Outline ·

[ Standard ] ·

Linear+

Investment Versa

|

Ramjade

|

Sep 8 2023, 03:18 PM Sep 8 2023, 03:18 PM

|

|

QUOTE(sweetpea123 @ Sep 8 2023, 03:37 AM) die lor, I just withdrew ALL from Versa Cash yesterday, and a big amt from it too last month on 18 Aug  planning to withdraw all from Versa Cash-i today , Ok , gonna leave rm100 inside. Thanks for the heads-up, btw, is KDI SAVE also the same? UPDATE : when I tried to leave rm100, it required me to do a FULL WITHDRAWAL. So I left rm200 inside and then it went through Don't know. I assume all mmf the same. So I usually do that. No need. RM200 inside. RM105 or RM110 enough. This post has been edited by Ramjade: Sep 8 2023, 03:25 PM |

|

|

|

|

|

Ramjade

|

Sep 11 2023, 10:03 AM Sep 11 2023, 10:03 AM

|

|

QUOTE(annoymous1234 @ Sep 11 2023, 09:42 AM) ASM can leave RM10 min right? Why RM100 though? Cause majority of unit trust all want you to have minimum 100 units inside. You can try 10 units and see. |

|

|

|

|

|

Ramjade

|

Sep 26 2023, 02:31 PM Sep 26 2023, 02:31 PM

|

|

QUOTE(BladeRider @ Sep 26 2023, 02:26 PM) Take aside promo rate, if shariah-compliant is not my concern, is it Regular Versa cash, versa moderate and Versa growth normally will have higher returns compare those -i ? None. Qqq have better returns than what versa/aham products. |

|

|

|

|

|

Ramjade

|

Sep 30 2023, 01:59 PM Sep 30 2023, 01:59 PM

|

|

QUOTE(contestchris @ Sep 30 2023, 01:48 PM) Is Versa easy to use? What's the current returns like? Yeah. But keep in mind everything is done via phone. No desktop version. Then there is delayed in returns. But you will get the promised returns but slow. 4.3%p.a if include rebates from versa. Less if no more rebates. This post has been edited by Ramjade: Sep 30 2023, 02:04 PM |

