QUOTE(Andr3w @ Mar 20 2025, 11:43 AM)

» Click to show Spoiler - click again to hide... «

same mid 40s .. same current approx 2k ++ premium ... same coverage as yours...

But ... new offer was only 5k for option 1....

Any sifus or experts can advise insurance company can quote whatever premium they like with fund sustainability as a reason but don't fully reveal every single detail how they come to our premium quote? Any BNM or law say they must?

I tried to answer your original question 1st. If you have done the right comparison, where the COI of your current medical plan vs the COI of the new medical plan, if there is indeed no increase, then i think i highly suggest you to move over. Because in your previous post, you mention from your annual statement but actually in annual statement it contains COI of other non medical plans as well.

As for your original question on why there is such a huge premium increase, that i can only educated guess. When an insurance company ask you to move to a different plan, they typically need to NOT JUST take into account the current COI, but also the FUTURE COI. For example, if your current medical is until age 70, but lets say the new medical plan is until age 80, even if the COI is about the same, they PROBABLY have to take into account the COI for that additional 10 years.

Whether to upgrade your current medical plan to the new medical plan, i personally will do it. I think you said your plan is 200k annual limit? While 5mil is unnecessary but 200k is abit on the lower range but still very comfortable factoring inflation and etc... Then again if 200k is annual limit, and no lifetime limit, actually still ok (IMO). I mean, unless we all have stats on average cost of treatment easily lying around and do our medical inflation projection... then... we do our own estimate la.

QUOTE(Andr3w @ Mar 20 2025, 01:41 PM)

» Click to show Spoiler - click again to hide... «

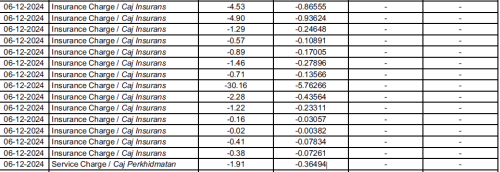

Seems like asking us pay higher premium, is to put more money into investment (if what the amount on the current COI table price is how much they will minus from yearly premium we pay).

I have 20k++ in my investment portion. My next COI will be around 1.5k annually according to COI age bracket table. I want to stop paying premium and force my yearly COI to be deducted from my 20k++ investment until maybe it reach around less than 3k++ , then only i continue paying premium. My policy say it will not lapse until the investment become 0 when premium next due. So from I see, it seems can do such a thing with no complication? The purpose I want do this is to channel my premium money to better invest into things like ETF etc that give better return.

Any advise about complication or advise about my decision to stop paying premium on my ILP to force deduction from investment portion and then later on continue paying premium when investment almost dry up?

Yes. In theory, if you have enough money in your policy, you can stop paying for awhile. It is the flexibility (pros and cons too) of owning ILP polic. Your plan is somewhat solid. You have realised what needs to be done with the necessary buffer.

I list down again the key thing you should do.

1) find out future charges

2) keep some buffer (the dwindling down to 3k)

3) you need to continuously monitor on a yearly basis on where your policy is now because 1 and 2 needs to be adjusted accordingly.

The complication is purely our human capacity and time. Such tracking is usually not for the average joe on the street. But if you are discipline, its ok too. And we all know in the long run ETF is the way to go. Insurance fund is like normal unit trust, under perform and high charges.

The increase in medical COI when done by the company is across the board ie it impacts everyone like you who bought the same medical plan from the same company.

I hope my input can help.

Dec 4 2024, 08:38 AM

Dec 4 2024, 08:38 AM

Quote

Quote

0.0347sec

0.0347sec

0.35

0.35

7 queries

7 queries

GZIP Disabled

GZIP Disabled