QUOTE(yehlai @ Dec 11 2020, 01:11 AM)

I bet someone from TG is reading this thread

probably have cascade to uncle Lim

Please let us know if they did reach out to you

It''s looking so rather clear.... he is way too obsessed with being no.1 . Way too determined trying to be a bigger stock than Maybank...

To be bigger than Maybank... you need to beat Maybank's market cap....

and what have we seen?

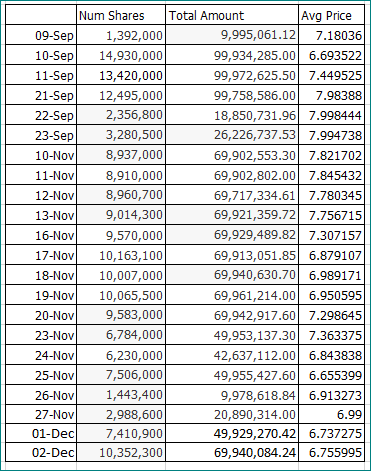

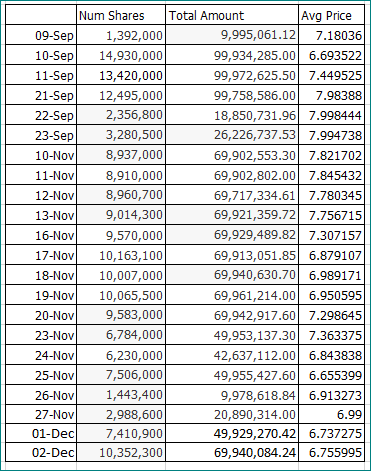

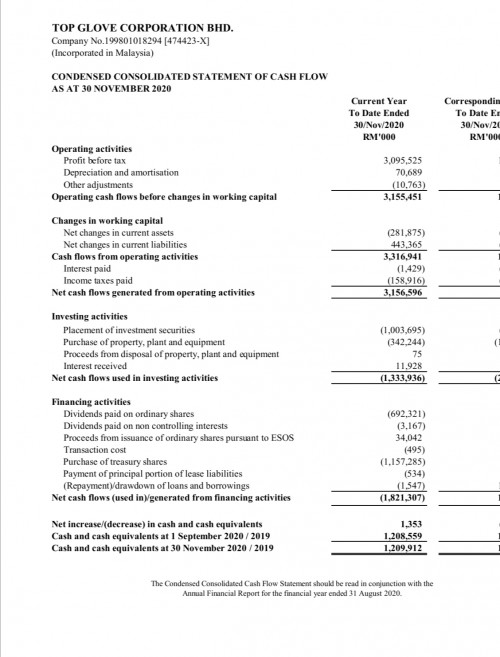

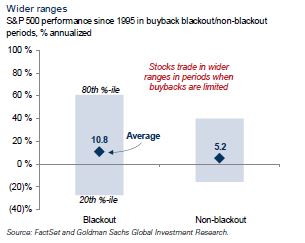

1. He used share buyback.... his 1.2 Billion war chest .... was literally gone just like that...

2. His position in EPF ... which meant there was conflict of interest, esp if EPF went on a buying spree of TG. And yes, EPF went in aggressively until lately....

3. His position as chairman in Tropicana .... he got Tropicana, a property stock to spent 78 millions buying TG shares....

4. Just yesterday, it was disclosed, the boss used his company, Top Fortress Ventures to buy shares in TG. Some of the directors joined the buying (but relatively small buyng)

Doesn't the boss appear to be possessed or what?

This is the stock market we are talking about. If the company is worth its weight in gold, there is no need for all this, right?

Just imagine ... current proposed dividend due xmas eve was 1.3 billion... and if the boss did not splashed the money unnecessary on these share buybacks... the boss could have given a dividend of 2.5 billion!!! Yeah... and then, there was a 2 billion plus investment in the money market fund. Why need to bother with such trivial stuff? I wonder if the boss is badly advised or what? Just imagine... throw this 2 billion plus as dividend.... ooo lalal... we could have seen Top Glove giving a record quarterly dividend of 4.5 billion back to shareholders......

think about that....

the stock could easily have traded past 20 bucks now... yup right this very moment.

... no need all these share buybacks.

yup.... think about that...

and sadly what do we have now? The boss is looking desperate to defend his share price... his integrity is put into question ....

Dec 8 2020, 05:17 PM

Dec 8 2020, 05:17 PM

Quote

Quote

0.0230sec

0.0230sec

0.06

0.06

5 queries

5 queries

GZIP Disabled

GZIP Disabled