QUOTE(Boon3 @ Nov 29 2020, 09:15 AM)

Hahaha... rumors!

Worst of all, such rumor is so damn difficult to confirm. Yup, how to confirm? Currently all based on heresay.

However, what's starring right in front of us is.........

1. Lots of ESOS being exercised on...

2. Lots of Bond holders are converting their shares...

Well, lots of new share, which are as expected but these shares have SIGNIFICANTLY much lower prices and these new shares could be sold.

The bond shares is the bigger worry.

That's 20 million shares which could be converted and sold for a very, very handsome profit. MILLIONS!

Normally, I would say, for the ESOS holders, well guys/gals you deserve it. But when you hear that the Executive Director, Lim Cheng Guan, also doing the same (

posted on this issue b4, see post #3284 in Oct) exercising 380,000 shares at a price of 1.70 and selling at 8.79 and 8.98 during a period when the company is doing aggressive buyback, that's a no no. Big NO NO.

The company and the boss should know. Such stuff is easily frown upon by the investing community and the market.

You cannot exercise/sell ESOS or dispose shares when the company is doing buyback.

Accusation is simple. Is the buyback enabling the selling to be done at a much higher market price?The 20 million bond shares issues. Do we know who the holders are? And once again, when these bond holders are converting and when they sell the newly converted shares, these holders will profit handsomely! And because buyback is happening at the same time, accusations will fly. Is there a coordinated effort between the conversion of bond with the share buyback?

These 2 issue is such a massive concern imo.

There is no smoke without fire. 90% of rumours in this country turn out to be true.

An experienced fisherman could tell from rod movement what fish is hooked under the water. similarly, if one is experienced, could tell intention or objective of corporate exercise.

QUOTE(Boon3 @ Nov 29 2020, 09:39 AM)

Did another table ....

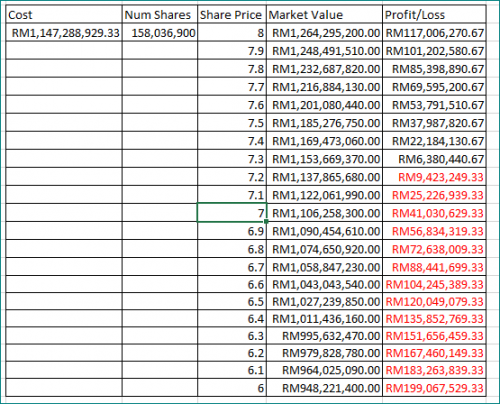

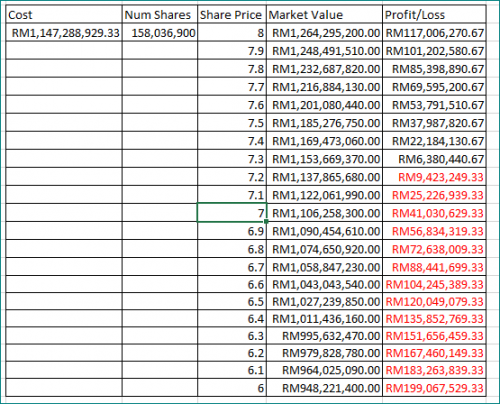

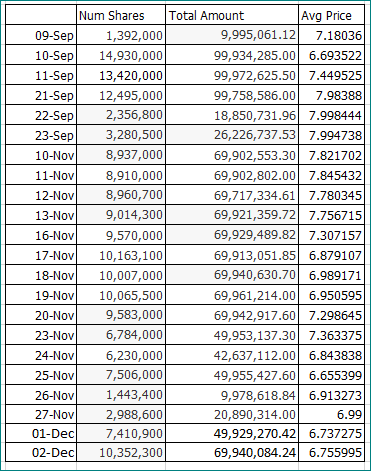

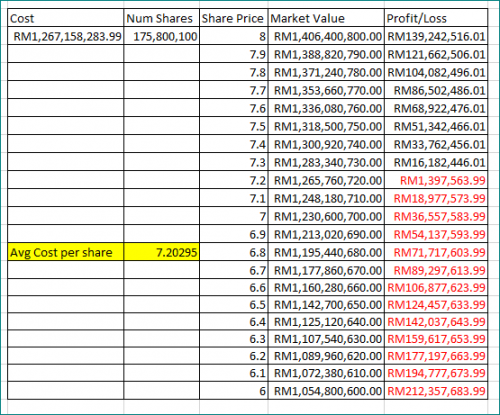

First column, COST = the total cost of the share buybacks since 9th Sept

Second column, NUM SHARES = shares bought back during this period

from there, this table is created. I created the third column, share price. Which calculates the value of all these treasury shares based on the share price displayed. ie. If Top Glove is trading at 8, one could know what is the marked to market price of these shares bough back. And from there I could do a simple assumption of the profit and loss

Share Price = share price.

Market Value = market value based on the previous column share price

Profit/loss = profit/loss based on the previous column share price

so for example, the table shows if TG is trading at 8, the share buybacks would have been worth 1.26 billion, which means that the share buybacks is worth a 117 million more.

and if refer the table, if TG is trading at 6.60, these share buybacks would have a loss of 104 million in value!

Yup, the figures are massive. Understandable. This is due to the sheer size of TG's buybacks.

Aggressive buyback, yes?

Once more... if the share buybacks are done with a 'noble' intention to reward the share holder by giving these buybacks as a bonus, wouldn't it be better if the company just give plain old cash back? Money is always better, yes?

Treasury loss of $104m mean cashed out shareholders gain. believe many retailers have also sold at these or higher price.

after this series of sbb, dividend will be declared to calm sentiment.

This post has been edited by icemanfx: Nov 29 2020, 11:47 AM

Nov 29 2020, 09:15 AM

Nov 29 2020, 09:15 AM

Quote

Quote

0.0225sec

0.0225sec

1.98

1.98

5 queries

5 queries

GZIP Disabled

GZIP Disabled