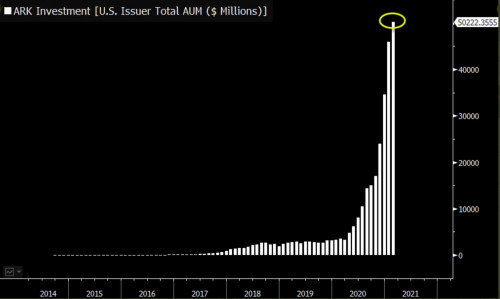

My intent is not to target Cathie Wood or the ARK team personally. I very much enjoy their work, think their analysts are incredibly unique thinkers, and have enjoyed learning from them over the years. But Cathie's commentary on bitcoin today is easily, verifiably false and demands a fact-check.

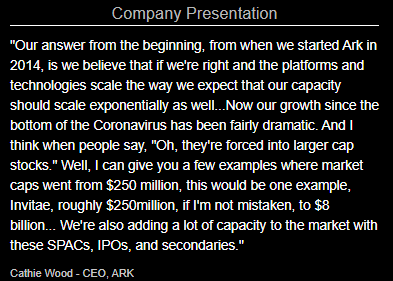

Here is the explanation she gave my former Bloomberg colleague Carol Massar today on why bitcoin's dropping:

"I think we're in a risk-off period, for all assets. If you look at the stock market, the more risky or more volatile parts of the stock market have come in dramatically since mid-February, and I think a lot of the concerns have been around inflation. Initially that was helping bitcoin, as bitcoin is a very important inflation hedge... but I think what's happening right now is because the stock market -- the highly volatile part of the stock market, the innovation part of the stock market -- has gone through such a correction, which has been inflamed by inflation fears, I think the correlation among volatile assets is going to 1 right now and that includes bitcoin."

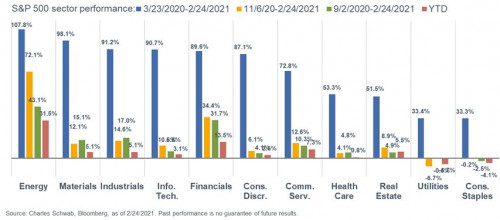

A risk-off period for all assets? Not even close.

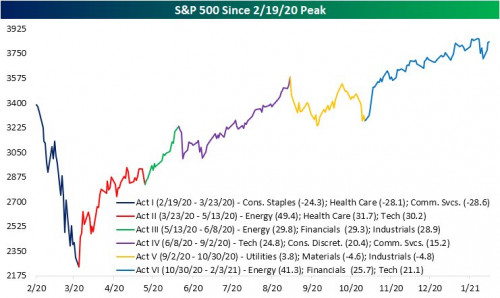

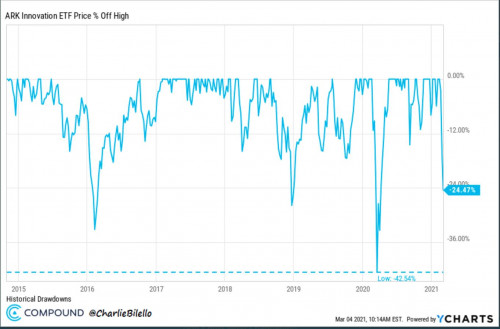

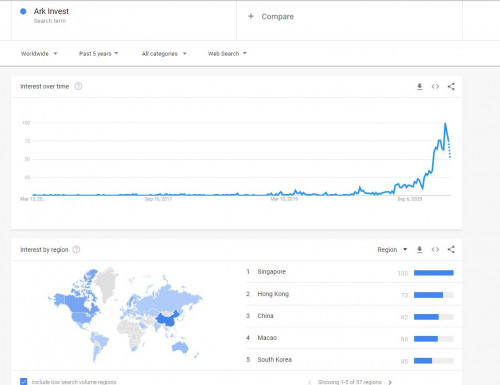

The Nasdaq has indeed been under some pressure, and inflation is certainly the talk of the town, but there is no broad de-risking happening in the market, according to the data so far. Cathie's arguing that bitcoin is down because investors are in a risk-off period of selling and that correlations across assets are rising. Such events do happen, and the Covid selloff in March last year was a perfect example. This market today is going through something very different: a steady, specific selection process of weeding out trades that investors don't think will work in a reflationary, growth-positive economic environment. There is no sign of widespread panic. A ton of stocks are at all-time highs. The stuff that's going down is the result of deliberate selection, not panic.

