Outline ·

[ Standard ] ·

Linear+

Credit Cards Affin Duo Credit Card, great rewards for eWallet

|

tan_aniki

|

Jun 9 2021, 05:11 PM Jun 9 2021, 05:11 PM

|

|

QUOTE(fruitie @ Jun 9 2021, 04:59 PM) Guys, gonna ask this so I got CIP and every month paying RM 2.5k for that, my spending is not as much as in the past... I have insurance RM 300 as well, so I should have RM 2.8k in the statement for these few months until CIP finishes. I need to spend another RM 200 and can get RM 15 cash back?  After CIP finishes, so I will have only this insurance RM 300 as balance, can I still get RM 9?  Sorry I'm so lost.  the min RM3k only for RM80, less than RM3k doesn't care about the cap, u can get 3c even with RM1 spend |

|

|

|

|

|

tan_aniki

|

Jun 10 2021, 06:31 PM Jun 10 2021, 06:31 PM

|

|

QUOTE(turbopips @ Jun 10 2021, 06:24 PM) Pay after the statement is generated la.. why pay so early? you have ~20 days to reconcile and pay.. sometime ppl pay before statement generate is to avoid credit shield |

|

|

|

|

|

tan_aniki

|

Jun 11 2021, 02:24 AM Jun 11 2021, 02:24 AM

|

|

QUOTE(turbopips @ Jun 10 2021, 08:45 PM) I dont know how payment before statement date relates to avoidance of credit shield. But anyway the person has explained the reason. credit share will charge 65c for every RM100 in your statement that 1 is to protect you if touch wood u pass away no need to pay with up to RM300k protection from affin |

|

|

|

|

|

tan_aniki

|

Jun 11 2021, 07:32 AM Jun 11 2021, 07:32 AM

|

|

QUOTE(LostAndFound @ Jun 11 2021, 06:37 AM)  you mean credit share is a 0.65% charge on your spending, actually. It is only useful if you have a big bill at the point of time you pass away (then your estate can write off). If it's some normal spending (e.g. RM3080 per statement with current iteration of the card) is it really hard for your estate to pay off? And the price for this protection is either a cumulative 0.65% charge (if you take advantage of intererest-free period) or immediate paying off of your spending (in which case what's the point of a CREDIT card?). that's why i didn't take the credit shield and normally pay off at due date but some ppl normally took the credit shield without notice when they got their cc especially during young age and they will make such practise to pay off their cc before statement in order to avoid such charges without knowing that they can actually remove it |

|

|

|

|

|

tan_aniki

|

Jun 11 2021, 10:02 AM Jun 11 2021, 10:02 AM

|

|

QUOTE(chelvis7 @ Jun 11 2021, 09:55 AM) After reading through the previous reply, did anybody notice about the period that we need to pay interest actually? Correct me if i am wrong. I show an example below. For June statement (22May-22June) we spend RM3080. On 22 June we receive the June statement date with outstanding balance RM3000: and payment due date is 11 July, 20days free interest from statement date- So we ignore the payment and continue to spend RM3080 for July. But when we receive the July statement on 22 July, the outstanding balance will become RM6000. On the day we receive the statement we immediately start to pay to clear the outstanding balance on June statement. But by doing this, we actually need to pay the interest from 11 July until 22 July already. Is my understanding correct? So that means there is no point to earn that extra RM30 (RM80-RM50), am i right? you won't get RM6k on 22/7, as you already late payment and daily interest calculate from the date u purchase, no more 20 days interest free you can pay off the previous RM3k and spend RM3080 before next statement to get RM80 off every month This post has been edited by tan_aniki: Jun 11 2021, 10:03 AM |

|

|

|

|

|

tan_aniki

|

Jun 11 2021, 12:15 PM Jun 11 2021, 12:15 PM

|

|

QUOTE(paogeh @ Jun 11 2021, 10:39 AM) so now , after July . Do we still need RM2667 to earn RM80 CB ? or RM3000 ? *assuming we pay after statement generated to qualify RM3000 statement balance QUOTE(tan_aniki @ May 20 2021, 07:38 PM) if you already got statement this month, you need to start spending the following: Got BT/FPP/unpaid balance of more or equal to RM413: Spend RM2667 + RM413 - RM80 = RM3k No BT/FPP/unpaid balance: Spend RM3080 - RM80 = RM3k Your next month statement balance will be your previous balance in July those who still doubt can refer to this how much to spend in order to get full This post has been edited by tan_aniki: Jun 11 2021, 12:15 PM |

