QUOTE(Ramjade @ Sep 15 2023, 10:59 AM)

» Click to show Spoiler - click again to hide... «

I worte about it in few post back about ILP Vs standalone. Anything bundle with life insurance is usually ILP.

Keep in mind that if your parents got existing condition they won't be covered eg high blood pressure, diabetes and it's complication.

You can choose to cover until whatever age you can afford. Nowadays got standalone insurance cover until 100 years old. But can you afford the premium at 20k/year?

I alway say get standalone. Don't get sold by agents or "planners" for ILP.

Cheapest standalone until age 80 (from what I calculate Vs AIA or GE you can cover to 100 also if you want)

1. Medisavers

https://medisavers.my/medisaversvip-prime.htmlOthers

AIA medi flex with rider

https://www.aia.com.my/en/our-products/medi...e-mediflex.htmlGE

https://www.greateasternlife.com/my/en/pers...-extender2.htmlGenerali

https://fiselect.my/medical/Keep in mind some last age to onboard is 70. Expect insurance companies to ask for medical report on health before approval due to age. They can ask for it and it is their right.

For me personally I went with AIA. I had an GE insurance, exercise my cooling period due to not so good reputation of GE trying their best to delay admission or GL (not I say, so many of my friends working in private hospitals tell me).

Which one is the best?

AIA and GE can apply for outpatient GL for dialysis while others pay and claim. There is no best. All depends on budget, room and board, how long post hospitalisation follow up.

Which is the cheapest?

If you cover until 80 years old, medisavers

Which one have longest outpatient coverage after hospitalisation?

GE

Which one have not so good reputation?

GE. Others unknown (Generali and medisavers) unable to dig up info on Generali or discovers due to not many people using it. AIA usually no-issue as long as pay on time and in full. No questions asked unlike GE.

When you buy medical insurance, do not expect any cash value left. Whatever you pay, just assumed it's burned. Only way to get returns on medical insurance is to use it for admission.

Cons of ILP

1. Unnecessary bundle

2. Extra cost

3. Lousy returns

4. Increase in price every few years when it's supposed to be fixed

Pro of ILP

1. You can take premium holiday and your insurance won't lapse i.e "forget" to pay or really forget to pay or need the money for other stuff (not recommended)

2. Can downgrade the plan

Pros of standalone

1. You know more or less how much you are paying

2. You pay only for medical insurance and commission. Nothing else.

3. You get better returns by putting the money into your parents EPF and they can take the money out anytime

4. Less sudden increase as what you see on the table is usually what you pay. Usually.

Cons of standalone

1. If you missed payment, then it's lapse and not covered anymore. No issue if you are a good paymaster

2. Amount of premium paid can shocked some people.

Hope this help your search. Keep in mind at 60+ premium is expensive yo. Sometimes at that age, best to pay out of pocket.

Why do you recommend medisavers? Actually that company still seem very dodgy. No credentials, medisavers powered by metafin, does not seem like something to be recommended.

QUOTE(Rinth @ Sep 15 2023, 11:22 AM)

Thanks for reply. So I'll ask my parent to get a quote for standalone policy with similar coverage.

Literally if able to purchase the policy before age 70, they should able to extent their medical policy above age 80, provided they can swallow the premium. I'm just afraid that due to whatever reason we want to extent, but due to the insurance doesnt allowed to extent then jialat.

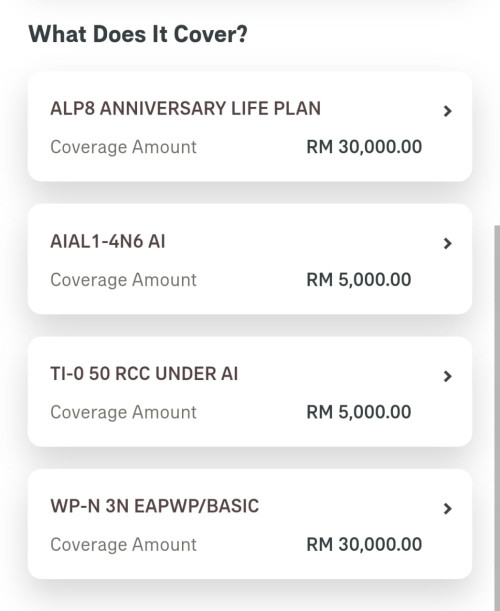

Paying out of pocket most likely was their initial plan, they do have 1 medical policy, but was like those very old policy, annual limit 30k, as they didnt review their policy b4, so now kinda late already.

