abang ni kecam Prudential insurance, kesian

|

|

Feb 22 2021, 10:45 AM, updated 5y ago Feb 22 2021, 10:45 AM, updated 5y ago

Show posts by this member only | Post

#1

|

Junior Member

175 posts Joined: Nov 2020 |

|

|

|

|

|

|

Feb 22 2021, 10:54 AM Feb 22 2021, 10:54 AM

Show posts by this member only | Post

#2

|

Senior Member

1,423 posts Joined: Nov 2013 |

kena sack inkambing

|

|

|

Feb 22 2021, 10:55 AM Feb 22 2021, 10:55 AM

Show posts by this member only | Post

#3

|

Junior Member

175 posts Joined: Nov 2020 |

QUOTE(nebula87 @ Feb 22 2021, 10:54 AM) kena sack from who? the brother is subscribing to prudential. he is not agent. |

|

|

Feb 22 2021, 10:56 AM Feb 22 2021, 10:56 AM

Show posts by this member only | IPv6 | Post

#4

|

Junior Member

3 posts Joined: Jul 2019 |

Ask any hospital staff, ask them which insurance always reject patients insurance claim.

The answer is always prudential. My friend told me around 90% of his patients got rejected. It was his advice to steer away from prudential |

|

|

Feb 22 2021, 10:56 AM Feb 22 2021, 10:56 AM

Show posts by this member only | Post

#5

|

Junior Member

175 posts Joined: Nov 2020 |

|

|

|

Feb 22 2021, 10:57 AM Feb 22 2021, 10:57 AM

Show posts by this member only | Post

#6

|

Junior Member

175 posts Joined: Nov 2020 |

wild_card_my

|

|

|

|

|

|

Feb 22 2021, 10:58 AM Feb 22 2021, 10:58 AM

Show posts by this member only | Post

#7

|

Senior Member

1,081 posts Joined: Aug 2018 |

normal like this, they selling insurance and want your money

|

|

|

Feb 22 2021, 10:59 AM Feb 22 2021, 10:59 AM

Show posts by this member only | IPv6 | Post

#8

|

Junior Member

280 posts Joined: Jul 2020 |

FORTHEWIND, akif93, and 5 others liked this post

|

|

|

Feb 22 2021, 11:00 AM Feb 22 2021, 11:00 AM

Show posts by this member only | Post

#9

|

Junior Member

840 posts Joined: Feb 2013 |

Any agent can clarify?

|

|

|

Feb 22 2021, 11:02 AM Feb 22 2021, 11:02 AM

|

Junior Member

477 posts Joined: Jan 2003 From: Klang |

agent didnt inform company previous illness?

|

|

|

Feb 22 2021, 11:03 AM Feb 22 2021, 11:03 AM

|

Junior Member

241 posts Joined: May 2007 |

QUOTE(Adiksado @ Feb 22 2021, 10:56 AM) Ask any hospital staff, ask them which insurance always reject patients insurance claim. On what basis were the claims rejected? Your friend is a doctor?The answer is always prudential. My friend told me around 90% of his patients got rejected. It was his advice to steer away from prudential But prudential really a pain in the ar*e when admitting to hosp..they will interrogate the doctors..the doctor who handles my case was totally pissed off by prudential..after all the hoo ha drama, I still manage to get the GL But goddamnit, received their sms today that my insurance premium increase by rm20 |

|

|

Feb 22 2021, 11:03 AM Feb 22 2021, 11:03 AM

|

Junior Member

104 posts Joined: May 2012 From: Kuala Lumpur |

2018 video

better close tered before PRU send LOD |

|

|

Feb 22 2021, 11:03 AM Feb 22 2021, 11:03 AM

Show posts by this member only | IPv6 | Post

#13

|

Junior Member

662 posts Joined: Apr 2019 |

|

|

|

|

|

|

Feb 22 2021, 11:04 AM Feb 22 2021, 11:04 AM

|

Junior Member

840 posts Joined: Feb 2013 |

|

|

|

Feb 22 2021, 11:05 AM Feb 22 2021, 11:05 AM

Show posts by this member only | IPv6 | Post

#15

|

Junior Member

662 posts Joined: Apr 2019 |

QUOTE(viole @ Feb 22 2021, 11:04 AM) go nude je not like gon get attack on heart once cancel plan. been paying all this while but never used it once, feel like wasting money feeding the agent. didn't even wish me hepi CNY nightzstar, ceo684, and 9 others liked this post

|

|

|

Feb 22 2021, 11:06 AM Feb 22 2021, 11:06 AM

Show posts by this member only | IPv6 | Post

#16

|

Senior Member

1,374 posts Joined: Feb 2016 From: Milky Way |

QUOTE(Adiksado @ Feb 22 2021, 10:56 AM) Ask any hospital staff, ask them which insurance always reject patients insurance claim. Wow....... luckily I Great Eastern. The answer is always prudential. My friend told me around 90% of his patients got rejected. It was his advice to steer away from prudential |

|

|

Feb 22 2021, 11:06 AM Feb 22 2021, 11:06 AM

|

Senior Member

5,967 posts Joined: Oct 2004 From: Malaysia... Duh! |

My experience with Prudential BSN has always been OK, cuma usually nak discharge to a bit longer sebab dia tanya macam-macam kat doctor.

4 surgery/op, semua dapat claim. |

|

|

Feb 22 2021, 11:08 AM Feb 22 2021, 11:08 AM

Show posts by this member only | IPv6 | Post

#18

|

Newbie

48 posts Joined: Dec 2015 |

Go AIA la.

|

|

|

Feb 22 2021, 11:08 AM Feb 22 2021, 11:08 AM

|

Junior Member

840 posts Joined: Feb 2013 |

QUOTE(pot-8-O's @ Feb 22 2021, 11:05 AM) go nude je Actually should be thankful you dont need to claim.not like gon get attack on heart once cancel plan. been paying all this while but never used it once, feel like wasting money feeding the agent. didn't even wish me hepi CNY Or maybe you got fetish to slap that white innocent pure nurse uniform. |

|

|

Feb 22 2021, 11:10 AM Feb 22 2021, 11:10 AM

Show posts by this member only | IPv6 | Post

#20

|

Junior Member

662 posts Joined: Apr 2019 |

|

|

|

Feb 22 2021, 11:12 AM Feb 22 2021, 11:12 AM

|

Junior Member

175 posts Joined: Nov 2020 |

|

|

|

Feb 22 2021, 11:12 AM Feb 22 2021, 11:12 AM

|

Junior Member

3 posts Joined: Jul 2019 |

|

|

|

Feb 22 2021, 11:12 AM Feb 22 2021, 11:12 AM

Show posts by this member only | IPv6 | Post

#23

|

Junior Member

457 posts Joined: Mar 2020 |

QUOTE(Adiksado @ Feb 22 2021, 10:56 AM) Ask any hospital staff, ask them which insurance always reject patients insurance claim. When you say 90%, then it usually means there are many non-disclosures by either the agent/customer or customer suka-suka claim things that are not claimable. With such high rejection rate, the regulators will come in already.The answer is always prudential. My friend told me around 90% of his patients got rejected. It was his advice to steer away from prudential |

|

|

Feb 22 2021, 11:14 AM Feb 22 2021, 11:14 AM

|

Junior Member

3 posts Joined: Jul 2019 |

QUOTE(AbbyCom @ Feb 22 2021, 11:12 AM) When you say 90%, then it usually means there are many non-disclosures by either the agent/customer or customer suka-suka claim things that are not claimable. With such high rejection rate, the regulators will come in already. How come other insurance rejection rate is low? When prudential rejection rate is so damn high even hospital staff take note of its rejection rate. |

|

|

Feb 22 2021, 11:18 AM Feb 22 2021, 11:18 AM

|

Senior Member

1,214 posts Joined: Oct 2005 From: tenet |

|

|

|

Feb 22 2021, 11:19 AM Feb 22 2021, 11:19 AM

Show posts by this member only | IPv6 | Post

#26

|

Junior Member

18 posts Joined: Apr 2013 |

So far mine is good. But never trust them 100%..

|

|

|

Feb 22 2021, 11:23 AM Feb 22 2021, 11:23 AM

Show posts by this member only | IPv6 | Post

#27

|

Junior Member

280 posts Joined: Jul 2020 |

QUOTE(Hiwatari @ Feb 22 2021, 11:18 AM) no wonder my fren jumped from prudential to aia I have personal experience with both. AIA so efficient. Prudential mahai banyak excuse. Unfortunately my insurance with Prudential. No choice. If you haven't buy yet, get AIA. Now I am thinking to get a separate Medical Insurance from AIA.last time promote prudential kaw2 now kutuk kaw2 i tot gimmick only to make aia looks good Isobel liked this post

|

|

|

Feb 22 2021, 11:24 AM Feb 22 2021, 11:24 AM

|

Senior Member

1,022 posts Joined: Dec 2011 |

his face and look no need take video online.

