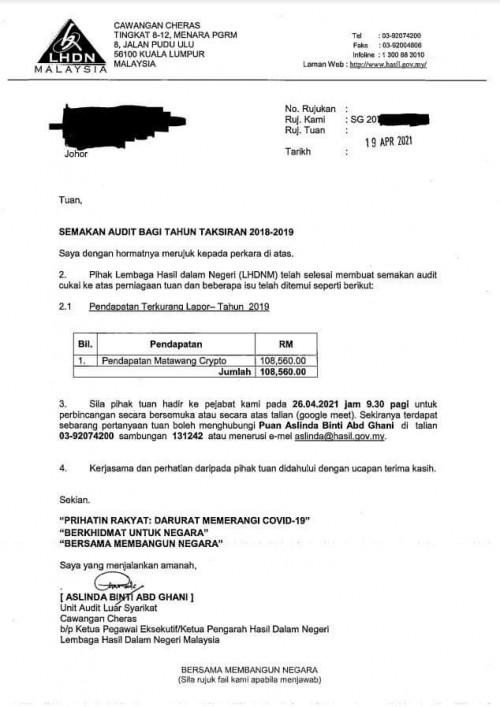

Crypto miner didn't pay taxes??

Chat Gov hunt coinminers, LHDN

|

|

Apr 20 2021, 05:56 AM, updated 5y ago Apr 20 2021, 05:56 AM, updated 5y ago

Show posts by this member only | IPv6 | Post

#1

|

Junior Member

49 posts Joined: Oct 2019 |

caksz and ahmadkhairil liked this post

|

|

|

|

|

|

Apr 20 2021, 05:57 AM Apr 20 2021, 05:57 AM

Show posts by this member only | Post

#2

|

Senior Member

774 posts Joined: Nov 2010 |

habislah inkambing bankrupcy notice alfiejr liked this post

|

|

|

Apr 20 2021, 06:04 AM Apr 20 2021, 06:04 AM

Show posts by this member only | IPv6 | Post

#3

|

Junior Member

49 posts Joined: Oct 2019 |

|

|

|

Apr 20 2021, 06:21 AM Apr 20 2021, 06:21 AM

Show posts by this member only | IPv6 | Post

#4

|

Junior Member

586 posts Joined: Jul 2010 |

Maybe selling asic

|

|

|

Apr 20 2021, 06:30 AM Apr 20 2021, 06:30 AM

Show posts by this member only | Post

#5

|

Junior Member

412 posts Joined: May 2009 |

Trading ?

|

|

|

Apr 20 2021, 06:32 AM Apr 20 2021, 06:32 AM

Show posts by this member only | Post

#6

|

Senior Member

774 posts Joined: Nov 2010 |

|

|

|

|

|

|

Apr 20 2021, 06:40 AM Apr 20 2021, 06:40 AM

Show posts by this member only | IPv6 | Post

#7

|

Junior Member

156 posts Joined: Sep 2017 |

kaya but cannot pay tax.

|

|

|

Apr 20 2021, 06:44 AM Apr 20 2021, 06:44 AM

Show posts by this member only | IPv6 | Post

#8

|

Junior Member

139 posts Joined: Jul 2007 From: Puchong |

ikan bilis level je

|

|

|

Apr 20 2021, 06:48 AM Apr 20 2021, 06:48 AM

Show posts by this member only | IPv6 | Post

#9

|

Junior Member

24 posts Joined: Jul 2020 |

kaya in bitcoins, can pay taxes using bitcoins?

|

|

|

Apr 20 2021, 07:05 AM Apr 20 2021, 07:05 AM

|

Junior Member

30 posts Joined: May 2010 |

if lost, can we claim back the money? whyamiblack and noien liked this post

|

|

|

Apr 20 2021, 07:10 AM Apr 20 2021, 07:10 AM

|

Junior Member

291 posts Joined: Aug 2019 |

Good

Ikankering can open new factory to mine coins No more spm workers. |

|

|

Apr 20 2021, 07:12 AM Apr 20 2021, 07:12 AM

|

Junior Member

93 posts Joined: Sep 2020 |

how u know its miner and not trader

anyway, always cash out offshore thats the whole point of crypto... borderless transactions made easy |

|

|

Apr 20 2021, 07:22 AM Apr 20 2021, 07:22 AM

|

Senior Member

1,374 posts Joined: Feb 2016 From: Milky Way |

|

|

|

|

|

|

Apr 20 2021, 07:23 AM Apr 20 2021, 07:23 AM

|

Senior Member

1,374 posts Joined: Feb 2016 From: Milky Way |

The letter said cryptocurrency income, it didn’t said mining. Most probably referring to trading income.

|

|

|

Apr 20 2021, 07:24 AM Apr 20 2021, 07:24 AM

Show posts by this member only | IPv6 | Post

#15

|

Junior Member

222 posts Joined: Mar 2013 |

Banyak tu ex bitfuckingdom masih bebas

|

|

|

Apr 20 2021, 07:25 AM Apr 20 2021, 07:25 AM

|

Senior Member

1,374 posts Joined: Feb 2016 From: Milky Way |

|

|

|

Apr 20 2021, 07:30 AM Apr 20 2021, 07:30 AM

Show posts by this member only | IPv6 | Post

#17

|

Newbie

3 posts Joined: Dec 2013 |

LHDN agents lurking in k too, habislah all the crypto sifu in k

|

|

|

Apr 20 2021, 07:36 AM Apr 20 2021, 07:36 AM

|

Senior Member

3,327 posts Joined: Jan 2003 From: Selangor |

If you really earn that much from trading and convert back to myr, then just pay tax lar... ahmadkhairil liked this post

|

|

|

Apr 20 2021, 07:41 AM Apr 20 2021, 07:41 AM

|

Junior Member

293 posts Joined: Sep 2012 |

|

|

|

Apr 20 2021, 07:45 AM Apr 20 2021, 07:45 AM

|

Junior Member

485 posts Joined: Dec 2013 |

QUOTE(Mr.Robert @ Apr 20 2021, 07:41 AM) He didn't declare la..it was IRB findings eaglefly liked this post

|

|

|

Apr 20 2021, 07:46 AM Apr 20 2021, 07:46 AM

Show posts by this member only | IPv6 | Post

#21

|

Newbie

3 posts Joined: Dec 2013 |

QUOTE(Mr.Robert @ Apr 20 2021, 07:41 AM) If you declare, you pay (at most) 25% of the income as tax.If you no declare, and LHDN find out, you pay 25% of the income, plus 80-300% of that, so effectively govt will take up to 75% of your profits. And it is pay first talk later, so good luck hiring a lawyer when you need to hand over 3/4 of all your gains, especially if you already "reinvest" it and the market turn into another years long bear market. |

|

|

Apr 20 2021, 07:48 AM Apr 20 2021, 07:48 AM

|

Junior Member

81 posts Joined: Feb 2019 |

In the end you still need to convert your crypto to fiat like USD or MYR. That's when they catch you.