One thing not mentioned by ramjade. But it does not change my advice regarding your parents.

There are fewer companies offering medical insurance as a standalone plan. Prudential does not have it. But GE, AIA still have them. Other pure general insurance company, means like lonpac, tune cant sell life insurance. So in this situation whatever they sell, will definitely not be an ILP plan, because they are not allowed to do so. So in theory you have this option to look into them.

Side note: Those companies with multiple license, can sell whatever but the life and general insurance company is technically different entity but should not much impact to the consumer in the end.

In general, the medical product designed by companies like AIA, GE (the life insurance company), Prudential, are more varied than their pure GI counterpart like tune. I also dunno why. Somehow these i cannot explain. Maybe they just happen to have a bigger market share too.

So i think GE was the one that started this annual limit 1million trend in the market. Those products that generally have 1mil annual limit, typically is offered as a rider under investment linked plan. So the current trend in the market is as such. Now some of them probably can offer 2mil annual limit if not more.

However if you look into AIA newer product A life medi flex, which is a standalone medical plan you can top up a booster to increase the annual limit higher, i think close to 1mil. But if someone who is not from aia or ge, then due to standalone medical plan not available, they cant recommend you.

For someone who is younger, i would recommend taking ILP plan, they can attach other coverage (like critical illness, life insurance), at the same time the newest benefit are introduced to the ILP version. The exception is probably this medi flex plan by aia.

For your 60+ year old parents assuming no more liability, the aia medi flex plan is a good exploration ground. They have an option between 500 deductible and 20% co-payment up to rm3,000.

Means everytime masuk hospital need to pay rm500 first OR For the copayment option, means every rm1 of the hospital bill, you have to fork out rm0.20. This is capped at rm3000. If masuk hospital, rm10k, then you pay 2k, aia pay 8k. If the bill is 20, you pay 3k, 17k paid by aia.

Obviously 20% copay version will be cheaper. For older ppl like your parents, you can consider this. This will make your insurance cost more palatable. If your parents stay healthy and use it less, will save some money. This would be the one i buy for my mother also. Let's just say mine does not have copayment, 0 deductible, i am paying 7k annual premium this year. Next year gonna be worse, she 71 y/o. I wish i had bought a copay version.

QUOTE(Ramjade @ Sep 15 2023, 11:23 AM)

There are 3 type of thinking when come to life insurance

1. I pay so much already, just continue paying until I die.

2. I want to leave something for my kids so let me buy life insurance

3. Modern conventional Singaporean thinking, cover all loans and cover until I retire. After I retire no need for life insurance anymore.

Again each thinking is different to everyone. Can't say what is right or wrong for you, myself or your parents.

For me I lean more towards 3. Also the only insurance I have is medical insurance and critical illness insurance. I won't bother with life insurance. I can't see the value of ILP henc ei avoid ILP. Also I am not a fan of ILP. No one have manage to convince me to buy an ILP yet. Haha... (waiting for that day)

I quote this from a financial blogger I follow, never ask a barber if you need a haricut. You know what that means. I don't need to say anymore. Only you yourself care about your own money. Don't listen to anyone. Don't listen to me. Seat down discuss with family members and do what is right for your money or their money

Show them the premium they are paying at age xyz. Also if budget is a concern, get the cheapest room at board at RM150.

I just want to comment on #3. Dont think the singaporean invented it.

This post has been edited by adele123: Sep 15 2023, 05:04 PM

Jul 24 2023, 06:30 PM

Jul 24 2023, 06:30 PM

Quote

Quote

0.0363sec

0.0363sec

0.47

0.47

7 queries

7 queries

GZIP Disabled

GZIP Disabled