just 1 kampung go to the head office with video and chanting "Malay ditindas"... konfirm the manager straight kneel down apologize and approve claim. |

|

|

Feb 22 2021, 11:26 AM Feb 22 2021, 11:26 AM

Show posts by this member only | IPv6 | Post

#29

|

Junior Member

280 posts Joined: Jul 2020 |

QUOTE(Newsray @ Feb 22 2021, 11:24 AM) his face and look no need take video online. You should watch his video. Don't stereotypes. This Abang consider EQ very good given his situation and no screaming Melayo di tindas.just 1 kampung go to the head office with video and chanting "Malay ditindas"... konfirm the manager straight kneel down apologize and approve claim. Unker sappork this Abang. This post has been edited by NB01: Feb 22 2021, 11:26 AM |

|

|

Feb 22 2021, 11:27 AM Feb 22 2021, 11:27 AM

|

Junior Member

342 posts Joined: Jan 2013 |

Deswai don't rely on insurance... just save your money to pay for own medical expenses. fongsk26 liked this post

|

|

|

Feb 22 2021, 11:28 AM Feb 22 2021, 11:28 AM

|

Senior Member

750 posts Joined: Oct 2008 |

QUOTE(pot-8-O's @ Feb 22 2021, 11:05 AM) go nude je how many years ady u service?not like gon get attack on heart once cancel plan. been paying all this while but never used it once, feel like wasting money feeding the agent. didn't even wish me hepi CNY i think i surrender in 2011, so now like already 10 years ++, nothing big happen also, imagine if i keep paying for the last 10 years, agent sure kaya raya same like u, felt nothing after service for 2 years, i dont feel any value paying insurance. Decided to stop, agent no call me also when i surrender |

|

|

Feb 22 2021, 11:29 AM Feb 22 2021, 11:29 AM

|

Senior Member

1,022 posts Joined: Dec 2011 |

QUOTE(NB01 @ Feb 22 2021, 11:26 AM) You should watch his video. Don't stereotypes. This Abang consider EQ very good given his situation and no screaming Melayo di tindas. i was just saying he got the look to make any manager shaking on the leg.Unker sappork this Abang. his look + malay + ditindas = super weapon that will destroy any manager face to face. nightzstar liked this post

|

|

|

Feb 22 2021, 11:31 AM Feb 22 2021, 11:31 AM

Show posts by this member only | IPv6 | Post

#33

|

Junior Member

662 posts Joined: Apr 2019 |

QUOTE(ashportal @ Feb 22 2021, 11:28 AM) how many years ady u service? KNEW IT.i think i surrender in 2011, so now like already 10 years ++, nothing big happen also, imagine if i keep paying for the last 10 years, agent sure kaya raya same like u, felt nothing after service for 2 years, i dont feel any value paying insurance. Decided to stop, agent no call me also when i surrender I think I signed on 2018. It's not that it's a heavy commitment but that pocket change can be entertainment expenses if ya know what i mean besides, as long as you're prepared with hospital funds right. aiyah biasalah agent take your money and just cabut. |

|

|

Feb 22 2021, 11:33 AM Feb 22 2021, 11:33 AM

Show posts by this member only | IPv6 | Post

#34

|

Junior Member

181 posts Joined: Mar 2009 From: Pengu world |

Prudential memang problem.

Nak masuk hosp susah, every year fee naik. Best so far: AIA Great eastern. Source: my wife - private doc/great eastern takaful agent |

|

|

Feb 22 2021, 11:34 AM Feb 22 2021, 11:34 AM

|

Senior Member

5,967 posts Joined: Oct 2004 From: Malaysia... Duh! |

QUOTE(halotaikor. @ Feb 22 2021, 11:12 AM) Left collar bone (2010), right collar bone (2012), knee PRP and liquid extraction (sebab koyak ACL, 2019), and elbow PRP (Golfer Elbow, 2020).To be fair, the first surgery je I claim full, the rest I claim benefit je sebab the full procedure covered by company insurance. And yes, I broke my collar bone twice. Semua salah JPJ tak mantain jalan. This post has been edited by emino: Feb 22 2021, 11:37 AM |

|

|

Feb 22 2021, 11:35 AM Feb 22 2021, 11:35 AM

|

Senior Member

1,902 posts Joined: Sep 2012 |

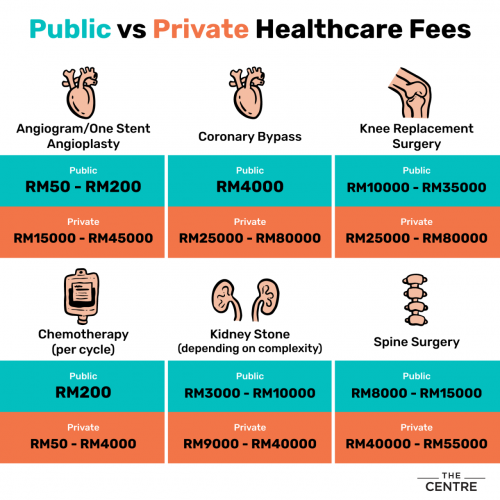

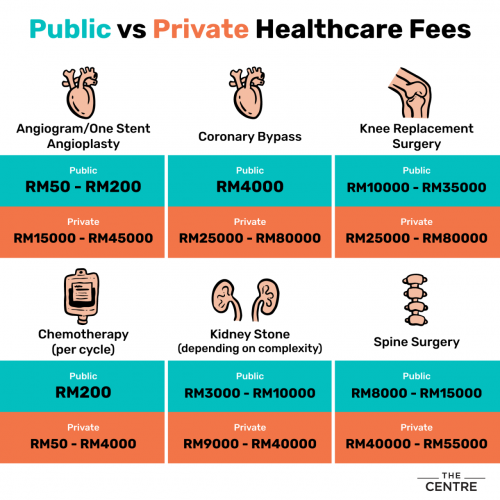

QUOTE(Adiksado @ Feb 22 2021, 10:56 AM) Ask any hospital staff, ask them which insurance always reject patients insurance claim. rm26K for kidney stones operation. wowThe answer is always prudential. My friend told me around 90% of his patients got rejected. It was his advice to steer away from prudential |

|

|

Feb 22 2021, 11:36 AM Feb 22 2021, 11:36 AM

|

Senior Member

1,902 posts Joined: Sep 2012 |

QUOTE(pot-8-O's @ Feb 22 2021, 11:31 AM) KNEW IT. agent liddat oneI think I signed on 2018. It's not that it's a heavy commitment but that pocket change can be entertainment expenses if ya know what i mean besides, as long as you're prepared with hospital funds right. aiyah biasalah agent take your money and just cabut. belum sign up all sweet one after that bye bye |

|

|

Feb 22 2021, 11:37 AM Feb 22 2021, 11:37 AM

Show posts by this member only | IPv6 | Post

#38

|

All Stars

10,722 posts Joined: Nov 2011 |

Pre existing illness memang tak boleh claim wat.

Sakit batu karang memang ada link stroke or sakit jantung wat This post has been edited by tikaram: Feb 22 2021, 11:39 AM |

|

|

Feb 22 2021, 11:41 AM Feb 22 2021, 11:41 AM

Show posts by this member only | IPv6 | Post

#39

|

Junior Member

911 posts Joined: Jun 2005 |

So his problem is he can't claim preexisting condition related hospitalizations?

|

|

|

Feb 22 2021, 11:41 AM Feb 22 2021, 11:41 AM

Show posts by this member only | IPv6 | Post

#40

|

Senior Member

1,132 posts Joined: Jun 2015 |

QUOTE(AbbyCom @ Feb 22 2021, 11:12 AM) When you say 90%, then it usually means there are many non-disclosures by either the agent/customer or customer suka-suka claim things that are not claimable. With such high rejection rate, the regulators will come in already. ada sakit mah claim la, if not buy insurance buat apa? charity?but need more specific on the rejection would like to know why nightzstar liked this post

|

|

|

Feb 22 2021, 11:42 AM Feb 22 2021, 11:42 AM

Show posts by this member only | IPv6 | Post

#41

|

All Stars

11,308 posts Joined: Feb 2008 |

insurance cheat people wan....

|

|

|

Feb 22 2021, 11:42 AM Feb 22 2021, 11:42 AM

|

Junior Member

107 posts Joined: Jun 2013 From: kl.klang. |

Agent aje masyuk dapat ipad becuti hnghhh

|

|

|

Feb 22 2021, 11:45 AM Feb 22 2021, 11:45 AM

|

Senior Member

5,967 posts Joined: Oct 2004 From: Malaysia... Duh! |

|

|

|

Feb 22 2021, 11:52 AM Feb 22 2021, 11:52 AM

|

Junior Member

426 posts Joined: Jan 2003 From: somewhere over the rainbow |

Confirm the agent didn't declare his pre-existing condition in the application form.

