Outline ·

[ Standard ] ·

Linear+

Gamers lead the way to fuck up wallstreet, Gamers did what communists failed.

|

tkh_1001

|

Jan 28 2021, 02:10 PM Jan 28 2021, 02:10 PM

|

|

QUOTE(epsilon_chinwk86 @ Jan 28 2021, 02:05 PM) Coz most my money got tied up in PLTR & BB already before the frenzy. And some stupid crypto that is still red btc to crash back down to reasonable level. this is baseless investment like any other speculative investment. |

|

|

|

|

|

tkh_1001

|

Jan 28 2021, 03:35 PM Jan 28 2021, 03:35 PM

|

|

QUOTE(AllnGap @ Jan 28 2021, 03:07 PM) did some digging on Melvin hedgefund. apparently they are very good at what they're doing, and many competitors copied their strategy, short selling what they sold. so this isnt just one hedge fund got burnt, it's a market leader at its segment that burnt badly. they were very greedy because GME from $40 pushed down to $4. yet these fuckers piled up more shorts which made them vulnerable padan mukak greedy wolves get stampede by reddit sheeps curious, how the shorter push the price down? they just short saja apa? |

|

|

|

|

|

tkh_1001

|

Jan 28 2021, 04:17 PM Jan 28 2021, 04:17 PM

|

|

cilaka now feeling like a stock market SJW

|

|

|

|

|

|

tkh_1001

|

Jan 28 2021, 10:29 PM Jan 28 2021, 10:29 PM

|

|

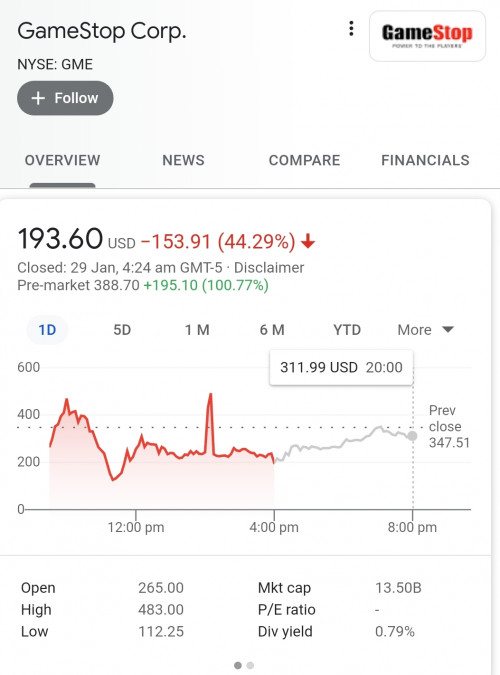

1 minute to stonks

|

|

|

|

|

|

tkh_1001

|

Jan 29 2021, 01:15 AM Jan 29 2021, 01:15 AM

|

|

Ok innnnn

|

|

|

|

|

|

tkh_1001

|

Jan 29 2021, 09:41 AM Jan 29 2021, 09:41 AM

|

|

|

|

|

|

|

|

tkh_1001

|

Jan 29 2021, 11:04 AM Jan 29 2021, 11:04 AM

|

|

tbh sounds like they slowly inching back?

|

|

|

|

|

|

tkh_1001

|

Jan 29 2021, 11:50 AM Jan 29 2021, 11:50 AM

|

|

baiklah malam ni masuk AMC pulak

|

|

|

|

|

|

tkh_1001

|

Jan 29 2021, 12:30 PM Jan 29 2021, 12:30 PM

|

|

Keep it goin

|

|

|

|

|

|

tkh_1001

|

Jan 29 2021, 05:26 PM Jan 29 2021, 05:26 PM

|

|

|

|

|

|

|

|

tkh_1001

|

Jan 29 2021, 06:28 PM Jan 29 2021, 06:28 PM

|

|

Gamestop will be an epic meme and history

|

|

|

|

|

|

tkh_1001

|

Jan 29 2021, 06:52 PM Jan 29 2021, 06:52 PM

|

|

Im wondering now how my buy went thru last night

|

|

|

|

|

|

tkh_1001

|

Jan 29 2021, 09:20 PM Jan 29 2021, 09:20 PM

|

|

QUOTE(Syie9^_^ @ Jan 29 2021, 08:36 PM) Watch Margin Call + Wolf of Wall Street. Everything is a series of math models, even stronk Peter Sullivan is in. But remember, Hedge Fund = (Borrowed Shares+ Borrowed Money + Pay smart guy + Sugarbaby like me) /Subtitute with sweettalker + cheap money access + ANALsis who loved being anal and moan what? |

|

|

|

|

|

tkh_1001

|

Jan 29 2021, 09:56 PM Jan 29 2021, 09:56 PM

|

|

dated 15 Jan. meaning they have already paid the interests?

|

|

|

|

|

|

tkh_1001

|

Jan 29 2021, 10:48 PM Jan 29 2021, 10:48 PM

|

|

Closed

|

|

|

|

|

|

tkh_1001

|

Jan 29 2021, 11:09 PM Jan 29 2021, 11:09 PM

|

|

Why GME dipped yesterday and why Holding the line matters more than ever.

