QUOTE(Davidtcf @ Jan 27 2022, 04:56 PM)

my pro investor friend told me this:

[4:47 pm, 27/01/2022] <name removed>: since buy ady just hold for long-term

[4:47 pm, 27/01/2022] <name removed>: unless SenHeng biz model fails

agree.

I didn't buy that much ya its IPO.. for those that buy a lot and if need money, then maybe different story.

Your pro investor doesn't sound so pro. [4:47 pm, 27/01/2022] <name removed>: since buy ady just hold for long-term

[4:47 pm, 27/01/2022] <name removed>: unless SenHeng biz model fails

agree.

I didn't buy that much ya its IPO.. for those that buy a lot and if need money, then maybe different story.

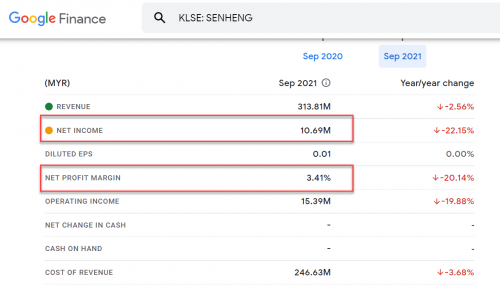

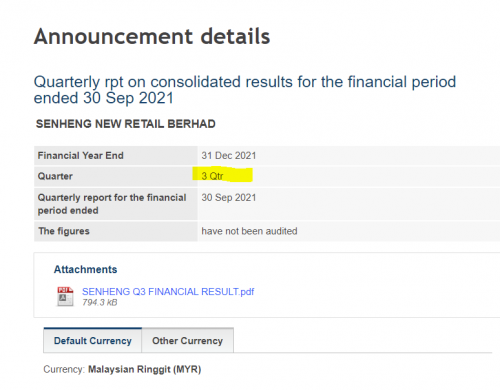

As it is, it's just a retailer which is trading at a rather high valuation.

Such a business model, the growth ain't easy. It's not easy and not profitable using the growth of new stores strategy....

Hence holding long term, might not help.

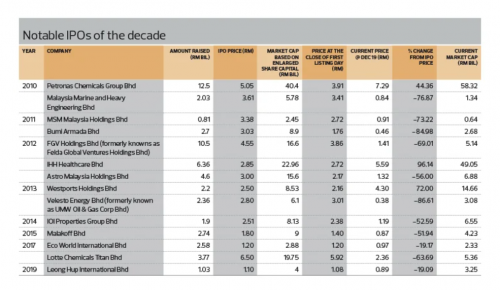

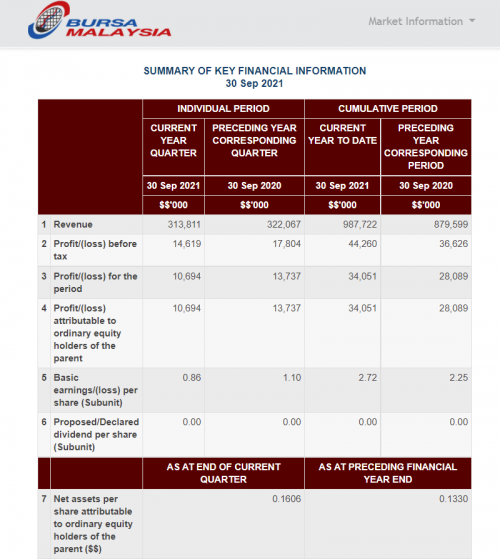

For example, that article again...

https://www.theedgemarkets.com/article/ipos...gs-fail-impress

That table...

see some of the BIG names...

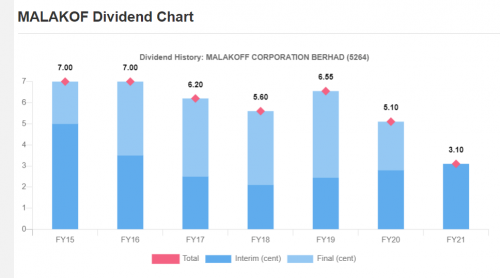

Malakoff... that listing is since 2015... IPO price 1.80. Today 27/1/2022 price is 72 sen.

Is Malakoff a bad company? Maybe not... but holding on to the stock since listing hasn't done the investor any favors...

and ya... it pays decent dividends but even if you total it up....

it's still an investment lost since 2015....

how? Hold another 5 years?

See the point is... telling someone hold long term sounds so pro... so easy....

sometimes.... it just doesn't work.

So what you need to do is consider... how long do you want to hold? 5 years? 10 years?

What if after 5 years... and you find out that... holding this long term is not a good idea... and ya... the worst thing about this when it happens is, what if come 5 years, the stock is only worth 'say' 50 sen? Then how? Same decision time once again... but only difference is that you could be holding on to an even bigger paper loss!

That's the worst case...

of course... if nasib good.... who knows.... maybe in 5 years, this stock could be trading at 2 bucks!

Jan 27 2022, 05:19 PM

Jan 27 2022, 05:19 PM

Quote

Quote

0.0261sec

0.0261sec

0.83

0.83

6 queries

6 queries

GZIP Disabled

GZIP Disabled