QUOTE(hafizmamak85 @ Mar 21 2025, 12:24 PM)

There is no hack. ITOs know about this so they don't allow for top-ups to be made until you've fully paid up any outstanding annual premium amounts

Not true.Insurance Talk V7!, Your one stop Insurance Discussion

|

|

Mar 21 2025, 10:02 PM Mar 21 2025, 10:02 PM

Return to original view | IPv6 | Post

#281

|

Senior Member

4,724 posts Joined: Jul 2013 |

|

|

|

|

|

|

Mar 22 2025, 12:40 AM Mar 22 2025, 12:40 AM

Return to original view | Post

#282

|

Senior Member

4,724 posts Joined: Jul 2013 |

QUOTE(hafizmamak85 @ Mar 21 2025, 10:24 PM) Wonderful. Can you please announce in this forum which ITOs allow for this? But... I didn't ask you the same question... I don't need to try so hard to prove myself to you.If what you say is true, what is there to stop policyholders from just paying top ups (high allocations) and not paying regular annual premiums (subject to high allocation charges; lower allocations)??? |

|

|

Mar 28 2025, 12:36 PM Mar 28 2025, 12:36 PM

Return to original view | Post

#283

|

Senior Member

4,724 posts Joined: Jul 2013 |

QUOTE(cactuscch2 @ Mar 28 2025, 11:39 AM) i wrote a post about the things to consider when you switch from your current policy from company A to company B. I'm not saying dont do it all, but do take into account the cost involved are complicated. I'm not fully understanding what you are putting here. did you also approach Allianz to get a new policy? i suppose you dont have a current policy with allianz? you should shop around but do read my previous post about the switching. Also want to clear up some misconception, assuming you are a normal person, non of the medical plans out there have 2 years waiting period. the 2-years is actually referring to the incontestability period, which somehow gets translate to "dont claim within 2 years". I dont work for GE, and i have no vested interest in GE. I put it in a different analogy, if you are switching from a honda city to honda accord, the jump of car loan installment will be smaller. but if you are switching from axia to accord, i'm sure the jump in car loan instalment is bigger. in the end we are consumers, it's our choice to want that accord or not. i wont say they blame it on the axia being cheap, but the axia is cheaper, that is the reality right? But what i like about the GE plan (SHP) is that it comes with a few deductible options. Fundamentally, insurance (including medical insurance) is a tool to transfer financial risk. honestly, if i were to masuk hospital now, assuming i'm working BUT i dont have employee insurance, i can still afford to fork out the medical bills myself. 10k 20k is a lot of money but i do have savings i can tap on and this 10k and 20k is not an amount that will put me in debt or wipe me out. but if the hospital bill is 100k 200k, then i will be in trouble. So coming back to the GE plan, they have deductible of 2.5k, 5k, 20k. so by going for deductible of say 5k or 20k, you will be paying lower charges and lower premium. whatever savings you can get, can be invested, and forms part of retirement fund, emergency fund, etc. I believe we as consumers benefit from these flexibility. it circles back to why we buy insurance, it's to cover the risk we can't absorb. risk that can hurts us alot or even wipe us out. just like why i dont care about travel insurance that covers luggage damage. after all, luggage damage, yes, it's not great, i need to spend money buy new luggage, but it's just cost of travelling. i care about travel insurance that covers my medical part, cause we know, if hospitalised, in places like USA, that medical bill really can wipe me out financially. added side note on the GE plan: from what i see on the brochure. the SHP Plus offers what i think are not important benefits, dont get it (IF you do decide to upgrade to SHP) This post has been edited by adele123: Mar 28 2025, 12:37 PM kyleen liked this post

|

|

|

Mar 28 2025, 03:03 PM Mar 28 2025, 03:03 PM

Return to original view | Post

#284

|

Senior Member

4,724 posts Joined: Jul 2013 |

QUOTE(cactuscch2 @ Mar 28 2025, 02:34 PM) I don't read about 90% for what hafizmamak writes. I believe contestchris has given a theory for some explanation on the differences of the premium. Which I can't add more since i dunno anyway. But those seems like the sound theoryInsurance product is more complicated than to compare. Not an excuse for the insurance companies but ya, it is not something you can compare easily with another person and just ask why he/she is different. Having said that you have sent an email to GE, they should give you a more complete answer than us mostly providing educated guess. |

