QUOTE(hafizmamak85 @ Apr 22 2025, 12:51 AM)

Chinese govt can order their companies to charity first rather than shareholder first.Insurance Talk V7!, Your one stop Insurance Discussion

Insurance Talk V7!, Your one stop Insurance Discussion

|

|

Apr 22 2025, 06:35 AM Apr 22 2025, 06:35 AM

Return to original view | IPv6 | Post

#581

|

All Stars

24,335 posts Joined: Feb 2011 |

|

|

|

|

|

|

Apr 22 2025, 05:02 PM Apr 22 2025, 05:02 PM

Return to original view | IPv6 | Post

#582

|

All Stars

24,335 posts Joined: Feb 2011 |

QUOTE(adam1190 @ Apr 22 2025, 05:00 PM) Is Hong Leong assurance medical insurance good enough as it is not as famous compared to prudential, AIA, GE etc.. Maybe amount of coverage offered is not good for the premium paid.This post has been edited by Ramjade: Apr 22 2025, 05:02 PM adam1190 liked this post

|

|

|

Apr 23 2025, 11:57 AM Apr 23 2025, 11:57 AM

Return to original view | IPv6 | Post

#583

|

All Stars

24,335 posts Joined: Feb 2011 |

QUOTE(kidmad @ Apr 23 2025, 11:49 AM) now others seem to have already shared their point of view and let me share mine with you. That's why I said RM100k insurance is sufficient for most people. But if want to cover everything, RM1m coverage.a Bypass surgery in UMSC, i had to fork out RM90k+ from my own pocket for my mum. I wish she had some sort of insurance even the cheaper ones which most likely she need to pay a couple of thousand at age 65. RM100k or RM150k covers ALOT of illness that's what i can tell you now. If my mum needs to join the queue in Serdang, most likely she's dead already. The queue alone with take more than a year just for an angiogram another 6 - 8 months to obtain the right amount of stent. it's a good option for the mass public which doesn't have enough in my books. of course if you can afford those RM400 - 600 monthly premium by all means go for it.. but if you only have RM100 to spare at age 30/40 these are good options. kidmad and Wedchar2912 liked this post

|

|

|

Apr 23 2025, 05:11 PM Apr 23 2025, 05:11 PM

Return to original view | IPv6 | Post

#584

|

All Stars

24,335 posts Joined: Feb 2011 |

|

|

|

Apr 25 2025, 09:18 PM Apr 25 2025, 09:18 PM

Return to original view | IPv6 | Post

#585

|

All Stars

24,335 posts Joined: Feb 2011 |

QUOTE(tiramisu83 @ Apr 25 2025, 06:22 PM) Guys, can someone suggest me which standalone medical card in Malaysia best for value now? Sure. I will point you.For age above 50, min 30k annual limit is enough, 200 board room https://www.etiqa.com.my/health/onemedical https://www.generali.com.my/medical-health/emedic-plus https://www.aia.com.my/en/our-products/heal...e-mediflex.html https://www.aia.com.my/en/our-products/heal...-med-basic.html kyleen liked this post

|

|

|

Apr 26 2025, 04:36 PM Apr 26 2025, 04:36 PM

Return to original view | IPv6 | Post

#586

|

All Stars

24,335 posts Joined: Feb 2011 |

QUOTE(hafizmamak85 @ Apr 26 2025, 02:19 PM) You or agent don't have access to average pool claim cost or claim size. So you can forget about this info. This info is only for those running the insurance company not those selling it. |

