QUOTE(Baconateer @ Jan 29 2021, 09:55 AM)

sell high buy low Gamers lead the way to fuck up wallstreet, Gamers did what communists failed.

Gamers lead the way to fuck up wallstreet, Gamers did what communists failed.

|

|

Jan 29 2021, 10:38 AM Jan 29 2021, 10:38 AM

Show posts by this member only | IPv6 | Post

#661

|

Senior Member

2,491 posts Joined: Dec 2004 From: initrd |

|

|

|

|

|

|

Jan 29 2021, 10:41 AM Jan 29 2021, 10:41 AM

|

Junior Member

487 posts Joined: May 2005 From: KL |

occupy wall street 2021

digital version |

|

|

Jan 29 2021, 10:42 AM Jan 29 2021, 10:42 AM

Show posts by this member only | IPv6 | Post

#663

|

Senior Member

4,561 posts Joined: Jan 2003 From: Penangites |

QUOTE(billyboy @ Jan 29 2021, 09:37 AM) f the squeeze had continued Citadel and Point72 would have had to bail out Melvin Capital again (which is odd since it was CNBC that also reported yesterday that the hedge fund had closed its shorts [fake news by CNBC]... which apparently was not exactly true). wolf pack eats the one which is bleedingAnd while $2.75 billion may be pocket change for Ken and Steve, $5 billion starts to look like real money. And what if it has to be followed by $10 billion, $20... and so on. On the other hand, if they did not throw more good money after bad, not only would their initial investment be wiped out, but once Melvin was forced to start selling its longs to fund its margin calls - which also happen to be the names contained in the Goldman Sachs Hedge Fund VIP basket biggest longs for Citadel and Point72 - that's when the real carnage would take place as everyone would scramble to frontrun the upcoming liquidation. The result would have been billions in losses for Citadel and Point72. [this could trigger the long awaited stockmarket crash in US - maybe] article from ZH. comments in brackets are mine. it's not only Melvin, combined short position of all hedge funds is -70Billion if regulators allow WSB to KO one melvin, then WSB become wolfpack to kill other hedge funds which are overly exposed shorting those dying stocks. |

|

|

Jan 29 2021, 10:47 AM Jan 29 2021, 10:47 AM

|

Senior Member

1,466 posts Joined: Mar 2019 |

QUOTE(happyking4ever @ Jan 29 2021, 10:36 AM) it is short seller obligation to return the borrowed shares. if they can't afford to, the creditors can force them to go bankrupt. Sounds risky Raistalin liked this post

|

|

|

Jan 29 2021, 10:48 AM Jan 29 2021, 10:48 AM

Show posts by this member only | IPv6 | Post

#665

|

Senior Member

4,561 posts Joined: Jan 2003 From: Penangites |

QUOTE(Matchy @ Jan 29 2021, 10:08 AM) from what i understand:- but actual thing is like this1. You borrow 10 units stock. 2. Then you sell the 10 units stock at current market price RM10 per unit. So you get RM100. 3. Stock price drop to RM7. 4. You need to return the 10 units stock. Since you already sold it, so you need to buy back. 5. You buy back at RM7 per unit, so total to spend is RM70 for 10 units. 6. Profit = RM100 - RM70 = RM30 at $280, all the stocks havent be repaid yet. 100% and there are running interest to hold the short position |

|

|

Jan 29 2021, 10:49 AM Jan 29 2021, 10:49 AM

Show posts by this member only | IPv6 | Post

#666

|

Senior Member

4,561 posts Joined: Jan 2003 From: Penangites |

|

|

|

|

|

|

Jan 29 2021, 10:51 AM Jan 29 2021, 10:51 AM

Show posts by this member only | IPv6 | Post

#667

|

Junior Member

38 posts Joined: Jul 2013 |

This is the big long, fuck the shorters! Buy GME!

|

|

|

Jan 29 2021, 10:51 AM Jan 29 2021, 10:51 AM

|

Senior Member

2,220 posts Joined: Apr 2006 |

QUOTE(keluarpattern @ Jan 29 2021, 10:47 AM) Short Seller was greedy.....they thought they can short the shares down to less than $1, and make more profit.However the risky part, is that, their Short Interest (Shorted Shares / Available Shares) was 140%, about 120% 24 hours ago...probably lower a little by today......... the Hedged Fund was UNhedged, and totally greedy...........thats why they became risky..... |

|

|

Jan 29 2021, 10:52 AM Jan 29 2021, 10:52 AM

Show posts by this member only | IPv6 | Post

#669

|

Junior Member

328 posts Joined: Jul 2008 |

LOL. All over the internet, the so called Financial Gurus / Experts are blaming the neets over at Reddit for causing instability they say.... https://www.bloomberg.com/news/articles/202...-funds-squeezed Look closer, and it makes more sense. “Buy what you know” is the mantra of Warren Buffett. So it’s easy to see why a bunch of millennial traders -- trapped at home amid the pandemic, with savings swollen by a lack of opportunities to spend disposable cash elsewhere or government stimulus payments -- could know a thing or two about gaming. Especially when they approach the market like a video game and their strategies include something akin to what gamers would call a “cheat code” -- in this case, banding together and piling into individual stocks and related options the way a tight-knit team attacks a roomful of dragons in “World of Warcraft.” All with the goal of forcing short-sellers and derivatives dealers to buy the stock, pumping up its price beyond anything a traditional investor would consider reasonable. focusrite liked this post