DD

Hello dear autists (and some new joiners who are about to hop on the train),

This is an unprecedented moment in Financial history. The establishment is balls deep in each others' arses and we saw that in the Citadel-Robinhood-Point72-StevenCohen collusion yesterday.

For those who missed what happened: Robinhood and other brokerage platforms coordinated a short attack on the retail investor by blocking buy orders and allowing only sell orders. This resulted in a near evaporation of buying volume and panic selling from a lot of understandably concerned stock holders.

It can be construed that this was happening on the orders of the great Citadel, who may have profited off opening short positions at the top. This was seen and caught by multiple order flow traders who noticed block trades.

A short ladder

A short ladder was initiated. They closed the gates to retail and then block sold orders in the open market to drive down the prices. They did this between hedge funds A, B and C to maintain positions while profiting off their short positions (initiated at ATH). This can also be cross checked by looking at yesterday's volume, which was truly minimal. These HFs engineered the short ladder to use the low price to cover their short positions for cheap. Yet, the short interest dipped only marginally (from 140 percent to 120 percent)

The idea was to have retail offload as many shares as possible to increase float, which will make covering the short positions easy. So now we know that this is what they want. They want us to sell. And they will try a variety of tricks to make us sell. The short ladder was one of those.

So what can we do? And how will it matter?

We do the opposite of what they want us to. We don't sell. How will this help the short squeeze?

Not selling (and letting the buyers pile in) will add to the buying pressure. It will also reduce float.

So when the shorts do choose to cover, they will need to buy again, and again, and again to cover their entire position.

So hear me out here let's do some quick math. Short interest (no of shares shorted/ no of available in float) = 120 percent. There are more shares shorted than exist to be bought.

Investors like Burry and Cohen further reduce this float by piling in. In reality, the short is a good multiple of the float (this is my hunch). We have caught them by the balls and have a chance of changing the status quo.

All you have to do is Hold and not increase the share float. Shorting Gamestop is becoming more expensive by the minute. The shorters need to pay their brokers margin to borrow shares too. By reducing float, we can make these HFs bleed more.

By holding the line, we make HFs taste blood.

To Valhalla. Or the Moon. 🚀🚀

I'm a retard on a break from my CFA studies. Not a financial advisor (yet) 😉

|

|

|

|

|

|

tkh_1001

|

Jan 29 2021, 11:49 PM Jan 29 2021, 11:49 PM

|

|

QUOTE(sheldonyong @ Jan 29 2021, 11:11 PM) Bought at 300 usd to send a message. HOLD THE FORTTTTTT Added another unit today |

|

|

|

|

|

tkh_1001

|

Jan 30 2021, 12:17 AM Jan 30 2021, 12:17 AM

|

|

QUOTE(icehart85 @ Jan 29 2021, 10:07 PM)  This is so beautiful HAHAHAHAH Lowest ask? |

|

|

|

|

|

tkh_1001

|

Jan 30 2021, 10:47 AM Jan 30 2021, 10:47 AM

|

|

QUOTE(dagnarus @ Jan 30 2021, 06:53 AM) To keep it simple.... There is only maximum around 20-30% shares floated. HF short more than 100% of the company shares. If there is no liquidity how the fk are they going to buy back the shares? By payinf big money for it of course.... Like at least 10x more So if you want to set a TP make it 5k So.. is the shares we buying now are from the 20-30 % floats? |

|

|

|

|

|

tkh_1001

|

Jan 30 2021, 12:52 PM Jan 30 2021, 12:52 PM

|

|

QUOTE(lurkingaround @ Jan 30 2021, 12:21 PM) . Yesterday Friday, NY time, GME/Gamestop share closed at around US$325 each. Are those who bought at this price, the Hedge Funds covering their short-sells or Retail investors hoping to cash in at coming prices of >US$500 to US$5k.? ....... What if the price does not increase above US$325 on Monday but instead crashes back to US$10 in the next week or two.? . No one cares. Cos its pocket money |

|

|

|

|

Jan 28 2021, 02:10 PM

Jan 28 2021, 02:10 PM

Quote

Quote

0.0639sec

0.0639sec

0.62

0.62

7 queries

7 queries

GZIP Disabled

GZIP Disabled