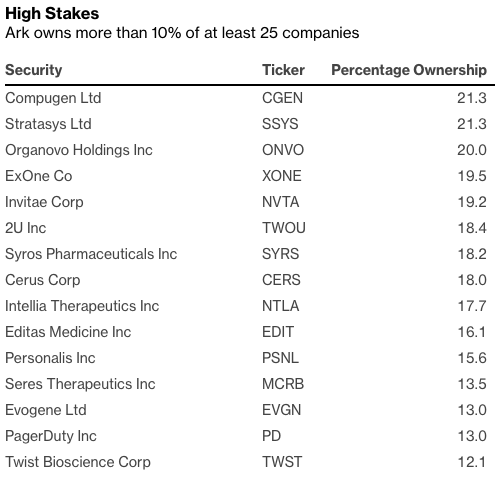

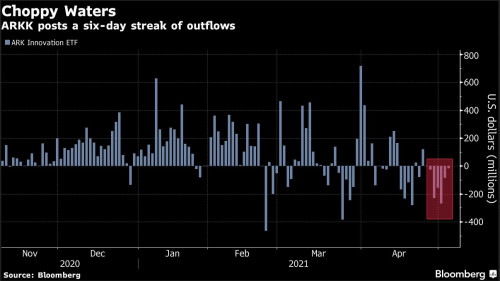

Since it's been almost exactly a month since bitcoin and the Nasdaq's highs, I used 30-day correlations to assess the veracity of her statement, and there's just no truth to it. No unusually high correlation between bitcoin and the Nasdaq, the S&P 500, not to FANG, growth funds, chipmakers, not even to the ARKK fund itself! The 30-day correlation of bitcoin to all these things did go to 1 in March last year. Today, they're all between 0 and 0.5.

It's not even true if you isolate the comparison to high-growth companies as she implies. In March last year, bitcoin's correlation to ARK hit 0.97. Today it's 0.6. Last year bitcoin's correlation to the SPDR growth fund hit 0.95; today's is 0.51. Its correlation To the Nasdaq: 0.94 vs 0.59 today. To the S&P 500: 0.97 vs 0.11. If selling gets severe, could we get a high-correlation selloff? For sure, but that won't explain why bitcoin's already been cut in half.

It also doesn't matter what correlation length you pick. Since Cathie cited mid-February, let's look at a 90-day correlations between "innovation tech" (ARKK) and bitcoin:

