IPO: IPO stocks can die one!

|

|

Feb 12 2022, 11:46 AM, updated 4y ago Feb 12 2022, 11:46 AM, updated 4y ago

Show posts by this member only | Post

#1

|

All Stars

15,942 posts Joined: Jun 2008 |

Come on in and complain............. |

|

|

|

|

|

Feb 12 2022, 11:48 AM Feb 12 2022, 11:48 AM

Show posts by this member only | Post

#2

|

All Stars

15,942 posts Joined: Jun 2008 |

https://www.theedgemarkets.com/article/ipos...gs-fail-impress

This post has been edited by Boon3: Feb 12 2022, 11:50 AM |

|

|

Feb 12 2022, 12:44 PM Feb 12 2022, 12:44 PM

Show posts by this member only | Post

#3

|

Senior Member

4,503 posts Joined: Mar 2014 |

Grab...52% down since listing in Dec last year. |

|

|

Feb 12 2022, 12:56 PM Feb 12 2022, 12:56 PM

Show posts by this member only | IPv6 | Post

#4

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Feb 12 2022, 01:01 PM Feb 12 2022, 01:01 PM

Show posts by this member only | Post

#5

|

Senior Member

4,503 posts Joined: Mar 2014 |

|

|

|

Feb 12 2022, 01:57 PM Feb 12 2022, 01:57 PM

Show posts by this member only | Post

#6

|

Senior Member

4,503 posts Joined: Mar 2014 |

Another one for the record

AAX. IPO at RM1.25 in 2013. 8 years and 1 rights issue later, down to RM0.05 But yesterday jump to RM0.50! (10:1 share consolidation) (Who is TF trying to fool?) This post has been edited by Cubalagi: Feb 12 2022, 01:57 PM |

|

|

|

|

|

Feb 12 2022, 02:00 PM Feb 12 2022, 02:00 PM

Show posts by this member only | Post

#7

|

Junior Member

320 posts Joined: Mar 2013 |

QUOTE(Cubalagi @ Feb 12 2022, 01:01 PM) Trading in the US mkt is so cheap: 1 popular US online brokerage firm is charging RM1 for trading. If KLSE continues to be in the doldrums, and the US gives better trading opportunities, gomen is going to ban US and overseas online brokerage companies.This post has been edited by swiss228: Feb 12 2022, 02:01 PM |

|

|

Feb 12 2022, 03:02 PM Feb 12 2022, 03:02 PM

Show posts by this member only | Post

#8

|

Senior Member

3,502 posts Joined: Dec 2007 |

QUOTE(Cubalagi @ Feb 12 2022, 01:01 PM) My own principle is never invest in negative operational cash flow company, especially ipo/spac types no matter what market.Only do that if you are in the early VC crowd where you gain major upside for that risk. But this principle also make me miss out super baggers like tesla tho. But its ok, be safe rather than sorry. |

|

|

Feb 12 2022, 03:16 PM Feb 12 2022, 03:16 PM

Show posts by this member only | Post

#9

|

All Stars

21,458 posts Joined: Jul 2012 |

QUOTE(Cubalagi @ Feb 12 2022, 12:44 PM) Some IPO especially tech stock is opportunity for pre-ipo investors to cash out rather than for public participation. otaida00taj, SYAMiLLiON, and 2 others liked this post

|

|

|

Feb 12 2022, 05:11 PM Feb 12 2022, 05:11 PM

|

Junior Member

320 posts Joined: Mar 2013 |

|

|

|

Feb 12 2022, 09:44 PM Feb 12 2022, 09:44 PM

|

Senior Member

6,250 posts Joined: Jun 2006 |

|

|

|

Feb 12 2022, 09:52 PM Feb 12 2022, 09:52 PM

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

QUOTE(Boon3 @ Feb 12 2022, 12:56 PM) In fact lost 3x pre ipo value and at the lowest post ipo as well lose 2/3 QUOTE(Cubalagi @ Feb 12 2022, 01:57 PM) Another one for the record Imagine at the lowest at 3 sen AAX. IPO at RM1.25 in 2013. 8 years and 1 rights issue later, down to RM0.05 But yesterday jump to RM0.50! (10:1 share consolidation) (Who is TF trying to fool?) TF just consolidating in order to payout less dividends next quarter |

