QUOTE(Hansel @ Oct 25 2023, 12:36 PM)

TOS and gents,... I've browsed thru the spreadsheet last night,... easy to understand, and I'm okay with getting that amt as shown in your speradsheet. I may be wondering why does the final line show am IRR of 2.7% though,... what formula did you use,...

Not sure which line you are referring to? You mean the 3rd spreadsheet using my actual CIMB SG cashflow data?

It's the same XIRR formula dwRK and I are using throughout our calculations.

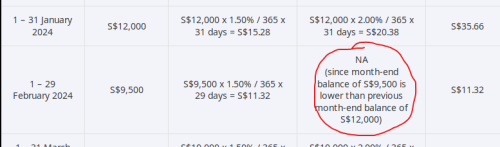

As said above to uncle dwRK, I strongly suspects the money movement in and out of the accounts affects the IRR as well. The delay of 20-days pulls down the IRR from 3.50% to 3.1-3.2%, and perhaps money movement pulls it further down to 2.6-2.7%.

So, a preliminary conclusion is if you want to maximize your CIMB SG account "3.5%" promo to its full extent, you have to treat the account as an FD account and not withdraw cash from it simply because you need to.

We also discovered that the effective rate, adjusting for the 20-day delay in bonus payments and

assuming that you leave the interests in your account for further compounding, is around 3.1-3.2% p.a.

The lucky thing on my side is with the exception of some one-off spending, I usually withdraw cash for SG T-bills, so overall my opportunity cost is capped at SG 6-month T-bill rates.

This post has been edited by TOS: Oct 25 2023, 01:05 PM

Sep 22 2023, 01:35 PM

Sep 22 2023, 01:35 PM

Quote

Quote

0.0450sec

0.0450sec

0.49

0.49

7 queries

7 queries

GZIP Disabled

GZIP Disabled