I bought my dad a prudential medical card in 2015, but the agent said no need to declare anything and just sign the form & he'll fill up the rest. We didn't follow his advice and declared everything. Had to do some medical checkups and they approved the application for higher contribution. for the past 3 years, my dad in and out of hospital for kidney stone also. Never had a problem claiming. Only wished we had gotten a different agent instead cos the a-hole still got his commission even tho he gave us the wrong advice. It's not the insurance co but the insurance agent. They will get you in trouble if you're not vigilant and just believe their sales pitch/lies. |

|

|

Feb 22 2021, 11:52 AM Feb 22 2021, 11:52 AM

Show posts by this member only | IPv6 | Post

#45

|

Junior Member

99 posts Joined: Jan 2003 |

QUOTE(JimbeamofNRT @ Feb 22 2021, 11:35 AM) Nothing new. Went to P@ntai recently they wanted RM30k. Decided to get a second opinion at UMSC Private RM4k only. Reason is if it can be treated with the shock wave it is cheaper than their so called surgery using the scope to remove the stones. So always get a 2nd opinion because the doctor first question is have you got insurance. Got lectured some more by doctor in P@ntai why my medical insurance coverage so low. Not everyone earns mega bucks to pay for insurance. In the end I submit the claim myself to Great Eastern and got reimbursed very fast. Saved GE RM30k and also save my ciput life time limit of RM200k. Peasant in Malaysia story why Private Hospital sucks you dry.My brother's employer (group insurance) paid close to RM50k to get his stones removed by a "famous" urologist in KL. |

|

|

Feb 22 2021, 11:54 AM Feb 22 2021, 11:54 AM

|

Senior Member

1,902 posts Joined: Sep 2012 |

QUOTE(JoLee @ Feb 22 2021, 11:52 AM) Nothing new. Went to P@ntai recently they wanted RM30k. Decided to get a second opinion at UMSC Private RM4k only. Reason is if it can be treated with the shock wave it is cheaper than their so called surgery using the scope to remove the stones. So always get a 2nd opinion because the doctor first question is have you got insurance. Got lectured some more by doctor in P@ntai why my medical insurance coverage so low. Not everyone earns mega bucks to pay for insurance. In the end I submit the claim myself to Great Eastern and got reimbursed very fast. Saved GE RM30k and also save my ciput life time limit of RM200k. Peasant in Malaysia story why Private Hospital sucks you dry. rm50K for stones!My brother's employer (group insurance) paid close to RM50k to get his stones removed by a "famous" urologist in KL. |

|

|

Feb 22 2021, 11:56 AM Feb 22 2021, 11:56 AM

|

All Stars

11,058 posts Joined: Jun 2008 |

|

|

|

Feb 22 2021, 11:59 AM Feb 22 2021, 11:59 AM

|

Senior Member

3,848 posts Joined: Dec 2009 From: Ampang |

Eh btw now positive covid patients cant sign up for new plans?

|

|

|

Feb 22 2021, 12:00 PM Feb 22 2021, 12:00 PM

Show posts by this member only | IPv6 | Post

#49

|

Junior Member

99 posts Joined: Jan 2003 |

QUOTE(JimbeamofNRT @ Feb 22 2021, 11:54 AM) This guy is famous if you get the drift especially when you have sex problems which Ktards sometimes quote his articles but he is the best in Malaysia according to my friend who is a doctor in all fairness. Even p@ntai wanted RM30k plus for the run of the mill specialist. |

|

|

Feb 22 2021, 12:04 PM Feb 22 2021, 12:04 PM

|

Junior Member

56 posts Joined: Feb 2014 From: Россия с любовью |

boomer dont nid insurance

|

|

|

Feb 22 2021, 12:04 PM Feb 22 2021, 12:04 PM

|

Senior Member

1,902 posts Joined: Sep 2012 |

QUOTE(JoLee @ Feb 22 2021, 12:00 PM) This guy is famous if you get the drift especially when you have sex problems which Ktards sometimes quote his articles but he is the best in Malaysia according to my friend who is a doctor in all fairness. Even p@ntai wanted RM30k plus for the run of the mill specialist. so which one?Dr Muhilan Parameswaran Dr Christopher Ho Chee Kong Dr Ambikai Balan Sothinathan Dr Vikramjit Singh Saren Dr Hemanth Kumar Ramasamy did i missed anyone? |

|

|

Feb 22 2021, 12:04 PM Feb 22 2021, 12:04 PM

|

Junior Member

520 posts Joined: Jul 2008 |

park

|

|

|

Feb 22 2021, 12:06 PM Feb 22 2021, 12:06 PM

|

Senior Member

2,980 posts Joined: Jan 2007 From: Mount Chiliad |

must be linking pre-existing illness

company wont suka suka decline. lesen BNM boleh kena tarik. |

|

|

Feb 22 2021, 12:07 PM Feb 22 2021, 12:07 PM

|

Junior Member

321 posts Joined: Jun 2016 |

walao now what age liao cashless admission pls no need claim claim RootOfJesse liked this post

|

|

|

Feb 22 2021, 12:17 PM Feb 22 2021, 12:17 PM

Show posts by this member only | IPv6 | Post

#55

|

Junior Member

309 posts Joined: Jun 2007 |

my mom too kena already expired cases from 2005 batu karang.. 2020 admitted to hospital cause of flight vertigo cannot claim.. str8 cancel insurance

|

|

|

Feb 22 2021, 12:21 PM Feb 22 2021, 12:21 PM

Show posts by this member only | IPv6 | Post

#56

|

Junior Member

99 posts Joined: Jan 2003 |

QUOTE(JimbeamofNRT @ Feb 22 2021, 12:04 PM) so which one? I forgot his name but I like his articles in The St@r and he is very witty and knowledgeable. He was highly recommended by my own doctor to consult him when I had kidney stones problem and my brother said he was very good also. But unlike my brother, this surgery was going to be paid out from my own insurance limit so I went for the cheapest doctor available since it was only kidney stones.Dr Muhilan Parameswaran Dr Christopher Ho Chee Kong Dr Ambikai Balan Sothinathan Dr Vikramjit Singh Saren Dr Hemanth Kumar Ramasamy did i missed anyone? |

|

|

Feb 22 2021, 12:27 PM Feb 22 2021, 12:27 PM

|

Senior Member

1,902 posts Joined: Sep 2012 |

QUOTE(JoLee @ Feb 22 2021, 12:21 PM) I forgot his name but I like his articles in The St@r and he is very witty and knowledgeable. He was highly recommended by my own doctor to consult him when I had kidney stones problem and my brother said he was very good also. But unlike my brother, this surgery was going to be paid out from my own insurance limit so I went for the cheapest doctor available since it was only kidney stones. I kana few years ago at S_MC also bill came out almost rm3K. non surgery. the stone sangkut along the ureter. just a few x ray check up by MO and, that's it. few hours gone and I am back into action!claimed , as usual |

|

|

Feb 22 2021, 12:30 PM Feb 22 2021, 12:30 PM

|

Junior Member

623 posts Joined: Sep 2008 |

to tell the truth all insurance company is tifu la.

what we pay month2 actually is agent salary the big tifu is car insurance. |

|

|

Feb 22 2021, 12:31 PM Feb 22 2021, 12:31 PM

|

Junior Member

500 posts Joined: Dec 2019 |

From the video,

RM400 per month, starting 2014. Total paid = 400 x 12 x 7 = RM33.6k not including interest etc. RM26k claim rejected. Bro has got a good reason to be pissed. |

|

|

Feb 22 2021, 12:32 PM Feb 22 2021, 12:32 PM

|

Senior Member

1,646 posts Joined: Apr 2013 |

last year met a prudential agent promote plan to me

i say i want to see the TnC, else I won't sign he say they dun have TnC, only have the handbook for customer to see plan payment illustration table, and some general TnC only i say i want see a full detailed TnC, he again say don't have, ask me go official website check see, but can't find TnC from their page. luckily i rejected him and say no detail TnC i won't sign furthermore i find that what he explain to me is wrong after i read the payment illustration table, but he insist he is right and very annoying, keep spam whatsapp me, and call me directly, chee bye This post has been edited by CyrusWong: Feb 22 2021, 12:33 PM |

|

|

Feb 22 2021, 12:32 PM Feb 22 2021, 12:32 PM

|

Junior Member

144 posts Joined: Sep 2005 From: Serdang, KL |

haiyo, buy insurance only buy

great eastern la. apa prudential bsn.. |

|

|

Feb 22 2021, 12:33 PM Feb 22 2021, 12:33 PM

Show posts by this member only | IPv6 | Post

#62

|

Junior Member

280 posts Joined: Jul 2020 |

|

|

|

Feb 22 2021, 12:35 PM Feb 22 2021, 12:35 PM

|

Junior Member

144 posts Joined: Sep 2005 From: Serdang, KL |

QUOTE(Newsray @ Feb 22 2021, 11:24 AM) his face and look no need take video online. prudential bsn is takaful leh. just 1 kampung go to the head office with video and chanting "Malay ditindas"... konfirm the manager straight kneel down apologize and approve claim. apa shout melayu ditindas? already islamic brotha |

|

|

Feb 22 2021, 12:35 PM Feb 22 2021, 12:35 PM

Show posts by this member only | IPv6 | Post

#64

|

Junior Member

280 posts Joined: Jul 2020 |

|

|

|

Feb 22 2021, 12:36 PM Feb 22 2021, 12:36 PM

|

Junior Member

70 posts Joined: Aug 2014 |

This is very common issue, my mum has heart problem, operation before hence I never got to buy any insurance for her. Even after the special board also rejected. Any difficulty you have before you purchase rarely cover by the insurance, if you lie about it, their investigator will also find out later, if you have any hospital record at all. So no point lying.