|

|

Mar 29 2025, 10:00 AM Mar 29 2025, 10:00 AM

Return to original view | Post

#285

|

Senior Member

4,724 posts Joined: Jul 2013 |

QUOTE(hafizmamak85 @ Mar 28 2025, 04:35 PM) QUOTE(cms @ Mar 29 2025, 12:56 AM) Hi both, spoiler function exist. Please use it. Like how I am using it. As demonstrated. CODE [SPOILER][/SPOILER] Please god damn stop having long useless post with multiple images and screenshots without spoiler. One type long, one go quote the long post. End up no one is reading/helping the people who needs help. cherroy |

|

|

Apr 12 2025, 06:05 PM Apr 12 2025, 06:05 PM

Return to original view | IPv6 | Post

#286

|

Senior Member

4,724 posts Joined: Jul 2013 |

QUOTE(boyboycute @ Apr 12 2025, 03:22 PM) Actually, Investment linked policy has a few "cost" built into the purchase and sale of investment unit trust. 1) i believe most unit trust companies and insurance companies do not practice the bid offer unit price anymore. I do note that due to my 5 minute google search, only Great Eastern is showing this. Spread between bid and offer price. When you pay premium, your premium is used immediately to buy units at offer price in the fund u have chosen. You're not buying at NAV. When your insurance charges and fees are due, they'll sell your unit trust at bid price (not at NAV). The spread is usually 5% Don't forget fund management charges from 0.5% to 2% deducted from the NAV. All these "cost" built into ILP will render all future projection on premium adequacy pretty useless. But many people still buy ILP because it's very flexible to make adjustments in your policies as your life requirements changes . This also includes additional concierge services by competent insurance agents to assist you whenever you need them. It's like relationship manager for your medical insurance However when i opened up the fund fact sheet of GE, i do see that there is actually 2 variation. There are "single pricing products" and "dual pricing products". My guess is, nowadays the dual pricing are no longer in practice. All should be "single pricing". I will let GE agents here to defend this. 2) highest management charge in insurance world is 1.5% p.a. 3) if customer were shown proper projections provided by insurance companies (guided by proper guideline by BNM), projections do take into account these charges. But given that it is 10 20 30 years down the road, it is pretty much useless. |

|

|

|

|

|

Apr 17 2025, 08:28 AM Apr 17 2025, 08:28 AM

Return to original view | IPv6 | Post

#287

|

Senior Member

4,724 posts Joined: Jul 2013 |

QUOTE(AhBoy~~ @ Apr 17 2025, 12:10 AM) how slow is GE communication to their customer? Dont have to smell menace everywhere. I only received message from my agent about "LEVEL UP MEDICAL COVERAGE CAMPAIGN" and inform need to decide with next week or so? I saw this campaign is starting since March until 30th April, but no email, letter until agent inform me, is this part of tactic to push customer to sign up new coverage? More like inefficiency or your agent got too many customer to handle. You still have almost 2 weeks to decide if the end date is 30th april. If you arent ready to decide then just dont do it. |

|

|

Apr 20 2025, 01:58 PM Apr 20 2025, 01:58 PM

Return to original view | IPv6 | Post

#288

|

Senior Member

4,724 posts Joined: Jul 2013 |

QUOTE(Jason @ Apr 20 2025, 01:42 AM) Answering your question. 1) the level premium is legit if you assume medical inflation remains zero which is impossible. So the answer, nope not legit. 2) no solution. 3) should ask your agent. But based on older plan, usually low or no deductible. But GE current on shelf plan has 2.5k and 5k. Just a reminder that ITOs are for-profit companies but it is also heavily regulated. If by this definition, then banks are evil too. Will ITOs continue to raise prices? Ya, if medical claims continue to increase. After all, the ITOs are not in it to run a losing money business. What you hope is they work hard to pay the right claims, catch the customers who make fraudulent claims. Which one? Dunno… |

|

|

Apr 20 2025, 06:32 PM Apr 20 2025, 06:32 PM

Return to original view | Post

#289

|

Senior Member

4,724 posts Joined: Jul 2013 |

QUOTE(Jason @ Apr 20 2025, 04:04 PM) Thanks Can email GE customer service. They should be able address easily since your question not a complicated one.3) problem with agents, every time see them also wanna increase. I don’t want to increase I want to retire. Which means optimization of my expenses. Clearly agents are NOT ALIGNED to MY NEEDS. They just want to increase the premium for their pockets. |