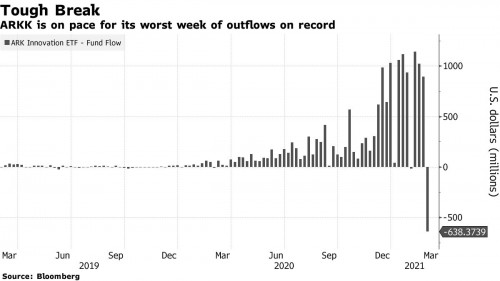

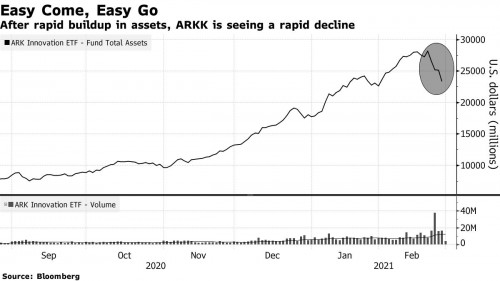

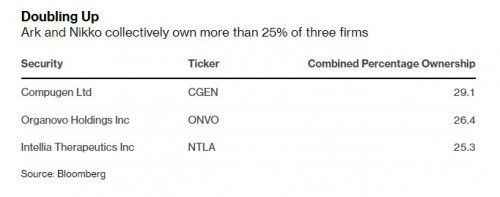

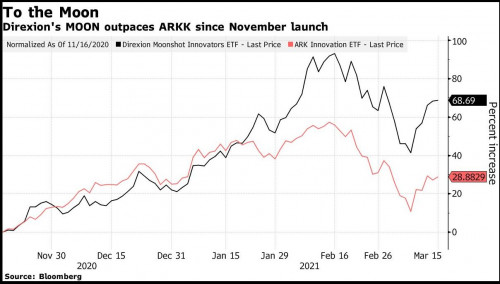

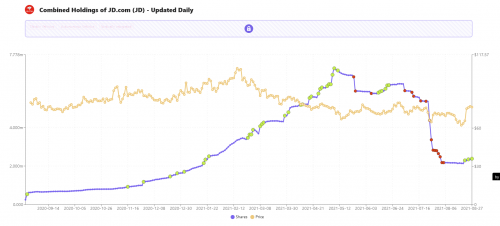

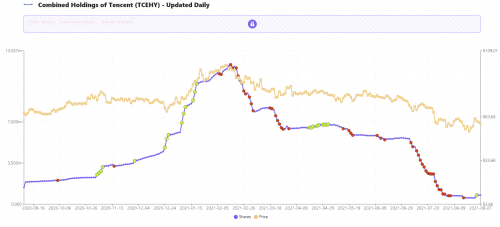

It's gone way down, because ARKK started rolling over first and is actually stable the past few days as bitcoin crashed. Investors might be choosing to bail on innovation tech and bitcoin in the same general time frame of the past quarter, but it has nothing to do with a sudden high-correlation panic sale across markets. Nothing like that is happening. The best you can do is argue bitcoin is a higher-beta version of some specific risk assets in the growth category, but doing so invalidates the other part of her claim, that bitcoin is an inflation hedge.

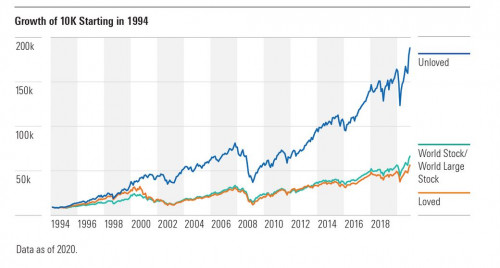

Here are the more important correlations. The correlation between value stocks and bitcoin, which did hit 0.97 during the Covid selloff, is currently at negative 0.2, its most inverse since the pandemic began. Bitcoin's correlation to Treasury prices is also rising, to .45, the highest since August. And most importantly, bitcoin's correlation to gold is negative 0.79, the most inverse ever.

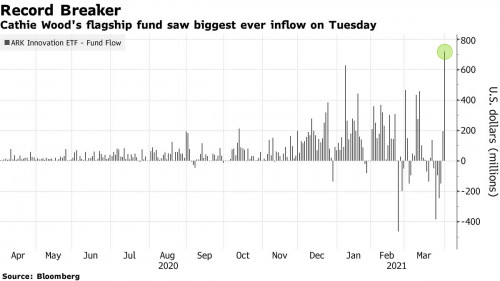

Investors are hating some things and loving others. It's a choice, not a forced liquidation. People are choosing which assets they think will thrive in the reflationary post-Covid economy that's emerging, and ARKK and bitcoin are not making the cut. It takes 30 seconds to run these charts. Why is she misleading investors?

Feb 3 2021, 10:05 PM, updated 5y ago

Feb 3 2021, 10:05 PM, updated 5y ago

Quote

Quote

0.1697sec

0.1697sec

0.44

0.44

6 queries

6 queries

GZIP Disabled

GZIP Disabled