Ok. Let's get started. First and foremost this is not financial advise. I am not a financial planner, licensed accountant or my job have anything to do with a finance industry. I am just a dude on the internet who puts his money where his mouth his. I am writing this from my own experience.

BackgroundHere's my story on how I get into options. I was a pure dividend investor since 2015 I believed. Nothing beats have cold hard cash rolling into your bank account every now and then. Cold hard cash which you don't need to work for. Even till today, nothing beats pure cold hard cash rolling into bank account without working for it.

By being a pure dividend investor, I was limited by few stuff namely:

1. Dividend with holding tax

- 30% dividend tax hurts. After the govt makan your 30% tax, you are basically left with breadcrumbs. There's no way you can get those dividend back especially US companies.

Now with options, I am not limited by dividend tax which means any company which have options is basically fair game. The premium I get from selling options I get to keep instead of say giving to US govt.

2. Can't invest in quality companies that don't pay a dividend

- many quality companies in the United States don't pay a dividend or they pay peanut dividend. Now is it better to invest in wonderful companies that's don't pay dividends or lousy companies that pay a dividend? Keep in mind both a losuy company and quality company can both don't pay a dividend or they can both pay dividends.

How do you know a company is if good quality. One of the criteria is growing revenue, gross profit in double digit. If company revenue is stagnanting or declining, I will avoid. Yes there are other metrics as well.

For me I want to buy quality companies but I was force to choose semi quality companies that pay a dividend.

Before this with options, I won't invest in non paying/peanut paying dividend quality companies. Now as mentioned if they have options, it's fair game. Premium I earned from selling options is basically my own DIY dividends

3. Peanuts dividends

See above.

4. Need to keep looking for new opportunities

As share price increase, every new addition of money into dividend account will decrease dividends received as share price is inversely proportional to yield. Hence your risk reward overtime decreases as you are getting paid lesser to hold your stocks. Hence you need to keep looking. I am a concentrated guy which means I only hold 10-12 stocks and I don't like to hold like 20-30 stocks.

With options, I can average up. No more looking for new companies eveye now and then.

5. Unable to receive your money fast.

Someone once told me they like to received their money fast and now I see the point of it. The faster you received the money, the faster you can reinvest and earned more money. Unlike normal dividends investing where money comes in every few months, now my money comes in every week. I can reinvest or keep the money until better opportunity comes (when market is red). Yes you can do a dividend portfolio that pays weeks but you will be holding like 100 stocks. I know of one guy who is doing that.

Now with options, you choose when you want to get paid.

6. Huge capital needed to generate so-so dividend returns.

Let's be honest here. To generate say RM50k of dividend per year at 5%p.a you need RM1,000,000. Remember not everyone have RM1,000,000 to start with. Even someone working for 30 years does not guarantee they have RM1,000,000. I am one of them without a RM1,000,000 in my bank account. Unless one is born with a gold/platinum spoon, working in private sector, have successful business, unlikely you can have RM1,000,000 in bank account.

However with options, I don't need RM1,000,000 to generate RM50k/year. I just need say RM378,000 to generate RM50k. RM378,000 is easier to get Vs RM1,000,000.

So how to generate say RM50k from RM378k?

Buy 100 shares of square, docusign and crowdstrike. Sell covered calls on them for the price of say USD100/week.

USD100 x 3 X 52 weeks = USD15600 x4.2 = RM65520/year.

There's less capital required than dividend investing.

Now I need less capital Vs dividend investing.

7. Limited dividends.

With selling options, I am getting paid 1 year worth of dividend in a month. That's 12 years worth of dividend in a single year just by selling options. What this means is if I stuck with dividend investing, I would need 12years of dividend to equal 1 month of cash flow from options. #True story. Talk about boosting your dividends

Rules1. Always do options on stocks you want to own long term. Never do options on stocks you don't even think of holding say 5 years.

That's basically my only rule. I don't do options on stocks that I don't want to hold no matter how good is the premium paid. Eg stuff I won't even think of buying. GME, AMC, penny stocks.

2. I only do selling options be it selling covered calls or cash secured put or naked put.

When you are buying options, you have time decay working against you. When you are selling options you have time decay working for you. Selling options is basically you become the insurance company, Genting/Macau. You want to become insurance seller or insurance buyer? You want to become gambler or the house?

3. I never ever sell naked call.

It's not worth it.