|

|

|

|

|

Ramjade

|

Oct 23 2023, 03:37 PM Oct 23 2023, 03:37 PM

|

|

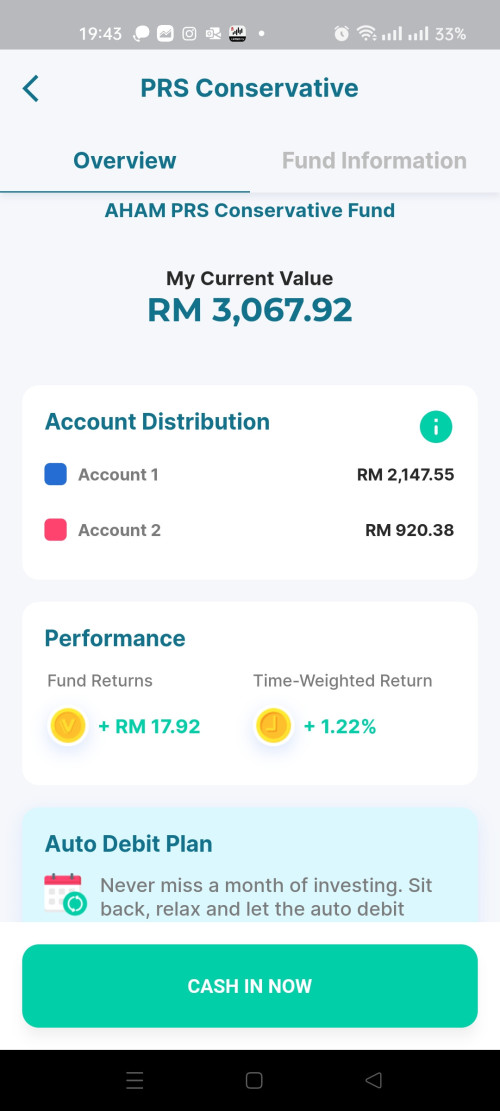

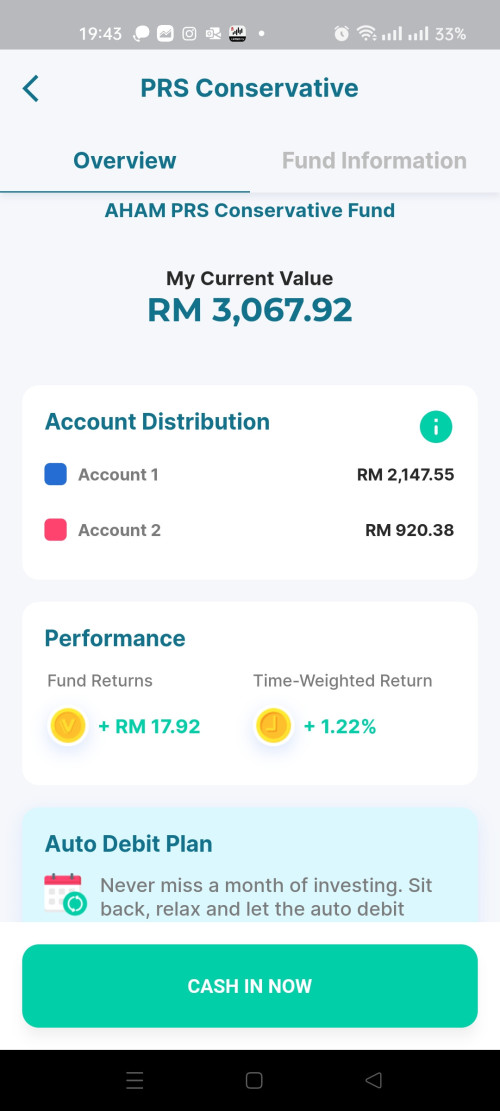

QUOTE(!@#$%^ @ Oct 23 2023, 03:25 PM) Likely lousy AHAM PRS funds. Nothing to see. Move along. Haha... This post has been edited by Ramjade: Oct 23 2023, 03:37 PM |

|

|

|

|

|

Ramjade

|

Oct 23 2023, 03:51 PM Oct 23 2023, 03:51 PM

|

|

QUOTE(ronnie @ Oct 23 2023, 03:43 PM) The only way they are getting my money is they have global fund or US focus prs. But Bnm wouldn't allow that IMO. |

|

|

|

|

|

Ramjade

|

Oct 23 2023, 06:01 PM Oct 23 2023, 06:01 PM

|

|

QUOTE(ronnie @ Oct 23 2023, 05:37 PM) Just got the update.... finally. RETIREMENT button appears. I wonder which would be the "best money making" PRS in AHAM ? None. As long as the funds all invest in Malaysia market, you can forget about it. |

|

|

|

|

|

Ramjade

|

Oct 23 2023, 06:35 PM Oct 23 2023, 06:35 PM

|

|

QUOTE(victorian @ Oct 23 2023, 06:32 PM) Just go for the lowest risk PRS to get the bonus and tax relief For me Prs must be able to match EPF returns at least. If cannot match, no point. |

|

|

|

|

|

Ramjade

|

Oct 23 2023, 06:47 PM Oct 23 2023, 06:47 PM

|

|

QUOTE(victorian @ Oct 23 2023, 06:42 PM) Prs will never be able to match EPF return. That's why if there is no tax relief, PRS will die. QUOTE(!@#$%^ @ Oct 23 2023, 06:43 PM) Can. If you choose the correct fund. Eg. Principal prs Asia Pacific was outperforming EPF all these years until covid and emperor xi. That's why now I switch to the only US focused fund 30% US is better than nothing. Once they intro like full US fund, I will transfer my PRS there. |

|

|

|

|

|

Ramjade

|

Oct 24 2023, 05:30 PM Oct 24 2023, 05:30 PM

|

|

QUOTE(virtualgay @ Oct 24 2023, 05:27 PM) i envy you... too bad there is no such thing as VERSA else i gonna max my tax relief SSPN, EPF, EPF Self Contribution and PRS.. anything else i miss out? Got. Call FSM. Medical insurance, life insurance. |

|

|

|

|

|

Ramjade

|

Nov 8 2023, 09:14 PM Nov 8 2023, 09:14 PM

|

|

QUOTE(virtualgay @ Nov 8 2023, 07:44 PM) This is supposed to be a conservative fund and yet it goes up and down like yoyo  It's over long time. Cause underlying are bonds and bonds returns go down interest rate increases. |

|

|

|

|

|

Ramjade

|

Nov 11 2023, 10:22 PM Nov 11 2023, 10:22 PM

|

|

QUOTE(joice11 @ Nov 11 2023, 04:54 PM) after reading some of the previous post, it is still worth to open versa account and inverst? my actual purpose is to open PRS account and see there is promotion on RM10k to get up to 6% for 3 month. But seem there are uncertainly in it? may be i should just open though FSM one ? Don't be short sighted. Why do you want to pay for lousy unit trust that at best match FD rates when you can get unit trust that at least match EPF returns over via FSM. Are you so tamak for one time RM150 promo? Unless affin hwang have a PRS that offer US exposure, I will stay as far away from their prs cause their prs returns honestly sucks. Your choice. If you feel the RM150 is worth locking up your money for subpar returns, by all means go for it. For me nope. |

|

|

|

|

|

Ramjade

|

Nov 12 2023, 06:40 AM Nov 12 2023, 06:40 AM

|

|

QUOTE(virtualgay @ Nov 12 2023, 12:52 AM) i put into prs not for the 150 but more for the tax rebate and i am near retirement I put in for both. Tax savings and returns. You can have your cake and still eat it. The only way is to get a fund with US market access. Not Malaysia or china market. |

