QUOTE(encikbuta @ Sep 7 2020, 09:38 PM)

i really did try my very best to favor e-wallets in my payments. during the introduction phase when e-wallets were handing out discounts left & right, it was worth the hassle to do so. keyword here is 'hassle'.

With CC, I just take out my Visa and wave, transaction completed in less than 5 seconds. With E-Wallet, it's a 5 minute ordeal that goes something like this:

Me: You accept TnG?

Merchant: Yes.

Me: Ok, wait ya I find my app in my phone.

Me: Found it! Wait ya for my app to load.

Me: Ok loaded. Eh, how much again?

Merchant: RM45.90

Me: Oops not enuf balance, wait ah I top up.

Me: Ok done. Eh I scan or you scan?

Merchant: You scan.

Me: Ok, wa so many QR codes on display, scan which one?

Merchant: *points to the TnG QR Code*

Me: Ok. *Tries for a while* Eh why my phone cannot scan wan.

Merchant: You try put the phone further a bit.

Me: Ok can already. Eh why the merchant name different from your shop? *shows phone to merchant*

Merchant: Yea that is correct.

Me: Ok. Aya, how much again?

Merchant: RM45.90.

Me: Ok can scan already. Wait ah, screen loading.

Me: Ok can already. *shows phone to merchant*

Merchant: Ok thank you.

So yea, e-wallet still has a long way to go before it beats CC in terms of convenience. Besides that, I don't like the 'trap' of having balances in my e-wallet. It kinda encourages over-spending, no? "Aiya I still got RM9.50 in my wallet, alang alang we go buy Tealive la to finish up the balance."

it depends on individual & merchant you encounter... in most of my cases ->

small merchant - i scan them - less than 5 seconds

me: *pre-scan the code when i'm queuing or reach the counter...

Merchant: RM9.90

me: *key in 9.90* Done! *show them my screen and walk away*

big merchant - they scan me - less than 10 seconds

me: *opening the app*

Merchant: RM9.90

me: grabpay/boost/tng, then show them my QR code

Merchant: okay... take their terminal and scan.. Done

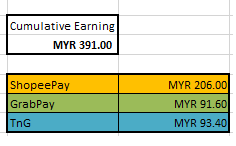

e-wallet has better control on how you spend and how much you spend... for example i reload RM600 into wallet first in using CC and earn 5% cc cashback to the max... then using it daily and i know how much balance i have for the monthly spending... versus paywave, which i can spend alot up to credit card limit without knowing how much i spend (the fastest posting date may be 1-2 days, vs ewallet is instant posting)

the conclusion is if you want fast, reload your wallet first (earn the 5% cashback from CC, eg PBB quantum card 5% for online transactions by loading ewallet , then you can use in any transaction via e-wallet)

using credit card paywave will only entitle you cc cashback, while using ewallet entitle you cc + ewallet cashback + instant expense tracking history.... and to me the payment time are more or less the same...

and lastly,you cannot use paywave/ credit card for saving/investment, but with e-wallet you can... eg: CC -> Boost -> SSPN-i or Opus Touch... which earn you 5% from cc + Boost coins, in front of any future investment return...

Jul 19 2020, 10:48 PM, updated a long time ago

Jul 19 2020, 10:48 PM, updated a long time ago

Quote

Quote

0.0950sec

0.0950sec

0.58

0.58

8 queries

8 queries

GZIP Disabled

GZIP Disabled