|

|

May 10 2025, 12:31 AM May 10 2025, 12:31 AM

Return to original view | Post

#290

|

Senior Member

4,724 posts Joined: Jul 2013 |

QUOTE(jutamind @ May 8 2025, 11:21 AM) common guidance for critical illness (CI) coverage is 3-5x of your annual income. If you have annual income of 100k, that's 300k of CI coverage which is probably not cheap for most folks. What's your CI coverage currently? is it following this common guidance/guideline of 3-5x of your annual income? QUOTE(jutamind @ May 8 2025, 07:56 PM) I do share the same believe with you partially but CI payout probably helps if you are unable to work short/long term due to dreaded disease but not permanently/temporarily disabled in the sense of TPD The 3x to 5x annual income for CI coverage is probably a rule of thumb came up to sell you more CI.CI is another expensive product which I might eventually cut during advance age to sustain my medical card longer I have about 450k CI coverage for my personal. I think this is enough ish. I started off lower at 200k but increased my coverage by 250k in 2022. When i 1st started, exceeded the 5x. Salary got increase over the years now, lower than the 5x annual income. But i feel the important thing is i feel the coverage amount is enough. I have been through 2 CI with relatives. Stroke and cancer. Ya, cancer treatment is expensive but also not as expensive as i thought. But sadly when it comes to something like stroke, after kena, not much medical treatment can help (like you know, no medication or surgery etc can help). Mostly is rehab, physio, and the money spent is mainly to reduce stress or for convenience. Having the insurance money is a buffer, and helps with just dealing with general stress. Yes, i have savings but both my savings and insurance money will come in helpful. Dont want to so fast deplete savings also. jutamind liked this post

|

|

|

Jul 18 2025, 01:56 PM Jul 18 2025, 01:56 PM

Return to original view | Post

#291

|

Senior Member

4,724 posts Joined: Jul 2013 |

cherroy This thread getting unreadable hafizmamak85 If you think there is truly misconduct by the insurance companies, then 1) create a new thread to explain problems of the industry 2) make your content readable that people actually can and want to understand 3) what solution / alternative there is. Solution that is practical. Keeping in mind, the sole purpose of companies is to make money. Does not mean they are trying to cheat people off their money either. Thats why regulation/regulators exist. Else, you are just depriving most people who come here to want to understand more about their current insurance policies and what practical alternatives they can go for. This post has been edited by adele123: Jul 18 2025, 01:57 PM JIUHWEI liked this post

|

|

|

Jul 24 2025, 03:35 PM Jul 24 2025, 03:35 PM

Return to original view | Post

#292

|

Senior Member

4,724 posts Joined: Jul 2013 |

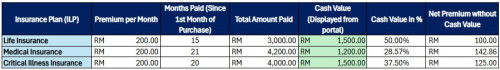

QUOTE(X-SenZ @ Jul 23 2025, 05:35 PM)  Guys, want to know how much % portion of your cash value based on monthly premium? For example, your medical will retain certain amount of cash value (based in certain %) since 1st month of purchase. I noticed certain insurance plan will have different cash value allocation. You do your calculation and whether all of us having similar cash value allocation or there are big gaps. My table is for illustration only. You as the customer pay premium to the insurance company. Example, RM200 a month. This RM200 a month is premium. The insurance company will take a portion of the money and after that then only use it to buy the investment fund. According to the screenshot shared by the poster above, you can see the allocation rate is 60% in the 1st year. this means RM80 is taken by the insurance company (to cover their expenses, pay commission to agents, or for their own profit and loss) and RM120 is allocated into your investment fund. every single month, there is insurance charges or cost of insurance (COI) that will be deducted from your investment fund to pay for your insurance coverage. for simplicity, assume the cost of insurance is RM105. so it will then deduct RM105 worth of investment from your RM120. Now the money sitting in your account now is RM15, this is your "cash value". This RM15 is just the current investment value, as we know value of investment can decrease or increase daily. This process repeats every month. Why some people will have more or less cash value depends on... 1) how much premium they paid 2) how much COI is charged 3) what investment fund they chose (every fund of course performs differently) Assuming someone paid the same premium, chose the same fund, they may have different cash value because if you have MORE coverage, this means MORE COI is deducted resulting in lower cash value that you may have. To answer your original question, how much is allocated to the investment is actually set by BNM. to be specific, the number BNM set, is the minimum, of course some insurance companies can give higher than what is set by BNM, but that would mean they earn less, assuming their expenses didnt reduce. |