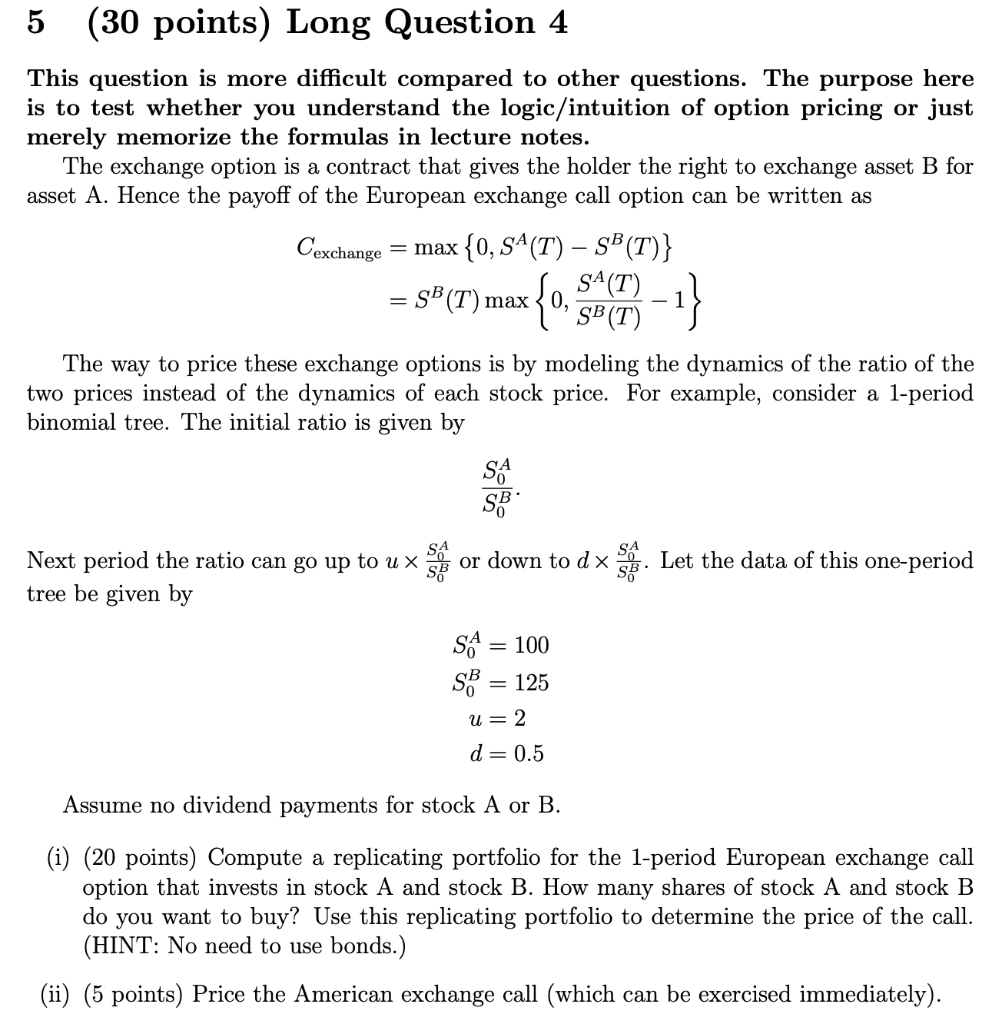

Basics of options.

Call options

Put options

So how I do it?

1. I do covered calls

Buy100 shares of the company you want to hol long term. You can o e shot buy 100 shares or slowly build up position.

Once you have reach 100 shares, you can now covered call provided the stock have options.

You can choose weekly, 2 weekly, one monthly, two monthly, yearly etc. Up to you. For me I choose weekly as I want time decay to work in my favour. Keep in mind all options have expiry date. Time decay of options works faster when the options is near expiry.

Some people might choose monthly or two monthly options to get some meat off the extrinsic value as they said weekly options have no meat left as the option is due to expired in 5 days. The choice is ultimately yours.

2. I do covered puts

Covered puts is basically fancy term for getting paid to wait/queue. What do I mean?

Eg a stock is worth USD100. You can buy at USD100 or you can queue at say USD95.

Normally when you queue, you don't get paid.

But when you sell a covered put, that means you are agreeing to buy 100 shares of the company at that strike price or below the strike price with cash as collateral (you need cash to buy 100 shares. The cash will be lockup as collateral and you cannot use the cash).

Now back to the eg.

Share A is trading at USD100. I feel USD100 is too expensive and I don't wamt to buy at USD100.

I can sell a covered put at stirke price of say USD95 and get paid say USD50 just for waiting for the share at USD95.