|

|

|

Apr 20 2021, 07:52 AM Apr 20 2021, 07:52 AM

Show posts by this member only | IPv6 | Post

#23

|

Junior Member

189 posts Joined: Jan 2009 |

|

|

|

Apr 20 2021, 07:54 AM Apr 20 2021, 07:54 AM

|

Junior Member

102 posts Joined: Dec 2015 From: kolumpo |

|

|

|

Apr 20 2021, 07:57 AM Apr 20 2021, 07:57 AM

Show posts by this member only | IPv6 | Post

#25

|

Senior Member

3,625 posts Joined: Nov 2007 From: Hornbill land |

QUOTE(nerdook @ Apr 20 2021, 07:46 AM) If you declare, you pay (at most) 25% of the income as tax. Only income from trading are taxable. Those who bought earlier is consider capital gain i think.If you no declare, and LHDN find out, you pay 25% of the income, plus 80-300% of that, so effectively govt will take up to 75% of your profits. And it is pay first talk later, so good luck hiring a lawyer when you need to hand over 3/4 of all your gains, especially if you already "reinvest" it and the market turn into another years long bear market. |

|

|

Apr 20 2021, 07:59 AM Apr 20 2021, 07:59 AM

|

Junior Member

293 posts Joined: Sep 2012 |

QUOTE(nerdook @ Apr 20 2021, 07:46 AM) If you declare, you pay (at most) 25% of the income as tax. This case seems "under-declared"If you no declare, and LHDN find out, you pay 25% of the income, plus 80-300% of that, so effectively govt will take up to 75% of your profits. And it is pay first talk later, so good luck hiring a lawyer when you need to hand over 3/4 of all your gains, especially if you already "reinvest" it and the market turn into another years long bear market. So easy can find out meh? Oversea trading account let u access meh. |

|

|

Apr 20 2021, 08:07 AM Apr 20 2021, 08:07 AM

|

Junior Member

485 posts Joined: Dec 2013 |

|

|

|

Apr 20 2021, 08:30 AM Apr 20 2021, 08:30 AM

|

Senior Member

774 posts Joined: Nov 2010 |

QUOTE(iGamer @ Apr 20 2021, 07:25 AM) don't have to la. can't talk too much coz i have a non-disclosure in effect. suffice to say, u will be surprised on the technology they used. it is far more sophisticated than you think |

|

|

Apr 20 2021, 08:40 AM Apr 20 2021, 08:40 AM

|

Senior Member

1,431 posts Joined: Mar 2009 |

QUOTE(DarkAeon @ Apr 20 2021, 08:30 AM) don't have to la. can't talk too much coz i have a non-disclosure in effect. suffice to say, u will be surprised on the technology they used. it is far more sophisticated than you think Can check all your accounts on all bank and some formula to detect the abnormal and consistent transfer. |

|

|

Apr 20 2021, 08:59 AM Apr 20 2021, 08:59 AM

|

Junior Member

296 posts Joined: Jul 2019 |

QUOTE(genjo @ Apr 20 2021, 08:40 AM) Can check all your accounts on all bank and some formula to detect the abnormal and consistent transfer. I belif it is the same method/tech that LDHN use to check on share trader's activity (on share market) on whether their profit gained from the trade is a capital gain (non-taxable) or taxable income. |

|

|

Apr 20 2021, 09:10 AM Apr 20 2021, 09:10 AM

|

Senior Member

1,052 posts Joined: Jun 2011 |

QUOTE(DarkAeon @ Apr 20 2021, 08:30 AM) don't have to la. can't talk too much coz i have a non-disclosure in effect. suffice to say, u will be surprised on the technology they used. it is far more sophisticated than you think when it comes to tax sampai lubang cacing pun buleh cariwhen it comes to refund krik krik kirk kirk............................ caksz liked this post

|

|

|

Apr 20 2021, 09:12 AM Apr 20 2021, 09:12 AM

|

Junior Member

94 posts Joined: Feb 2019 From: Qin |

QUOTE(Mr.Robert @ Apr 20 2021, 07:41 AM) no u dumb. this is the only beginning. you think bank negara has no agenda or motive legalising luno etc in malaysia? it's for the long term tax Phoenix_KL liked this post

|

|

|

Apr 20 2021, 09:13 AM Apr 20 2021, 09:13 AM

|

Junior Member

202 posts Joined: Nov 2015 |

QUOTE(mois @ Apr 20 2021, 07:57 AM) capital gain is not taxable. keep your proof of records. as long u dont do day trading or short term shud be okayThis post has been edited by jyll92: Apr 20 2021, 09:13 AM |

|

|

Apr 20 2021, 09:16 AM Apr 20 2021, 09:16 AM

Show posts by this member only | IPv6 | Post

#34

|

Junior Member

66 posts Joined: Aug 2010 |

Probably cash out via lunoo. Easy to trace

This post has been edited by yiporan: Apr 20 2021, 09:17 AM |

|

|

Apr 20 2021, 09:17 AM Apr 20 2021, 09:17 AM

|

Junior Member

500 posts Joined: Dec 2019 |

Cukur penjanaan kewangan

|

|

|

Apr 20 2021, 10:20 AM Apr 20 2021, 10:20 AM

|

All Stars

15,192 posts Joined: Oct 2004 |

|

|

|

Apr 20 2021, 10:21 AM Apr 20 2021, 10:21 AM

|

Senior Member

9,041 posts Joined: Jan 2003 |

As long got a paper trail of any transactions locally, BNM and LHDN can track them down.

|

|

|

Apr 20 2021, 10:24 AM Apr 20 2021, 10:24 AM

|

Senior Member

1,407 posts Joined: May 2010 |

must be golden 2 5 finger

|

|

|

Apr 20 2021, 10:26 AM Apr 20 2021, 10:26 AM

Show posts by this member only | IPv6 | Post

#39

|

Senior Member

9,616 posts Joined: Dec 2013 |

Ok

|

|

|

Apr 20 2021, 10:26 AM Apr 20 2021, 10:26 AM

|

Junior Member

162 posts Joined: Mar 2007 |

Bitcoin traders in here suda sked liao

|

|

|

Apr 20 2021, 10:28 AM Apr 20 2021, 10:28 AM

|

Senior Member

914 posts Joined: Jan 2012 |

But how LHDN knows ?