|

|

Feb 12 2022, 10:52 PM Feb 12 2022, 10:52 PM

|

Junior Member

141 posts Joined: Feb 2022 |

|

|

|

|

|

|

Feb 13 2022, 10:11 AM Feb 13 2022, 10:11 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Feb 13 2022, 10:34 AM Feb 13 2022, 10:34 AM

|

Senior Member

6,250 posts Joined: Jun 2006 |

QUOTE(Boon3 @ Feb 13 2022, 10:11 AM) yeah.I remember in the 80s my classmate asking everyone to help his father with ipo lottery... those days can really win big... nowadays I wait for big big discounts from ipo/euphoria peaks then consider... |

|

|

Feb 13 2022, 11:42 AM Feb 13 2022, 11:42 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(dwRK @ Feb 13 2022, 10:34 AM) yeah. Yup! Exactly. The IPO market is like a lottery. Even if one is lucky enough to strike the jackpot, there's nothing written in the wall that the lucky strike will even win money! I remember in the 80s my classmate asking everyone to help his father with ipo lottery... those days can really win big... nowadays I wait for big big discounts from ipo/euphoria peaks then consider... If bad cow luck, you strike a lousy ipo like SengHeng, one will end up losing money! and yea... then of course, if one delve deeper, then there's the world of the discount for the big boys. |

|

|

Feb 13 2022, 12:36 PM Feb 13 2022, 12:36 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

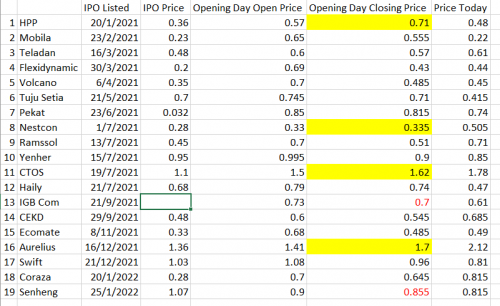

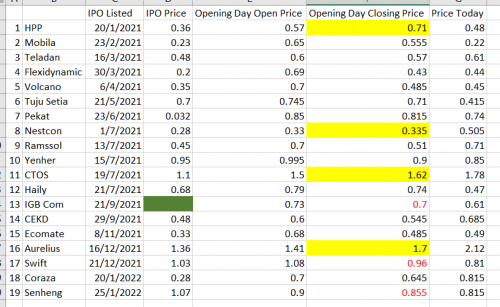

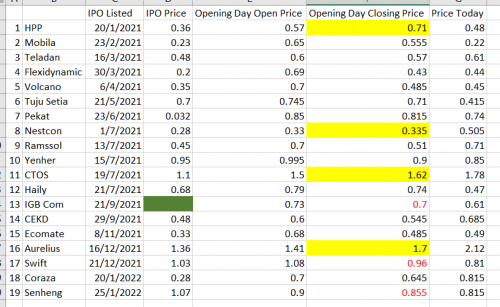

So far since 2021...

Swift Haulage...... IPO price 1.03 Closing price on listing day 0.96 SenHeng............. IPO price 1.07 Closing price on listing day 0.855 *sorry for error since IGB Comm IPO reference price is much complex* This post has been edited by Boon3: Feb 13 2022, 05:19 PM |

|

|

Feb 13 2022, 01:24 PM Feb 13 2022, 01:24 PM

|

Senior Member

4,503 posts Joined: Mar 2014 |

QUOTE(Boon3 @ Feb 13 2022, 12:36 PM) This one is not really RM1 offered to the public. in fact there was no retail offering.Can see story here. https://www.thestar.com.my/business/busines...e-price-concern Actually this one at current price looks interesting to me. Will study. This post has been edited by Cubalagi: Feb 13 2022, 01:25 PM |

