QUOTE(88receiver @ Dec 5 2020, 11:50 AM)

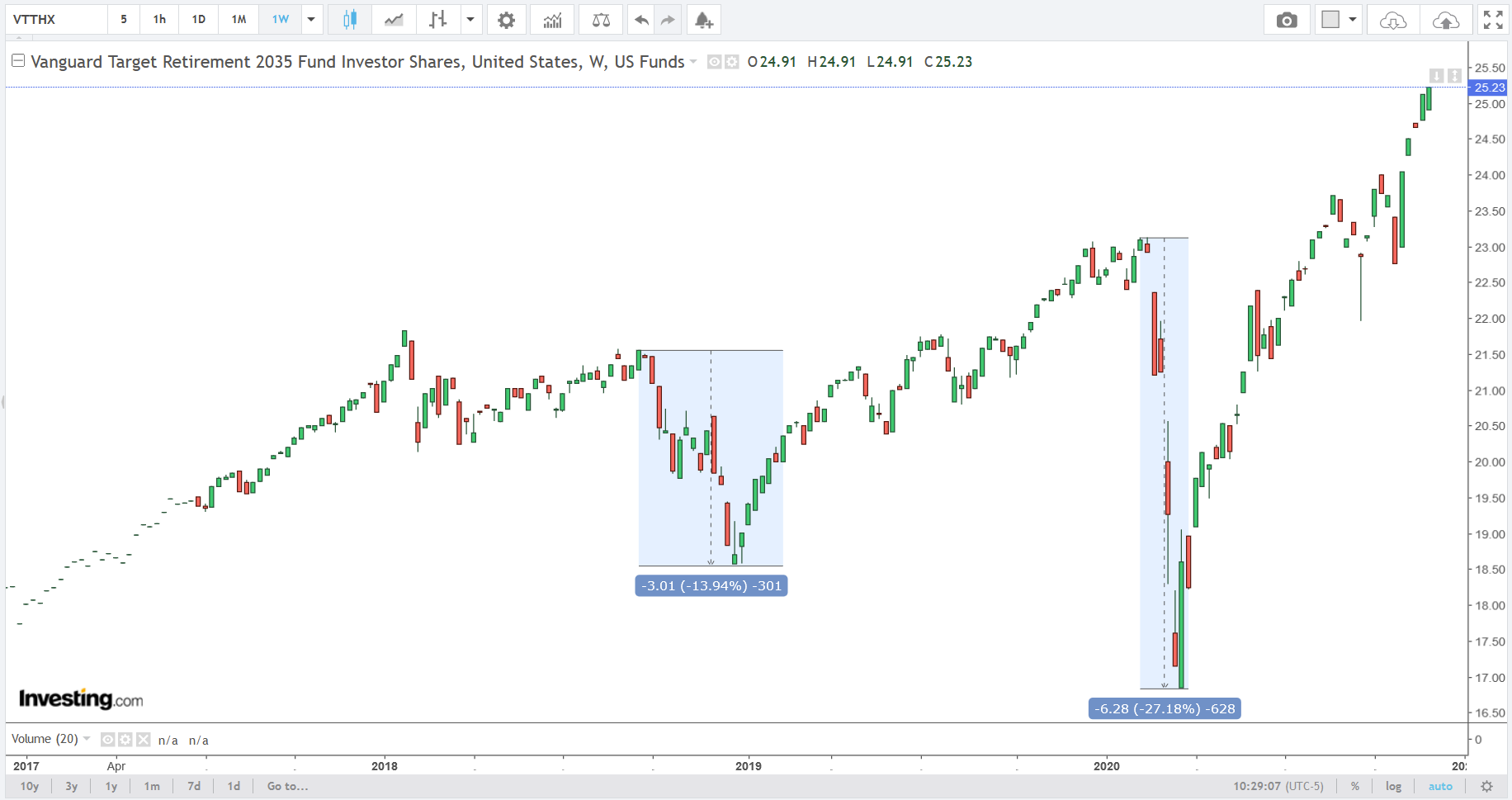

Hey mate, thanks for your suggestion. Where'd you find a FD yielding 3% p.a.? Most FDs are hovering around 2%. An aggressive ETF you say. I personally have got ARKK in my personal portfolio. VTTHX consists of the total stock market (similar to VTI), total international stock market (similar to VXUS), total bond and international bond funds which I believe which adds up to provide similar risk portfolio as what you've suggested. Bonds would definitely be riskier than FD's but with what FDs are yielding now with respect to inflation, I don't think it's worth it? Returns from FDs might even go to negative territory with the inflation in Malaysia. The equity portion of VTTHX would be less riskier compared to that of if I just went with ARKK as it covers the world market. Over a long term period (15 years), the dips should smooth out. Let me know what you think. I'll be calling a few banks to inquire about Amanah Saham too. If that's available I'll probably just put all the funds in there. Any tips on attaining Amanah Saham (fixed priced fund non-bumi ASM) shares would be much appreciated.

you need to do your own work man, we can only share views and let you know some of the possibilities, but can't not give you A to Z step by step, such services you need to seek for professional consultant or wealth planner, the good ones charge by hour just for consultation alone, the rate is higher than specialist doctors in hospital.

with all due respect, personally i dont consider those in banks that sell you mutual funds or investment plans as good wealth planner, they are just sales people with limited knowledge in investment markets. also its conflict of interest, most of the time, their priority is how much can get from commission instead of your needs.

think long term and average out, we were having over 4% just 2 years ago.

https://forum.lowyat.net/topic/4154481/+9980btw, well done on ARKK, I had some in the past as well, hope catherine can sort out the company take over issue soon.

This post has been edited by lamode: Dec 5 2020, 12:59 PM

Dec 4 2020, 11:44 PM

Dec 4 2020, 11:44 PM

Quote

Quote 0.0177sec

0.0177sec

0.20

0.20

6 queries

6 queries

GZIP Disabled

GZIP Disabled