|

|

|

|

|

tan_aniki

|

Jun 16 2021, 07:34 PM Jun 16 2021, 07:34 PM

|

|

QUOTE(jiaen0509 @ Jun 16 2021, 05:04 PM) Anyone here can help to see why I get so little CB this month? Mainly top-up boost for CB. [attachmentid=10910355] *** I noticed that my last Boost top-up posted late. But I should still entitle for the CB? Posted date same as statement date. u only got cb for RM394 you can (must) do non online/ew RM3080 before your next statement date as you already did RM2690 on Boost This post has been edited by tan_aniki: Jun 16 2021, 07:36 PM |

|

|

|

|

|

tan_aniki

|

Jun 17 2021, 01:14 AM Jun 17 2021, 01:14 AM

|

|

QUOTE(revolution @ Jun 17 2021, 12:55 AM) hi all for the new policy change. Does the RM3080 balance include CASH-ON-CALL INSTALMENT PLAN (“CIP”) balance? they just see your previous balance, doesn't care how much and how you owe them, SST, cash advance, authorized charges, retail interest etc btw not RM3080 but RM3k, the RM3080 is u assume not yet deduct RM80 This post has been edited by tan_aniki: Jun 17 2021, 01:15 AM |

|

|

|

|

|

tan_aniki

|

Jun 18 2021, 11:25 AM Jun 18 2021, 11:25 AM

|

|

QUOTE(eternity4av @ Jun 18 2021, 08:39 AM) hi senior, i'm trying to a build real case here, please feel free to advise statement date 14/7/2021 30/6/2021 - top up big pay rm1k (don't pay) 12/6/2021 - top up big pay rm1k (don't pay) 12/6/2021 - top up lazada wallet/shopee pay rm1,080. projected cash back 14/7/2021 = rm80. correct? just check your statement on 14/6 got at least RM3k or not |

|

|

|

|

|

tan_aniki

|

Jun 19 2021, 11:55 AM Jun 19 2021, 11:55 AM

|

|

QUOTE(eternity4av @ Jun 19 2021, 09:42 AM) RM500 unfortunately. so what should i do? means spends another RM2580 by 11th of July? your next statement will cap at RM50 even though u spend RM3080 if you wish to get RM80 in Aug, then you can spend RM3050 (minus your unposted RM2500+), after that RM3080 from Aug onwards if you wish to continue get RM50, then you stop spending for July as your RM2500+ already entitled RM50 cb and you can continue to spend RM1666.67 to get RM50 |

|

|

|

|

|

tan_aniki

|

Jun 20 2021, 04:00 PM Jun 20 2021, 04:00 PM

|

|

QUOTE(cucikaki @ Jun 20 2021, 03:35 PM) My statement date is 22nd. Just call affin to confirm. Statement must be RM3k and above, excluding any BT, Cash advance, annual fee, sst, finance charges etc, but inlucluding rebate. So it’s your pure purchases transaction be at least 3080 to entitle for rm80 next month. at lot CS dun even know their products well, most ppl here can be the CS affin only check your previous balance https://www.affinonline.com/AFFINONLINE/med...AFFINDUO_EN.pdfjust make sure your spending is qualified spending RM2667 then only get RM80, not your previous balance must be qualified spending... This post has been edited by tan_aniki: Jun 20 2021, 04:06 PM |

|

|

|

|

|

tan_aniki

|

Jun 20 2021, 08:10 PM Jun 20 2021, 08:10 PM

|

|

QUOTE(MGM @ Jun 20 2021, 04:47 PM) Actually cb based on previous statement balance is going to infuriate customers who didnt meet requirement due to last minute unexpected credits. only benefit for those who follow the tnc, just like how we adapt to changes for uob yolo etc |

|

|

|

|

|

tan_aniki

|

Jun 23 2021, 09:27 PM Jun 23 2021, 09:27 PM

|

|

QUOTE(owj @ Jun 23 2021, 05:46 PM) Hi all. I have just gotten my duo card today. Want to ask clarification from everyone here: 1. Since the effective date for the new TnC is 1/Jul, will I get RM80 if I spend RM3080 between now and 30 June? 2. Or if I just start spending on 1 Jul onwards, will I get RM50 cashback since Jul will be my 1st statement and there is no previous statement to check my balance? maybe 1st statement will be unique, anyway it's your choice to spend RM3050 or RM3080, but for me i don't mind to spend extra RM30 as if they really give RM80 cb then your RM3050 will become RM2970 and will affect next statement as well |