|

|

|

Feb 22 2021, 12:38 PM Feb 22 2021, 12:38 PM

|

Junior Member

70 posts Joined: Aug 2014 |

QUOTE(panafone @ Feb 22 2021, 11:52 AM) Confirm the agent didn't declare his pre-existing condition in the application form. Change agent very easy, contact prudential HQ asking for new agent. They will send you one very fast.I bought my dad a prudential medical card in 2015, but the agent said no need to declare anything and just sign the form & he'll fill up the rest. We didn't follow his advice and declared everything. Had to do some medical checkups and they approved the application for higher contribution. for the past 3 years, my dad in and out of hospital for kidney stone also. Never had a problem claiming. Only wished we had gotten a different agent instead cos the a-hole still got his commission even tho he gave us the wrong advice. It's not the insurance co but the insurance agent. They will get you in trouble if you're not vigilant and just believe their sales pitch/lies. |

|

|

Feb 22 2021, 12:40 PM Feb 22 2021, 12:40 PM

|

Junior Member

70 posts Joined: Aug 2014 |

QUOTE(loserguy @ Feb 22 2021, 12:31 PM) From the video, Not about how long you pay bro, its about that particular health issue. Im sure in his policy, there's a clause there saying this same issue will not be covered.RM400 per month, starting 2014. Total paid = 400 x 12 x 7 = RM33.6k not including interest etc. RM26k claim rejected. Bro has got a good reason to be pissed. |

|

|

Feb 22 2021, 12:41 PM Feb 22 2021, 12:41 PM

|

All Stars

10,162 posts Joined: Nov 2014 |

It's important for the policy holder to check their policy after they've bought it to make sure the details keyed in is exactly as discussed.

Sometimes agent will left out or didn't fill up correctly. |

|

|

Feb 22 2021, 12:42 PM Feb 22 2021, 12:42 PM

|

Junior Member

241 posts Joined: May 2007 |

Sigh...very unhappy with prudential's service...very difficult to admit hosp...even the doctor screwed me..

Somemore premium increase every year although agent showed the repayment would not increase till 80yrs. |

|

|

Feb 22 2021, 12:43 PM Feb 22 2021, 12:43 PM

|

Senior Member

1,692 posts Joined: Mar 2009 From: Probation? |

AIA best got free voucher for exercising as well This post has been edited by spacelion: Feb 22 2021, 12:43 PM leah235 liked this post

|

|

|

Feb 22 2021, 12:44 PM Feb 22 2021, 12:44 PM

|

Senior Member

1,692 posts Joined: Mar 2009 From: Probation? |

QUOTE(CyrusWong @ Feb 22 2021, 12:32 PM) last year met a prudential agent promote plan to me ask for Formal Contract haha ,, they dont dare givei say i want to see the TnC, else I won't sign he say they dun have TnC, only have the handbook for customer to see plan payment illustration table, and some general TnC only |

|

|

Feb 22 2021, 12:47 PM Feb 22 2021, 12:47 PM

|

Junior Member

495 posts Joined: Apr 2009 From: The Fifth Dimension |

yes, Prudential indeed sucks when it comes to claim...

too fucking long story to explain, took us 6 months to settle, despite the seriousness of the patient condition... on a side note, their plans are indeed very good when compare against others. i did an extensive research after the above case coz i want to change to other company, end up i still stick with Prudential... but seriously fuck the claim departments. |

|

|

Feb 22 2021, 12:49 PM Feb 22 2021, 12:49 PM

|

Senior Member

5,170 posts Joined: Jul 2006 From: /k//k/, /k/undasang |

Only prudential insurance run like MLM company, their annoying sohai agents all post updates like MLM people. Success this and that, join this company la, free trip la, incentive la.

other insurance companies I dont see their agents post MLM style like prudential This post has been edited by ah_suknat: Feb 22 2021, 12:52 PM |

|

|

Feb 22 2021, 12:53 PM Feb 22 2021, 12:53 PM

|

Newbie

37 posts Joined: Jan 2019 |

QUOTE(RootOfJesse @ Feb 22 2021, 11:03 AM) On what basis were the claims rejected? Your friend is a doctor? Can also partially blame the people who tries their best to abuse the system, there is this thing about doctor pakat/kautim with patient with their "arranged" admission.But prudential really a pain in the ar*e when admitting to hosp..they will interrogate the doctors..the doctor who handles my case was totally pissed off by prudential..after all the hoo ha drama, I still manage to get the GL But goddamnit, received their sms today that my insurance premium increase by rm20 |

|

|

Feb 22 2021, 12:53 PM Feb 22 2021, 12:53 PM

|

Junior Member

500 posts Joined: Dec 2019 |

QUOTE(karazure @ Feb 22 2021, 12:40 PM) Not about how long you pay bro, its about that particular health issue. Im sure in his policy, there's a clause there saying this same issue will not be covered. I am just saying, that if he were to not pay that RM400, and just pay cash, it would probably be much easier. No claims, no medical reports, no begging from the insurance company.If I were being stubborn, I would ask the insurance agent, does he get any discounts on the premium because of all the exclusions in his policy? |

|

|

Feb 22 2021, 12:55 PM Feb 22 2021, 12:55 PM

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(RootOfJesse @ Feb 22 2021, 12:42 PM) Sigh...very unhappy with prudential's service...very difficult to admit hosp...even the doctor screwed me.. I believe you're subscribed to an investment link.Somemore premium increase every year although agent showed the repayment would not increase till 80yrs. The premium/contribution is not guaranteed to remain the same until you're x Age, the insurance company has the right to alter it by giving you a notice. What the investment link offer is a level payment on a monthly basis. RootOfJesse liked this post

|

|

|

Feb 22 2021, 12:59 PM Feb 22 2021, 12:59 PM

Show posts by this member only | IPv6 | Post

#77

|

Junior Member

168 posts Joined: May 2012 From: On bed blindfolded, with both arms and legs tied. |

i remember got 1 ktard here is prudential agent. forgot the name. mohon pencerahan pls.

|

|

|

Feb 22 2021, 01:00 PM Feb 22 2021, 01:00 PM

|

Junior Member

666 posts Joined: Oct 2017 |

That's why I don't buy insurance. Same shit saja. The money spend on whatever insurance monthly or yearly, go put in some low risk investments. Really bad luck need medical bill confirm enough cover.

If u really so lan 7 scare got cancer or kuku pecah for in predictable reasons. Go do full test full whatever test every 6 months. Still cheaper than paying insurance monthly getting nothing in return. Worst still when memang needed that insurance they reject. Chao ci bai. Same goes to those insurance agent sell an empty promise in the name of ' you are insured if u buy' |

|

|

Feb 22 2021, 01:01 PM Feb 22 2021, 01:01 PM

|

Junior Member

359 posts Joined: Jan 2015 |

ayam actually subbed to prudential since 2011, *o..shit*

|

|

|

Feb 22 2021, 01:03 PM Feb 22 2021, 01:03 PM

Show posts by this member only | IPv6 | Post

#80

|

Junior Member

772 posts Joined: Jan 2015 |

QUOTE(pot-8-O's @ Feb 22 2021, 11:05 AM) go nude je How dare she no wish u CNY... not like gon get attack on heart once cancel plan. been paying all this while but never used it once, feel like wasting money feeding the agent. didn't even wish me hepi CNY All agents same... They got new n good prospect, they will abandon the less profit one... |

|

|

Feb 22 2021, 01:07 PM Feb 22 2021, 01:07 PM

Show posts by this member only | IPv6 | Post

#81

|

Junior Member

662 posts Joined: Apr 2019 |

|

|

|

Feb 22 2021, 01:11 PM Feb 22 2021, 01:11 PM

|

Senior Member

3,810 posts Joined: Jan 2006 |

I bought aia medical.. 100k limit per year..

|

|

|

Feb 22 2021, 01:11 PM Feb 22 2021, 01:11 PM

Show posts by this member only | IPv6 | Post

#83

|

Junior Member

268 posts Joined: May 2014 |

Me using allianz, so far ok

1 million per year limit Claimed few times before This post has been edited by lorrydriverrocks: Feb 22 2021, 01:12 PM |

|

|

Feb 22 2021, 01:16 PM Feb 22 2021, 01:16 PM

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(littlegamer @ Feb 22 2021, 01:00 PM) That's why I don't buy insurance. Same shit saja. The money spend on whatever insurance monthly or yearly, go put in some low risk investments. Really bad luck need medical bill confirm enough cover. if you understand the history of how Insurance first came about, it was invented by the rich to safeguard themselves without losing too much financially.If u really so lan 7 scare got cancer or kuku pecah for in predictable reasons. Go do full test full whatever test every 6 months. Still cheaper than paying insurance monthly getting nothing in return. Worst still when memang needed that insurance they reject. Chao ci bai. Same goes to those insurance agent sell an empty promise in the name of ' you are insured if u buy' Unless you're willing to use your hard earn money to pay for unfortunate events, it'll definitely dry you up faster than if you've bought some kind of insurance. Insurance is a tool to transfer your risk to the insurance company for a fraction of the cost. If you're not leveraging on it then I guess YOLO right? |

|

|

Feb 22 2021, 01:17 PM Feb 22 2021, 01:17 PM

|

Junior Member

76 posts Joined: Aug 2006 |

I didn't know "Predator" have insurance plan

|

|

|

Feb 22 2021, 01:26 PM Feb 22 2021, 01:26 PM

Show posts by this member only | IPv6 | Post

#86

|

Junior Member

320 posts Joined: Jun 2019 |

A lot of all this claims rejection are caused by non-disclosure by buyers and agents. There are a lot of unscrupulous agents out there who misrepresented insurance policies just because they want to get the biz. Can’t really blame the insurance companies as the pay based on the terms and conditions of the policies. Always understand what you bought. Got insurance does not mean you get covered for everything. That is what a lot of people do not understand and a lot of agents failed to make them understand.That is why getting a good agent is vital as even though there are a lot of lousy agents, there are also a lot of good agents too. Changes are being introduced by Bank Negara to improve agency services. It is still work in progress but I think in the next few years, only the good agents will survive due to good service.