|

|

|

Apr 20 2021, 10:28 AM Apr 20 2021, 10:28 AM

Show posts by this member only | IPv6 | Post

#42

|

Junior Member

71 posts Joined: Sep 2018 |

Want untung banyak but don’t want pay tax. Then complain our country is backwards. Lemaooooo

This post has been edited by WaterBuffalo: Apr 20 2021, 10:28 AM |

|

|

Apr 20 2021, 10:29 AM Apr 20 2021, 10:29 AM

|

Junior Member

480 posts Joined: Sep 2004 |

Fake. Photoshop.

|

|

|

Apr 20 2021, 10:31 AM Apr 20 2021, 10:31 AM

|

Junior Member

300 posts Joined: Jul 2007 From: Area 51 |

you sell usdt directly to other buyer, how they can determine it is gain ?? its just like you transfer money to friend like that.

|

|

|

Apr 20 2021, 10:31 AM Apr 20 2021, 10:31 AM

|

All Stars

15,192 posts Joined: Oct 2004 |

|

|

|

Apr 20 2021, 10:32 AM Apr 20 2021, 10:32 AM

Show posts by this member only | IPv6 | Post

#46

|

Junior Member

92 posts Joined: Jun 2012 From: hurr-durr |

ambil sikit2 suda la

|

|

|

Apr 20 2021, 10:39 AM Apr 20 2021, 10:39 AM

Show posts by this member only | IPv6 | Post

#47

|

Junior Member

361 posts Joined: Jul 2015 |

The profits made by individuals who occasionally trade cryptocurrencies or shares may be viewed as capital gains, which is not taxable in Malaysia. But the profits earned by individuals who trade frequently may be viewed as revenue and thus, deemed as taxable income.

https://www.theedgemarkets.com/article/thew...20in%20Malaysia. On topic : Government need moolah okay |

|

|

Apr 20 2021, 10:44 AM Apr 20 2021, 10:44 AM

|

All Stars

15,192 posts Joined: Oct 2004 |

This is the outcome from tax audit on the tax declaration submitted for YA 2018-2019 and then IRB found out there were some incoming funds which were not declared (probably checked through the bank accounts) and noted that as profit....

|

|

|

Apr 20 2021, 11:19 AM Apr 20 2021, 11:19 AM

|

Junior Member

485 posts Joined: Dec 2013 |

|

|

|

Apr 20 2021, 11:20 AM Apr 20 2021, 11:20 AM

Show posts by this member only | IPv6 | Post

#50

|

Junior Member

769 posts Joined: Aug 2011 |

And people think that pay first, challenge second tax rules not gonna affect them.

|

|

|

Apr 20 2021, 11:22 AM Apr 20 2021, 11:22 AM

Show posts by this member only | IPv6 | Post

#51

|

Junior Member

966 posts Joined: Sep 2008 From: Not sure |

QUOTE(Clement1001 @ Apr 20 2021, 10:28 AM) Nowadays a lot of offshore banks require us to give them permission to share our details with the country of our residence. I was recently requested to submit my proof of residence and also sign papers to give the banks permission to provide the country of my residence with my bank statements. It’s very easy to check on gains when all banks all over the world are interlinked. |

|

|

Apr 20 2021, 11:24 AM Apr 20 2021, 11:24 AM

|

Junior Member

706 posts Joined: Jul 2012 |

They confiscated all the mining machines and then mine themselves.

|

|

|

Apr 20 2021, 11:27 AM Apr 20 2021, 11:27 AM

|

Junior Member

70 posts Joined: Feb 2014 |

No problem to include crypto in taxing for day-trading but how they count losses? If the fella gain 100k on his portfolio but dropped 200k, still need to pay 100k tax? Die lo

This post has been edited by whyamiblack: Apr 20 2021, 11:28 AM |

|

|

Apr 20 2021, 11:27 AM Apr 20 2021, 11:27 AM

|

Senior Member

8,651 posts Joined: Sep 2005 From: lolyat |

QUOTE(mois @ Apr 20 2021, 07:57 AM) this is incorrect, it depends on your frequency of buy/sell transaction to determine business income or capital gainQUOTE(Clement1001 @ Apr 20 2021, 10:28 AM) Maybe he wire the money into Malaysian bank and raise red flag? or SC recognized platform provide information |

|

|

Apr 20 2021, 11:28 AM Apr 20 2021, 11:28 AM

Show posts by this member only | IPv6 | Post

#55

|

Senior Member

1,054 posts Joined: Jan 2008 |

actually trade also consider capital gain kan. i think mining should be kena tax but not trading.

|

|

|

Apr 20 2021, 11:32 AM Apr 20 2021, 11:32 AM

Show posts by this member only | IPv6 | Post

#56

|

Senior Member

813 posts Joined: May 2013 |

QUOTE(iGamer @ Apr 20 2021, 07:25 AM) all depo/withdrawal over certain amount is submitted to BNM and of coz LHDN got eyes on it as well.srsly ppl tink they can escape? just depends the gov agency have enuf resources or rajin anot only |

|

|

Apr 20 2021, 11:36 AM Apr 20 2021, 11:36 AM

Show posts by this member only | IPv6 | Post

#57

|

Senior Member

1,225 posts Joined: Nov 2012 |

|

|

|

Apr 20 2021, 11:38 AM Apr 20 2021, 11:38 AM

|

Senior Member

5,363 posts Joined: Apr 2005 From: กรุงเทพมหานคร BKK |

Meh

U scared? |

|

|

Apr 20 2021, 11:39 AM Apr 20 2021, 11:39 AM

Show posts by this member only | IPv6 | Post

#59

|

Junior Member

40 posts Joined: Dec 2020 |

the problem is not crypto tax

the problem is who can do crypto tax for me in accordance to LHDN requirements i ask two small account/tax company and they dont know, so who know? can LHDN do crypto tax for me? i put my profits in USDT, is it taxed? or it get taxed only when the money transfer to my bank account? This post has been edited by crecar: Apr 20 2021, 11:42 AM |

|

|

Apr 20 2021, 11:39 AM Apr 20 2021, 11:39 AM

|

Senior Member

564 posts Joined: Dec 2007 |

Okay. They should pay it. Pc peripherals price are on rising because of them This post has been edited by unixcorp: Apr 20 2021, 11:40 AM ahmadkhairil and Phoenix_KL liked this post

