?

|

|

|

|

|

|

Aug 19 2022, 01:20 PM Aug 19 2022, 01:20 PM

Return to original view | Post

#14

|

Junior Member

887 posts Joined: Mar 2012 |

QUOTE(honsiong @ Aug 19 2022, 12:45 PM) Well, if you look at the overall one. The one that has data from past year, it shows overall akru seems to be better (lower losses but lower gains as well). Looks more conservative but at least reacts fast when downturn. For capital preservation akru looks good. But right now i am more interested in kdi and if it can perform as good or better, i might try it out. Still using the save function only for now until further info available. |

|

|

Aug 19 2022, 01:56 PM Aug 19 2022, 01:56 PM

Return to original view | Post

#15

|

Junior Member

887 posts Joined: Mar 2012 |

QUOTE(download88 @ Aug 19 2022, 01:32 PM) You can do a full withdrawal. If you have less than 100 then why do you want to use the save function? If you have less than 250 then why invest? I don't think that is an issue. If you have less than 250, it is wiser not to do anything with it but put it into your bank account to be honest. Go accumulate more first then only you think about using save or invest. The first thing you should be doing is actually have an emergency fund of at least 3 months expenditure. That's the first golden rule. I would say 6 months to a year. It means if you do lose your job or income, you can survive 3 months while you look for jobs. If you do not have this money, do not invest in anything coz you will ended up losing more coz investment usually goes up and down and when you need money in emergency, you could be stucked at a losing position. Bad choice. So go save up for that emergency fund first and for that you can move it into kdi save for more interest (this is what i do hence i only use kdi save). But if you don't even have 100, then keep it in your bank account and don't split your money. When you have a certain sum of money, do not move all into kdi. I keep 1 month expenses in saving and the rest move to kdi save. Plan to move in and out every month. That's how you should be using it. This post has been edited by Wolves: Aug 19 2022, 01:59 PM lovelyuser liked this post

|

|

|

Aug 22 2022, 12:23 PM Aug 22 2022, 12:23 PM

Return to original view | Post

#16

|

Junior Member

887 posts Joined: Mar 2012 |

QUOTE(tadashi987 @ Aug 22 2022, 10:38 AM) If OPR continue to raise, kdi should also raise. The point of kdi is to beat or equal FD rates but more flexibility. If they are lower than FD then they will lose ppl. Hope we getting better and better rates :XThis post has been edited by Wolves: Aug 22 2022, 12:24 PM |

|

|

Aug 23 2022, 08:12 PM Aug 23 2022, 08:12 PM

Return to original view | Post

#17

|

Junior Member

887 posts Joined: Mar 2012 |

QUOTE(tadashi987 @ Aug 22 2022, 02:37 PM) yeah, in fact now other competitors e.g. TnG GoInvest claiming they are close to 3% already with 2.85%*p.a. returns. hope KID don't disappoint us after the revision Actually i think they should revise during next interest rate announcement (probably september) coz if TnG can reach 2.85% "now", they will increase to beat kdi save 3% (promotion) by next interest rate increase. If that is the case the promotion is no longer a promotion rate -.-"Come on kdi, you should beat the rest of your competitor |

|

|

Aug 25 2022, 12:46 AM Aug 25 2022, 12:46 AM

Return to original view | IPv6 | Post

#18

|

Junior Member

887 posts Joined: Mar 2012 |

QUOTE(Ramjade @ Aug 24 2022, 11:43 PM) Cause like I told you in the pm, everything can be done online and yet you still want to ask your RM to do for you. My 2 cents. Older and richer ppl have thier RM but RM is expensive and variety/options might be limited to the company the RM works for or RM themselves. RM draws salary from thier investment afterall and sometimes doesn't suggest options to the best interest of the investor. They might want cheaper options. Free DIY might be "troublesome" and sometimes complicated with extra steps that the older rich ppl might find it too troublesome. If they can charge tiny fees and simpler one click all in one apps then older rich ppl might come.I want to see how well their superapp going or be especially polish apples like moomoo, tiger, webull and go trade in sg exist. Alternatively they might target younger investors who are newer and dunno what to do or what is thier options. This is the all in one platform and one click station. With attractive low fees and "all you need to know" alternative to complicated ways.. they can pick up quite a bit of newer gen customers who still have plenty of years to live. For those who are in between, a one-stop station, simple and cheap options might attract them IF it actually works as intended. Plus they are leveraging on thier company's image as one of the top investment company in Malaysia. So i can see how they can work. As long as they give better rates for save and cheaper investment options with more varieties of investment vehicle at a convenient click of a button. |

|

|

Aug 30 2022, 11:13 PM Aug 30 2022, 11:13 PM

Return to original view | IPv6 | Post

#19

|

Junior Member

887 posts Joined: Mar 2012 |

QUOTE(BrookLes @ Aug 30 2022, 10:02 PM) Yet they cannot even handle their registration system for more then 2 months. I registered around 4 weeks ago. At first i have the same pin issue but after keep trying for a few times.. i think 3 times.. i changed the time to 12.30am (midnight) coz i figured less congestion and it works. You can try midnight if you want to give it a try.Maybe they dun want new customers and this is their strategy. But why they cannot just say they are not accepting new customers at the moment? Or that new customers cannot use KDI save, I also help another person register the next morning (sat) and after keep clicking for around 5 times it also works. You just need to keep trying in a row for it to work. Its "clunky" i admit but i managed to register two account by persisting. This post has been edited by Wolves: Aug 30 2022, 11:16 PM |

|

|

Aug 30 2022, 11:20 PM Aug 30 2022, 11:20 PM

Return to original view | IPv6 | Post

#20

|

Junior Member

887 posts Joined: Mar 2012 |

QUOTE(BrookLes @ Aug 30 2022, 11:16 PM) End of year is still end of year. I think i registered august 2nd. I count 4 months. But the amount i put in it will equal maybank savings account 1 year interest times 3 (that time) so still worth it. After that i did another top up and just this month (almost 30 days) i already have 2x maybank savings yearly interest. I got my maybank yearly interest in June so i know. Try it. You won't regret it This post has been edited by Wolves: Aug 30 2022, 11:21 PM |

| Change to: |  0.1041sec 0.1041sec

0.72 0.72

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 14th December 2025 - 07:34 AM |

All Rights Reserved © 2002- 2025 Vijandren Ramadass (~unite against racism~)

Powered by Invision Power Board © 2025 IPS, Inc.

Quote

Quote