QUOTE(icemanfx @ Feb 12 2022, 03:16 PM)

Some IPO especially tech stock is opportunity for pre-ipo investors to cash out rather than for public participation.

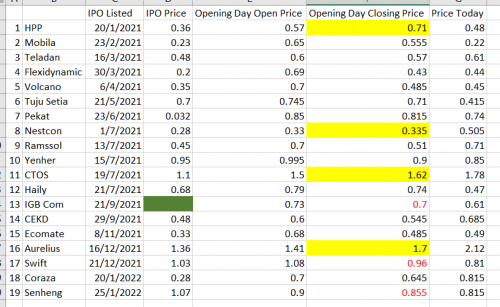

Most recent KLSE tech stock, Coraza, did quite wellIPO: IPO stocks can die one!

|

|

Feb 12 2022, 10:52 PM Feb 12 2022, 10:52 PM

Return to original view | Post

#1

|

Junior Member

141 posts Joined: Feb 2022 |

|

|

|

|

|

|

Feb 13 2022, 05:02 PM Feb 13 2022, 05:02 PM

Return to original view | Post

#2

|

Junior Member

141 posts Joined: Feb 2022 |

QUOTE(Boon3 @ Feb 13 2022, 11:42 AM) Yup! Exactly. The IPO market is like a lottery. Even if one is lucky enough to strike the jackpot, there's nothing written in the wall that the lucky strike will even win money! If you know how to value a company, it's less of a lottery. Still need luck to strike, but chances of profiting is almost guaranteed.If bad cow luck, you strike a lousy ipo like SengHeng, one will end up losing money! and yea... then of course, if one delve deeper, then there's the world of the discount for the big boys. |

|

|

Feb 14 2022, 09:51 AM Feb 14 2022, 09:51 AM

Return to original view | Post

#3

|

Junior Member

141 posts Joined: Feb 2022 |

QUOTE(Boon3 @ Feb 13 2022, 05:16 PM) Yup. That's what they all said. Do read that link posted earlier: What I mean is your own valuation, instead of relying on analyst valuation. Those published analyst report cant always believe 100%, very likely they have their own agenda.So many big names, yes? So many valuations done on them, yes? And yet... these stocks failed big time and let their IPO investors down. So was it a question that the market did not know how to value those stocks? End of the day... it is what it is. One can lose money in an IPO and they are cases where one can turn into long term investor and yet despite holding the stocks for a long time, they are still losing money! That's my message. |

|

|

Feb 14 2022, 10:57 AM Feb 14 2022, 10:57 AM

Return to original view | Post

#4

|

Junior Member

141 posts Joined: Feb 2022 |

QUOTE(Boon3 @ Feb 14 2022, 10:15 AM) Well of course la but how many of us can dare say their valuation skills is better? I also dunno how to value, but i know people who do. The IPO they recommend will mostly do well. So its not really a gamble, just see your luck if can be successful in the application. Anyway, the analyst report valuation was used as a simplistic example on how even they could get it so wrong. And of course to complicate things further, many do get rich betting and when they strike an ipo allocation. Some of those local ipo do fly. That's a fact. Performance of newly listed stocks since 2021...  But forget us not that there are incidents where big name IPO die big time! Strike the wrong IPO and one will be a big water fish! So i wouldnt really say play IPO sure die.. if you got skills, can win. |

|

|

Feb 14 2022, 05:30 PM Feb 14 2022, 05:30 PM

Return to original view | Post

#5

|

Junior Member

141 posts Joined: Feb 2022 |

QUOTE(Boon3 @ Feb 14 2022, 11:12 AM) The topic of this thread is called ipo stocks CAN die one. It doesn't say SURE die. I agree with you, but I'm not sure does the general public really think IPO sure can win? I don't think so, judging by the response to IPOs nowadays. Those days of sure win IPOs are long gone, I think most people know that. Rely on other ppl? Lol. If it works for u, go ahead. And yeah, if you have your own niche in betting on ipo stocks and winning, stick to it..... Ps.. My excel table included in that post DOES highlight a lot of IPO winners. And yeah, I would rather rely on people I trust, rather than some analyst I don't know. Ideally I would love to be able to do my own research, but I'm not from this field and I dont have time for it, so next best thing is to rely on trusted people. Results speak volumes. |

| Change to: |  0.0187sec 0.0187sec

1.36 1.36

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 23rd December 2025 - 09:46 AM |