QUOTE(WaCKy-Angel @ Feb 19 2024, 03:45 PM)

Anyone can explain how to split a claim to 2 medical cards?

Like say if fees is 50K and got 3K deductible/co-insurance can use another card to claim for that 3K amount?

The thing is both companies requests for original receipts and/or hospital reports. How do i submit only 1 original copy to both?

Also related to above, the real situation i want to ask..

I was admitted but post-admission is pay&claim and no issue for claiming post-admission.

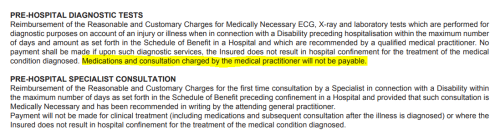

However i want to ask does outpatient GP also considered as pre-admission? Is it depends on the policy clause?

Lets say policy does say GP pre-admission not covered, is it possible to claim this GP pre-admission under different medical card (as per 1st question)?

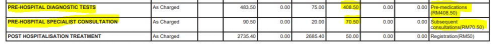

The first set of original receipts, you take and go claim it from the first policy.

The first policy will then issue a settlement statement, detailing what was paid and what wasn't. For example, the 3k deductible or co-insurance.

If the 3k is a deductible, yes you can take the settlement statement that shows the deductible payments made to the hospital and claim it from the second policy.

If the 3k is a co-insurance, then no you won't be able to claim a co-insurance payment from the second policy. Because it is a co-insurance.

However i want to ask does outpatient GP also considered as pre-admission? Is it depends on the policy clause?Yes, with a referral letter that led to the eventual hospitalization, up to the periods stipulated in the policy contract.

Eg: 30 days, 60 days etc, before hospital admission,

This post has been edited by JIUHWEI: Feb 23 2024, 10:07 AM

Feb 19 2024, 02:38 PM

Feb 19 2024, 02:38 PM

Quote

Quote

0.0255sec

0.0255sec

0.41

0.41

7 queries

7 queries

GZIP Disabled

GZIP Disabled