QUOTE(Natsukashii @ Nov 27 2023, 08:27 PM)

Then they shouldn't provide plan with rm1m annual limit, then while we don't even claim.. still want to increase the premium.

I think you don't realize how the plan is being structured (which is ok, since not all car drivers know how each part of the car functions).

1. For medical insurance, insurance companies are basically managing a pooled funds that policyholders contribute to.

2. Insurance companies charge a management fee (that is their profit).

3. Let's say for a year, premium contributions exceed the claims and the management fees the insurance company charge, these 'excess' funds are placed in to the pool as reserves - these are not 'profit' to the insurance company, they are to cover years when claims exceed average (for example during a pandemic, which is normally not covered but were covered after they assessed the risks).

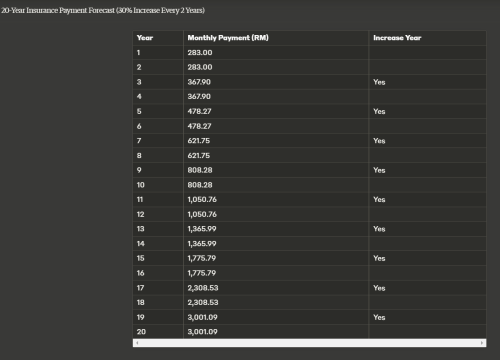

4. The premium to be charged will normally be based on average claims for the past few years and the projected claims for the next few years - using logic, the claims will continue to rise due to medical inflation. It is not based on everyone claiming RM1m, it's based on the actual total claims for that medical plan's portfolio.

If you ask me, I will take RM1m plan any day, or even RM3m plan if available, because I am using my health condition now (which is relatively healthy) and lock in a plan that I can claim up to RM3m maybe 20, 30 years into the future (when I might not be so healthy). Maybe 15 years ahead, a typical cancer treatment will cost RM1mil but by that time I have high blood la, diabetes la, that will normally cause my application to be rejected or will be very expensive to buy, so if given the chance I will lock in the highest annual claim limit possible, even though the typical cost of medical treatment NOW is nowhere near RM1m. I reiterate - the premium charged is not based on RM1m or RM3m limit, it's based on the total claims history of the portfolio in the near term.

It's a free country, if you feel it's a scam, just stop it lo. You do you.

I was super healthy, my family too for years after buying the medical plan (10 yrs) and I don't anticipate using the medical card for years to come, but then 1 episode of dengue and snake bite saw 3 of us (my child, my partner and me hospitalised AT THE SAME TIME). It's not so much whether I can profit from the medical plan, it is where can I find the money to pay for the treatment and hospital deposit for 3 family members AT THE SAME TIME in one of the best hospitals in KV that is only 2km from where I stay?

Edit : We went to the govt hospital in another state for the snake bite (partner was in a campsite outstation la) since private don't have anti-venom, but after a few days' observation at the emergency department (they have no beds in regular wards). When my partner stabilised, we came back to KLGH and got a bed - I can't remember the number of people in the ward, but the row my partner was in have like 20 patients, some are suffering from cancer pain, some are dying - groaning all the time. Straight away partner say kenot, we then got discharged and went to the private hospital that's near to our house. Then the dengue came - jialat.

This post has been edited by AbbyCom: Nov 27 2023, 11:02 PM

Mar 31 2021, 06:11 PM, updated 5y ago

Mar 31 2021, 06:11 PM, updated 5y ago

Quote

Quote

0.1629sec

0.1629sec

0.87

0.87

5 queries

5 queries

GZIP Disabled

GZIP Disabled