|

|

|

Feb 22 2021, 01:35 PM Feb 22 2021, 01:35 PM

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(Namelessone1973 @ Feb 22 2021, 01:26 PM) A lot of all this claims rejection are caused by non-disclosure by buyers and agents. There are a lot of unscrupulous agents out there who misrepresented insurance policies just because they want to get the biz. Can’t really blame the insurance companies as the pay based on the terms and conditions of the policies. Always understand what you bought. Got insurance does not mean you get covered for everything. That is what a lot of people do not understand and a lot of agents failed to make them understand.That is why getting a good agent is vital as even though there are a lot of lousy agents, there are also a lot of good agents too. Changes are being introduced by Bank Negara to improve agency services. It is still work in progress but I think in the next few years, only the good agents will survive due to good service. That's true.1. Insurance company has the duty to pay out claim if the condition meets the criteria as stipulated within the policy. 2. It's also the insurance company duty to make sure that the claims are genuine and no fraud is taking place; the insurance company has shareholders and other policy owners as stakeholders, you also don't want the insurance company to make payout for a fraudulent claim. Otherwise as a shareholder, you'll be losing investment returns whereas policy owners will face repricing of their premium. 3. It's true that BNM has step up their game to make sure agents are more professional with lesser chance to do this career as "part-time". However , there are still agents who will do the shortcut way or the illegal way. Just a matter of who you engage with. This post has been edited by lifebalance: Feb 22 2021, 01:37 PM |

|

|

Feb 22 2021, 01:35 PM Feb 22 2021, 01:35 PM

|

Junior Member

500 posts Joined: Dec 2019 |

QUOTE(lifebalance @ Feb 22 2021, 01:16 PM) if you understand the history of how Insurance first came about, it was invented by the rich to safeguard themselves without losing too much financially. Sorry, but I have to disagree. Insurance was originally intended for businesses to smooth the cashflow. Unless you're willing to use your hard earn money to pay for unfortunate events, it'll definitely dry you up faster than if you've bought some kind of insurance. Insurance is a tool to transfer your risk to the insurance company for a fraction of the cost. If you're not leveraging on it then I guess YOLO right? https://en.wikipedia.org/wiki/History_of_insurance A person rich enough to afford the medical expenses should not buy medical insurance. Statistically the odds are stacked against you. If that were not the case, insurance companies would go bankrupt from losing money. Never use medical insurance for leverage. If you cannot afford the medical fees and need the insurance, please pray that you never need to claim that insurance. |

|

|

Feb 22 2021, 01:40 PM Feb 22 2021, 01:40 PM

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(loserguy @ Feb 22 2021, 01:35 PM) Sorry, but I have to disagree. Insurance was originally intended for businesses to smooth the cashflow. https://en.wikipedia.org/wiki/History_of_insurance A person rich enough to afford the medical expenses should not buy medical insurance. Statistically the odds are stacked against you. If that were not the case, insurance companies would go bankrupt from losing money. Never use medical insurance for leverage. If you cannot afford the medical fees and need the insurance, please pray that you never need to claim that insurance. |

|

|

Feb 22 2021, 02:13 PM Feb 22 2021, 02:13 PM

|

Junior Member

666 posts Joined: Oct 2017 |

QUOTE(lifebalance @ Feb 22 2021, 01:16 PM) if you understand the history of how Insurance first came about, it was invented by the rich to safeguard themselves without losing too much financially. Seriously, how high are the chance u get life threatening disease? And often when ppl have cancer or anything tragic to your life, I'd doubt the reimbursement will cover/ cover enough. Unless you're willing to use your hard earn money to pay for unfortunate events, it'll definitely dry you up faster than if you've bought some kind of insurance. Insurance is a tool to transfer your risk to the insurance company for a fraction of the cost. If you're not leveraging on it then I guess YOLO right? Thus I mention, if u are so sacred of all these unforseen things, go do check up every 6months. Is a frequent enough time frame to discover any early symptoms. The point of insurance is never to protect u. It to buy a sense of security. This post has been edited by littlegamer: Feb 22 2021, 02:36 PM |

|

|

Feb 22 2021, 02:38 PM Feb 22 2021, 02:38 PM

|

Senior Member

719 posts Joined: Jul 2011 |

QUOTE(RootOfJesse @ Feb 22 2021, 11:03 AM) On what basis were the claims rejected? Your friend is a doctor? can like that meh? change of terms can do by sms ke?But prudential really a pain in the ar*e when admitting to hosp..they will interrogate the doctors..the doctor who handles my case was totally pissed off by prudential..after all the hoo ha drama, I still manage to get the GL But goddamnit, received their sms today that my insurance premium increase by rm20 |

|

|

Feb 22 2021, 02:41 PM Feb 22 2021, 02:41 PM

Show posts by this member only | IPv6 | Post

#92

|

Senior Member

1,892 posts Joined: Jun 2011 |

|

|

|

Feb 22 2021, 02:49 PM Feb 22 2021, 02:49 PM

|

Newbie

33 posts Joined: Aug 2012 |

|

|

|

Feb 22 2021, 02:53 PM Feb 22 2021, 02:53 PM

Show posts by this member only | IPv6 | Post

#94

|

Junior Member

320 posts Joined: Jun 2019 |

QUOTE(littlegamer @ Feb 22 2021, 02:13 PM) Seriously, how high are the chance u get life threatening disease? And often when ppl have cancer or anything tragic to your life, I'd doubt the reimbursement will cover/ cover enough. Insurance is like buying lottery except that you do not want to kena this lottery. You are buying protection just in case something bad happens. It might not even be for you but for you family. There’s no right or wrong about buying insurance. Just be sure of why you buy and clear about what you want to be covered.Thus I mention, if u are so sacred of all these unforseen things, go do check up every 6months. Is a frequent enough time frame to discover any early symptoms. The point of insurance is never to protect u. It to buy a sense of security. A lot of people have the same mentality like you where they think the odds of getting life threatening disease is low when they are young. Even if you do check up every month or have a healthy lifestyle, there is no guarantee you won’t get disease later when you’re older. A lot of people regret not getting insurance later in their life when they need it the most. When they need to chalk up huge medical bills, they will then say why did I not buy insurance earlier? When you need to dive into your retirement savings for medical bills, then you’ll know the pain. Insurance might not cover all but it helps alleviate the monetary pain. A lot of people complain about claiming from Prudential is difficult but it is actually something good to the industry. One of the reason why medical inflation is happening is caused by easy insurance claims. Private medical centres will simply charge everything if they know you have insurance. Try comparing a bill without insurance and with insurance charged by private hospitals. You will see a clear markup when there is insurance. In the long run, this is the reason why private medical services is getting more costly. jojolicia liked this post

|

|

|

Feb 22 2021, 03:02 PM Feb 22 2021, 03:02 PM

Show posts by this member only | IPv6 | Post

#95

|

Junior Member

386 posts Joined: Sep 2020 |

I only have insurance from my company.

