QUOTE(timeekit @ Mar 9 2023, 03:10 PM)

@denion @lifebalance @MUM @contestchris

Thank you for your input and advice given.

Would like to seek your opinion on this matter as well

My mum actually bought a PRU medical policy way back when I was a teen, but the medical policy I feel is currently obsolete.

Annual limit +/- 70k and lifetime limit around 200k, paying around rm200 per month.

Is there anything that can be done to increase the effectiveness of this policy? Or am I just being overinsured if I continue with this medical policy, since I already have a GE medical policy which I feel is good as well.

Just wondering are there any medical card for normal clinic visit claim, free health check up etc that can complement my current GE medical card?

For me I will pick the one card. You don't need two unless you are paranoid.

Just surrender the old card and stick with great eastern.

If you are paranoid and don't mind paying extra around rm500/year, can sub for gathercare. It's crowd sourcing medical care. Coverage up to 1m and 100 years old. No annual increment unlike traditional insurance.

No insurance will cover outpatient treatment. There is only 1 medical insurance in Malaysia which covers outpatient. It's AXA outpatient insurance. Another option is your employer insurance might have out patient insurance.

https://www.axa.com.my/medical-health/smartmedi-outpatient If you want health screening, vaccination and no claim benefit go AIA

https://www.aia.com.my/en/our-products/medi...0Annual%20Limit.

The condition is must be healthy and must exercise.

Great eastern don't have this benefit.

Disclaimer. I am not an insurance agent just someone who have been shopping for insurance.

Another thing to note Great Eastern is very particular about claims. There have been report of them declined claims for critical illness because of

1. Patient didn't disclose have anxiety and claimed for cancer stage 4 (no relationship with cancer)

2. Patient having valve problem claimed critical insurance from great eastern but decline cause surgeon did key hole (minimally invasive surgery Vs open heart). Prudential paid out fully critical illness claim

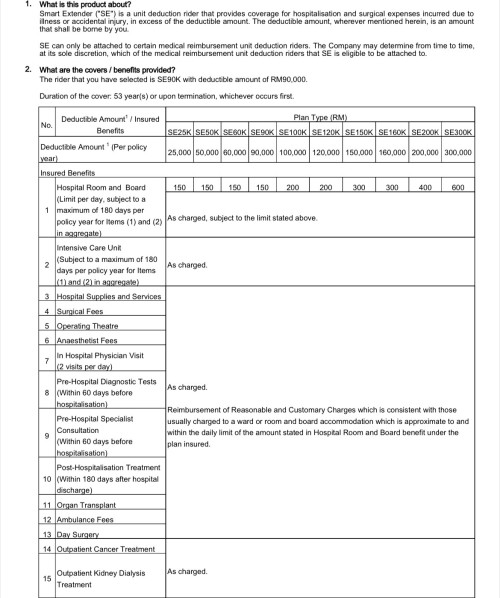

https://forum.lowyat.net/topic/4833082https://forum.lowyat.net/topic/5125587The above post/comments and Reddit comments make me skeptical to choose GE as my critical insurance illness. I am goin with AIA or prudential. I am only going for Great Eastern for standalone card cause they are the cheapest and have outpatient GL for cancer treatment and dialysis.

Hope this help

This post has been edited by Ramjade: Mar 9 2023, 03:58 PM

Jan 5 2023, 01:08 PM

Jan 5 2023, 01:08 PM

Quote

Quote

0.0269sec

0.0269sec

0.75

0.75

7 queries

7 queries

GZIP Disabled

GZIP Disabled