|

|

|

|

|

Apr 26 2025, 06:44 PM Apr 26 2025, 06:44 PM

Return to original view | Post

#587

|

All Stars

24,335 posts Joined: Feb 2011 |

QUOTE(MUM @ Apr 26 2025, 05:26 PM) I just checked my old received repricing letter. Of course insurance company don't bother. They will still be making money at the end of the day. Join them as shareholdee. Can buy OCBC to get exposure to GE or buy AIA directly. Then you will feel happy everytime they are repricing cause your companies are working for you.They did provides some info. Just not sure what those info can help a new potential customers in determining which insurance companies to choose to buy a new plan or help an existing policy holder's to determine if he should cancel it or change to another company. I did not bother with the repricing reason, ...I just continue to pay as asked, since I can still afford it, and the feeling of the need of that coverage which I think I needed it. If I am buying a new plan, I still don't bother with the repricing reasons as I know it is a constant increasing things which does not just happens in Malaysia. Even a strong governance country like Spore are facing this issue too. I strongly beliefs, It is either you buy or continue to keep or you can do the opposites..... the insurance companies don't bother. Average medical inflation is 5.3% pa, yet the premium increase is 25%. Luckily it is not every year premium increase 25%, and luckily BNM said no more than 10% until, .... But hor, .... I just checked my last month cc bill. ... Billed RM4,656, that is another 35.58% from last year of RM3434 |

|

|

Apr 27 2025, 09:44 AM Apr 27 2025, 09:44 AM

Return to original view | IPv6 | Post

#588

|

All Stars

24,335 posts Joined: Feb 2011 |

QUOTE(adam1190 @ Apr 27 2025, 12:04 AM) I am 35 this year, looking for standalone medical policy with minimum annual coverage limit of 1million, do you have any suggestions? Yes.By the way, for standalone medical coverage, do they usually the CI waiver where do you don’t have to pay the premium ? AIA Mediflex with booster. You need the booster. https://www.aia.com.my/en/our-products/heal...e-mediflex.html GE Great medic shield with extender https://www.greateasternlife.com/my/en/pers...-extender2.html Generali SmartCare Optimum Plus https://www.generali.com.my/medical-health/...re-optimum-plus No waiver for standalone. Keep in mind the waiver is very specific. If you don't fulfilled the illness despite have the illness, you cannot get the waiver. The waiver only cover your basic CI adam1190 liked this post

|

|

|

May 2 2025, 10:46 AM May 2 2025, 10:46 AM

Return to original view | IPv6 | Post

#589

|

All Stars

24,335 posts Joined: Feb 2011 |

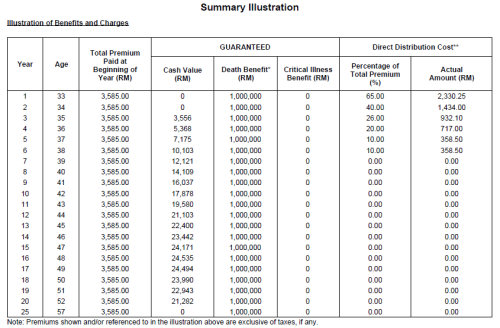

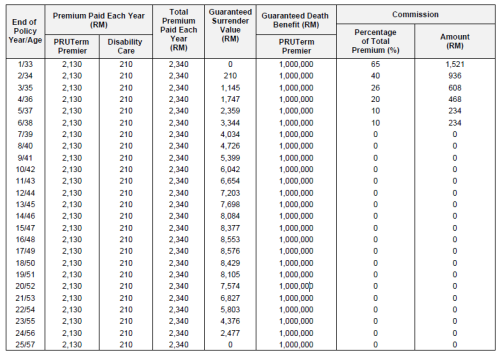

QUOTE(contestchris @ May 2 2025, 09:31 AM) An interesting point to note, as I compare PruWeath vs PruWealth Premier. If you are open to buying term life insurance in Singapore, you can get cheaper. Downside is have to travel down there to sign the documents and of course cost will be in SGD.PreWealth covers only death + TPD. PruWealth Premier covers only death, with a TPD add on. Both policies cover the same term, same sum assured. In both cases, premiums are guaranteed. The terms and conditions, benefits and exclusions are all identical. Yet, PruWealth annual premium is RM3,585 and PruWealth Premier (with TPD rider) annual premium is just RM2,340. The reason why? Because PruWealth probably has a lower lapse assumption built into the pricing, which allows for a higher surrender value mid policy. PruWealth Premier, being newer, possibly has updated pricing assumptions including higher lapse assumptions, which tighten the surrender value considerably. PruWealth:  PruWealth Premier:  |