Dont kecam me and agents please dont PM me Im not interested in getting personal insurance |

|

|

Feb 22 2021, 03:09 PM Feb 22 2021, 03:09 PM

|

Junior Member

221 posts Joined: May 2017 |

even lamtin r saintner compare to em

|

|

|

Feb 22 2021, 03:17 PM Feb 22 2021, 03:17 PM

Show posts by this member only | IPv6 | Post

#97

|

Senior Member

3,348 posts Joined: May 2006 From: The Matrix |

Ini semua agent punya pasal la nih

|

|

|

Feb 22 2021, 03:20 PM Feb 22 2021, 03:20 PM

Show posts by this member only | IPv6 | Post

#98

|

Junior Member

70 posts Joined: Apr 2020 |

|

|

|

Feb 22 2021, 03:22 PM Feb 22 2021, 03:22 PM

|

Junior Member

170 posts Joined: Jan 2014 |

|

|

|

Feb 22 2021, 03:30 PM Feb 22 2021, 03:30 PM

Show posts by this member only | IPv6 | Post

#100

|

Junior Member

666 posts Joined: Oct 2017 |

QUOTE(Namelessone1973 @ Feb 22 2021, 02:53 PM) Insurance is like buying lottery except that you do not want to kena this lottery. You are buying protection just in case something bad happens. It might not even be for you but for you family. There’s no right or wrong about buying insurance. Just be sure of why you buy and clear about what you want to be covered. Then don't go private then. If really is so bad u need a lungs transplant or a quarter of kidney, or u need some synaptic nerves connection. Any major shit that u needed a huge sum amount to fix yet u won't be original after you have heal is something even with money cant solve. A lot of people have the same mentality like you where they think the odds of getting life threatening disease is low when they are young. Even if you do check up every month or have a healthy lifestyle, there is no guarantee you won’t get disease later when you’re older. A lot of people regret not getting insurance later in their life when they need it the most. When they need to chalk up huge medical bills, they will then say why did I not buy insurance earlier? When you need to dive into your retirement savings for medical bills, then you’ll know the pain. Insurance might not cover all but it helps alleviate the monetary pain. A lot of people complain about claiming from Prudential is difficult but it is actually something good to the industry. One of the reason why medical inflation is happening is caused by easy insurance claims. Private medical centres will simply charge everything if they know you have insurance. Try comparing a bill without insurance and with insurance charged by private hospitals. You will see a clear markup when there is insurance. In the long run, this is the reason why private medical services is getting more costly. If I have such issues after frequent check up, then no regrets. I will just ask for pain killers and let me pass in peace. What's the point living fighting an illness that it cripple me to a point even after recovery my life is still affected, not to mention my family side. People will go buy insurance with a high premium, smoking and drinking every possible chance they get, never look after their weight. And junk up their stomach everytime they have chance to enjoy good food. To me they are like have bad body odor instead of having a shower frequently, they go buy excessive amount of perfume to mask out the smell. To me this is something just crazy... That said if u have known to have weaker body, susceptible to normal Illness very frequently, chances are they might have more severe condition as they age. In such case get insurance by all means. Else taking carew what u eat and sleep well goes a long way. |

|

|

Feb 22 2021, 03:31 PM Feb 22 2021, 03:31 PM

|

Junior Member

98 posts Joined: Jul 2015 |

Insurance mmg one fuk up system .

The more honest the agent is , the more likely that he will lose the sales . Just about tells you everything |

|

|

Feb 22 2021, 03:32 PM Feb 22 2021, 03:32 PM

|

Junior Member

185 posts Joined: May 2007 |

rejecting heart treatment due to kidney stone? how? why?

|

|

|

Feb 22 2021, 03:35 PM Feb 22 2021, 03:35 PM

Show posts by this member only | IPv6 | Post

#103

|

Junior Member

486 posts Joined: Dec 2013 |

That is why BNM need too regulate..imposetime bar on previous illness..

if the disease healed or treated for more than let say 8 yrs.. the exemption clause should not be used.. ini penyakit 20 years ago pun nak relate back to current illness.. but every year always do marketing no medical chack promotion. puihhh.. brb.. terminating my prudential |

|

|

Feb 22 2021, 03:55 PM Feb 22 2021, 03:55 PM

Show posts by this member only | IPv6 | Post

#104

|

Junior Member

175 posts Joined: Nov 2020 |

most b40 in this country dont have personal insurance and cant afford it. rilek je. janji maruah bangsa dipertahankan.

|

|

|

Feb 22 2021, 04:12 PM Feb 22 2021, 04:12 PM

|

Junior Member

320 posts Joined: Jun 2019 |

QUOTE(littlegamer @ Feb 22 2021, 03:30 PM) Then don't go private then. If really is so bad u need a lungs transplant or a quarter of kidney, or u need some synaptic nerves connection. Any major shit that u needed a huge sum amount to fix yet u won't be original after you have heal is something even with money cant solve. People go to private because they can get instant care. That is something government hospitals cannot give you. I am not saying government hospitals are lousy but government hospitals are usually overwhelmed with patients. If I have such issues after frequent check up, then no regrets. I will just ask for pain killers and let me pass in peace. What's the point living fighting an illness that it cripple me to a point even after recovery my life is still affected, not to mention my family side. People will go buy insurance with a high premium, smoking and drinking every possible chance they get, never look after their weight. And junk up their stomach everytime they have chance to enjoy good food. To me they are like have bad body odor instead of having a shower frequently, they go buy excessive amount of perfume to mask out the smell. To me this is something just crazy... That said if u have known to have weaker body, susceptible to normal Illness very frequently, chances are they might have more severe condition as they age. In such case get insurance by all means. Else taking carew what u eat and sleep well goes a long way. Insurance covers all sorts of things. My wife had complications after giving birth. So, according to you, I should just let her suffer and and let her pass in peace? Thanks to insurance, all her medical bills were covered. The total cost reach nearly 20K. Yes, I can afford it but it will be a big pain to my pocket. You are young, strong without responsibilities now. You can easily say things like this but wait until you reach certain age, then you'll know. Let's see whether you'll say the same thing when someone you care like your parents or siblings suffers from disease or have an accident. Will you also say just let them die in peace? No point saving them anymore as after surgery nothing is original anymore. Nobody ask you to abuse your health after getting insurance. Nobody is so stupid to want to screw up their own health. Even if you practise super healthy lifestyle, there is no guarantee you won't get disease or accidents. There are so many people who are super fit and healthy suddenly fall ill or die. Insurance is just a protection. It is not only for yourself but your loved ones as well. namealreadytaken liked this post

|

|

|

Feb 22 2021, 04:17 PM Feb 22 2021, 04:17 PM

|

Junior Member

320 posts Joined: Jun 2019 |

QUOTE(gogocan @ Feb 22 2021, 03:35 PM) That is why BNM need too regulate..imposetime bar on previous illness.. If the person disclose his 20 years ago illness openly, he'll not face any problem with claims. No medical check up is to encourage more people to take up insurance. However, a lot of people especially under advise for unscrupulous agents do not disclose their real medical conditions which resulted in complication when claiming.if the disease healed or treated for more than let say 8 yrs.. the exemption clause should not be used.. ini penyakit 20 years ago pun nak relate back to current illness.. but every year always do marketing no medical chack promotion. puihhh.. brb.. terminating my prudential |

|

|

Feb 22 2021, 04:44 PM Feb 22 2021, 04:44 PM

Show posts by this member only | IPv6 | Post

#107

|

Junior Member

666 posts Joined: Oct 2017 |

QUOTE(Namelessone1973 @ Feb 22 2021, 04:12 PM) People go to private because they can get instant care. That is something government hospitals cannot give you. I am not saying government hospitals are lousy but government hospitals are usually overwhelmed with patients. Calculate yourself how much insurance u have paid before hand to get 20k reimbursement? If u have save just rm200 per month that would have been easily covered. Insurance covers all sorts of things. My wife had complications after giving birth. So, according to you, I should just let her suffer and and let her pass in peace? Thanks to insurance, all her medical bills were covered. The total cost reach nearly 20K. Yes, I can afford it but it will be a big pain to my pocket. You are young, strong without responsibilities now. You can easily say things like this but wait until you reach certain age, then you'll know. Let's see whether you'll say the same thing when someone you care like your parents or siblings suffers from disease or have an accident. Will you also say just let them die in peace? No point saving them anymore as after surgery nothing is original anymore. Nobody ask you to abuse your health after getting insurance. Nobody is so stupid to want to screw up their own health. Even if you practise super healthy lifestyle, there is no guarantee you won't get disease or accidents. There are so many people who are super fit and healthy suddenly fall ill or die. Insurance is just a protection. It is not only for yourself but your loved ones as well. U are right no one wants to screw their own health, but ppl cna go as far as no taking care their own is beyond me. I won't buy insurance for my family. They all know, if they deem it worthy by all means go for it. For me I'm not buying. If I die the next day, even at my age young and healthy, if I married next 3 years and I sudden death, I have enough amount to let my spouse inherit to an extensive amount. I rather have my own cash by not buying insurance. Worst when u buy insurance kena reject when u really need it. |

|

|

Feb 22 2021, 05:08 PM Feb 22 2021, 05:08 PM

Show posts by this member only | IPv6 | Post

#108

|

Senior Member

2,173 posts Joined: Jan 2012 From: Butterworth, Penang |

As to why the claim was rejected, only the customer, agent and Prudential will know.