|

|

Jul 25 2025, 09:46 PM Jul 25 2025, 09:46 PM

Return to original view | Post

#293

|

Senior Member

4,724 posts Joined: Jul 2013 |

QUOTE(raul88 @ Jul 24 2025, 07:22 PM) fyi, baby medical insurance is very expensive. if you ignore all the noises, medical insurance is the same for kids and adult. after all, what you need is someone pay the hospital bill if you are sick. now the problem is babies get sick alot when they are younger. so this resulted in frequent hospitalisation and thus resulting in more expensive medical insurance. looks like you have tried searching online, so i summarise to a few potential option (realistically). we are not here to debate why babies masuk hospital often and whether those hospitalisation is necessary because that's beyond me and that wont be helpful to your question anyway. 1) you buy medical insurance from agent. this is likely to cost AT LEAST 150 a month if you want low deductible amount like 300 500. If you are ok to go higher deductible, i may be cheaper. how much higher deductible. 5k 10k... etc... but this is probably not something suitable for you. 2) you probably need to buy as family plan, as you have pointed out above (not sure what's the cost, you do your own maths) 3) as cruel as it sounds, private medical insurance may not be the option for you. you can consider this maybe after your child grows abit older, the cost of medical insurance starts to dive around age 5 to 6 also. JIUHWEI liked this post

|

|

|

|

|

|

Aug 1 2025, 08:58 PM Aug 1 2025, 08:58 PM

Return to original view | Post

#294

|

Senior Member

4,724 posts Joined: Jul 2013 |

QUOTE(daidragon12 @ Aug 1 2025, 05:15 PM) Look at the link provided. Basically you need to understand how you current medical plan works, and look at this new medical plan offered. The newer plan comes with higher deductible and co-takaful, and hopefully higher limit than your current plan. I would recommend seriously looking into it, switching into higher deductible to lower down the overall premium that you have to pay. for example, i can see that they have deductible of 500, 1000, 3000 and also 10% co-takaful. I think going for 1000, 3000 or 10% co-takaful is a worthwhile option to go for. in the long run, the hopes is that you pay less premium and being charge lower charges. i wont elaborate too much, just giving general pointers. of course, please do your due diligence. JIUHWEI and daidragon12 liked this post

|

|

|

Aug 14 2025, 10:56 AM Aug 14 2025, 10:56 AM

Return to original view | Post

#295

|

Senior Member

4,724 posts Joined: Jul 2013 |

QUOTE(vvn0vvn @ Aug 13 2025, 03:44 PM) I tried to renew my house insurance with Etiqa online but failed. I was told that they don't accept because my postcode is in flood risk area. Does anyone have similar experience? Which other insurance company is good for houseowner/householder insurance? Have you tried tune protect? They also have house insurance online. I buy from them, cause same thing but cheaper than etiqa. If both also cannot, then I think you need to go through proper agent. Could be unlucky your postcode share with some high risk area but yours is quite safe. This post has been edited by adele123: Aug 14 2025, 10:57 AM |

|

|

Aug 15 2025, 12:22 AM Aug 15 2025, 12:22 AM

Return to original view | Post

#296

|

Senior Member

4,724 posts Joined: Jul 2013 |

QUOTE(vvn0vvn @ Aug 14 2025, 03:32 PM) Thanks. Will check out on Tune. Then etiqa system problem. How's the service with Tune? Just wondering which insurer is better? My concern is also on the efficiency of their processing. Of course this is only if we need to make a claim but that's the crucial time when u need them the most The funny thing with Etiqa is that i tried different postcode all also cannot be processed I don't think too much about claims processing. Ini fire insurance, not car or travel insurance. I Don't want to overthink. There is no way fire insurance claim will be a smooth claim. |

|

|

Aug 20 2025, 05:43 PM Aug 20 2025, 05:43 PM

Return to original view | IPv6 | Post

#297

|

Senior Member

4,724 posts Joined: Jul 2013 |

QUOTE(JC999 @ Aug 20 2025, 02:56 PM) You can buy standalone medical which is a cheaper option, most insurers have it and it covers to 80-100 years old. Actually most insurers dont have standalone medical. Even with standalone, age 0 is gonna cost alot too. Cost more than adults.Take note of your sustainability if you buying from agents, and they always come with investment link which may not be best the difference put it in your epf and you get best returns and standalone medical. Best from both |