|

|

Feb 13 2022, 02:22 PM Feb 13 2022, 02:22 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Cubalagi @ Feb 13 2022, 01:24 PM) This one is not really RM1 offered to the public. in fact there was no retail offering. Can see story here. https://www.thestar.com.my/business/busines...e-price-concern Actually this one at current price looks interesting to me. Will study. Thanks for the correction! Now looks too complicate for me to count. Hohoho.... Anyway.... here's an interesting stat for stats lovers.... Most of the IPO stocks listed since 2021, on listing day, they tend to close LOWER than its opening price (15 out of 19 or 78.9%)  which means... if one is a betting person... on average, one tends to lose money if one buys the stock on its listing day! * yeah... some will say 'screw the stats'.... |

|

|

Feb 13 2022, 02:28 PM Feb 13 2022, 02:28 PM

|

All Stars

21,458 posts Joined: Jul 2012 |

QUOTE(Boon3 @ Feb 13 2022, 12:36 PM) So far since 2021... IGB Commercial... IPO price 1.00 Closing price on listing day 0.7 Swift Haulage...... IPO price 1.03 Closing price on listing day 0.96 SenHeng............. IPO price 1.07 Closing price on listing day 0.855 QUOTE(Boon3 @ Feb 13 2022, 02:22 PM) Thanks for the correction! Now looks too complicate for me to count. Hohoho.... Anyway.... here's an interesting stat for stats lovers.... Most of the IPO stocks listed since 2021, on listing day, they tend to close LOWER than its opening price (15 out of 19 or 78.9%)  which means... if one is a betting person... on average, one tends to lose money if one buys the stock on its listing day! * yeah... some will say 'screw the stats'.... |

|

|

Feb 13 2022, 05:02 PM Feb 13 2022, 05:02 PM

|

Junior Member

141 posts Joined: Feb 2022 |

QUOTE(Boon3 @ Feb 13 2022, 11:42 AM) Yup! Exactly. The IPO market is like a lottery. Even if one is lucky enough to strike the jackpot, there's nothing written in the wall that the lucky strike will even win money! If you know how to value a company, it's less of a lottery. Still need luck to strike, but chances of profiting is almost guaranteed.If bad cow luck, you strike a lousy ipo like SengHeng, one will end up losing money! and yea... then of course, if one delve deeper, then there's the world of the discount for the big boys. |

|

|

Feb 13 2022, 05:16 PM Feb 13 2022, 05:16 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

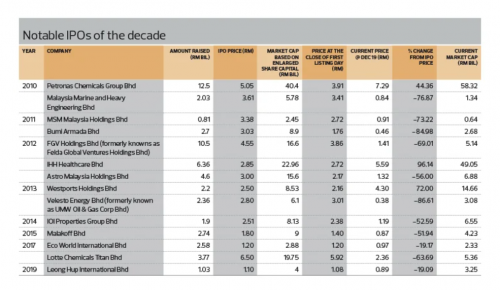

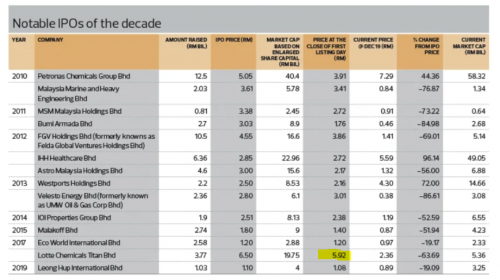

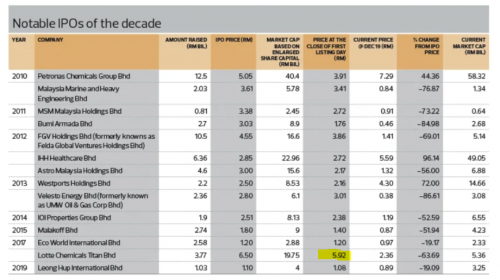

QUOTE(jaapers @ Feb 13 2022, 05:02 PM) If you know how to value a company, it's less of a lottery. Still need luck to strike, but chances of profiting is almost guaranteed. Yup. That's what they all said. Do read that link posted earlier: https://www.theedgemarkets.com/article/ipos...gs-fail-impressSo many big names, yes? So many valuations done on them, yes? And yet... these stocks failed big time and let their IPO investors down. So was it a question that the market did not know how to value those stocks? End of the day... it is what it is. One can lose money in an IPO and they are cases where one can turn into long term investor and yet despite holding the stocks for a long time, they are still losing money! That's my message. |

