Hey guys, I'm currently planning my mum's financials and would like the opinion of my Lowyat friends.

My mum was diagnosed with cancer earlier this year so we would like to keep this fund a little more liquid compared to if it was locked in EPF until the age of 65.

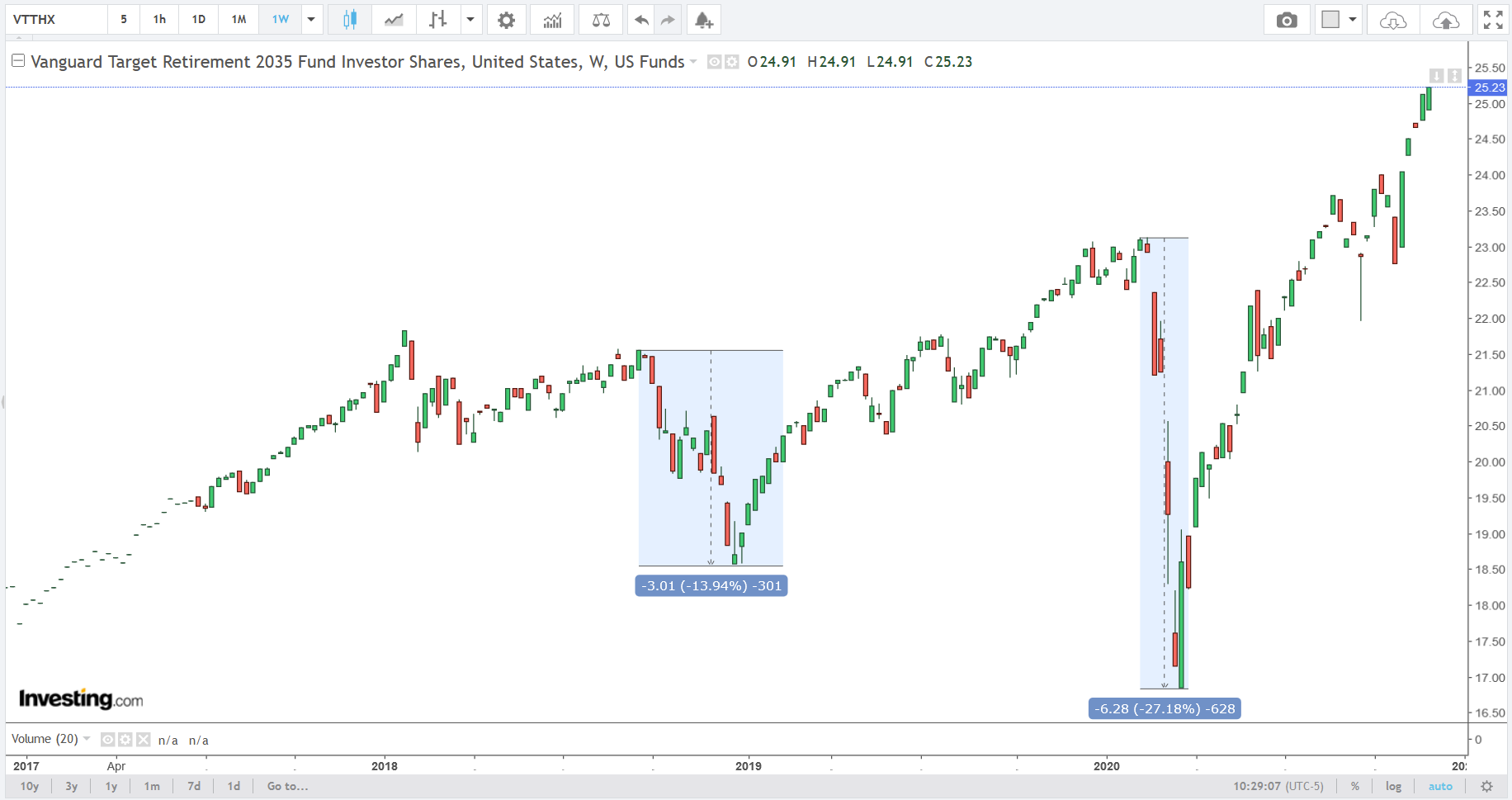

My mum currently has >RM700,000 to be placed in a retirement fund and investment horizon will be around 15 years or more. Vanguard's Target Retirement 2035 Fund $VTTHX has a expense ratio of only 0.14%.

In comparison, mutual funds like PB Mixed Asset Conservative Fund $PUBMXCF has an expense ratio of 1.29% and a management fee of 1.25% and a few other hidden costs such as sales charge, repurchase charge, annual trustee fees and brokerage expenses.

If it weren't for the 30% capital gains tax on $VTTHX upon withdrawal I would have definitely gone with this investment.

I feel that it'll be more convenient for my mum to access information of the PB mutual fund at a bank branch as well.

$VTTHX is definitely convenient (tech-wise) and will be invested through TD Ameritrade.

Let me know what you guys think long-term. My decision is skewed towards Vanguard's retirement fund.

Many thanks.

Retirement: Local mutual fund or Vanguard fund, Retirement fund, investments

Dec 4 2020, 02:29 PM, updated 6y ago

Dec 4 2020, 02:29 PM, updated 6y ago

Quote

Quote

0.0221sec

0.0221sec

0.64

0.64

5 queries

5 queries

GZIP Disabled

GZIP Disabled