QUOTE(Boon3 @ Feb 13 2022, 11:42 AM)

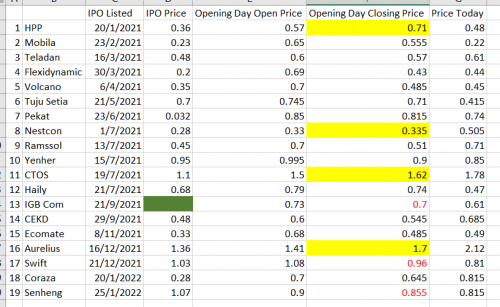

Yup! Exactly. The IPO market is like a lottery. Even if one is lucky enough to strike the jackpot, there's nothing written in the wall that the lucky strike will even win money!

If bad cow luck, you strike a lousy ipo like SengHeng, one will end up losing money!

and yea... then of course, if one delve deeper, then there's the world of the discount for the big boys.

If you know how to value a company, it's less of a lottery. Still need luck to strike, but chances of profiting is almost guaranteed.If bad cow luck, you strike a lousy ipo like SengHeng, one will end up losing money!

and yea... then of course, if one delve deeper, then there's the world of the discount for the big boys.

Feb 13 2022, 05:02 PM

Feb 13 2022, 05:02 PM

Quote

Quote

0.0195sec

0.0195sec

1.72

1.72

5 queries

5 queries

GZIP Disabled

GZIP Disabled