|

|

|

Jan 29 2021, 10:53 AM Jan 29 2021, 10:53 AM

|

Senior Member

1,692 posts Joined: Feb 2017 |

QUOTE(AllnGap @ Jan 29 2021, 10:42 AM) wolf pack eats the one which is bleeding this is stock market all about. willing buyer willing seller.it's not only Melvin, combined short position of all hedge funds is -70Billion if regulators allow WSB to KO one melvin, then WSB become wolfpack to kill other hedge funds which are overly exposed shorting those dying stocks. |

|

|

Jan 29 2021, 10:53 AM Jan 29 2021, 10:53 AM

|

Junior Member

611 posts Joined: Feb 2018 |

QUOTE(billyboy @ Jan 29 2021, 10:51 AM) Short Seller was greedy.....they thought they can short the shares down to less than $1, and make more profit. on the contrary. They have the least risk, because they know they are too big to fail However the risky part, is that, their Short Interest (Shorted Shares / Available Shares) was 140%, about 120% 24 hours ago...probably lower a little by today......... the Hedged Fund was UNhedged, and totally greedy...........thats why they became risky..... |

|

|

Jan 29 2021, 10:53 AM Jan 29 2021, 10:53 AM

Show posts by this member only | IPv6 | Post

#672

|

Junior Member

215 posts Joined: Jan 2019 |

damn, its crazy, now d buyers dont care about losing money, as a lot of new buyers are pissed off with what citadel n Robinhood doing, so now just buy for d sake to pissed off the Hedge fund

|

|

|

Jan 29 2021, 10:58 AM Jan 29 2021, 10:58 AM

|

Senior Member

2,220 posts Joined: Apr 2006 |

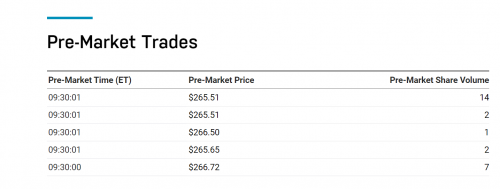

QUOTE(AllnGap @ Jan 29 2021, 10:49 AM) this is - i think - is market manipulation by the Empire.remember yesterday most brokers stopped buy orders. then someone sells 443,000 shares at 120. USD53m - one bloc - surely its to crash the price down..... trip all the margin buyers who gets killed..... the broker msg the margin buyer, pls top up within one hour (if lucky - usually no notice) otherwise i will sell your position. broker then dumps all these shares to their Buddy Hedge Funds at 120.....and then the price picks up.... now premarket price is 263 Pipit totally screwed. TLDR - Stockbroker Gang with Hedge Fund to screw Retail Investor - Stockbroker ban BUY of shares - Hedge Fund forces down the price - Retail Investor face Margin Call / Forced Share Sale - Hedge Fund scoop up cheap shares - Retail Invester screwd.  tkh_1001 liked this post

|

|

|

|

|

|

Jan 29 2021, 11:03 AM Jan 29 2021, 11:03 AM

|

Senior Member

2,220 posts Joined: Apr 2006 |

QUOTE(dagnarus @ Jan 29 2021, 10:52 AM) LOL. you are reading the narrative of the EMPIRE.....it includes the Hedge Funds / Stockbrokers / Media (bloomberg / CNBC)All over the internet, the so called Financial Gurus / Experts are blaming the neets over at Reddit for causing instability they say.... https://www.bloomberg.com/news/articles/202...-funds-squeezed Look closer, and it makes more sense. “Buy what you know” is the mantra of Warren Buffett. So it’s easy to see why a bunch of millennial traders -- trapped at home amid the pandemic, with savings swollen by a lack of opportunities to spend disposable cash elsewhere or government stimulus payments -- could know a thing or two about gaming. Especially when they approach the market like a video game and their strategies include something akin to what gamers would call a “cheat code” -- in this case, banding together and piling into individual stocks and related options the way a tight-knit team attacks a roomful of dragons in “World of Warcraft.” All with the goal of forcing short-sellers and derivatives dealers to buy the stock, pumping up its price beyond anything a traditional investor would consider reasonable. balance your view....go read Reddit / Wallstreetbets..... its like reading the Star and believe it as the TRUTH from heaven hint : key word is the Short Outstanding postion.... |

|

|

Jan 29 2021, 11:04 AM Jan 29 2021, 11:04 AM

|

Senior Member

2,547 posts Joined: Oct 2007 |

tbh sounds like they slowly inching back?

|

|

|

Jan 29 2021, 11:06 AM Jan 29 2021, 11:06 AM

|

Senior Member

2,220 posts Joined: Apr 2006 |

|

|

|

Jan 29 2021, 11:07 AM Jan 29 2021, 11:07 AM

|

Junior Member

480 posts Joined: Sep 2004 |

BUY GME & AMC, and HOLD THE LINE

|

|

|

Jan 29 2021, 11:08 AM Jan 29 2021, 11:08 AM

|

Junior Member

27 posts Joined: Mar 2010 |

|

|

|

Jan 29 2021, 11:09 AM Jan 29 2021, 11:09 AM

Show posts by this member only | IPv6 | Post

#679

|

Junior Member

328 posts Joined: Jul 2008 |

QUOTE(billyboy @ Jan 29 2021, 11:03 AM) you are reading the narrative of the EMPIRE.....it includes the Hedge Funds / Stockbrokers / Media (bloomberg / CNBC) hahaha, of course man, I just read it for the luls.balance your view....go read Reddit / Wallstreetbets..... its like reading the Star and believe it as the TRUTH from heaven hint : key word is the Short Outstanding postion.... I can smell the butthurt two million miles away! |

|

|

Jan 29 2021, 11:09 AM Jan 29 2021, 11:09 AM

|

Junior Member

27 posts Joined: Mar 2010 |

|

| Change to: |  0.0261sec 0.0261sec

0.37 0.37

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 6th December 2025 - 01:20 PM |