Gamers lead the way to fuck up wallstreet, Gamers did what communists failed.

Gamers lead the way to fuck up wallstreet, Gamers did what communists failed.

|

|

Jan 30 2021, 12:05 PM Jan 30 2021, 12:05 PM

Return to original view | Post

#101

|

Senior Member

2,220 posts Joined: Apr 2006 |

xenogearz88 and dupreehere liked this post

|

|

|

|

|

|

Jan 30 2021, 12:31 PM Jan 30 2021, 12:31 PM

Return to original view | Post

#102

|

Senior Member

2,220 posts Joined: Apr 2006 |

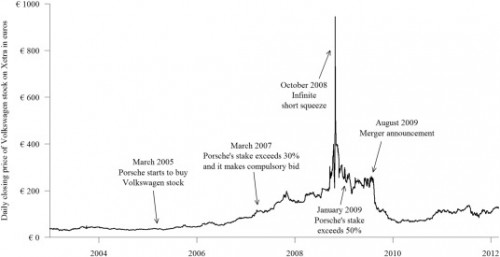

QUOTE(lurkingaround @ Jan 30 2021, 12:21 PM) . the key is to monitor the Short Interest position......Yesterday Friday, NY time, GME/Gamestop share closed at around US$325 each. Are those who bought at this price, the Hedge Funds covering their short-sells or Retail investors hoping to cash in at coming prices of >US$500 to US$5k.? ....... What if the price does not increase above US$325 on Monday but instead crashes back to US$10 in the next week or two.? . your hypothesis about USD325 to USD10 is valid.....its like saying we are all going to die Question : what are we going to do before we die ? what is the share price going to do between USD325 to USD10 ? Look at the Volkswagen short ....  stop being so melodramatic. Syie9^_^ liked this post

|

|

|

Jan 30 2021, 01:12 PM Jan 30 2021, 01:12 PM

Return to original view | Post

#103

|

Senior Member

2,220 posts Joined: Apr 2006 |

QUOTE(lurkingaround @ Jan 30 2021, 01:02 PM) . Sigh....https://markets.businessinsider.com/news/st...21-1-1030020684 - short-sellers-sitting-on-19-billion-of-(paper) losses-on-gamestop-data-shows - 6 hours ago ... Melvin Capital and Citron Research both said this week that they had closed their short positions, but they did not disclose any losses incurred. .... What if most of the affected Hedge Funds have already closed most of their short-sells on GME/Gamestop at about US$300 per share yesterday, Friday.? If so, the price will likely crash next week or two. . you believe CNBC that Melvin Capital has closed out, is like you believing Raja Petra that Najib is the best PM of Malaysia ever....

think (its allowed)...... 1. Why do they advertise the article that CNBC claims that Melvin Capital has sold out 2. Why did Robinhood block buying of GME (because Melvin's parent company Citadel makes 40% to 60% of Robinhood's revenue) 3. Why is the short interest still above > 100% they are spreading fear into the weak hands to shake them out...... its like the Msian syndicates, before they goreng, articles magically appear so beautiful about their target company......

|

|

|

Jan 30 2021, 01:25 PM Jan 30 2021, 01:25 PM

Return to original view | Post

#104

|

Senior Member

2,220 posts Joined: Apr 2006 |

[not investment advice - from WSB]