|

|

|

Apr 20 2021, 11:39 AM Apr 20 2021, 11:39 AM

|

Senior Member

2,746 posts Joined: Mar 2006 From: 21st century |

|

|

|

Apr 20 2021, 11:41 AM Apr 20 2021, 11:41 AM

|

Junior Member

303 posts Joined: Aug 2005 |

|

|

|

Apr 20 2021, 11:42 AM Apr 20 2021, 11:42 AM

Show posts by this member only | IPv6 | Post

#63

|

Senior Member

1,374 posts Joined: Feb 2016 From: Milky Way |

QUOTE(crecar @ Apr 20 2021, 11:39 AM) the problem is not crypto tax You go IRB tell them you got big crypto income surely they will calculate for you the problem is who can do crypto tax for me in accordance to LHDN requirements i ask two small account/tax company and they dont know, so who know? can LHDN do crypto tax for me? |

|

|

Apr 20 2021, 11:42 AM Apr 20 2021, 11:42 AM

|

Junior Member

301 posts Joined: Dec 2009 |

as far as i know, capital gain no tax. so thanks god im not trader. hodler no need to worry. Zaryl liked this post

|

|

|

Apr 20 2021, 11:44 AM Apr 20 2021, 11:44 AM

|

Senior Member

1,052 posts Joined: Jun 2011 |

|

|

|

Apr 20 2021, 11:45 AM Apr 20 2021, 11:45 AM

|

Senior Member

3,625 posts Joined: Nov 2007 From: Hornbill land |

|

|

|

Apr 20 2021, 11:49 AM Apr 20 2021, 11:49 AM

|

Senior Member

1,052 posts Joined: Jun 2011 |

|

|

|

Apr 20 2021, 11:55 AM Apr 20 2021, 11:55 AM

Show posts by this member only | IPv6 | Post

#68

|

Junior Member

460 posts Joined: Oct 2008 |

QUOTE(crecar @ Apr 20 2021, 11:39 AM) the problem is not crypto tax Small don't know, then go find bigger firm. the problem is who can do crypto tax for me in accordance to LHDN requirements i ask two small account/tax company and they dont know, so who know? can LHDN do crypto tax for me? i put my profits in USDT, is it taxed? or it get taxed only when the money transfer to my bank account? |

|

|

Apr 20 2021, 12:00 PM Apr 20 2021, 12:00 PM

|

Senior Member

1,709 posts Joined: Jan 2003 From: Kedah Khap Khoun Khap (4K) |

|

|

|

Apr 20 2021, 12:09 PM Apr 20 2021, 12:09 PM

Show posts by this member only | IPv6 | Post

#70

|

Junior Member

257 posts Joined: Feb 2010 |

|

|

|

Apr 20 2021, 12:11 PM Apr 20 2021, 12:11 PM

Show posts by this member only | IPv6 | Post

#71

|

Junior Member

818 posts Joined: Jul 2019 |

Doesn't look genuine to me. I think its made by some gamer who's upset he can't afford a graphics card. That's one of the reasons why I don't use Luno or any of the SEC approved crypto trading platforms. I trade through Singapore where the tax is lower and at least the taxes paid isn't wasted on making another crony wealthier. Mining? Catch me if you can. ye0073 liked this post

|

|

|

Apr 20 2021, 12:16 PM Apr 20 2021, 12:16 PM

|

Senior Member

1,709 posts Joined: Jan 2003 From: Kedah Khap Khoun Khap (4K) |

QUOTE(BillCollector @ Apr 20 2021, 12:11 PM) Doesn't look genuine to me. Halu TNBI think its made by some gamer who's upset he can't afford a graphics card. That's one of the reasons why I don't use Luno or any of the SEC approved crypto trading platforms. I trade through Singapore where the tax is lower and at least the taxes paid isn't wasted on making another crony wealthier. Mining? Catch me if you can. Halu Sarawak Energy Halu Sabah Energy Corp Halu Lembaga Letrik Negara |

|

|

Apr 20 2021, 12:18 PM Apr 20 2021, 12:18 PM

|

Senior Member

4,225 posts Joined: Jan 2003 From: Selangor |

those who use luno to cash out will kena first

|

|

|

Apr 20 2021, 12:18 PM Apr 20 2021, 12:18 PM

|

Junior Member

480 posts Joined: Sep 2004 |

Malaysia no capital gain tax. If want to go through it, must pass parliament.

Helang will be the one who oppose first. Capital gain = income from rental / sold property, stocks, investment, etc. |

|

|

Apr 20 2021, 12:20 PM Apr 20 2021, 12:20 PM

|

Junior Member

42 posts Joined: Feb 2013 From: Putrajaya |

QUOTE(BillCollector @ Apr 20 2021, 12:11 PM) Doesn't look genuine to me. wait so you declare crypto profit in SG?I think its made by some gamer who's upset he can't afford a graphics card. That's one of the reasons why I don't use Luno or any of the SEC approved crypto trading platforms. I trade through Singapore where the tax is lower and at least the taxes paid isn't wasted on making another crony wealthier. Mining? Catch me if you can. |

|

|

Apr 20 2021, 12:24 PM Apr 20 2021, 12:24 PM

|

Junior Member

382 posts Joined: Sep 2006 |

|

|

|

Apr 20 2021, 12:24 PM Apr 20 2021, 12:24 PM

|

Senior Member

2,096 posts Joined: Oct 2007 |

capital gain mana ada tax...

this could be miners... every month ada income. |

|

|

Apr 20 2021, 12:25 PM Apr 20 2021, 12:25 PM

|

Senior Member

1,552 posts Joined: Feb 2013 |

QUOTE(Songlap @ Apr 20 2021, 12:20 PM) open a pvt ltd in singapore. sell your crypto and money masuk singapore company.first $100,000 profit tax = 4.25% $100,001 to 200,000 profit tax = 8.5% around RM600,000 only max 8.5%. in msia, first RM500,000 profit already 17%. |

|

|

Apr 20 2021, 12:31 PM Apr 20 2021, 12:31 PM

|

Junior Member

818 posts Joined: Jul 2019 |

QUOTE(Zaryl @ Apr 20 2021, 12:16 PM) You forgot to add SPRM and PDRM to that list. My reply would be :- eh eh lama tak jumpa. Hari ini nak buka puasa kat mana ya? QUOTE(Songlap @ Apr 20 2021, 12:20 PM) Yes as I have a company set up in Singapore for this purpose. |

