QUOTE(timeekit @ Sep 29 2023, 06:12 PM)

Hi Sifus,

My Insurance Agent shared this campaign to me.

Seems quite worthwhile as able to double my annual limit.

Just wanted to know your opinion if worth to take it up, if it doesn't increase my current premium (or increase by a little)

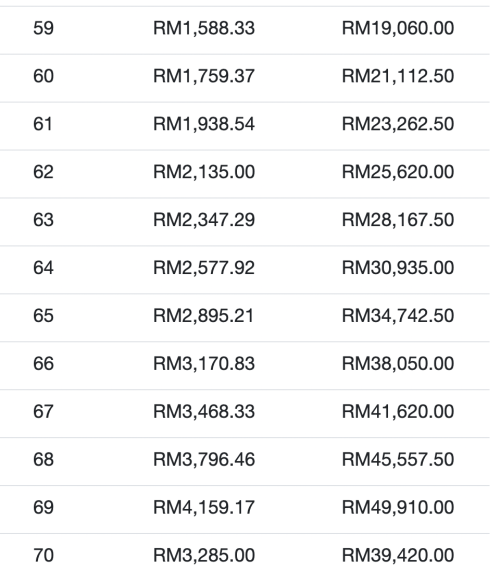

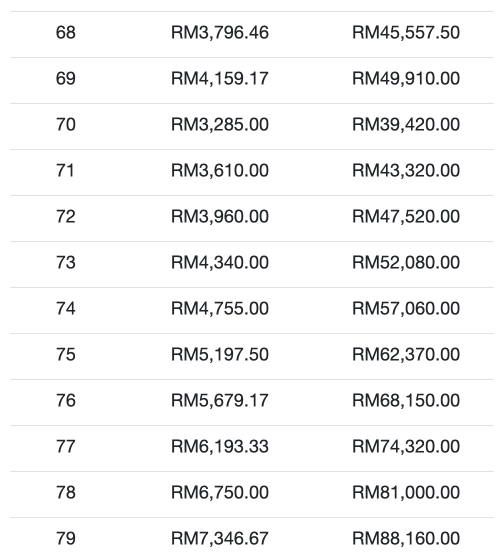

Great Eastern Double Annual Limit Campaign

If you dont have a medical plan and you want to buy, go ahead. But as always best to compare with another 2 companies. Just so you know where it stands. My Insurance Agent shared this campaign to me.

Seems quite worthwhile as able to double my annual limit.

Just wanted to know your opinion if worth to take it up, if it doesn't increase my current premium (or increase by a little)

Great Eastern Double Annual Limit Campaign

If you already have an existing medical plan, different story.

QUOTE(Alternate Gabriel @ Sep 29 2023, 11:23 PM)

I want to know why some of the Insurance Agents in Malaysia are resigning from their job?

Can I know what's the reason you all resigning?

I took an insurance from my ex colleagues previously and I noticed that he managed to get a lot of people to sign up insurance under him.

Fast forwards 2 year later, I got a letter from AIA mentioning that my ex colleague already resigned. Texted him, he said that he jumped to Hong Leong Assurance. It's pretty frustrated when I got the letter. He won't even bother to text me that he had resigned. I asked other persons that signed up insurance under him also didn't aware that he's already resigned.

Now my insurance is handled by random lady that I didn't know at all. The only text message that I received is wishing me Happy Birthday and encourage me to use AIA+.

One person resign, you make it sound like 300 ppl resign. You talk like my 60+ y/o old ppl at home with no notion.Can I know what's the reason you all resigning?

I took an insurance from my ex colleagues previously and I noticed that he managed to get a lot of people to sign up insurance under him.

Fast forwards 2 year later, I got a letter from AIA mentioning that my ex colleague already resigned. Texted him, he said that he jumped to Hong Leong Assurance. It's pretty frustrated when I got the letter. He won't even bother to text me that he had resigned. I asked other persons that signed up insurance under him also didn't aware that he's already resigned.

Now my insurance is handled by random lady that I didn't know at all. The only text message that I received is wishing me Happy Birthday and encourage me to use AIA+.

Random lady who takes care of your insurance policy does not really matter. What matters is she does her job. At least not every single communication she give you is to ask you buy stuff.

You should ask your friend why he resigned.

This post has been edited by adele123: Sep 30 2023, 12:44 AM

Sep 30 2023, 12:39 AM

Sep 30 2023, 12:39 AM

Quote

Quote

0.0263sec

0.0263sec

0.55

0.55

7 queries

7 queries

GZIP Disabled

GZIP Disabled