There are legal avenues for disputing the claim if he feels that Prudential had rejected his claim blindly. The insurer will not simply reject the claim if it has no basis for rejecting the claim. Since it is a financial product and a legal contract that is bounded by terms and conditions. Eg, go swipe your credit card and don’’t pay on time. You can’t claim that the agent did not inform you right? One of the most basic and important T&C in insurance is that all insurer will not pay for any Pre-Existing illness if it has not been made known to the insurer during the Medical Underwriting process. Otherwise everyone will just wait until cancer were to occur before even finding an insurance. There is also a poster that commented that 90% of the claims in hospital is rejected by Prudential. If that is the case then why make a dupe to comment and why Prudential is still accepted in most private hospitals? |

|

|

Feb 22 2021, 05:12 PM Feb 22 2021, 05:12 PM

|

Junior Member

320 posts Joined: Jun 2019 |

QUOTE(littlegamer @ Feb 22 2021, 04:44 PM) Calculate yourself how much insurance u have paid before hand to get 20k reimbursement? If u have save just rm200 per month that would have been easily covered. It's up to you if you don't want any insurance but to call insurance as totally useless is just not right. I buy insurance and might not even use a single sen until I die but I will not say it's a complete waste of money as I feel more assured that if something happens to me, I have some sort of protection. Like I say before a lot of people are thankful of insurance. You keep hearing case of insurance getting reject but there are millions of insurance claims approved where people do not highlight. U are right no one wants to screw their own health, but ppl cna go as far as no taking care their own is beyond me. I won't buy insurance for my family. They all know, if they deem it worthy by all means go for it. For me I'm not buying. If I die the next day, even at my age young and healthy, if I married next 3 years and I sudden death, I have enough amount to let my spouse inherit to an extensive amount. I rather have my own cash by not buying insurance. Worst when u buy insurance kena reject when u really need it. You keep thinking about death but there are incidents where you are permanently disabled or suffering from long term illness. Like I say before, you might be super fit and healthy but nobody can predict the future. What happened if you suddenly suffer from some accident and permanently disabled. None of your family members will give up on you. Your mentality shows that you are still young and without any responsibilities. Wait until you really get married and have children or wait until your parents are older and start to have health problems. Let's see whether you will still say I will let my spouse enherit an extensive amount. Youngsters nowadays seems to think they can easily become millionaires. NB01 liked this post

|

|

|

Feb 22 2021, 05:20 PM Feb 22 2021, 05:20 PM

|

Junior Member

175 posts Joined: Nov 2020 |

rilex. if b40 can survive should be no problem.

just apply this. free of charge. https://www.pekab40.com.my/bm/soalan-lazim |

|

|

Feb 22 2021, 05:36 PM Feb 22 2021, 05:36 PM

Show posts by this member only | IPv6 | Post

#111

|

Junior Member

666 posts Joined: Oct 2017 |

QUOTE(Namelessone1973 @ Feb 22 2021, 05:12 PM) It's up to you if you don't want any insurance but to call insurance as totally useless is just not right. I buy insurance and might not even use a single sen until I die but I will not say it's a complete waste of money as I feel more assured that if something happens to me, I have some sort of protection. Like I say before a lot of people are thankful of insurance. You keep hearing case of insurance getting reject but there are millions of insurance claims approved where people do not highlight. So. U just prove my point. Insurance is for your sense of security. To feel safe. Shit happens in life, an insurance didn't change the outcome of it dosent it?You keep thinking about death but there are incidents where you are permanently disabled or suffering from long term illness. Like I say before, you might be super fit and healthy but nobody can predict the future. What happened if you suddenly suffer from some accident and permanently disabled. None of your family members will give up on you. Your mentality shows that you are still young and without any responsibilities. Wait until you really get married and have children or wait until your parents are older and start to have health problems. Let's see whether you will still say I will let my spouse enherit an extensive amount. Youngsters nowadays seems to think they can easily become millionaires. Having those money and whatever plans go to insurance would have better use elsewhere. If u are so so so so so afraid of the miniscule chance u might die or disable for life, heres a free advice, go buy a car with highest safety standard and u drive below speed limit. U can die/ handicap from automobile accident more than illnesses even if u do regular check up. And even if u have the safest car, no one is going to guarantee u won't get hit by a truck going stray. There is so much u can do to prevent to migitate the ' what if' in life. Back to insurance, so why being so afraid in the first place? Well maybe because thats what insurance agent like about ppl like u. There are tonnes and tonnes of way to secure or even outright reduce the chance but hey, gonna use a strong perfume for bad odour instead of shower isnt it? Boomer like u don't know how to earn and playing the safe game knows nothing about risk. What's the point living afraid this that, cover the ground, have some security on this that. Why not earn more income, find a job that cover u and your children insurance (woahhh mind blown). If u like it go ahead, there isn't right or wrong. To me is a complete waste of money, having your families or spouse inherit enough in case anything happens to me is better than buying this that to cover up the if where the chances is so small. If you really really betting on u will need the insurance claim, might as well start buying lottery. The chances u ever need the money from insurance is almost the same chance as winning 4D, perhaps 4D might be higher. Having u said u get to claim 20k (such a small amount), is like some living changing event actually just prove u yourself aren't prepared. Like I said, saving rm200 per month in fixed deposit would have enough just over the span of few years. But hey insurance is safety bro. Alright u do u. This post has been edited by littlegamer: Feb 22 2021, 05:47 PM |

|

|

Feb 22 2021, 05:56 PM Feb 22 2021, 05:56 PM

|

Junior Member

270 posts Joined: Sep 2016 From: Penang lo |

well... if reject, need to find out why... if reject without reason goto consumer court high chance to win.

medical insurance, is an assurance to doctor that they will receive money saving, is an assurance that when matured you receive money life, is an assurance that your next of kin receive money depending on what you want / need though. |

|

|

Feb 22 2021, 06:16 PM Feb 22 2021, 06:16 PM

Show posts by this member only | IPv6 | Post

#113

|

Junior Member

320 posts Joined: Jun 2019 |

QUOTE(littlegamer @ Feb 22 2021, 05:36 PM) So. U just prove my point. Insurance is for your sense of security. To feel safe. Shit happens in life, an insurance didn't change the outcome of it dosent it? You still don’t get the purpose of insurance. To you it’s a waste of money as your are young and mighty. Can take on the world. Can easily make money through your investments and live comfortably for the rest of your life. Maybe you can but to a lot of people, they can’t and that is where insurance comes in. Even the rich and famous people buy insurance. Are they all stupid?Having those money and whatever plans go to insurance would have better use elsewhere. If u are so so so so so afraid of the miniscule chance u might die or disable for life, heres a free advice, go buy a car with highest safety standard and u drive below speed limit. U can die/ handicap from automobile accident more than illnesses even if u do regular check up. And even if u have the safest car, no one is going to guarantee u won't get hit by a truck going stray. There is so much u can do to prevent to migitate the ' what if' in life. Back to insurance, so why being so afraid in the first place? Well maybe because thats what insurance agent like about ppl like u. There are tonnes and tonnes of way to secure or even outright reduce the chance but hey, gonna use a strong perfume for bad odour instead of shower isnt it? Boomer like u don't know how to earn and playing the safe game knows nothing about risk. What's the point living afraid this that, cover the ground, have some security on this that. Why not earn more income, find a job that cover u and your children insurance (woahhh mind blown). If u like it go ahead, there isn't right or wrong. To me is a complete waste of money, having your families or spouse inherit enough in case anything happens to me is better than buying this that to cover up the if where the chances is so small. If you really really betting on u will need the insurance claim, might as well start buying lottery. The chances u ever need the money from insurance is almost the same chance as winning 4D, perhaps 4D might be higher. Having u said u get to claim 20k (such a small amount), is like some living changing event actually just prove u yourself aren't prepared. Like I said, saving rm200 per month in fixed deposit would have enough just over the span of few years. But hey insurance is safety bro. Alright u do u. Today I managed to claim 20k. I might not claim again for the rest of my life but if unfortunately, I might need to claim again when I have already retired with no steady income. 20k to you now might seems like peanuts but when you’re old and without income, then you see whether 20k is a big deal or not. Like I say before, your mentality will change when you’re older, married and have children. Youngsters like you are super clever about taking risks. Always think boomers don’t know about risks. You all forgot that all boomers were young before and they have experienced all sorts of ups and downs before. Don’t cry to mommy daddy when they need to bail you out 😀 |

|

|

Feb 22 2021, 06:21 PM Feb 22 2021, 06:21 PM

Show posts by this member only | IPv6 | Post

#114

|

Junior Member

175 posts Joined: Nov 2020 |

relax guys.

just exercise regularly. god willing nothing happens to you. |

|

|

Feb 22 2021, 06:21 PM Feb 22 2021, 06:21 PM

Show posts by this member only | IPv6 | Post

#115

|

Senior Member

1,924 posts Joined: Feb 2016 |

QUOTE(littlegamer @ Feb 22 2021, 04:44 PM) Calculate yourself how much insurance u have paid before hand to get 20k reimbursement? If u have save just rm200 per month that would have been easily covered. My sole reason of buying myself a medical card is to not burden financially any of my family members, should I one day require medical cost/ surgery/ hospitalization.U are right no one wants to screw their own health, but ppl cna go as far as no taking care their own is beyond me. I won't buy insurance for my family. They all know, if they deem it worthy by all means go for it. For me I'm not buying. If I die the next day, even at my age young and healthy, if I married next 3 years and I sudden death, I have enough amount to let my spouse inherit to an extensive amount. I rather have my own cash by not buying insurance. Worst when u buy insurance kena reject when u really need it. I am responsible to my own medical welfare. Not the one that pass on the bug type, tak kesah. Second reason, I pay my medical card to protect my wealth. I wish to pass on my wealth bulat bulat to my family and not using it to pay my medical cost. Just me. This post has been edited by jojolicia: Feb 22 2021, 06:25 PM |