|

|

|

|

|

tan_aniki

|

Jun 24 2021, 05:47 PM Jun 24 2021, 05:47 PM

|

|

QUOTE(maxwongsauwei @ Jun 24 2021, 05:36 PM)  Lesson Learned, always check your transaction if you are playing exact amount on the statement date. Lucky i got BT trasnfer to cover and exceed 3k of spending. This is so tricky, yup BT save the day |

|

|

|

|

|

tan_aniki

|

Jun 25 2021, 03:09 PM Jun 25 2021, 03:09 PM

|

|

QUOTE(cute_boboi @ Jun 25 2021, 02:59 PM) I have scenario 2 issue in this month. So this month billing is RM 0. Zero cashback as well. Really messed up my cashback for June + July. 1) This means next month (July), I will not get cashback, right ? Since it refers to June = zero billed. 2) So, for next month, do I still need to spend minimum RM1667 to receive RM50 in August ? 3) Or add this month unbilled amount to July cummulatively ? Thanks  It depends u want RM50/month (RM1667) or RM80/month (RM3k after deduct cb or add others with RM2667 on qualifying spending) |

|

|

|

|

|

tan_aniki

|

Jun 25 2021, 08:09 PM Jun 25 2021, 08:09 PM

|

|

QUOTE(cybpsych @ Jun 25 2021, 03:23 PM) assuming you always want max RM80 cb, every month 1) spend RM3,050 or more (RM2,667 on eligible transactions + RM383 others) by July statement. you'll earn max cb RM50 only though, since your June statement is <RM3,000 already 2) this depends whether you want Aug to get RM80 cb or RM50 cb. if RM80, follow (1) above. If RM50, spend just RM1,667 on eligible txns. <-- this is "simpler" to follow as you dont need to monitor your statement balance every month  if RM80, follow (1) above. (+RM413 others) for subsequent month |

|

|

|

|

|

tan_aniki

|

Jun 25 2021, 08:16 PM Jun 25 2021, 08:16 PM

|

|

QUOTE(cute_boboi @ Jun 25 2021, 07:47 PM) ok, assume want to max RM80. Assume scenario below. June: 1x spending RM2k for the whole statement month. Transaction date 08-June. Posting date 18-June Statement date 18-June. Amount payable for June = RM0 since posting date didn't make it into June statement. June Cashback = RM0 (zero) already reflected in my latest statement (18-June) July: My understanding with the new T&C, whether I spend or not, I will not get any cashback in July because my prior month balance is RM0, right ?  assuming u want RM80 every month, just spend RM3050 before 18/7 to get RM50 cb with statement balance RM3k, then next month onwards just spend RM3080 to get RM80 cb |

|

|

|

|

|

tan_aniki

|

Jun 25 2021, 09:08 PM Jun 25 2021, 09:08 PM

|

|

QUOTE(cute_boboi @ Jun 25 2021, 08:36 PM) You did not read the question properly to answer whether July will get cashback or not since June spending = zero. you will get RM50 max, only above RM50 cb need to see the previous statement balance got RM3k or not check this out, the last 5th and 6th https://forum.lowyat.net/index.php?showtopi...ost&p=101005287This post has been edited by tan_aniki: Jun 25 2021, 09:10 PM |

|

|

|

|

|

tan_aniki

|

Jun 26 2021, 07:52 PM Jun 26 2021, 07:52 PM

|

|

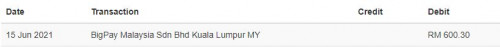

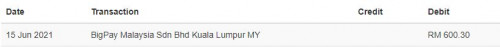

QUOTE(engsen123 @ Jun 26 2021, 07:48 PM)  this bigpay transaction eligible for cash back for visa duo cb card?because normally is shown BIGPAY-EC KUALA LUMPUR MY |

|

|

|

|

|

tan_aniki

|

Jun 26 2021, 08:08 PM Jun 26 2021, 08:08 PM

|

|

QUOTE(engsen123 @ Jun 26 2021, 07:57 PM) this look like become offline transaction, normally is shown BIGPAY-EC KUALA LUMPUR MY it doesn't matter, the Bigpay is in the list, just like TNG ewallet became TNG wallet also eligible, as long as got the word TNG |

|

|

|

|

Sorry I'm so lost.

Sorry I'm so lost.

Jun 9 2021, 05:11 PM

Jun 9 2021, 05:11 PM

Quote

Quote

0.1930sec

0.1930sec

0.28

0.28

7 queries

7 queries

GZIP Disabled

GZIP Disabled