|

|

Apr 20 2021, 12:35 PM Apr 20 2021, 12:35 PM

|

Junior Member

42 posts Joined: Feb 2013 From: Putrajaya |

QUOTE(ShinG3e @ Apr 20 2021, 12:25 PM) open a pvt ltd in singapore. sell your crypto and money masuk singapore company. first $100,000 profit tax = 4.25% $100,001 to 200,000 profit tax = 8.5% around RM600,000 only max 8.5%. in msia, first RM500,000 profit already 17%. QUOTE(BillCollector @ Apr 20 2021, 12:31 PM) You forgot to add SPRM and PDRM to that list. wow thanks My reply would be :- eh eh lama tak jumpa. Hari ini nak buka puasa kat mana ya? Yes as I have a company set up in Singapore for this purpose. both same company? |

|

|

Apr 20 2021, 12:37 PM Apr 20 2021, 12:37 PM

|

Senior Member

1,035 posts Joined: Feb 2007 |

QUOTE(BillCollector @ Apr 20 2021, 12:31 PM) You forgot to add SPRM and PDRM to that list. If you arent using residential area with residential tariffs for large scale mining they wont disturb you.My reply would be :- eh eh lama tak jumpa. Hari ini nak buka puasa kat mana ya? Yes as I have a company set up in Singapore for this purpose. But an interesting test case would be industrial (not commercial) area mining. Industrial rates are cheaper than commercial with off peak discounts to encourage ...well industry. I dont think bit coin mining can be considered as such So my friend...where is your farm? |

|

|

Apr 20 2021, 12:39 PM Apr 20 2021, 12:39 PM

Show posts by this member only | IPv6 | Post

#82

|

Junior Member

818 posts Joined: Jul 2019 |

|

|

|

Apr 20 2021, 12:39 PM Apr 20 2021, 12:39 PM

|

Senior Member

9,333 posts Joined: May 2009 |

|

|

|

Apr 20 2021, 12:40 PM Apr 20 2021, 12:40 PM

|

Senior Member

9,333 posts Joined: May 2009 |

QUOTE(ShinG3e @ Apr 20 2021, 12:25 PM) open a pvt ltd in singapore. sell your crypto and money masuk singapore company. so high?first $100,000 profit tax = 4.25% $100,001 to 200,000 profit tax = 8.5% around RM600,000 only max 8.5%. in msia, first RM500,000 profit already 17%. Big company in SG under certain scheme only get taxed 5% despite billions in turnover |

|

|

Apr 20 2021, 12:46 PM Apr 20 2021, 12:46 PM

Show posts by this member only | IPv6 | Post

#85

|

Junior Member

966 posts Joined: Sep 2008 From: Not sure |

QUOTE(BillCollector @ Apr 20 2021, 12:11 PM) Doesn't look genuine to me. That’s bullshit bro. Unless you are a citizen in Singapore, you pay taxes in your home country. Even if you trade in Singapore, you need to declare taxes Malaysia. I think its made by some gamer who's upset he can't afford a graphics card. That's one of the reasons why I don't use Luno or any of the SEC approved crypto trading platforms. I trade through Singapore where the tax is lower and at least the taxes paid isn't wasted on making another crony wealthier. Mining? Catch me if you can. Just like an American expat working in KL who pays taxes to the American government and not to Malaysia. |

|

|

Apr 20 2021, 12:48 PM Apr 20 2021, 12:48 PM

|

Senior Member

1,552 posts Joined: Feb 2013 |

QUOTE(Songlap @ Apr 20 2021, 12:35 PM) whatchu mean? QUOTE(MeToo @ Apr 20 2021, 12:40 PM) under certain scheme that is deemed worthy ma. i don't think i can find any scheme under crypto yet lol last time 2016/2017 lagi best wey. first $100,000 no tax at all. open multiple pvt ltd, sell crypto max $100,000 each company, no tax. declare as dividend to director (again, not tax on dividend like MY which is witholding tax). MY sdn bhd if reached RM500,000 need register for SST/GST. for singapore, hit $1mil baru apply GST/SST/VAT. |

|

|

Apr 20 2021, 12:50 PM Apr 20 2021, 12:50 PM

Show posts by this member only | IPv6 | Post

#87

|

Senior Member

1,054 posts Joined: Jan 2008 |

QUOTE(friedricetheman @ Apr 20 2021, 01:46 PM) That’s bullshit bro. Unless you are a citizen in Singapore, you pay taxes in your home country. Even if you trade in Singapore, you need to declare taxes Malaysia. thats personal tax la, if company follow the country i suppose.Just like an American expat working in KL who pays taxes to the American government and not to Malaysia. |

|

|

Apr 20 2021, 12:50 PM Apr 20 2021, 12:50 PM

Show posts by this member only | IPv6 | Post

#88

|

Junior Member

315 posts Joined: Nov 2011 |

|

|

|

Apr 20 2021, 12:50 PM Apr 20 2021, 12:50 PM

|

Senior Member

9,333 posts Joined: May 2009 |

QUOTE(ShinG3e @ Apr 20 2021, 12:48 PM) whatchu mean? Not only company tax.under certain scheme that is deemed worthy ma. i don't think i can find any scheme under crypto yet lol last time 2016/2017 lagi best wey. first $100,000 no tax at all. open multiple pvt ltd, sell crypto max $100,000 each company, no tax. declare as dividend to director (again, not tax on dividend like MY which is witholding tax). MY sdn bhd if reached RM500,000 need register for SST/GST. for singapore, hit $1mil baru apply GST/SST/VAT. Even employee income tax also Msia value nearly double SG side for most ppl. Unless u earning millions then it works out to be more or less even... |

|

|

Apr 20 2021, 12:52 PM Apr 20 2021, 12:52 PM

|

Senior Member

1,552 posts Joined: Feb 2013 |

QUOTE(MeToo @ Apr 20 2021, 12:50 PM) Not only company tax. in planning actually. Even employee income tax also Msia value nearly double SG side for most ppl. Unless u earning millions then it works out to be more or less even... talking to some firms in singapork and see how they do it. |

|

|

Apr 20 2021, 12:53 PM Apr 20 2021, 12:53 PM

Show posts by this member only | IPv6 | Post

#91

|

Senior Member

1,768 posts Joined: Feb 2008 |

Under declared, IRB have no direct access to bank record

|

|

|

Apr 20 2021, 12:53 PM Apr 20 2021, 12:53 PM

Show posts by this member only | IPv6 | Post

#92

|

Junior Member

966 posts Joined: Sep 2008 From: Not sure |

|

|

|

Apr 20 2021, 12:55 PM Apr 20 2021, 12:55 PM

|

Senior Member

1,230 posts Joined: Dec 2009 |

Haha, 20 pages inkambing.....