|

|

Feb 13 2022, 06:22 PM Feb 13 2022, 06:22 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(jaapers @ Feb 13 2022, 05:02 PM) If you know how to value a company, it's less of a lottery. Still need luck to strike, but chances of profiting is almost guaranteed. Here's one of the big name that died from that Edge article... LC Titan. IPO price was readjusted to 6.50. Closed much lower at 5.92 during listing day. Kenanga in its IPO research notes (16 pages long too) valued the company at 9.05  the earnings estimates was 1.473 billion for fy 2017 and 1.69 billion for fy 2018. and how did LCTitan do?  which is way off the estimates...... yeah.... valuations ..... valuations ... valuations.... and of course, the classic teachings teaches one that proforma numbers tends to be optimistic but LCTitan actual performances was way off (which explains why since listing the stock had tanked so much!) and yeah... LCTitan is a relisting....company listed before then delisted via privatization and then got relisted again... and yeah... LCTitan is like dejavu all over again..... This post has been edited by Boon3: Feb 13 2022, 06:23 PM |

|

|

Feb 13 2022, 11:58 PM Feb 13 2022, 11:58 PM

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

QUOTE(Boon3 @ Feb 13 2022, 05:16 PM) Yup. That's what they all said. Do read that link posted earlier: https://www.theedgemarkets.com/article/ipos...gs-fail-impress Not the market but blame those investment banking and market listers who just hype pre iPo prices to trap the retail and while exiting a massive profit So many big names, yes? So many valuations done on them, yes? And yet... these stocks failed big time and let their IPO investors down. So was it a question that the market did not know how to value those stocks? End of the day... it is what it is. One can lose money in an IPO and they are cases where one can turn into long term investor and yet despite holding the stocks for a long time, they are still losing money! That's my message. |

|

|

Feb 14 2022, 12:41 AM Feb 14 2022, 12:41 AM

|

All Stars

21,458 posts Joined: Jul 2012 |

|

|

|

Feb 14 2022, 09:12 AM Feb 14 2022, 09:12 AM

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

|

|

|

Feb 14 2022, 09:51 AM Feb 14 2022, 09:51 AM

|

Junior Member

141 posts Joined: Feb 2022 |

QUOTE(Boon3 @ Feb 13 2022, 05:16 PM) Yup. That's what they all said. Do read that link posted earlier: What I mean is your own valuation, instead of relying on analyst valuation. Those published analyst report cant always believe 100%, very likely they have their own agenda.So many big names, yes? So many valuations done on them, yes? And yet... these stocks failed big time and let their IPO investors down. So was it a question that the market did not know how to value those stocks? End of the day... it is what it is. One can lose money in an IPO and they are cases where one can turn into long term investor and yet despite holding the stocks for a long time, they are still losing money! That's my message. |

|

|

Feb 14 2022, 10:09 AM Feb 14 2022, 10:09 AM

|

Senior Member

5,529 posts Joined: Oct 2007 |

|

|

|

Feb 14 2022, 10:15 AM Feb 14 2022, 10:15 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(jaapers @ Feb 14 2022, 09:51 AM) What I mean is your own valuation, instead of relying on analyst valuation. Those published analyst report cant always believe 100%, very likely they have their own agenda. Well of course la but how many of us can dare say their valuation skills is better?Anyway, the analyst report valuation was used as a simplistic example on how even they could get it so wrong. And of course to complicate things further, many do get rich betting and when they strike an ipo allocation. Some of those local ipo do fly. That's a fact. Performance of newly listed stocks since 2021...  But forget us not that there are incidents where big name IPO die big time! Strike the wrong IPO and one will be a big water fish! |

|

|

Feb 14 2022, 10:16 AM Feb 14 2022, 10:16 AM

|

Senior Member

5,529 posts Joined: Oct 2007 |

QUOTE(icemanfx @ Feb 12 2022, 03:16 PM) Some IPO especially tech stock is opportunity for pre-ipo investors to cash out rather than for public participation. actually not just tech stock. it is for most IPO in fact. even in bursa. i will avoid those IPOs / companies that have large offer for sale portion at all cost. typically those PE / VC firm backed IPO. |

