Hi peoples, i'd like to get some suggestions on my situation.

I'm currently 39, non-smoker, no prior claim, clean payment.

Have 200k debt (house & car), parents to care, intending to remain single.

Backstory

» Click to show Spoiler - click again to hide... «

Back then i was rather ignorant on things such as financial/investment/insurance.

After settling most of the study loan and managed to get a loan for the family house, i was already reaching 30.

So in 2016, i signed up this Allianz PowerLink (which i did not really understand at that time was ILP, thinking it was a insurance package) through my colleague/friend.

I was told that all i need to do is pay the premium of rm280 and i'll be covered till the maturity date.

We set up an auto-pay using credit card and i've never missed a single payment.

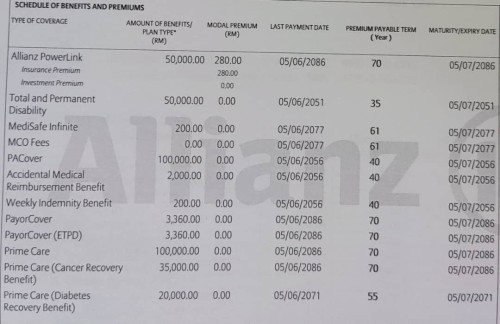

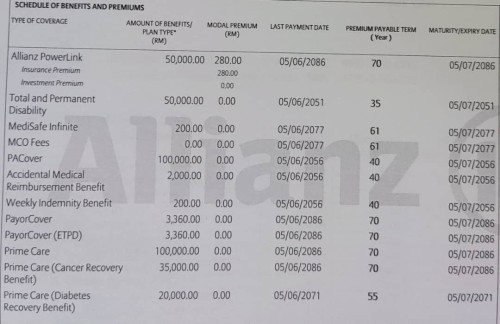

Here's the breakdown:

However, due to my 1cent brain cell, i've never bothered to check any statement.

I think i've opted for e-statement or something, so i've never received a physical copy ever.

Fast forward to last month, i thought of downloading the app and have a look since its almost 10 years and i haven't spoke to any agent since signing (colleague/friend stop being agent after few years, new agent never approached).

Looking through all the yearly statements and 2 notices (repricing 2022,2025), it seems that i was suggested to "top up" since the 4th year itself.

In the 2019 year end statement, it noted that my policy coverage is projected to last for the next 34 years and 4

months, and i need to revise regular top up rider premium of RM 374.00 such that the insurance coverage is projected to last until the maturity date of 05/07/2086.

@_@ What's this about coverage of 34 years? Why the top up? I thought all i need to pay is rm280 till the maturity of each plan?

So i start digging and reading, and now i have some understanding of what i really signed up for. T_T

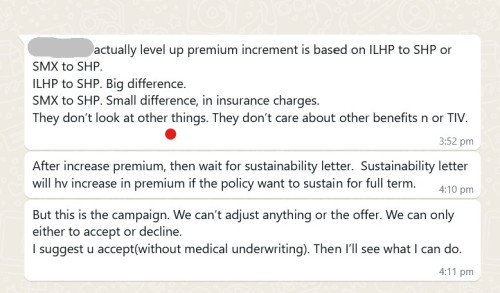

Evidently, i skipped the repricing notice as well. Asking for a new premium of rm402.

And then last year's statement asking for rm676.

And now, the latest repricing notice, double by year 5 (20% increment per year, rm560 at year 5) for 24 years sustainability, with optional top up rm227/rm420 to sustain up to age 70/80 respectively.

With that said, met with the new agent, and here's the options discussed.

1. maintain the same plan, don't accept repricing = 20 years

2. maintain the same plan, accept repricing (rm560 at year 5) = 24 years. Optional top up rm420. So rm980 in total to reach age 80

3. replace MediSafe Infinite - Plan 200 to HealthAssured, but sign new AssuredLink policy = rm380 while maintaining the rest as-is rm280. So rm660 in total to reach age 80

4. go look for other insurer

Honestly speaking i'm now feeling reluctant towards ILP.

But based on my limited online search, the offerings are more enticing than standalone.

So here i am, seeking your opinions on:

1. what are the recommended range i should be aiming for medical, pa, ci & life?

2. is what i have sign up worth to hold on now?

3. if yes, how better to navigate this repricing situation?

4. if not, what suggestions can you direct me to?

I sincerely thank you for your time reading, and i appreciate any response hereon!

1. You are paying for them to manage your money in hopes that they can pay your future insurance premium. In reality that is not the case. As and when the ILP is not performing and sustain losses (which is like majority of the time), you are required to add on extra into your premium to make up for the losses or else the duration covered cannot be sustained.

2. Whether the ILP is making money or not, you are losing money 1.5%p.a in fund management fees. This is excluding if your ILP have service charges (means everytime they take money from you they charge like 5%)

Life insurance is usually needed for people with dependends (kids or wife). Single people don't need life insurance. Also another way of insurance is having cash flow coming in. If you have say 6 figure of passive income coming in do you really need any insurance?

Shop around for critical life insurance. For me I found cheaper and more coverage in Singapore. This is real example. AIA offered me RM500k coverage for RM14k p.a. I found in Singapore they can do like RM1m for only RM7k p.a

Once you have insurance you cannot run away from repricing. If ILP or standalone you can opt for cheaper plan (downgrade). If you don't pay up for ILP now, your sustainability will be reduce. It cannot last as long as promise in the original contract. It's either you pay up now or pay up later. Either way you cannot run away. The only way you can control it is

1. Increase your topup for ILP now

2. Do a lump sum top up near retirement day RM50-70k topup

3. Control how the investment part perform by going standalone and EPF route as you are cutting away lousy fund performance.

Don't ask agent what you should do as they are incline to sell you things. Find independent financial advisor who are not earning via commission. That way they are unbiased.

Old post still relevant.

EPF perform better than majority of ILP over long term. I can't advise you. I can only tell you what I am doing. I buy standalone only and use investment money to pay for my future insurance cost with more excess than what I can get with ILP.

Jan 19 2025, 08:50 AM

Jan 19 2025, 08:50 AM

Quote

Quote

0.0268sec

0.0268sec

0.61

0.61

7 queries

7 queries

GZIP Disabled

GZIP Disabled