Lotsa crypto pppl in /k This post has been edited by Hobbez: Apr 20 2021, 12:55 PM |

|

|

Apr 20 2021, 12:55 PM Apr 20 2021, 12:55 PM

|

Senior Member

2,353 posts Joined: Dec 2006 |

this is when large crypto traders who made a windfall should watch breaking bad on how to detergent your money

open shell company, and payout small amounts monthly |

|

|

Apr 20 2021, 12:56 PM Apr 20 2021, 12:56 PM

|

Junior Member

214 posts Joined: Jan 2019 |

Parked it in SG or TH lah bodo. You bring back to Malaysia via Malaysia banking/Financial system sure will triggered the LHDN. This post has been edited by ApocalypseSoon: Apr 20 2021, 12:56 PM ye0073 liked this post

|

|

|

Apr 20 2021, 12:57 PM Apr 20 2021, 12:57 PM

Show posts by this member only | IPv6 | Post

#96

|

Junior Member

66 posts Joined: Jun 2016 |

coinminers that steals electric should be punished. thats all

|

|

|

Apr 20 2021, 01:01 PM Apr 20 2021, 01:01 PM

Show posts by this member only | IPv6 | Post

#97

|

Junior Member

60 posts Joined: Dec 2020 |

|

|

|

Apr 20 2021, 01:40 PM Apr 20 2021, 01:40 PM

|

All Stars

15,192 posts Joined: Oct 2004 |

QUOTE(crecar @ Apr 20 2021, 11:39 AM) the problem is not crypto tax I can do for you but the fee/charges is not cheap.the problem is who can do crypto tax for me in accordance to LHDN requirements i ask two small account/tax company and they dont know, so who know? can LHDN do crypto tax for me? i put my profits in USDT, is it taxed? or it get taxed only when the money transfer to my bank account? |

|

|

Apr 20 2021, 01:45 PM Apr 20 2021, 01:45 PM

|

Senior Member

992 posts Joined: Jan 2003 From: Malaysia |

QUOTE(ShinG3e @ Apr 20 2021, 12:25 PM) open a pvt ltd in singapore. sell your crypto and money masuk singapore company. If you mine it in Malaysia, you still need to pay tax. first $100,000 profit tax = 4.25% $100,001 to 200,000 profit tax = 8.5% around RM600,000 only max 8.5%. in msia, first RM500,000 profit already 17%. Even if you transfer your crypto to your SG company and sell it in SG. You can read this under transfer pricing in IRB's public ruling. So far, what I can say. Even though people have the perception that Malaysia's civil service is incompetent. However, their taxation department is actually very effective in countering loopholes and tax avoidance yhtan liked this post

|

|

|

Apr 20 2021, 01:46 PM Apr 20 2021, 01:46 PM

|

All Stars

15,192 posts Joined: Oct 2004 |

QUOTE(Computer^freak @ Apr 20 2021, 01:45 PM) If you mine it in Malaysia, you still need to pay tax. many bravo in lowyat to recommend such.Even if you transfer your crypto to your SG company and sell it in SG. You can read this under transfer pricing in IRB's public ruling. So far, what I can say. Even though people have the perception that Malaysia's civil service is incompetent. However, their taxation department is actually very effective in countering loopholes and tax avoidance |

|

|

Apr 20 2021, 01:48 PM Apr 20 2021, 01:48 PM

|

Senior Member

8,651 posts Joined: Sep 2005 From: lolyat |

QUOTE(BillCollector @ Apr 20 2021, 12:11 PM) Doesn't look genuine to me. U form a company in Singapore to enjoy the 17% corporate tax? If u use personal name then how u derive as yourself as Singapore tax resident?I think its made by some gamer who's upset he can't afford a graphics card. That's one of the reasons why I don't use Luno or any of the SEC approved crypto trading platforms. I trade through Singapore where the tax is lower and at least the taxes paid isn't wasted on making another crony wealthier. Mining? Catch me if you can. Your word seem confusing me. QUOTE(friedricetheman @ Apr 20 2021, 12:46 PM) That’s bullshit bro. Unless you are a citizen in Singapore, you pay taxes in your home country. Even if you trade in Singapore, you need to declare taxes Malaysia. I think u get it wrong, if an American expat come to KL and work full time, he need to pay tax to LHDN, not US. Just like an American expat working in KL who pays taxes to the American government and not to Malaysia. eaglefly liked this post

|

|

|

Apr 20 2021, 01:52 PM Apr 20 2021, 01:52 PM

|

Senior Member

1,552 posts Joined: Feb 2013 |

QUOTE(Computer^freak @ Apr 20 2021, 01:45 PM) If you mine it in Malaysia, you still need to pay tax. if we're talking about mining, yes i agree.Even if you transfer your crypto to your SG company and sell it in SG. You can read this under transfer pricing in IRB's public ruling. So far, what I can say. Even though people have the perception that Malaysia's civil service is incompetent. However, their taxation department is actually very effective in countering loopholes and tax avoidance as far as i know for singapore, airdrop and hardfork coin is exempted from tax. not sure about lhdn msia part on their definition. also, yield-farming topic yet to be decided either park under the definition of mining or airdrop. or neither. |

|

|

Apr 20 2021, 01:53 PM Apr 20 2021, 01:53 PM

|

Junior Member

966 posts Joined: Sep 2008 From: Not sure |

QUOTE(yhtan @ Apr 20 2021, 01:48 PM) I think u get it wrong, if an American expat come to KL and work full time, he need to pay tax to LHDN, not US. Ah ok. Thanks for the heads up. I always thought they are required to pay taxes to the American government.So, it’s only gains from investment made in Malaysia that is taxable then by the US government if the investor is American? eaglefly liked this post

|

|

|

Apr 20 2021, 01:56 PM Apr 20 2021, 01:56 PM

|

Junior Member

966 posts Joined: Sep 2008 From: Not sure |

QUOTE(yhtan @ Apr 20 2021, 01:48 PM) U form a company in Singapore to enjoy the 17% corporate tax? If u use personal name then how u derive as yourself as Singapore tax resident? That bill collector is kopitiam’s greatest bullshitter. Don’t believe a word he says. His other dupe is Asquith and we all know how many lies /k caught that was posted by his dupe. If his words can pakai, then I am the president of the United States. blanket84 liked this post

|

|

|

Apr 20 2021, 02:01 PM Apr 20 2021, 02:01 PM

|

Junior Member

234 posts Joined: Jan 2003 From: Subang Jaya 2040 AD |

QUOTE(friedricetheman @ Apr 20 2021, 01:53 PM) Ah ok. Thanks for the heads up. I always thought they are required to pay taxes to the American government. Actually Americans get double taxation, they pay both US tax & the country they are working in tax. So, it’s only gains from investment made in Malaysia that is taxable then by the US government if the investor is American? |