|

|

Feb 14 2022, 10:17 AM Feb 14 2022, 10:17 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Feb 14 2022, 10:18 AM Feb 14 2022, 10:18 AM

|

Senior Member

5,529 posts Joined: Oct 2007 |

QUOTE(Boon3 @ Feb 13 2022, 06:22 PM) Here's one of the big name that died from that Edge article... LC Titan. valuations....... is it art, science or magic? IPO price was readjusted to 6.50. Closed much lower at 5.92 during listing day. Kenanga in its IPO research notes (16 pages long too) valued the company at 9.05  the earnings estimates was 1.473 billion for fy 2017 and 1.69 billion for fy 2018. and how did LCTitan do?  which is way off the estimates...... yeah.... valuations ..... valuations ... valuations.... and of course, the classic teachings teaches one that proforma numbers tends to be optimistic but LCTitan actual performances was way off (which explains why since listing the stock had tanked so much!) and yeah... LCTitan is a relisting....company listed before then delisted via privatization and then got relisted again... and yeah... LCTitan is like dejavu all over again..... |

|

|

Feb 14 2022, 10:20 AM Feb 14 2022, 10:20 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Feb 14 2022, 10:21 AM Feb 14 2022, 10:21 AM

|

Senior Member

5,529 posts Joined: Oct 2007 |

|

|

|

Feb 14 2022, 10:34 AM Feb 14 2022, 10:34 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(tehoice @ Feb 14 2022, 10:21 AM) hahahahahah! we all know thattttt..... Hehe.... by the way, what other valuations method do you all use other than PE? Would you do your own DCF to value a company? Since DCF is one of the most widely used valuation method. For LC Titan, I blame LC Titan itself. They had that infamous water cut issue which impacted their profits greatly just before their IPO. They DID NOT disclose this issue, which would have forced them to revise their IPO proforma numbers much lower...... and yeah, subsequently the company was goreng and fined by SC. LOL! DCF? This could easily make valuations sky high. This post has been edited by Boon3: Feb 14 2022, 10:43 AM |

|

|

Feb 14 2022, 10:41 AM Feb 14 2022, 10:41 AM

|

Senior Member

5,529 posts Joined: Oct 2007 |

QUOTE(Boon3 @ Feb 14 2022, 10:34 AM) Hehe.... and that entire team got replaced and left the (year of zodiac) IB...... For LC Titan, I blame LC Titan itself. They had that infamous water cut issue which impacted their profits greatly just before their IPO. They disclose this issue, which would have forced them to revise their IPO proforma numbers much lower...... and yeah, subsequently the company was goreng and fined by SC. LOL! DCF? This could easily make valuations sky high. |

|

|

Feb 14 2022, 10:45 AM Feb 14 2022, 10:45 AM

Show posts by this member only | IPv6 | Post

#37

|

Senior Member

1,727 posts Joined: Nov 2004 From: Planet Earth |

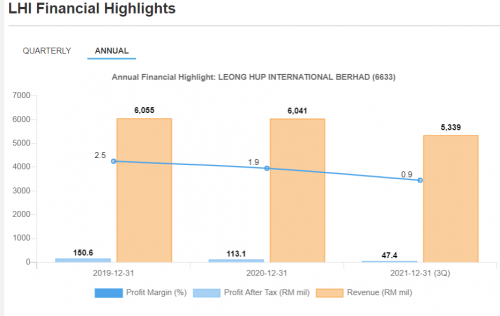

LHI Leong Hup International Bhd 6633

Never back to IPO price lulz |

|

|

Feb 14 2022, 10:57 AM Feb 14 2022, 10:57 AM

|

Junior Member

141 posts Joined: Feb 2022 |

QUOTE(Boon3 @ Feb 14 2022, 10:15 AM) Well of course la but how many of us can dare say their valuation skills is better? I also dunno how to value, but i know people who do. The IPO they recommend will mostly do well. So its not really a gamble, just see your luck if can be successful in the application. Anyway, the analyst report valuation was used as a simplistic example on how even they could get it so wrong. And of course to complicate things further, many do get rich betting and when they strike an ipo allocation. Some of those local ipo do fly. That's a fact. Performance of newly listed stocks since 2021...  But forget us not that there are incidents where big name IPO die big time! Strike the wrong IPO and one will be a big water fish! So i wouldnt really say play IPO sure die.. if you got skills, can win. |