I am a hedge fund manager (long-short, derivative mixed equity fund primarily value focused with some growth). In the past we have been value holders of GME three other times and started a small position today nears it's intraday high and will likely add to this next week should the stock fall. Previously all my Reddit comments have involved my e-Skate collection or my landing of my airplane in challenging conditions (see: https://youtu.be/Rn7XoYKlZl0) However, I can't resist commenting on the fascinating technical factors that likely will continue to propel this issue higher - perhaps significantly so over the next few weeks. Andrew Left's mocking derision of retail investors may prove to be his waterloo. Why would a value focused fund manager buy a stock that based on classic fundamental value analysis appears significantly overvalued? GME appears to be a very interesting example of individual stock reflexivity. What is reflexivity you ask? This is the theory, originally promoted by George Soros that the stock market itself can cause the economy to either rise of fall (as opposed to the classic teaching that the economy affects the stock market). An example of market reflexivity would be the great depression whereby a crashed market brought down an economy that was only in an ordinary recession, or the recent improvement in the economy, not withstanding Covid, which has followed a rising market. In GME's case the rise in the stock price itself will likely result in fundamental improvements to the underlying economic metrics of the company. Why? As the price of the stock rises, GME finds itself in the enviable position where it can use it's stock at currency to buy complementary businesses it could not otherwise afford - monetization of the current short squeeze by the enterprise will lead to fundamentally higher revenue and profits of the enterprise should they find good strategic acquisitions to further monetize their large retail customer base (which has real and to date largely untapped value). The company is likely right now on the hunt for a major acquisition that could fundamentally alter the companies future prospects with that acquisition largely paid for on the back of short seller covering. Monetization of the short covering increase in share price via issue of a secondary . The $500 million in debt (net of cash) the company currently has could be entirely extinguished with a secondary that is dilutive of only 10% of the equity base. In fact such a secondary will, despite this dilution, likely result in a significant price rise for the stock (versus the usual fall in price after most, but not all, secondaries). Bankruptcy risk will largely be eliminated with this secondary as will interest rate risk and financing costs ultimately increasing cash flow per share. A 20% secondary will leave the company in a strong cash positive position with this cash available for expansion of sales efforts, cloud offerings, acquisitions, etc. Directly increased sales and revenue by virtue of the large amount of attention this epic short squeeze has brought to the company. I suspect most long retail stockholders have explored the companies web offerings and are considering becoming customers. This is free advertising to people with money who are tech savvy and the exact demographic GME would target with paid advertising. Retention and efforts of existing management now becomes easy. Every manager there wants to see this continue. Operations at companies with sinking share prices typically suffer as management and employees leave the enterprise or develop anger and lassitude (think Sears Holdings). The opposite is occurring here with every manager trying to beat their numbers to see the squeeze continue. This issue remains extremely heavily shorted. Despite the squeeze that has already occurred, other "value" based investors have dived into short positions as the price has risen. The short positions of this issue appears (although I can't be certain) to exceed 100% with all available shares already lent out from marginal accounts and probably a lot of naked shorting going on as well. Although I don't yet have the current data on todays short position, I can say for certain the stock remains very heavily shorter, perhaps more so now than at any previous time. Today, I called my broker asking about the availability of shares to short and the borrow costs. We have one of the larger accounts at our brokers firm and I was able to speak directly to the "hard to borrow" desk. No borrowable shares are available at any broker, anywhere, at this time, even for high borrow costs or even from other brokers. This extreme short against a small common float, made more extreme no-doubt by naked shorting, could end very poorly for those short this issue. As they are forced to close out their positions, the stock will continue to rise and continue to exacerbate the positive effects the rising price has on the above 4 issues. Impossible to know really where the stock goes from here as there does currently exist a disconnect from fundamentals. However, the extreme short position against the unrestricted common float here suggests to me there is a much greater chance of GME's price continuing to increase, perhaps significantly so, and this chance is far greater than the now fearful pundit in hiding's proclamation that the stock would soon see $20. For what it's worth, over the past 13 years of this funds life, we have significantly beaten both the overall market and the dow, (12.2%/year margin over DJIA inclusive of dividends since 2008). We have had plenty of losing issues despite this beat but also way more big winners, some really big. Right now my money's with the retail investors who are long GME. We only have a small position here but this may prove a big winner for us also. Cheers. |

|

|

Jan 30 2021, 01:28 PM Jan 30 2021, 01:28 PM

Return to original view | Post

#105

|

Senior Member

2,220 posts Joined: Apr 2006 |

TLDR: 🚀

They can make strategic acquisitions using shares They can issue shares to destroy the bankruptcy story Infinity squeeze and higher sales = free marketing GME management will work hard because they are jacked to the tits with their shares up 400% No shares available to borrow/short |

|

|

Jan 30 2021, 01:53 PM Jan 30 2021, 01:53 PM

Return to original view | Post

#106

|

Senior Member

2,220 posts Joined: Apr 2006 |

QUOTE(lurkingaround @ Jan 30 2021, 01:41 PM) . True. The affected HF can also hold a portion of their massive 130% of short-sells of GME stock for as long as possible by paying just 5% annual interest to the brokerage firm = 0.42% interest per month. Eg if GME share price is US$300, it costs just US$1.20 for the HF to hold the short-sell of one GME share for 1 month = if 1,000 GME shares = US$1,200 interest per month. Correct.? This battle between HF short-sellers and the posse of online Retail investors on social media may end up with who chickens out first = thereafter GME share price crashes down to earth at about US$10 per share. . i think you are delusional to imagine that Short Seller can borrow at 5% to buy a share. Ask your stockbroker how much he'd charge you for share margin financing. Its much higher than 5% for a 'safe' stock. How about for a highly speculative stock ? One source mentioned to me its 29% financing fee for GME.....if you can get it........still checking.... |

|

|

|

|

|

Jan 30 2021, 02:24 PM Jan 30 2021, 02:24 PM

Return to original view | Post

#107

|

Senior Member

2,220 posts Joined: Apr 2006 |

ohman and red streak liked this post

|

|

|

Jan 30 2021, 02:35 PM Jan 30 2021, 02:35 PM

Return to original view | Post

#108

|

Senior Member

2,220 posts Joined: Apr 2006 |

if i could, i would really love to know;