|

|

|

|

|

Ramjade

|

Nov 12 2023, 02:40 PM Nov 12 2023, 02:40 PM

|

|

QUOTE(joice11 @ Nov 12 2023, 02:30 PM) My purpose is for income tax relief. if inverst PRS though FSM, can we choice the unit that offer us exposure? as i understand we can only choice conservative, aggresive or moderate right? Wrong. You are free to choose your fund. There are only 2 fund with US exposure and no surprise that they are beating all the other prs by at least 2x. AIA growth PRS and principal retireeasy classes of fund. You can choose how many % of US you want by picking the principal fund. I think the lowest being 10-30%. Of course you need to choose the fund with correct name and not blindly buy any AIA or principal fund. This post has been edited by Ramjade: Nov 12 2023, 03:02 PM |

|

|

|

|

|

Ramjade

|

Nov 28 2023, 06:25 PM Nov 28 2023, 06:25 PM

|

|

QUOTE(virtualgay @ Nov 28 2023, 05:38 PM) Quite crazy their promotion Imagine 10k in December how much you will get Just assume Dec base rate is 3.4% So again it will be 3.4% + 0.90% = 4.3% 3.4% + 8.6% = 12% Total would be 3.4% + 0.9% + 8.6% = 12.9% 10000 x 12.9% / 365 x 31 days = RM109.56 Hope my calculations is correct Again said don't know how many times. Not worth it for a one time gain when if you look at their performance, it practically sucks. But if you can withdraw due to age, then yeah. Good money. Instant 12% return This post has been edited by Ramjade: Nov 28 2023, 06:59 PM |

|

|

|

|

|

Ramjade

|

Nov 29 2023, 03:10 PM Nov 29 2023, 03:10 PM

|

|

QUOTE(virtualgay @ Nov 29 2023, 02:47 PM) u ask me if i am 30 now i wont even put a single cent into PRS even if taxable income is 100k base on 100k taxable income if you invest RM3k you can back tax saving of RM570 - (you are at 19%) tax bracket but if you are now 30 your 3000 inside PRS at most will only grow like 3.5% to 4.5% average per year for the period of 25 years it is as good as gone case maybe you die also you cannot withdraw because is like EFP so those young ones if u really believe in PRS then invest RM3k give it a try those old one, just do it if you are at 50 years old like me, few more months i am 51 then i have 4 more years left then i can take out my PRS I am 30+ but I will still put in PRS as long as got tax relief. I am only asking for simple stuff. They must match EPF returns. Failing to match EPF mean I will switch it out. Looking at AHAM prs average return for past 5y, cannot even march EPF. Hence avoiding. I put in when najib intro youth scheme at free RM1k. This post has been edited by Ramjade: Nov 29 2023, 05:20 PM |

|

|

|

|

|

Ramjade

|

Nov 29 2023, 08:03 PM Nov 29 2023, 08:03 PM

|

|

QUOTE(bokbokchai @ Nov 29 2023, 08:01 PM) you mean PRS was doing pretty good? I won't agree so thou cuz I did give at least 10 years time for it to prove itself. 10 years time got high and low, if i could invest in apple stock during that 10 years time, thing would have been different (if im young and ok for higher risk).  Aham funds 10 years also lousy. 10y the good fund was principal Asia Pacific ex Japan. It all went down hill after emperor xi crackdown on tech and start common prosperity. |

|

|

|

|

|

Ramjade

|

Nov 29 2023, 11:50 PM Nov 29 2023, 11:50 PM

|

|

QUOTE(bokbokchai @ Nov 29 2023, 10:58 PM) I guess it’s depends also on what PRS fund you holding. Mine is top 3 countries invested is USA TAIWAN and SOUTH KOREA. Not china. Hong Kong has more composition also. But kinda sad if compared to US stock holding for that 10 year period. My PRS currently at around 66% profit after 10 years… if now wanna withdraw, cant right? Can withdraw. Pay penalty. |

|

|

|

|

|

Ramjade

|

Nov 30 2023, 12:06 PM Nov 30 2023, 12:06 PM

|

|

QUOTE(ronnie @ Nov 30 2023, 07:43 AM) i wonder which minister introduce PRS to begin with Received my RM50 referral fees... thanks ya. Najib. Took our moment from 1mdb and intro us prs to keep us happy. |

|

|

|

|

|

Ramjade

|

Dec 7 2023, 08:22 PM Dec 7 2023, 08:22 PM

|

|

QUOTE(ASoulNamedLeo @ Dec 7 2023, 08:02 PM) More like OCBC 4.18% FD (effective rate 4.09%) better, got PIDM protection some more as well~ FD early withdrawal no interest. Not the same. |

|

|

|

|

Sep 8 2023, 03:18 PM

Sep 8 2023, 03:18 PM

Quote

Quote

0.0316sec

0.0316sec

0.50

0.50

7 queries

7 queries

GZIP Disabled

GZIP Disabled