Outline ·

[ Standard ] ·

Linear+

Is eWallet these days still worth using?

|

GrumpyNooby

|

Jul 20 2020, 07:29 AM Jul 20 2020, 07:29 AM

|

|

QUOTE(Vincentccw @ Jul 19 2020, 10:48 PM) Due to the recent massive decline in eWallet value for GRAB (used to be x20, x9 then x3 and now required even more points to redeem stuff) and Boost (more points required for exchanging cash with lesser value), and Bigpay point is difficult to earn if you are just using for topping up eWallet. Consider you only earn 1 point for every RM10 spend, to redeem a flight outside Malaysia one way will cost at least 10,000 points...... As for touch n go (only good if there is a campaign running, otherwise you don't get any benefits out of it). Is eWallet still worth it? I would personally go for NO, and switch to using credit card with cashback instead or switch to card that gives me at least x5 and x8 points for exchanging vouchers in future. Yes, not worth at all. Faster close all e-wallets now. Just credit card will be the best. |

|

|

|

|

|

GrumpyNooby

|

Jul 23 2020, 02:40 PM Jul 23 2020, 02:40 PM

|

|

QUOTE(ClarenceT @ Jul 23 2020, 02:10 PM) Just paid to a electricity account, RM10 got RM1.32 cashback. Ewallet can be better than credit cards. SarawakPay is a very good rewarding wallet with great feature embedded. |

|

|

|

|

|

GrumpyNooby

|

Sep 22 2020, 08:39 PM Sep 22 2020, 08:39 PM

|

|

Main purpose for using e-wallet is for reduce note and coins circulation.

I don't bring much cash out in my wallet.

RM 500 cash in various denomination notes could last me for the whole month.

This post has been edited by GrumpyNooby: Sep 22 2020, 08:39 PM

|

|

|

|

|

|

GrumpyNooby

|

Sep 25 2020, 03:23 PM Sep 25 2020, 03:23 PM

|

|

Kenanga partners Merchantrade in planned stockbroker e-wallet rolloutKUALA LUMPUR (Sept 25): Kenanga Investment Bank Bhd announced today its partnership with Merchantrade Asia Sdn Bhd on the planned rollout of a stockbroker e-wallet known as Kenanga Money under the former's ongoing digitalisation journey. In a statement today, Kenanga said Kenanga Money will be supported by a Visa prepaid card feature. "Kenanga Money will be rolled out in phases over the next few months," Kenanga said. https://www.theedgemarkets.com/article/kena...ewallet-rollout

|

|

|

|

|

|

GrumpyNooby

|

Oct 9 2020, 06:31 PM Oct 9 2020, 06:31 PM

|

|

Tesco Malaysia enables e-wallet payments at all food courts KUALA LUMPUR: Tesco Stores (Malaysia) Sdn Bhd has enabled e-wallet payments across all its food courts in a move to help its food vendors compete in an increasingly digital market space. https://www.thestar.com.my/business/busines...all-food-courts

|

|

|

|

|

|

GrumpyNooby

|

Oct 17 2020, 05:39 PM Oct 17 2020, 05:39 PM

|

|

QUOTE(noobandroid @ Oct 17 2020, 05:18 PM) i use boost for slow pay, and samsung pay for fast pay 🙃 LOLz ...  |

|

|

|

|

|

GrumpyNooby

|

Oct 21 2020, 10:20 AM Oct 21 2020, 10:20 AM

|

|

Call for e-Wallet firms to work together and boost industryPETALING JAYA: E-wallet providers have to work together to move the industry towards inter-wallet operability where money credits can be moved between different e-wallet operators, according to Boost chief executive officer Mohd Khairil Abdullah. “There are a lot of things the regulators are doing to support inter-operability. The interoperable credit transfer framework had been issued by Bank Negara to promote wallet interoperability. “We are working closely with Paynet (Payments Network Malaysia Sdn Bhd) as we want to be part of this network, ” Khairil said at a virtual press conference yesterday. “Paynet is like the extension of the regulatory arm. I’m on the industry advisory council on Paynet and I believe they are doing all the right things to promote interoperability, ” Khairil added. He said that e-Wallet industry players need to also cooperate and adopt a different approach to their thinking when dealing with inter wallet operability. https://www.thestar.com.my/business/busines...-boost-industry

|

|

|

|

|

|

GrumpyNooby

|

Nov 20 2020, 06:40 PM Nov 20 2020, 06:40 PM

|

|

How To Double Dip On Rewards With Credit Cards & E-WalletsOver the last few years, there has been a new entry into the cashless payments landscape: e-wallets. Especially with the recent pandemic, many Malaysians have turned to a digital lifestyle, using e-wallets for contactless payments and e-commerce shopping. E-wallets come with their own host of consumer benefits, from loyalty programmes and cashback to vouchers and promotions. For savvy e-wallet users, the best part usually lies in the fact that you can get all of these e-wallet benefits on top of the advantages your credit cards have to offer. This has led to the “double dipping” phenomenon, and it looks like it’s here to stay – which is great news for consumers! https://ringgitplus.com/en/blog/sponsored/h...bna1T2ecDCZbiOE

|

|

|

|

|

|

GrumpyNooby

|

Jan 29 2021, 10:23 AM Jan 29 2021, 10:23 AM

|

|

QUOTE(enterthefatdragon @ Jan 29 2021, 10:21 AM) i think questions now is how many ewallet you have 4: GrabPay, TnG e-wallet, ShopeePay, Boost |

|

|

|

|

|

GrumpyNooby

|

Feb 18 2021, 06:52 PM Feb 18 2021, 06:52 PM

|

|

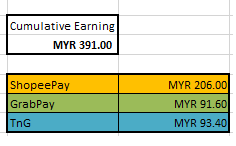

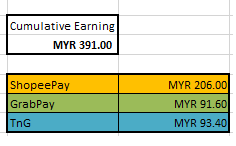

QUOTE(Haloperidol @ Feb 18 2021, 06:51 PM)  This year to date profit. Not counted Credit Card cashback yet ~ How much in term of percent over gross spending amount? |

|

|

|

|

Jul 20 2020, 07:29 AM

Jul 20 2020, 07:29 AM

Quote

Quote

0.0499sec

0.0499sec

0.50

0.50

9 queries

9 queries

GZIP Disabled

GZIP Disabled