[From WSB]

I just wanted to throw this out there in the middle of the outrage, in the hopes that someone can take it in and strategize, rather than be upset. Worked @ Merrill as an analyst from 2014-2016.

I also like to keep it concise so follow along. This ain't a fucking Qanon fan fiction.

Disclaimer: I own GME. This is not financial advice. This is just some dude chatting with his old buddies.

Robinhood, restrictions, suppression:

When you place an order through RH, Citadel or some other HFT front runs your trade and pockets the spread; However, the transaction is not complete.

Enter: Clearing house. The clearing house is the intermediary between the counter-parties. Because they stand between sellers & buyers, they have very defined levels of risk, risk management and regulation to be in front of. The clearing house is who gives you the "title" for your shares, the folks who make it official.

What Likely Happened: The risk department retard @ the clearing house, who does jack shit all year other than flag Stacy's trade so he can get some face time with her runs to the C-Suite frazzled; He has looked at option open interest expiring this week, has done the math and there simply isn't enough float for GME in anyway, shape or form; turns out WSB is printing out their stock certificates and burying them in the Mojave Desert. It's simply not enough.

In addition, they got a Snapchat from SEC/OCC which said hey, if you fucking keep selling open positions, you're on your own; we ain't gonna help you. SEC is sneaky like that; they like sending messages through the backdoor, not the front because they used to be hedgies themselves. If you're not following, Front door is making a public statement while the backdoor is a threat sent to an intermediary who you and millions of investors don't even know exists.

So, they call up the risk department at RH and tell em to stop fucking selling GME, there simply isn't enough float, the SEC told the clearing house they're on their own and who tf is gonna take the blame/liability if there's a "failure to deliver"?

2) Failure to Deliver:

This is a pretty fucking big deal. Bigger than you imagine, because it's basically a slam-dunk law suit.

Failure to deliver means that one of the counterparties (in this case, the firm who sold you the option, RH or the clearing house) has failed to deliver you a contractually obligated position, profit or certificate. Since there's no float and ITM calls get exercised by HFT bots at the end of the day, how in the fucking hell are they gonna deliver the option holders their contractually obligated merchandise if there is no merchandise to be delivered? There simply isn't enough for everyone. Thousands (or possibly hundreds of thousands) of failures to deliver = big risk

3) Liability:

You must be asking so what? Fuck them; They should be the ones figuring it out and they gotta give me, the customer, the right to choose or whatever the fuck; That sounds great in a boomer fashion but it's not that simple. Robinhood is contractually obligated to deliver you those shares or positions. If they fail to, they become liable for any losses or profits that you may have endured and they will LOSE in court cause they FAILED to DELIVER. How many people have options on GME on RH? Half? Imagine if half of these fine RH customers were legally owed benefits and they were engaged in DDoS style lawsuits involving Robinhood or the clearing house. There would be no Robinhood left. There would likely be no clearing house left. Robinhood is also a shitshow of a company, so they likely didn't even have additional collateral to put up to the clearing house for normal share buying and selling on the meme tickers and since they bank with T-Mobile, they had to pull the plug.

Hence: Bad Decision > Bankruptcy or worse (WSB finds Vlad's mom and becomes her boyfriend collectively)

I personally don't believe it was out of malice or a coordination for RH; there's definitely coordination all around, but occam's razor says this is not such an ordeal.

Couple of semi-related notes:

-Fuck Billionaires. Parasites of modern society, simply existing to leech off every slurp of alpha and take up resources meant for billions of poor people. **** them in the streets, ***** them in the **** , **** them from skyscrapers. Whatever is needed to discourage hoarding of resources of this tiny fucking planet.

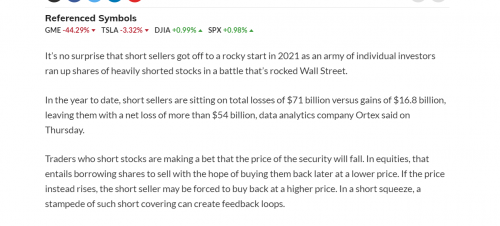

-I very much doubt that Ken Griffin and Citadel (the HF) would engage in blatant market manipulation or coercion of Robinhood or other brokers to make a few bucks on Gamestop or AMC. They cleared over 6 billion net last year, so just logically, it seems pretty unlikely to risk it for this. It is also very unlikely that Citadel Securities would engage in illegal behavior for the profit of Citadel, simply because it's such a money maker. If you were an evil genius, would you let your money maker go to shit because you were getting squeezed on some short?

-The media just wants clicks and engagement, so they will bring the worst people on, simply to pad their own bottom line. Don't get engaged. Don't give in to them. Be the captain of your own ship and fuck over wall-street however you please.

-The restrictions on the others tickers is likely proactive, not reactive.

TL;DR: There's simply not enough float and the broker/clearing house will fail to deliver on a large scale if they keep letting new positions be opened, hence restrictions.

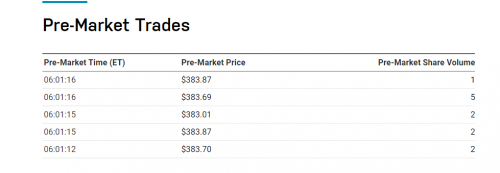

What will happen now: Based on my previous short squeezes, Friday (tomorrow) will be nuts; All this gamma has to go somewhere and since there's not enough float, I'm guessing up up up up up.

Jan 29 2021, 12:30 PM

Jan 29 2021, 12:30 PM

Quote

Quote

0.0777sec

0.0777sec

0.47

0.47

7 queries

7 queries

GZIP Disabled

GZIP Disabled