|

|

May 3 2025, 07:33 PM May 3 2025, 07:33 PM

Return to original view | IPv6 | Post

#590

|

All Stars

24,335 posts Joined: Feb 2011 |

|

|

|

May 5 2025, 02:38 PM May 5 2025, 02:38 PM

Return to original view | IPv6 | Post

#591

|

All Stars

24,335 posts Joined: Feb 2011 |

|

|

|

May 8 2025, 11:46 AM May 8 2025, 11:46 AM

Return to original view | IPv6 | Post

#592

|

All Stars

24,335 posts Joined: Feb 2011 |

QUOTE(hafizmamak85 @ May 8 2025, 11:36 AM) Just a Substack - with screenshots of some of the things I had posted in this forum. Write in what you post to that MP going after the insurance company. No point you write here. No politician going to read this.To be frank, communications is not my area of expertise - I don't know how to write things simple enough for a mass audience. No point writing something technical if the layperson who is actually impacted doesn't get the point and feels there is nothing much they can do about it. I was hoping for others working in media to carry forward this issue. They are the ones with the platform to spread awareness, not me. But maybe it's too much of an ask. |

|

|

May 9 2025, 09:07 AM May 9 2025, 09:07 AM

Return to original view | Post

#593

|

All Stars

24,335 posts Joined: Feb 2011 |

QUOTE(MUM @ May 9 2025, 06:03 AM) For that highlighted, .... if you want to do that, try after age 65. No need pm here and there. I got nothing to sell/hide.As an article from SG, pointed out that "most critical illness claims happen from age 51 to 55. And the bulk of claims happen from age 41 to 65". Regarding your mention of "CI is expensive", try PM "Ramjade", I think he got one from SG at "alot much lower price" compared to MY. This post has been edited by Ramjade: May 9 2025, 09:07 AM |

|

|

|

|

|

May 9 2025, 10:02 AM May 9 2025, 10:02 AM

Return to original view | Post

#594

|

All Stars

24,335 posts Joined: Feb 2011 |

MUM liked this post

|

|

|

May 9 2025, 08:34 PM May 9 2025, 08:34 PM

Return to original view | IPv6 | Post

#595

|

All Stars

24,335 posts Joined: Feb 2011 |

|

|

|

May 24 2025, 08:01 PM May 24 2025, 08:01 PM

Return to original view | IPv6 | Post

#596

|

All Stars

24,335 posts Joined: Feb 2011 |

QUOTE(john123x @ May 24 2025, 06:54 PM) I need help regarding my insurance. I got SMS saying that my insurance premium will be hiked on 1 Jul 2025. What happen if continue paying the same amount?What happen if i continue paying the same premium amount? mu monthly premium is enough to cover insurance charges. And Insurance funds is the lousiest fund ever. Imagine this, bond fund after 5 years, return is mere 2%. I really dont know why I cant just pay the monthly insurance charges only. Why i am forced to invest lousy funds? Prudential says if i cant afford, ask me to downgrade, my plan is already the most bottom and i already copay 3k Well you can. Just that your coverage duration decreases. How much, there should be a letter saying how many months or year decrease if maintain current premium. I really dont know why I cant just pay the monthly insurance charges only. Why i am forced to invest lousy funds? 1. They want to make more money because by you signing up for ILP you are force to buy life insurance, critical illness insurance even though amount of coverage is the bare minimum. There is also annual expense fees charge by unit trust around 1.5-1.8%p.a. Never underestimate these small fees. Overtime they become substantial. 2. Easy to sell ma. People like easy stuff. Oh you just pay this amount, we do investment and hopefully the investment pay for your insurance. Well you can. If you are healthy and no illness, just surrender your insurance (make sure to write in) so you can get money back. Buy standalone and use the excess to invest. If you don't know how to invest, dump it into kwsp. If you want better returns S&P500 or QQQ etf. EPF, S&P500 and QQQ will definitely outperform whatever ILP you can buy over 20-30 years time frame. This post has been edited by Ramjade: May 24 2025, 08:02 PM devilmaycry9 and john123x liked this post