|

|

Apr 20 2021, 02:07 PM Apr 20 2021, 02:07 PM

|

Senior Member

1,035 posts Joined: Feb 2007 |

QUOTE(friedricetheman @ Apr 20 2021, 12:46 PM) That’s bullshit bro. Unless you are a citizen in Singapore, you pay taxes in your home country. Even if you trade in Singapore, you need to declare taxes Malaysia. Expats in Malaysia have to pay taxes in Malaysia. Their income is derived from a Malaysian source. A prequisite for renewing their employment pass is to file and clear all outstanding with LHDN.Just like an American expat working in KL who pays taxes to the American government and not to Malaysia. Now in the case of bill...hmmm it is possible for him to pay taxes in Singapore , for example company taxes for his company registered and operating out of Singapore. if hes operating out of Malaysia but deriving overseas income, say trading or exporting then yes he has to pay in Malaysia. He could mean that lar..hahah. You ever wonder why he's back after such a long hiatus while another disappeared? |

|

|

Apr 20 2021, 02:10 PM Apr 20 2021, 02:10 PM

|

Senior Member

8,651 posts Joined: Sep 2005 From: lolyat |

QUOTE(friedricetheman @ Apr 20 2021, 01:53 PM) Ah ok. Thanks for the heads up. I always thought they are required to pay taxes to the American government. If u are Malaysia tax resident, gain from investment is either capital or business gain. If business gain then taxable under Malaysia. So, it’s only gains from investment made in Malaysia that is taxable then by the US government if the investor is American? But US and Malaysia doesn't have double taxation agreement, so US citizen has to pay tax for both side. QUOTE(friedricetheman @ Apr 20 2021, 01:56 PM) That bill collector is kopitiam’s greatest bullshitter. Don’t believe a word he says. His other dupe is Asquith and we all know how many lies /k caught that was posted by his dupe. No wonder bullshit until so pannai If his words can pakai, then I am the president of the United States. |

|

|

Apr 20 2021, 02:11 PM Apr 20 2021, 02:11 PM

|

Senior Member

1,035 posts Joined: Feb 2007 |

QUOTE(yhtan @ Apr 20 2021, 01:48 PM) U form a company in Singapore to enjoy the 17% corporate tax? If u use personal name then how u derive as yourself as Singapore tax resident? Hes paying company profit tax not personal income tax. Thats how I see it. No other way save he has a Singaporean citizenship. |

|

|

Apr 20 2021, 02:13 PM Apr 20 2021, 02:13 PM

|

Senior Member

8,651 posts Joined: Sep 2005 From: lolyat |

QUOTE(9m2w @ Apr 20 2021, 02:11 PM) Hes paying company profit tax not personal income tax. Thats how I see it. No other way save he has a Singaporean citizenship. SG corporate tax is 17% but i not sure got any other incentive in it.To be SG tax residence u need to stay there for at least 183 days (same rule like Malaysia tax residence), or else they will tax at highest bracket IINM. |

|

|

Apr 20 2021, 02:15 PM Apr 20 2021, 02:15 PM

Show posts by this member only | IPv6 | Post

#110

|

Senior Member

4,893 posts Joined: May 2008 |

Just declare la

Just to be on the safe side |

|

|

Apr 20 2021, 02:16 PM Apr 20 2021, 02:16 PM

Show posts by this member only | IPv6 | Post

#111

|

Senior Member

813 posts Joined: May 2013 |

QUOTE(friedricetheman @ Apr 20 2021, 01:56 PM) That bill collector is kopitiam’s greatest bullshitter. Don’t believe a word he says. His other dupe is Asquith and we all know how many lies /k caught that was posted by his dupe. And i am Putin.If his words can pakai, then I am the president of the United States. |

|

|

Apr 20 2021, 02:36 PM Apr 20 2021, 02:36 PM

|

Junior Member

966 posts Joined: Sep 2008 From: Not sure |

QUOTE(9m2w @ Apr 20 2021, 02:11 PM) Hes paying company profit tax not personal income tax. Thats how I see it. No other way save he has a Singaporean citizenship. Lol. Bill collector only know how to talk cock. You really believe that he even invests? With his amateur response to country taxation laws on investment gains, I don’t think he has even ventured out from Ulu Kelang. |

|

|

Apr 20 2021, 02:54 PM Apr 20 2021, 02:54 PM

|

Senior Member

1,035 posts Joined: Feb 2007 |

QUOTE(friedricetheman @ Apr 20 2021, 02:36 PM) Lol. Bill collector only know how to talk cock. You really believe that he even invests? With his amateur response to country taxation laws on investment gains, I don’t think he has even ventured out from Ulu Kelang. Who knows, maybe some truth here and there . My interest is the timing though. One alpha came back when another left. And iirc I actually recommended a VPN for Asquith to use in China and now bills back from there 😂 😂 |

|

|

Apr 20 2021, 03:02 PM Apr 20 2021, 03:02 PM

Show posts by this member only | IPv6 | Post

#114

|

Junior Member

268 posts Joined: May 2014 |

|

|

|

Apr 20 2021, 05:11 PM Apr 20 2021, 05:11 PM

|

Junior Member

485 posts Joined: Dec 2013 |

|

|

|

Apr 20 2021, 05:12 PM Apr 20 2021, 05:12 PM

|

Junior Member

93 posts Joined: Sep 2020 |

|

|

|

Apr 20 2021, 05:14 PM Apr 20 2021, 05:14 PM

Show posts by this member only | IPv6 | Post

#117

|

Senior Member

2,746 posts Joined: Mar 2006 From: 21st century |

|

|

|

Apr 20 2021, 05:31 PM Apr 20 2021, 05:31 PM

|

Junior Member

55 posts Joined: Apr 2020 |

With offshore account, lhdn do enquire the source of fund.