|

|

Feb 22 2021, 06:22 PM Feb 22 2021, 06:22 PM

|

Senior Member

2,834 posts Joined: Jul 2006 From: here |

QUOTE(Lyu @ Feb 22 2021, 02:03 PM) How dare she no wish u CNY... my agent mia for 13 years. No courtesy call /contact me to remind me my policy due . Zero effort to reach out. All agents same... They got new n good prospect, they will abandon the less profit one... Last year suddenly received msg from her promoting new scheme upgrade policy , top up $$$. Business muz be real bad till like this. |

|

|

Feb 22 2021, 06:40 PM Feb 22 2021, 06:40 PM

|

Junior Member

500 posts Joined: Dec 2019 |

QUOTE(jojolicia @ Feb 22 2021, 06:21 PM) My sole reason of buying myself a medical card is to not burden financially any of my family members, should I one day require medical cost/ surgery/ hospitalization. I would say, please do the math. You are not passing on your wealth bulat-bulat. Part of your wealth is going to the insurance company. Calculate the amount over the course of your life. How much will you get over the years if you place it into the EPF? It is not negligible. I am responsible to my own medical welfare. Not the one that pass on the bug type, tak kesah. Second reason, I pay my medical card to protect my wealth. I wish to pass on my wealth bulat bulat to my family and not using it to pay my medical cost. Just me. The insurance companies have already done the math. The total amount the average consumer pays will always be more than what the insurance pays out. If you can afford it, forget the medical insurance. How much is enough? How much is your insurance coverage? |

|

|

Feb 22 2021, 07:09 PM Feb 22 2021, 07:09 PM

Show posts by this member only | IPv6 | Post

#118

|

Junior Member

666 posts Joined: Oct 2017 |

QUOTE(Namelessone1973 @ Feb 22 2021, 06:16 PM) You still don’t get the purpose of insurance. To you it’s a waste of money as your are young and mighty. Can take on the world. Can easily make money through your investments and live comfortably for the rest of your life. Maybe you can but to a lot of people, they can’t and that is where insurance comes in. Even the rich and famous people buy insurance. Are they all stupid? The fact u think that getting matured means to buy insurance just prove u are just some boomer. Rich ppl buy insurance means they are right? Today I managed to claim 20k. I might not claim again for the rest of my life but if unfortunately, I might need to claim again when I have already retired with no steady income. 20k to you now might seems like peanuts but when you’re old and without income, then you see whether 20k is a big deal or not. Like I say before, your mentality will change when you’re older, married and have children. Youngsters like you are super clever about taking risks. Always think boomers don’t know about risks. You all forgot that all boomers were young before and they have experienced all sorts of ups and downs before. Don’t cry to mommy daddy when they need to bail you out 😀 With your logic Rich ppl make money to buy insurance why don't u, why don't u also be rich like rich ppl? U can learn to buy insurance like rich but can't be rich like them? Your argument is completely flawed. U can't even agree that saving rm 200 for few years will get your 20k covered. I don't know sounds like someone fail math during standard 6 but talk like it has maturity. Any dumb insurance plan also cost rm200.. The premium one might be even higher. Go learn how to save rm200 per month instead of clinging to the idea insurance make u safe. A father that can't pull 20k cash to me that just sounds irresponsible in many level. Knowing your kid is growing up and starting a family. I don't need cry mommy and daddy to bail. Cuz unlike u being a irresponsible dad, my parents and family take care their own health, and have emergency plans for everything including medical. They don't buy a security. That 'HAVE' security. Me being so young already have the same security just shows u might be too reliant on insurance. This post has been edited by littlegamer: Feb 22 2021, 07:17 PM |

|

|

Feb 22 2021, 07:30 PM Feb 22 2021, 07:30 PM

Show posts by this member only | IPv6 | Post

#119

|

Junior Member

154 posts Joined: Aug 2008 |

Ohh no I just upgraded my Prudential medical card to premium

This post has been edited by Ahsin1987: Feb 22 2021, 07:31 PM |

|

|

Feb 22 2021, 07:40 PM Feb 22 2021, 07:40 PM

|

Junior Member

18 posts Joined: Aug 2016 |

Cancelling mine now...

|

|

|

Feb 22 2021, 07:41 PM Feb 22 2021, 07:41 PM

Show posts by this member only | IPv6 | Post

#121

|

Junior Member

320 posts Joined: Jun 2019 |

QUOTE(littlegamer @ Feb 22 2021, 07:09 PM) The fact u think that getting matured means to buy insurance just prove u are just some boomer. Rich ppl buy insurance means they are right? See you assume I am poor and can't even save RM200. Youngsters like you assume too much and think they know everything about the world. With your logic Rich ppl make money to buy insurance why don't u, why don't u also be rich like rich ppl? U can learn to buy insurance like rich but can't be rich like them? Your argument is completely flawed. U can't even agree that saving rm 200 for few years will get your 20k covered. I don't know sounds like someone fail math during standard 6 but talk like it has maturity. Any dumb insurance plan also cost rm200.. The premium one might be even higher. Go learn how to save rm200 per month instead of clinging to the idea insurance make u safe. A father that can't pull 20k cash to me that just sounds irresponsible in many level. Knowing your kid is growing up and starting a family. I don't need cry mommy and daddy to bail. Cuz unlike u being a irresponsible dad, my parents and family take care their own health, and have emergency plans for everything including medical. They don't buy a security. That 'HAVE' security. Me being so young already have the same security just shows u might be too reliant on insurance. Nobody is clinging to insurance to make themselves safe. This shows that you know nothing about insurance at all. Why does insurance exist in the first place? Why there are so many types of insurance in the world. Your knowledge about insurance shows that you only know only a little bit about life insurance. Basically, you know nothing at all but pretends to be expert in insurance. All I want to say is I hope your family stay healthy forever. I hope your family emergency funds will be enough for your mom, dads and your siblings. Good luck to you Mr big shot super investor with big security in the future. nugget_piece, ajaibman, and 1 other liked this post

|

|

|

Feb 22 2021, 07:41 PM Feb 22 2021, 07:41 PM

Show posts by this member only | IPv6 | Post

#122

|

Senior Member

2,531 posts Joined: Feb 2009 From: Land below the wind |

|

|

|

Feb 22 2021, 07:48 PM Feb 22 2021, 07:48 PM

Show posts by this member only | IPv6 | Post

#123

|

Junior Member

666 posts Joined: Oct 2017 |

QUOTE(Namelessone1973 @ Feb 22 2021, 07:41 PM) See you assume I am poor and can't even save RM200. Youngsters like you assume too much and think they know everything about the world. Good for you.Nobody is clinging to insurance to make themselves safe. This shows that you know nothing about insurance at all. Why does insurance exist in the first place? Why there are so many types of insurance in the world. Your knowledge about insurance shows that you only know only a little bit about life insurance. Basically, you know nothing at all but pretends to be expert in insurance. All I want to say is I hope your family stay healthy forever. I hope your family emergency funds will be enough for your mom, dads and your siblings. Good luck to you Mr big shot super investor with big security in the future. |

|

|

Feb 22 2021, 07:53 PM Feb 22 2021, 07:53 PM

|

Junior Member

144 posts Joined: Sep 2005 From: Serdang, KL |

QUOTE(littlegamer @ Feb 22 2021, 07:48 PM) dude, insurance are for poor fags like us. because anything happen to us, dunno how our kids wanna survive. iIf u sick and u die straight away is the best case scenario. the worst case is you still alive, but u cant work. then shit hits the fan. high keras, lotsa-bling bling people like u, no need buy insurance also nvm la. at least something bad happen u can still cover. |

|

|

Feb 22 2021, 08:13 PM Feb 22 2021, 08:13 PM

|

Junior Member

112 posts Joined: Jun 2019 |

I rather go public hospital than paying money to this stupid scams

|

|

|

Feb 22 2021, 08:17 PM Feb 22 2021, 08:17 PM

Show posts by this member only | IPv6 | Post

#126

|

Junior Member

666 posts Joined: Oct 2017 |

QUOTE(judas @ Feb 22 2021, 07:53 PM) dude, insurance are for poor fags like us. because anything happen to us, dunno how our kids wanna survive. i Nope not some rich guy here, unlike some uncle here claim that he is rich and so mature because he buy insurance. If u sick and u die straight away is the best case scenario. the worst case is you still alive, but u cant work. then shit hits the fan. high keras, lotsa-bling bling people like u, no need buy insurance also nvm la. at least something bad happen u can still cover. I think anyone should have the life expenses covered or working towards that. If seriously so bad luck end up become like plant can't even say: I don't want the meds like me die instead. Too bad la can't even decide that yourself. Not to mention the chances of that happening is so so so low. Like what I said, if we bet on something so low chance will happen and get covered, why not buy lottery instead? Not like the imburse amount gonna get rid of the bad outcome completely. If u are dead, u are dead. Don't give meaning to it like :' ohh I should have some safeguard for my family, I should have love my cats more' etc etc only the living suffers, the dead don't have the mind to think. While human is still alive, there are many things we can do, and I don't mean Yolo. Shouldn't go afraid this that knowing uncertainty is certain. Do what u can and must, and I don't find insurance is the way to. |

|

|

Feb 22 2021, 08:18 PM Feb 22 2021, 08:18 PM

|

Junior Member

500 posts Joined: Dec 2019 |

|

|

|

Feb 22 2021, 08:22 PM Feb 22 2021, 08:22 PM