QUOTE(changshen @ Oct 8 2021, 10:08 AM)

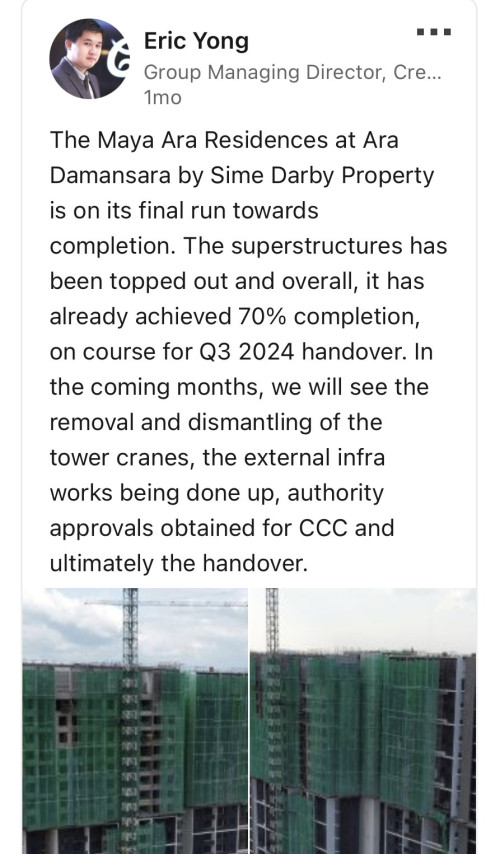

In my humble opinion....high rise already oversupply generally. Everyone knows that.

Is up to your holding power. Try checking the rental surrounding. Definitely not as good as the bull run days.

Holding power is the key now.

If u think of positive return in terms of Capital appreciation try explore landed.

Just my 2 cents.

Totally agree on this, especially for the capital appreciation on landed.

As for the oversupply, it’s depending on location. Most oversupply or overhang properties are at weird location or outskirts, which no one is buying as it’s not convenient. If location is good, unlikely will be oversupply.

QUOTE(jianwei90 @ Oct 8 2021, 10:24 AM)

you are right about holding power, if a person can hold up to 10 years or more, should be fine I guess..

Applicable only for landed. For high rise, unlikely. Just have a look around u, how many high rise have big capital appreciation after 2015? Why I take after 2015? Cos pre 2015 is property bill run time, any Tom and dick property u buy sure increase.

And, if the management of the high rise is not good and the building looks like shit after 10 years, u should be glad if the price didn’t reduce, let alone appreciate.

QUOTE(W.ROOK @ Oct 8 2021, 11:08 AM)

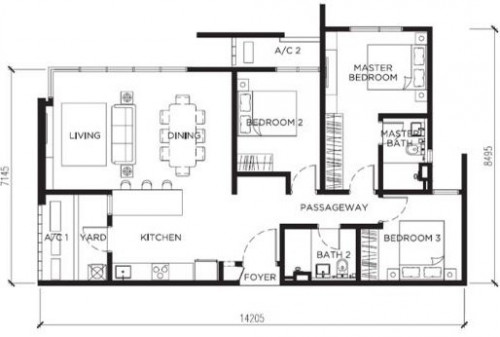

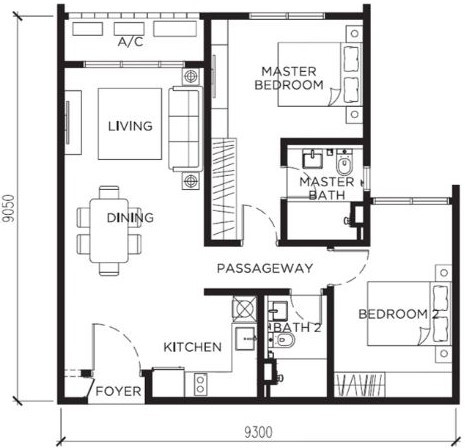

Whats the size of the RSKU units?

and came to know that maintenance fees + singking fund will be around 0.46cts. Does RSKU pay the same rate?

Confirm 46 cents? This is extremely high.

Sep 10 2021, 02:17 AM, updated 4y ago

Sep 10 2021, 02:17 AM, updated 4y ago

Quote

Quote

0.2607sec

0.2607sec

1.00

1.00

6 queries

6 queries

GZIP Disabled

GZIP Disabled