Now I get to buy the shares at cheaper price and get paid to do it if the price do drop to USD95 or below.

Now this is not an issue as I want to own the share at USD95. That's why it is important to do options on shares you want to hold long term. Now if you don't want to hold it long term, you basically become a bag holder.

3. I do naked puts as well.

What does this mean? This is basically cash secured put but this time your put is secured with margin/loan from brokerage.

Why margin?

Isn't it dangerous? Yes and no. Depending on how you use it. Keep in mind you buy a house with loan unless you are loaded and pay around 3.5-4.5%p.a in interest.

Same concept as buying a house. I am willing to buy good quality companies using loan. Not to mentioned interactive broker interest is only 1.5%p.a. Yes you read that right. Only 1.5%p.a. Hence if you are buying any one of the above stock on margin (say USD 27k = 100 shares) you are only paying USD405/year = USD33.05/month in interest.

One month of covered call basically pay off the whole year interest rate already. You can then do covered call to slowly pay off the margin.

Good thing about interactive broker is as long as your put options is not assigned (never hit the strike price or went below the stirke price of the put), no interest will be charged. Tried and tested.

Say you have USD100k, by taking a loan of 20% only, it's not even 50%. For me I usually keep it around 20-30% of my portfolio worth.

The goal is do not overleverage. Practice self discipline. It's only dangerous if you don't have restrain. It's like a knife and fire. Use it wrongly and get burn or get slashed.

4. Don't be greedy.

Pick far away strike price. Like Visa for example. A safe premium would be in the range of USD50-60.

For stuff like docusign, square, the range would be in the USD100/week range

For stuff like palantir, I love selling premium for USD10. Yes it's peanuts but it's safe. I am getting around 20%p.a from palantir. So think USD10/week is still peanuts?

You are supposed to look at Delta, theta etc but I don't. There is no formula from me.

There are many ways you can do options, iron condor, butterfly, strangle, saddle. Pick one which you like and you know. I only know covered call and coverd put hence I do that only.

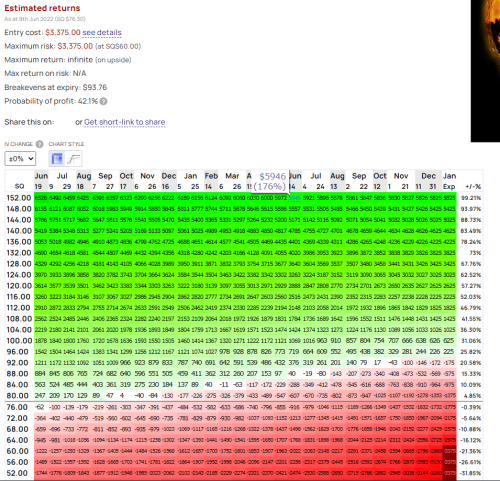

LEAPS

- buying a call which is atm or very deep in the money with very far expiry date. This one only do when market is very red.

Now what are risk associated with options?It can't be bed of roses right? Yes that's right.

By selling a covered call, you are capping your upside. How much you are willing to sell your stock.

By selling a put, the stock can drop lower but because you are the seller, you have the obligation to buy the stock at the strike price even if current market price upon expiry is way at the below the strike price.

I will give some real life examples of risk with options

1. Sold lemonade puts at 120. Took assignment and stock price drop to USD60+ I didn't panic. But continue selling options at USD20/week. I average down my lemonade holdings as I believed in it long term. I am still holding it. As mentioned above, only do on stocks you want to keep long term.

2. Sold crowdstrike covered call at USD257.5. Took assignment and stock ran up to 280+. I missed the run up to USD280+ but it's ok. Now I am doing covered puts on it at USD257.50

I've seen you around a lot and I have much respect for your extensive knowledge - do you mind going a little bit more on Covered Call/Poor Man's Covered Call/Synthetic Covered Call and how to utilize it as a side income, or recommended reading? (I've seen you stating that this is your staple income in the $100 a day thread.) I plan to do it as I start buying and holding individual US stocks that I really like and okay with holding for life.

The post with all the videos you linked isn't loading for me for now, I'll revisit those when they are available again. Any input or advice is appreciated!

Oct 11 2021, 09:16 PM, updated 2y ago

Oct 11 2021, 09:16 PM, updated 2y ago

Quote

Quote

0.1359sec

0.1359sec

1.02

1.02

6 queries

6 queries

GZIP Disabled

GZIP Disabled