|

|

Feb 14 2022, 11:12 AM Feb 14 2022, 11:12 AM

Show posts by this member only | IPv6 | Post

#39

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(jaapers @ Feb 14 2022, 10:57 AM) I also dunno how to value, but i know people who do. The IPO they recommend will mostly do well. So its not really a gamble, just see your luck if can be successful in the application. The topic of this thread is called ipo stocks CAN die one. It doesn't say SURE die. So i wouldnt really say play IPO sure die.. if you got skills, can win. Rely on other ppl? Lol. If it works for u, go ahead. And yeah, if you have your own niche in betting on ipo stocks and winning, stick to it..... Ps.. My excel table included in that post DOES highlight a lot of IPO winners. This post has been edited by Boon3: Feb 14 2022, 11:15 AM |

|

|

Feb 14 2022, 11:13 AM Feb 14 2022, 11:13 AM

Show posts by this member only | IPv6 | Post

#40

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Feb 14 2022, 11:37 AM Feb 14 2022, 11:37 AM

|

Junior Member

692 posts Joined: Nov 2021 |

Just to add my opinion (I am from Spore btw). SGX behaves the same as Bursa. Those IPO stock no guaranteed winners. Some readers mention this observation is not unique to Bursa it is everywhere. That is why for SGX IPO stock unless it is REIT I basically avoid. Now even with REIT also will kena delisted! I kena Soildbuild delisted at their asking 0.538 vs IPO 0.78. Although you get dividends but due to low acquiring price you do the maths still rugi. So for individual stock trading, it is always high risk high returns and losses too. Which is why I think now safer to invest in ETF instead. I now worried ETF (since it is like a stock) get delisted and at their low acquiring price !!! Davidtcf liked this post

|

|

|

Feb 14 2022, 11:59 AM Feb 14 2022, 11:59 AM

Show posts by this member only | IPv6 | Post

#42

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(sgh @ Feb 14 2022, 11:37 AM) Just to add my opinion (I am from Spore btw). SGX behaves the same as Bursa. Those IPO stock no guaranteed winners. Some readers mention this observation is not unique to Bursa it is everywhere. That is why for SGX IPO stock unless it is REIT I basically avoid. Now even with REIT also will kena delisted! I kena Soildbuild delisted at their asking 0.538 vs IPO 0.78. Although you get dividends but due to low acquiring price you do the maths still rugi. So for individual stock trading, it is always high risk high returns and losses too. Which is why I think now safer to invest in ETF instead. Thanks for the share!!I now worried ETF (since it is like a stock) get delisted and at their low acquiring price !!! |

|

|

Feb 14 2022, 12:08 PM Feb 14 2022, 12:08 PM

|

Junior Member

692 posts Joined: Nov 2021 |

QUOTE(Boon3 @ Feb 14 2022, 11:59 AM) Not sure how stock in Bursa work for delisting. In SGX delisted can be below1. Company delisted as no trading volume and company feel undervalued so don't want to list in exchange waste time go other exchange listed 2. Some bigtime investors want to buy the company many many shares so triggered a mandatory offering based on SGX rules. After they succeed get many shares company delisted 3. Company bankrupt no more monies If your stock is above point 3 cham liao. I kena before three incidents. Incident 1. Company pay off creditors and then dunno judge so good heart reserved a bit for the shareholders. I get back $13 for $1000 investment. Enough to buy economic rice a few meals. Incident 2. Company delisted and then send to my house a piece of A4 size paper stating I owned XXX shares of the delisted company Incident 3. Company delisted and I don't even get any piece of A4 size paper for me to put chicken, fish bones !!!!! |

