QUOTE(mini orchard @ Oct 5 2023, 05:20 AM)

Yes. And first time trying to admit for surgery.

I suspect the insurer didn't want to approve is because we didn't agreed to the proposed premium increment but choose the minimal option.

I am not sure how the agent works as there was no further purchase of new policy.

We did ask the operations procedure and dr said to admit.

My spouse never like hospital esp the needle and knife and rather hold on to the operation.

If not because of my nagging and encouragement, we wouldn't have gone for the appointment.

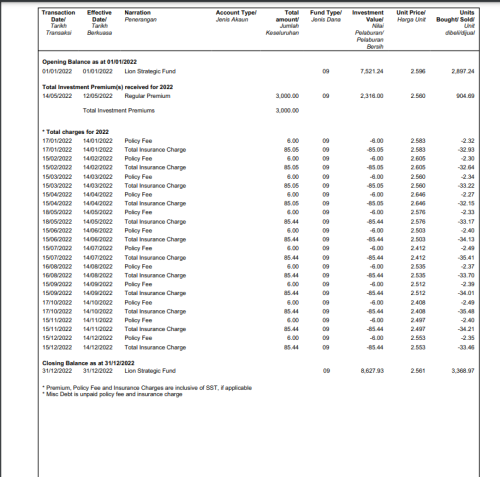

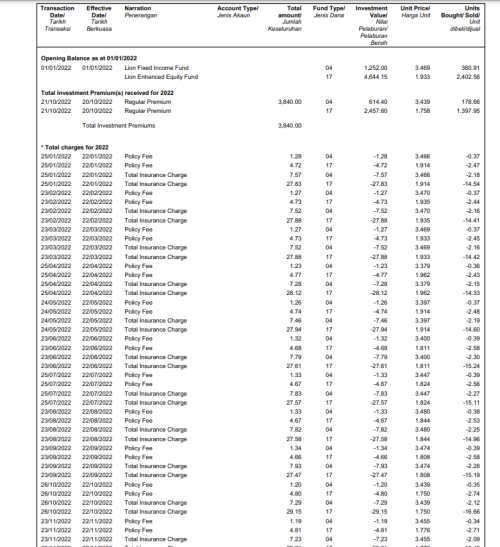

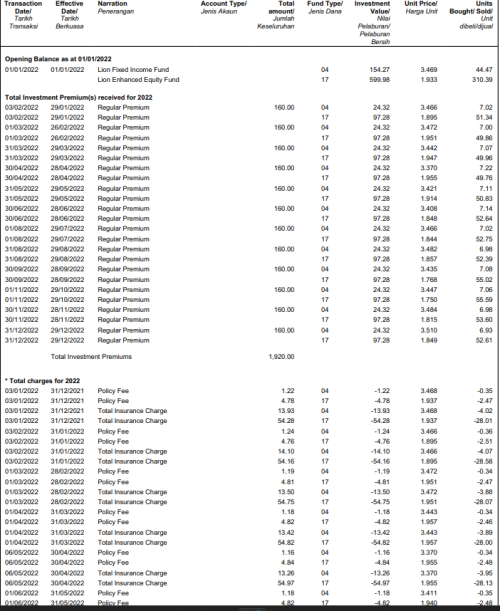

Premium is due in Dec and has adjusted from 3.5k to almost 6k. If I compare the new premium to the standalone policy for the same age band, is 50% higher .... what ILP 😡 are we talking here?

Maybe after the operation, will decide to cancel the policy and buy another. See how the next hospital admission goes. Cannot afford to take risk if something more serious and ask to pay first claim again 😡

based on my experience, company got no rights to decline GL because you don't agree to the premium increment. if you don't mind to call the hotline on your medical card, you can actually call and ask. remember to record down the conversation. the reason of decline must tally with what is stated in contract document for example:

1. maybe got premium due

2. policy on premium holiday

3. condition is fall under exclusion clause

4. non-disclosure

5. contestable period (we can exclude this since you said the policy is more than 20 years old)

find out first before having the thought of cancelling the medical card and purchasing a new one after the op. if it falls under exclusion clause, then likely even you change to another medical card, same thing will occur again.

QUOTE(Rinth @ Oct 5 2023, 09:53 AM)

Means insurance company got the rights to not issue GL and ask us to pay 1st claim later without any reason? Damned.

hi Rinth, insurance company got the rights to not issue GL and ask us to pay 1st claim later but not without reason, there will be a reason, need to find out either via agent or the GL hotline.

This post has been edited by denion: Oct 5 2023, 10:51 AM

Aug 2 2023, 04:17 PM

Aug 2 2023, 04:17 PM

Quote

Quote

0.4061sec

0.4061sec

0.51

0.51

7 queries

7 queries

GZIP Disabled

GZIP Disabled