|

|

|

May 24 2025, 08:07 PM May 24 2025, 08:07 PM

Return to original view | IPv6 | Post

#597

|

All Stars

24,335 posts Joined: Feb 2011 |

QUOTE(YoungMan @ May 24 2025, 04:25 PM) elven88Wrong guy but nevermind I will try to answer. The big names in Malaysia AIA, GE, Allianz, Prudential have Singapore coverage be it standalone or ILP. Prudential does not have standalone and allianz standalone is pathetic. I don't know is it pay and claim basis or sort of cashless |

|

|

May 24 2025, 08:13 PM May 24 2025, 08:13 PM

Return to original view | IPv6 | Post

#598

|

All Stars

24,335 posts Joined: Feb 2011 |

QUOTE(john123x @ May 24 2025, 08:05 PM) thank you, i decided to pay the same amount. They will in the future down the road (that is where the coverage years is reduce) if you have not sufficient cash balance inside.what i really worried, is they cancelled my policy despite having enough balance to cover insurance charges Another way to make it as sustainable is be 100% equity. if they have equity with US equity, the largest amount, choose that. Equity will also give more returns Vs bonds over long long term. Yes US market is scary right now but US market have always been easy to make money. Agents will shoot me, but if you know markets you have to face reality. Unfortunately insurance in Malaysia have very poor overseas exposure as if by design. Most funds are focus locally. This post has been edited by Ramjade: May 24 2025, 08:15 PM |

|

|

May 24 2025, 09:02 PM May 24 2025, 09:02 PM

Return to original view | IPv6 | Post

#599

|

All Stars

24,335 posts Joined: Feb 2011 |

QUOTE(john123x @ May 24 2025, 08:43 PM) my current insurance charges is RM52.69 a month. When my monthly insurance charges over my premium, then i topup extra. Well you need to monitor when insurance cost more than the investment. I believe it is visible online on the platform your cash value.If you see your cash value drop, that is when they started minusing your investment. |

|

|

Jun 13 2025, 09:24 AM Jun 13 2025, 09:24 AM

Return to original view | IPv6 | Post

#600

|

All Stars

24,335 posts Joined: Feb 2011 |

QUOTE(hafizmamak85 @ Jun 12 2025, 07:51 PM) You're buying insurance for protection, not for speculation. Plus, a sustainable ILP policy requires fees and charges to be met as and when due. In order for this to happen, the investment asset return profile needs to stable, not volatile. ILP is designed to hopefully pay for your insurance down the road. So you need something that can compound at least at EPF returns over long period of time. Wouldn't it be better for a portion of allocated funds to be in short to medium term liquid, safe assets to meet short to medium term fees and charges as and when due and the rest to be in some sort of a balanced fund to meet long term fees and charges? Wouldn't this require a continuous rebalancing of allocated assets? Shouldn't ITOs provide continuously rebalanced low to medium risk allocation strategy options - I think quite a number do, but how often do they actually promote them to policyholders? The default most of the time is the 100% equity option as the premiums are cheaper. Whether the investment assets should be in the Malaysian, US, Japanese, Asia Ex-Japan etc. or a mix of those markets, what forex, mix of asset class and counterparty risks to take, do you think the average consumer has the knowledge to make such decisions? Whatever allocation option chosen, the ITO must be accountable for the return rate assumed for sustainability purposes. If a negative balance arises, the ITO musn't lapse the policy. They have to take on the liability for it. Unfortunately those funds offered by insurance companies are rubbish. If you buy a mixed fund, the fund manager suppose to rebalance for you. If you buy a fixed income, then the fund can only invest in bonds. |

| Change to: |  0.0309sec 0.0309sec

0.71 0.71

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 4th December 2025 - 12:22 PM |