- FD interest calculation : $10,000 x 3.5% = $350 x 1 day / 365 days = $0.9589 interest daily

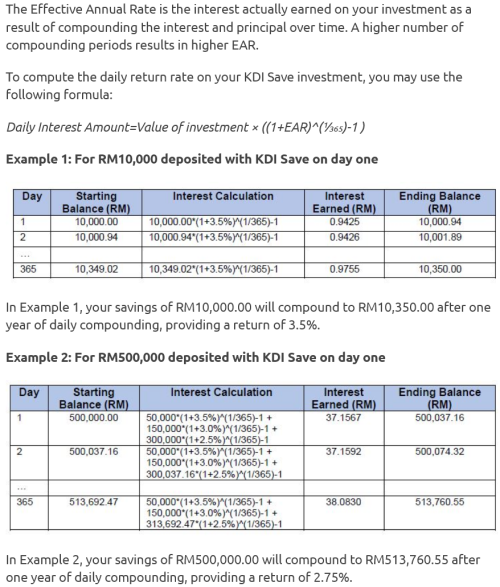

- KDI Save's returns : $10,000*(1+3.5%)^(1/365)-1 = $0.9425 interest daily

- KDI Save's returns after 1 year for $10,000 in 3.5% = $10,350 interest yearly

1. I thought compound interest is superior to regular FD but in a real world, both FD and KDI Save rate "compounding the interest and principal over time" after a year results 10,350 same as FD.

2. If a bank's promo FD is more than 3.5% would yield higher returns than KDI Save

3. KDI Save's depositors can withdraw 9 days with interest but banks penalize early FD withdrawal.

4. KDI's day 1 interest 0.9425 is lesser than bank's 0.9589.

I had wanted to raise queries, but I came to these conclusions, am I wrong?

Your thoughts are welcome.

» Click to show Spoiler - click again to hide... «

Apr 16 2023, 08:41 AM

Apr 16 2023, 08:41 AM

Quote

Quote

0.0848sec

0.0848sec

0.32

0.32

7 queries

7 queries

GZIP Disabled

GZIP Disabled