However malaysia hv no jurisdiction in the earning from foreign country... |

|

|

Apr 20 2021, 06:06 PM Apr 20 2021, 06:06 PM

Show posts by this member only | IPv6 | Post

#119

|

Junior Member

77 posts Joined: Oct 2019 |

QUOTE(Reubs @ Apr 20 2021, 12:09 PM) Curious to know this as well. What's the minimum? keyword is active trader.Is 30 days considered as capital gain? I wanna liquidate but I sked. kalau once a while maybe tak kena. but if slighty kerap but you bilis i dont think they waste their time cari you. but for peace of mind declare aja. |

|

|

Apr 20 2021, 06:14 PM Apr 20 2021, 06:14 PM

Show posts by this member only | IPv6 | Post

#120

|

Junior Member

77 posts Joined: Oct 2019 |

QUOTE(whyamiblack @ Apr 20 2021, 11:27 AM) No problem to include crypto in taxing for day-trading but how they count losses? If the fella gain 100k on his portfolio but dropped 200k, still need to pay 100k tax? Die lo i think its net annual income. But dont think can carry forward losses unless you register business. I think so lah, might be wrong. |

|

|

Apr 20 2021, 06:15 PM Apr 20 2021, 06:15 PM

|

Senior Member

2,245 posts Joined: Apr 2005 |

No wonder many beemers on market 2nd hand tapi g20 sunset oren

|

|

|

Apr 20 2021, 06:23 PM Apr 20 2021, 06:23 PM

|

Junior Member

127 posts Joined: Oct 2011 |

QUOTE(Computer^freak @ Apr 20 2021, 01:45 PM) If you mine it in Malaysia, you still need to pay tax. their irb taxation dept full of elites from big 4Even if you transfer your crypto to your SG company and sell it in SG. You can read this under transfer pricing in IRB's public ruling. So far, what I can say. Even though people have the perception that Malaysia's civil service is incompetent. However, their taxation department is actually very effective in countering loopholes and tax avoidance |

|

|

Apr 20 2021, 07:26 PM Apr 20 2021, 07:26 PM

Show posts by this member only | IPv6 | Post

#123

|

All Stars

15,192 posts Joined: Oct 2004 |

|

|

|

Apr 22 2021, 12:18 PM Apr 22 2021, 12:18 PM

|

Junior Member

818 posts Joined: Jul 2019 |

QUOTE(yhtan @ Apr 20 2021, 01:48 PM) U form a company in Singapore to enjoy the 17% corporate tax? If u use personal name then how u derive as yourself as Singapore tax resident? Never stated I’m a Sg resident. Your word seem confusing me. I think u get it wrong, if an American expat come to KL and work full time, he need to pay tax to LHDN, not US. I use a SG company to reduce my tax liabilities Also an American citizen pays tax on worldwide income similar to China nationals though double taxation treaties do exist in some cases. |

|

|

Apr 22 2021, 12:22 PM Apr 22 2021, 12:22 PM

|

Junior Member

818 posts Joined: Jul 2019 |

QUOTE(friedricetheman @ Apr 20 2021, 12:46 PM) That’s bullshit bro. Unless you are a citizen in Singapore, you pay taxes in your home country. Even if you trade in Singapore, you need to declare taxes Malaysia. An American expat working in Malaysia is subject to both Malaysia and US tax only because American citizens are taxed on their worldwide income.Just like an American expat working in KL who pays taxes to the American government and not to Malaysia. Other than China nationals no one else is subject to similar laws. Stick to other people’s watches as it’s clear you’re clueless otherwise. |

|

|

Apr 22 2021, 12:59 PM Apr 22 2021, 12:59 PM

Show posts by this member only | IPv6 | Post

#126

|

Junior Member

966 posts Joined: Sep 2008 From: Not sure |

QUOTE(BillCollector @ Apr 22 2021, 12:22 PM) An American expat working in Malaysia is subject to both Malaysia and US tax only because American citizens are taxed on their worldwide income. Lol. So what are you? Since you have just admitted that still need to pay taxes in Malaysia. Other than China nationals no one else is subject to similar laws. Stick to other people’s watches as it’s clear you’re clueless otherwise. Bodoh simpan sikit. Don’t talk nonsense about not paying taxes in malaysia when you are a Malaysian |

|

|

Apr 22 2021, 01:03 PM Apr 22 2021, 01:03 PM

|

Senior Member

1,035 posts Joined: Feb 2007 |

QUOTE(friedricetheman @ Apr 22 2021, 12:59 PM) Lol. So what are you? Since you have just admitted that still need to pay taxes in Malaysia. Save the aggravationBodoh simpan sikit. Don’t talk nonsense about not paying taxes in malaysia when you are a Malaysian Refer here https://forum.lowyat.net/index.php?showtopi...#entry100692378 Not gonna layan already for me haha friedricetheman liked this post

|

|

|

Apr 22 2021, 01:04 PM Apr 22 2021, 01:04 PM

|

Junior Member

435 posts Joined: Jun 2007 |

|

|

|

Apr 22 2021, 01:05 PM Apr 22 2021, 01:05 PM

|

Senior Member

1,520 posts Joined: May 2008 |

QUOTE(BillCollector @ Apr 22 2021, 12:22 PM) An American expat working in Malaysia is subject to both Malaysia and US tax only because American citizens are taxed on their worldwide income. Where did you put Asquith's body after you kill him?Other than China nationals no one else is subject to similar laws. Stick to other people’s watches as it’s clear you’re clueless otherwise. |

|

|

Apr 22 2021, 01:06 PM Apr 22 2021, 01:06 PM

|

Senior Member

1,035 posts Joined: Feb 2007 |

QUOTE(TianJian @ Apr 22 2021, 01:04 PM) Yes Malaysia participated in the Automatic Exchange of Financial Account Information.Other participating countries include Singapore and Hong Kong. So yeah they will know how much you have. With modern analytics dont need much effort to sort thru all the data also |

|

|

Apr 22 2021, 01:07 PM Apr 22 2021, 01:07 PM

|

Senior Member

1,123 posts Joined: Sep 2013 |

|

|

|

Apr 22 2021, 01:07 PM Apr 22 2021, 01:07 PM

|

Junior Member

435 posts Joined: Jun 2007 |

QUOTE(9m2w @ Apr 22 2021, 01:06 PM) Yes Malaysia participated in the Automatic Exchange of Financial Account Information. hmmm , o well , waiting them come arrest me i guessOther participating countries include Singapore and Hong Kong. So yeah they will know how much you have. With modern analytics dont need much effort to sort thru all the data also |

|

|

Apr 22 2021, 01:16 PM Apr 22 2021, 01:16 PM

|

Senior Member

1,035 posts Joined: Feb 2007 |

|

|

|

Apr 22 2021, 01:19 PM Apr 22 2021, 01:19 PM

|

Junior Member

435 posts Joined: Jun 2007 |

|

|

|

Apr 27 2021, 12:12 PM Apr 27 2021, 12:12 PM

|

All Stars

15,192 posts Joined: Oct 2004 |

This is true case. I know the poster

|

| Change to: |  0.0429sec 0.0429sec

1.03 1.03

5 queries 5 queries

GZIP Disabled GZIP Disabled

Time is now: 4th December 2025 - 01:05 AM |