QUOTE(Boon3 @ Dec 5 2020, 01:15 PM)

Distribute wealth? Do you really believe all such rumours. Lol. That's the easy way out, isn't it?

How about if I say the boss is way to determined and relentless in trying to maintain his stock's market cap?

Why not? Company got profit windfall ma. He wants his stock market cap to challenge Maybank. Understandable. Sudden extreme richness brings extreme wishes....

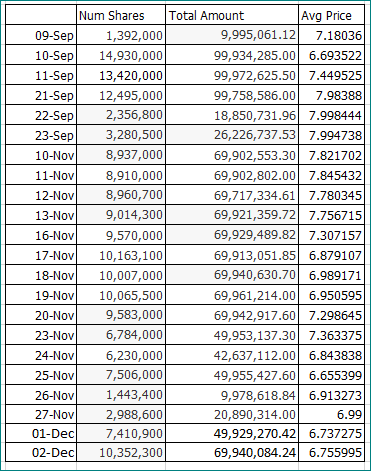

So could this be why his aggressiveness in buying back the stock, trying to maintain certain top price for his stock?

No matter what... right now... the way the company is buying back the stocks is not good for the shareholders. Current prices indicate a paper loss of close to 100 million. If the stock reaches a low of 6, losses will be over 200 million.

If one is the shareholder, one has the right to ask.. Wtf.

If you want to reward is, give us cash.

The way the company is conducting its buyback, the shareholders rewards dimishes!!

Personally I think the boss is preparing his move for next takeover. All those shares can be used to offset his next big purchase just in case if they are still interested to stay related with gloves. It would not reduce/dilute his shareholdings in TG.How about if I say the boss is way to determined and relentless in trying to maintain his stock's market cap?

Why not? Company got profit windfall ma. He wants his stock market cap to challenge Maybank. Understandable. Sudden extreme richness brings extreme wishes....

So could this be why his aggressiveness in buying back the stock, trying to maintain certain top price for his stock?

No matter what... right now... the way the company is buying back the stocks is not good for the shareholders. Current prices indicate a paper loss of close to 100 million. If the stock reaches a low of 6, losses will be over 200 million.

If one is the shareholder, one has the right to ask.. Wtf.

If you want to reward is, give us cash.

The way the company is conducting its buyback, the shareholders rewards dimishes!!

Dec 5 2020, 01:28 PM

Dec 5 2020, 01:28 PM

Quote

Quote

0.0249sec

0.0249sec

1.45

1.45

5 queries

5 queries

GZIP Disabled

GZIP Disabled