|

|

Aug 23 2025, 09:25 AM Aug 23 2025, 09:25 AM

Return to original view | Post

#298

|

Senior Member

4,724 posts Joined: Jul 2013 |

QUOTE(JC999 @ Aug 22 2025, 11:57 PM) Nope, stand alone is always the cheapest. You are saying ILP is more expensive than standalone. Inside insurance plan there is 2 element, insurance premium + investment or savings But standalone only has insurance premium, and insurance premium is standardize across the company. I have never seen a standalone medical card more expensive than those all in one My original post to that person was saying age 0 medical insurance is not gonna be cheap. You do realise we are talking about different things right? JIUHWEI liked this post

|

|

|

Aug 30 2025, 12:26 PM Aug 30 2025, 12:26 PM

Return to original view | Post

#299

|

Senior Member

4,724 posts Joined: Jul 2013 |

QUOTE(ornehx @ Aug 28 2025, 05:10 PM) Anyone with experience with Kaotim product, specifically Kaotim Medikad and Kaotim Legasi? Kaotim is underwritten by Syarikat Takaful Malaysia Berhad, a license takaful company. if not mistaken, STMB is owned by Bank Islam.Looking for standalone, agentless, online type. I check Fi-Life but seems Legasi is much cheaper. Kaotim is by myTakaful, should be ok? Long story short, it's a legit company, running a legit business. do choose a higher deductible if you can when you buy. i recall they have deductible option of 2k or 3k. QUOTE(Jason @ Aug 27 2025, 01:51 AM) ayam very confused, I think these ILP stuff is hiding a lot of things behind the scenes and agents misrepresenting stuff to sell. 1. i am 99.99% confident, you can just drop your medical rider, maintain the whole policy. and rightfully, you will receive a premium reduction. tolong advise 1. I got existing life+ci with medical rider with GE. If I ONLY want to drop the medical rider do I need to cancel the whole policy? or just drop the rider and maintain the existing policy. And if I drop the medical rider, premium logically should go down right? why my agent quote me a new policy.. I just want to remove the medical rider and buy a new medical policy. Or insurance so stupid must cancel my existing policy just because I wanna remove a rider. If my old policy remove and start from 0 again.. fk this insurance I just go other company lah 2. how come same insurance (GE) same policy, same waiver, same deductible, same rider.. 1 agent quote Rm300/month another agent RM200/month... coverage same, benefits same.. everything same but such huge discrepancy.. 1st agent.. show as age progress..premium increase..but the rm200 show same monthly premium up to age 100..not possible kan.. 2. there are other "factors" that are at play which are quite technical to explain. Usually, it will be the sustainability age of the policy, fund selection as well. of course, obviously we are referring to the exact same product. but however, what you are explaining sounds like their mechanism works differently, so it's not the exact same thing. JIUHWEI liked this post

|

|

|

Oct 12 2025, 10:49 PM Oct 12 2025, 10:49 PM

Return to original view | Post

#300

|

Senior Member

4,724 posts Joined: Jul 2013 |

QUOTE(Altrost @ Oct 1 2025, 11:17 AM) Hi sifus, hope you can help answer this: While I acknowledge that medical inflation is real and in the range of double digits, annual limit of 1mil is still very high. It will probably last 20 years at least, if not more. Of course, just guessing game from all of us but to assume 1mil can't cover anything serious in 10 years is still too doomsday perspective. Given the forever rising medical charges, is there any difference with ILP and non-ILP policies if I want to update for the new costs? For example, we have non-ILP AIA MediFlex Plan 250 with MediBoost for 1mil annual limit. Say after 10 years, RM250 hospital room and 1mil annual is impossible to cover anything serious. What are the options available to update? Will we need to get an entirely new policy, and be subject to new waiting period? Does this differ between ILP and non-ILP? Regardless of ILP or non ILP, your typical terms and conditions are the same usually. Because they are medical insurance. As for options to update, it can be tricky. Some companies do offer their existing customers to upgrade, get a new plan, etc. but you do have to put in some effort to scout and understand as well. I will slowly answer other parts when I am free. JIUHWEI liked this post

|

| Change to: |  0.2632sec 0.2632sec

0.24 0.24

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 3rd December 2025 - 07:31 AM |