1. how much capital (cash and loan facility undrawn) left for short sellers. 2. how many days / weeks of interest left can they afford to pay. 3. what are the lenders to the HF's game plan. it may end up with Citadel (as owner of Melvin) which has AUM of USD30bn or the largest lender of Melvin. |

|

|

Jan 30 2021, 02:57 PM Jan 30 2021, 02:57 PM

Return to original view | Post

#109

|

Senior Member

2,220 posts Joined: Apr 2006 |

you following the wrong guy....

they only focus on GME....... try following the key leaders (not offically given) like DeepFkngValue |

|

|

Jan 30 2021, 05:46 PM Jan 30 2021, 05:46 PM

Return to original view | Post

#110

|

Senior Member

2,220 posts Joined: Apr 2006 |

Imagine you are a gambler enjoying a night at the casino. You decide to play Blackjack. Your hand is a ten and the dealer shows a 7. "I would like to hit." "No sir. You are only allowed to stand or surrender." "That's not the rules of the game. Aren't you regulated?" "Due to the votality your hand represents to the Casino, sir, you are only allowed to stand or surrender. These are extraordinary times." "...are you only allowed to stand or surrender?" "No sir. In fact, we may double down." "Wait. What? You are the dealer, you can't put more money in that I didn't put in. That money doesn't even exist on the table!" "Sir, you have a gambling problem. We might have to report the commission on you for attempting to hit with your hand because your friend told you that you should." "Wait, are you trying to make me fold?" "Sir, we reported you to the newspaper for being a degenerate." "You guys are crazy!" "Sir, we have decided that in order to protect your interests, you have decided to surrender." This post has been edited by billyboy: Jan 30 2021, 05:48 PM miuk and xenogearz88 liked this post

|

|

|

Jan 30 2021, 07:09 PM Jan 30 2021, 07:09 PM

Return to original view | Post

#111

|

Senior Member

2,220 posts Joined: Apr 2006 |

QUOTE(Syie9^_^ @ Jan 30 2021, 06:22 PM) he quite short selling analyst report liao.he wants to do only long analyst report....crazy...market so high, and want to do long only report. he should STFU and go play with his grandkids Outspoken activist short seller Andrew Left on Friday said that after 20 years, his firm Citron Research will exit the business of writing reports focusing on companies whose value may fall. Via Twitter and YouTube video, Left explained his decision with a headline saying: “Citron Research discontinues short selling research. After 20 years of publishing Citron will no longer publish ‘short reports’.” Citron said it would focus instead “on giving long side multibagger opportunities for individual investors.” |

|

|

Jan 31 2021, 12:54 PM Jan 31 2021, 12:54 PM

Return to original view | Post

#112

|

Senior Member

2,220 posts Joined: Apr 2006 |

QUOTE(lurkingaround @ Jan 31 2021, 12:35 PM) . before you call it a scam, do google "short interest position" and try to understand first........Gullible/foolish people believing in the Gamestop short-squeeze of HF short-sellers story in social media and the mass media(which can be manipulated for brainwashing) could be similar to such people believing in the FUD stories set up by a group/"gangsters" of Macau scammers. . calling a scam a scam and you get it right gives you a rush of adrenaline, and you feel good..... calling a scam when its not a scam, arguably it could be instantaneous stupidity. Out of character and senseless. One of those things. calling a scam, and doubling down, makes one wonder if its DNA stupidity then its tough. alluding GME to a scam, because there are other scam is like saying the sun rises everyday, and i get cheated by the Helang everyday. So the Sun cause the Helang to cheat me. Correlation is NOT causation. Think....its allowed..... Malaysians in general have been trained not to think by the education system. Easier for Helang to control and manipulate. Try thinking, and set aside your ego. Facts and logic. Its quite refreshing. Buffalo Soldier liked this post

|

|

|

Feb 1 2021, 09:58 AM Feb 1 2021, 09:58 AM

Return to original view | Post

#113

|

Senior Member

2,220 posts Joined: Apr 2006 |

|

|

|

Feb 1 2021, 10:00 AM Feb 1 2021, 10:00 AM

Return to original view | Post

#114

|

Senior Member

2,220 posts Joined: Apr 2006 |

|

|

|

Feb 1 2021, 04:26 PM Feb 1 2021, 04:26 PM

Return to original view | Post

#115

|

Senior Member

2,220 posts Joined: Apr 2006 |

i think.....

interest is 30% at market price... |

| Change to: |  0.2207sec 0.2207sec

0.29 0.29

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 3rd December 2025 - 10:20 PM |