QUOTE(Altrost @ Oct 1 2025, 06:09 PM)

My understanding of ILP is:

1. Pay more earlier and the investment returns hopefully will cover the increasing premiums at later ages

-but counterpoint is the 5% front loaded cost (not sure if standard across industry) will eat into the returns

2. Since there is cash value, there is some protection against policy lapse.

-this is actually the most attractive feature in my opinion

3. There's also the fancy benefits like AIA Health Wallet

-but I think it's just nice added benefits, not big consideration in grand scheme of things

What I wanted to confirm is, does ILP have special treatment in regards to policy upgrades? I heard that term = no upgrades possible, ILP can get offers from company to upgrade.

What other benefits are there that I missed with ILP to justify point no.1?

That's a good point...

Is it true that only ILP are offered upgrades? Assuming no claims of course.

I am not an agent. I got nothing to sell you. What I am writing here is going to get lots of backlash among the agents here.

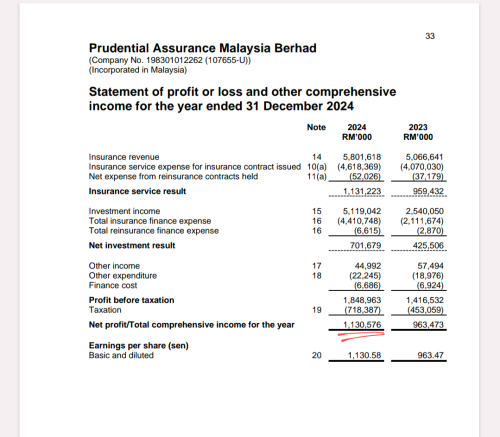

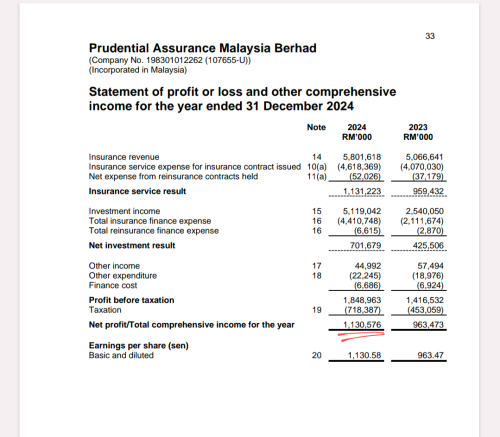

1. Hope is not a plan but a disaster waiting to happen. Get an agent to quote you. Please use and see the table provided in the pdf. Use the 2%p.a returns projected as mandate by BNM and see if it is sustainable until the age you want. If yes congrats, you have the cost that you want. Majority of the unit trust sold in Malaysia are rubbish and cannot perform. What this means is either negative or 1-2%p.a. Yes there are exceptions. You don't need to take my word for it See for yourself here

https://www.fsmone.com.my/funds/tools/chart-centreSelect all the AIA funds available. Yes there maybe some AIA funds that are not available on FSM website but only on AIA platform but it will give you the feel of how majority of the funds are performing.

I am not sure if there is 5% service charge front loading fees for ILP. You should be more concerned about the

(I) 1.5% p.a expense ratio charged whether the fund makes money or not. Fees matter long term. That is why I advocate buy standalone and invest yourself. The difference in unit trust fees Vs ETF is astronomical. 1.5% Vs 0.03%. That's a 4200% difference. You can see youself here. You can put in any value for the 3rd fees.

https://www.schwabmoneywise.com/investment-fees-calculator(ii) If the fund is not making money or losses it affects the sustainability of the ILP aka you need to pay more.if they are not making money

(iii) unnecessary change. If you are not buying life insurance, you are required to still purchase the minimum amount of life insurance around RM5k worth of coverage means you are getting change for stuff you don't want.

(ii). Cash value is only if you are a poor payer aka you forget to pay your bills. Is it so hard to put a remainder into your phone calender or Gmail calender as reminder to pay your insurance? Payment is only once a year. If your agent is truthful and honest with you he or she will tell you that an ILP with medical insurance the cash value at best will be zero at the end of the insurance or most common scenario negative amount. Ask them that. What is the expected cash value at around 80 years old when your insurance ends? See if they try to avoid answering the question. Why so bad? Come back to the first point above. Many unit trust are not performing. You are getting negative, 1-2%p a hence the insurance cost will rise faster then whatever returns you can get

(iii) All fully paid for by you. I didn't sub for AIA wallet as I am not going to pay extra RM10//month for them to make me healthy. No free lunch when you buy insurance. Something you need to remember. It's marketing by AIA.

I am not sure if upgrade are only for ILP but seems like it. I wouldn't count myself into the upgrade program. Better for me to assume I am not entitled Vs hope on it. My plan is change plan every 10 years provided I am still healthy. One thing I have learn is don't depend on the govt or company. Always depend on yourself and your own financial capability. No one cares about your money more than ourselves. Never ask a barber if you need a haircut.

This post has been edited by Ramjade: Oct 1 2025, 07:28 PM

Jun 14 2025, 12:22 PM

Jun 14 2025, 12:22 PM

Quote

Quote 0.0257sec

0.0257sec

0.51

0.51

7 queries

7 queries

GZIP Disabled

GZIP Disabled