|

|

Feb 14 2022, 01:48 PM Feb 14 2022, 01:48 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(cofin @ Feb 14 2022, 10:45 AM) And then there's the sticky issue about LHI IPO....cause it was once listed and like LC Titan, this was basically a relisting. Internet searches would quickly showed that during the privatization of Leong Hup, many had complained that the owners delisted the company at a very cheap valuation. It was delisted on 2012 and relisted 2019. When it was delisted the offer made for the privatization was 300 million plus. During the relisting, based on LHI ipo price, the company was valued at 4 billion.... the disconnect was there, no? delisted at a cheap price, relisting price high, high..... https://www.theedgemarkets.com/article/leon...longawaited-ipo QUOTE In FY17, the company registered a profit after tax (PAT) of RM247.4 million on a revenue of RM5.5 billion. Its revenue and PAT grew by a compound annual rates of 8% and 22.1%, respectively, for the financial years ended Dec 31, 2015 (FY15) to FY17. That was from the edge article before listing .... LHI had a PAT of 247 million for fy2017.... and nice annual growth rates.... but after listing....  and this is why some of those superinvestors like unker Buffett had mentioned that they do not invest in IPOs..... * other reference links: https://www.thestar.com.my/business/busines...cklustre-debut/ This post has been edited by Boon3: Feb 14 2022, 01:50 PM |

|

|

Feb 14 2022, 02:38 PM Feb 14 2022, 02:38 PM

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

QUOTE(jaapers @ Feb 14 2022, 09:51 AM) What I mean is your own valuation, instead of relying on analyst valuation. Those published analyst report cant always believe 100%, very likely they have their own agenda. You got remember some analyst their employers are the shareholders looking for exit hence the agenda is there Unlike in US whereby the analyst, family and employers have disclose publicly whether are they is shareholders while publishing those reports |

|

|

Feb 14 2022, 05:30 PM Feb 14 2022, 05:30 PM

|

Junior Member

141 posts Joined: Feb 2022 |

QUOTE(Boon3 @ Feb 14 2022, 11:12 AM) The topic of this thread is called ipo stocks CAN die one. It doesn't say SURE die. I agree with you, but I'm not sure does the general public really think IPO sure can win? I don't think so, judging by the response to IPOs nowadays. Those days of sure win IPOs are long gone, I think most people know that. Rely on other ppl? Lol. If it works for u, go ahead. And yeah, if you have your own niche in betting on ipo stocks and winning, stick to it..... Ps.. My excel table included in that post DOES highlight a lot of IPO winners. And yeah, I would rather rely on people I trust, rather than some analyst I don't know. Ideally I would love to be able to do my own research, but I'm not from this field and I dont have time for it, so next best thing is to rely on trusted people. Results speak volumes. |

|

|

Mar 14 2022, 09:08 AM Mar 14 2022, 09:08 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Mar 14 2022, 10:44 AM Mar 14 2022, 10:44 AM

|

Senior Member

5,529 posts Joined: Oct 2007 |

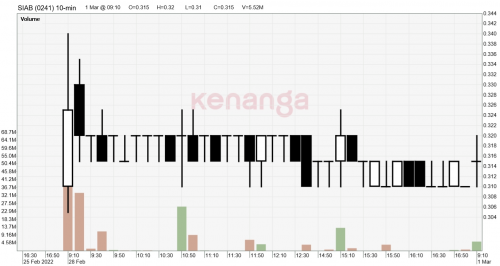

QUOTE(Boon3 @ Mar 14 2022, 09:08 AM) And how about Siab Holdings? ipo winner on ipo day only. the rest is history. IPO price of 30 sen. Opened at 31 sen. Briefly reached a high of 34 sen. Closed at 30.5 sen? An IPO winner? not even 12 trading days later....  or should i say, that's the only history thus far? |

|

|

Mar 14 2022, 12:00 PM Mar 14 2022, 12:00 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Mar 14 2022, 03:11 PM Mar 14 2022, 03:11 PM

|

Senior Member

5,529 posts Joined: Oct 2007 |

|

|

|

Mar 14 2022, 03:20 PM Mar 14 2022, 03:20 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Mar 14 2022, 03:25 PM Mar 14 2022, 03:25 PM

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

|

| Change to: |  0.0338sec 0.0338sec

1.30 1.30

5 queries 5 queries

GZIP Disabled GZIP Disabled

Time is now: 23rd December 2025 - 06:40 PM |

All Rights Reserved © 2002- 2025 Vijandren Ramadass (~unite against racism~)

Powered by Invision Power Board © 2025 IPS, Inc.

Quote

Quote